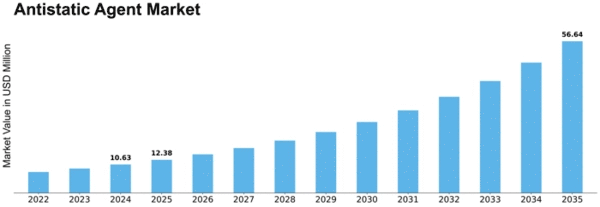

Antistatic Agent Size

Antistatic Agent Market Growth Projections and Opportunities

The antistatic agent market is influenced by a myriad of factors that collectively shape its dynamics and demand across various industries. The following key points outline the market factors contributing to the growth and evolution of the antistatic agent market:

Increased Adoption in Plastics and Polymers: The widespread use of antistatic agents in the plastics and polymers industry is a significant factor driving market demand. Antistatic agents are incorporated into plastic and polymer formulations to mitigate static electricity buildup, preventing issues such as dust attraction and surface adhesion.

Growing Electronics Industry: The expansion of the electronics industry is a major driver for the antistatic agent market. These agents are crucial in preventing electrostatic discharge (ESD) in electronic components and devices, ensuring the integrity and functionality of sensitive electronic equipment during manufacturing, handling, and transportation.

Rise in Packaging Applications: The packaging industry extensively utilizes antistatic agents to address static-related challenges in packaging materials. Antistatic agents prevent static charges that can attract dust, affect the appearance of packaging, and create handling difficulties. The demand for static-free packaging contributes significantly to the market.

Textile and Fibers Sector Integration: Antistatic agents play a pivotal role in the textile and fibers sector, particularly in the production of synthetic fibers. These agents are employed to minimize static cling, enhance textile processing, and improve the overall quality of synthetic textiles, contributing to their widespread use in the textile industry.

Surge in Demand for Consumer Goods: The increasing demand for consumer goods, including electronics, textiles, and plastic-packaged products, drives the need for antistatic agents. As consumer preferences evolve, manufacturers seek solutions to enhance the aesthetic and functional aspects of products, further fueling the demand for antistatic agents.

Incorporation in Industrial Coatings: Antistatic agents find application in industrial coatings to mitigate static-related issues during the coating process. The use of these agents ensures a smooth and even coating application, reducing defects caused by static charge buildup on surfaces.

Preference for Water-Based Antistatic Agents: The market is witnessing a shift towards water-based antistatic agents due to environmental considerations and regulatory pressures. Water-based formulations offer a more sustainable and eco-friendly alternative, aligning with the industry's focus on reducing the environmental impact of chemical additives.

Automotive Sector Utilization: The automotive industry integrates antistatic agents in various components to address static-related challenges. From interior materials to electronic components, antistatic agents contribute to improving the overall performance, safety, and aesthetics of vehicles.

Technological Advancements in Antistatic Agents: Ongoing research and development efforts lead to technological advancements in antistatic agents, enhancing their effectiveness and versatility. Innovations in formulation technologies contribute to the development of more efficient and specialized antistatic solutions for diverse applications.

Regulatory Compliance and Safety Standards: Adherence to regulatory compliance and safety standards is a crucial factor influencing the antistatic agent market. Manufacturers and end-users prioritize products that meet stringent regulations, ensuring the safety of consumers, workers, and the environment.

Global Supply Chain Dynamics: The global supply chain dynamics, including the availability and pricing of raw materials used in antistatic agent production, impact the overall market. Fluctuations in the supply chain can influence product costs and availability, affecting market dynamics.

Consumer Awareness and Sustainability: Increasing consumer awareness regarding the importance of antistatic properties in various products and the emphasis on sustainability influence market demand. Consumers and businesses alike seek products that meet performance requirements while aligning with sustainable and environmentally conscious practices.

Leave a Comment