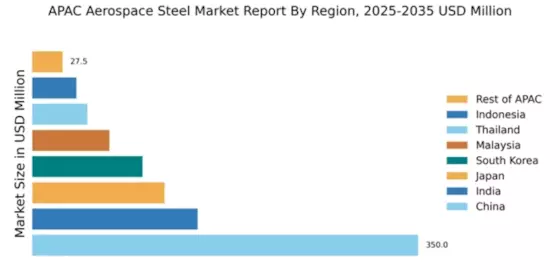

China : Unmatched Growth and Demand Trends

China holds a commanding market share of 350.0 million, representing a significant portion of the APAC aerospace steel market. Key growth drivers include robust government investments in aerospace infrastructure and a rising demand for commercial aircraft. The country is witnessing a shift towards advanced manufacturing technologies, supported by favorable regulatory policies aimed at boosting domestic production. Additionally, initiatives like the Made in China 2025 plan are enhancing industrial capabilities, further driving consumption patterns in the aerospace sector.

India : Rapid Growth and Investment Opportunities

India's aerospace steel market is valued at 150.0 million, showcasing a growth rate of 10% annually. The government's push for 'Make in India' has catalyzed investments in aerospace manufacturing, leading to increased demand for high-quality steel. Regulatory frameworks are evolving to support foreign investments, while local consumption patterns are shifting towards advanced aerospace technologies. The burgeoning space sector also contributes to rising steel requirements, indicating a promising trajectory for the market.

Japan : Strong Manufacturing and Export Focus

Japan's aerospace steel market is valued at 120.0 million, driven by its advanced manufacturing capabilities and a strong export-oriented approach. The country is focusing on high-performance materials to meet the demands of next-generation aircraft. Government initiatives, such as the Aerospace Industry Strategy, are fostering innovation and collaboration among key players. The demand for lightweight and durable materials is on the rise, aligning with global trends in aerospace engineering.

South Korea : Government Support and Industrial Expansion

South Korea's aerospace steel market is valued at 100.0 million, bolstered by government support and strategic partnerships with global aerospace firms. The country is investing heavily in R&D to enhance its aerospace capabilities, leading to increased demand for specialized steel products. Regulatory policies are being streamlined to facilitate faster project approvals, while local consumption is driven by both military and commercial aerospace sectors, creating a dynamic market environment.

Malaysia : Investment and Infrastructure Development

Malaysia's aerospace steel market is valued at 70.0 million, reflecting a growing manufacturing base supported by government initiatives. The Malaysian Aerospace Industry Blueprint aims to position the country as a regional hub for aerospace manufacturing, driving demand for high-quality steel. Key cities like Selangor and Penang are emerging as industrial centers, attracting investments from major players. The competitive landscape is evolving, with local firms collaborating with international partners to enhance capabilities.

Thailand : Strategic Location and Investment Potential

Thailand's aerospace steel market is valued at 50.0 million, benefiting from its strategic location in Southeast Asia. The government is actively promoting the aerospace sector through investment incentives and infrastructure development. Demand is increasing for both commercial and military aircraft, with local manufacturers expanding their capabilities. Key regions like Chonburi and Bangkok are becoming focal points for aerospace activities, attracting significant foreign investments and partnerships.

Indonesia : Emerging Opportunities and Challenges

Indonesia's aerospace steel market is valued at 40.0 million, with growth driven by increasing domestic demand for aircraft and components. The government is implementing policies to boost local manufacturing, although challenges remain in terms of infrastructure and regulatory frameworks. Key cities like Jakarta and Bandung are central to aerospace activities, with local firms beginning to collaborate with international players. The market is gradually evolving, presenting opportunities for growth in the aerospace sector.

Rest of APAC : Varied Markets and Growth Potential

The Rest of APAC aerospace steel market is valued at 27.46 million, encompassing a diverse range of countries with varying growth trajectories. Emerging markets are witnessing increased investments in aerospace infrastructure, driven by government initiatives and foreign partnerships. Demand trends vary significantly, with some countries focusing on military applications while others emphasize commercial aviation. The competitive landscape is fragmented, with local players vying for market share alongside established global firms.