China : Rapid Growth and Urbanization Trends

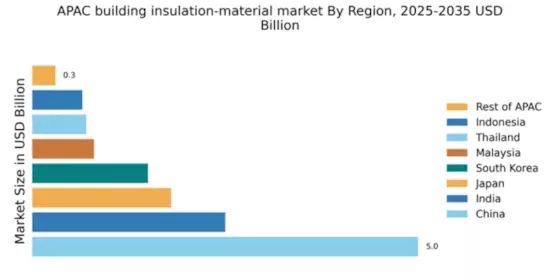

China holds a commanding 5.0% market share in the APAC building insulation sector, driven by rapid urbanization and government initiatives promoting energy efficiency. The demand for insulation materials is surging, particularly in residential and commercial construction, as the country aims to reduce energy consumption. Regulatory policies, such as the Energy Conservation Law, are pushing for better insulation standards, further fueling market growth. Infrastructure projects, including the Belt and Road Initiative, are also enhancing demand for insulation materials.

India : Growing Demand in Urban Areas

India's building insulation market accounts for 2.5% of the APAC total, reflecting a burgeoning demand driven by rapid urbanization and increasing construction activities. Government initiatives like the Smart Cities Mission are promoting energy-efficient buildings, which is boosting the insulation sector. The rising awareness of energy conservation among consumers is also contributing to demand trends, particularly in metropolitan areas. Regulatory frameworks are evolving to support sustainable building practices, enhancing market prospects.

Japan : Technological Advancements in Insulation

Japan's market share stands at 1.8%, characterized by a stable demand for high-performance insulation materials. The country is witnessing a shift towards innovative insulation solutions, driven by stringent energy efficiency regulations and a focus on sustainability. The government is promoting initiatives to enhance building performance, which is positively impacting consumption patterns. The aging infrastructure also necessitates retrofitting with advanced insulation materials, further driving market growth.

South Korea : Sustainability and Energy Efficiency

South Korea holds a 1.5% share in the APAC insulation market, with a strong emphasis on sustainability and energy efficiency. The government has implemented various policies to promote green building practices, which are driving demand for insulation materials. Urban areas like Seoul and Busan are key markets, where construction activities are on the rise. Major players like Owens Corning and Rockwool International are actively participating in this competitive landscape, focusing on innovative solutions to meet local needs.

Malaysia : Market Expansion in Construction Sector

Malaysia's building insulation market represents 0.8% of the APAC total, with growth driven by increasing awareness of energy efficiency and sustainability. Government initiatives, such as the Green Building Index, are encouraging the adoption of insulation materials in new constructions. The demand is particularly strong in urban centers like Kuala Lumpur, where construction activities are booming. The competitive landscape includes key players like Knauf Insulation, which are adapting to local market dynamics.

Thailand : Rising Construction Activities Drive Demand

Thailand's insulation market accounts for 0.7% of the APAC total, with growth fueled by rising construction activities and urbanization. The government is promoting energy-efficient building practices through various initiatives, which is enhancing the demand for insulation materials. Key markets include Bangkok and Chiang Mai, where infrastructure development is accelerating. The competitive landscape features local and international players, with a focus on adapting products to meet local needs and regulations.

Indonesia : Urbanization Boosts Insulation Demand

Indonesia's market share is 0.65%, with significant growth potential driven by rapid urbanization and increasing construction projects. Government initiatives aimed at improving energy efficiency are also contributing to the demand for insulation materials. Key cities like Jakarta and Surabaya are witnessing a surge in construction activities, creating a favorable environment for market expansion. The competitive landscape includes both local and international players, focusing on innovative solutions tailored to the Indonesian market.

Rest of APAC : Varied Demand Across Sub-regions

The Rest of APAC accounts for 0.3% of the insulation market, characterized by diverse demand patterns influenced by local regulations and economic conditions. Countries in this category are experiencing varying levels of urbanization and infrastructure development, impacting insulation material consumption. The competitive landscape is fragmented, with both local and international players vying for market share. Sector-specific applications vary widely, from residential to industrial uses, reflecting the unique challenges and opportunities in each market.