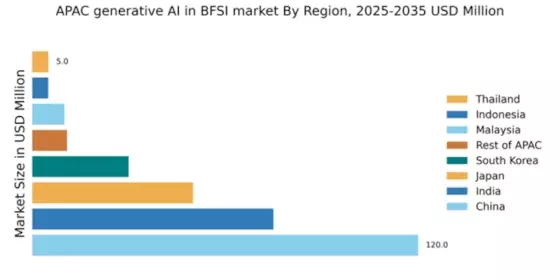

China : Robust Growth and Innovation Hub

China holds a commanding market share of 120.0, representing a significant portion of the APAC generative AI in BFSI sector. Key growth drivers include rapid digital transformation, increased investment in AI technologies, and supportive government policies promoting innovation. Demand trends show a rising adoption of AI for risk management and customer service, while regulatory frameworks are evolving to ensure data security and privacy. Infrastructure development, particularly in major cities, is enhancing the operational capabilities of financial institutions.

India : Rapid Adoption and Innovation

Key markets include Bengaluru, Mumbai, and Hyderabad, where numerous fintech companies are based. The competitive landscape features major players like IBM and Microsoft, alongside a vibrant startup scene. Local dynamics are characterized by a focus on mobile banking and personalized financial services, with AI applications in fraud detection and customer support gaining traction.

Japan : Technological Advancement and Trust

Tokyo and Osaka are key markets, hosting major banks and financial institutions. The competitive landscape includes global players like Google and local firms leveraging AI for risk assessment and customer insights. The business environment is characterized by a high level of trust in technology, with AI applications in automated trading and personalized financial advice becoming more prevalent.

South Korea : Strong Government Support and Investment

Seoul is the primary market, home to major banks and fintech startups. The competitive landscape features significant players like NVIDIA and local firms focusing on AI-driven solutions. The business environment is dynamic, with a focus on AI applications in credit scoring and risk management, reflecting the sector's commitment to innovation.

Malaysia : Strategic Initiatives and Development

Kuala Lumpur is a key market, hosting several banks and fintech companies. The competitive landscape includes major players like Salesforce and local startups. The business environment is characterized by a focus on digital banking and AI applications in customer service and fraud detection, reflecting the sector's growth potential.

Thailand : Regulatory Support and Market Growth

Bangkok is the primary market, home to major banks and fintech startups. The competitive landscape features both global players and local firms focusing on AI-driven solutions. The business environment is evolving, with a focus on AI applications in customer service and risk management, reflecting the sector's potential for growth.

Indonesia : Emerging Market with Potential

Jakarta is a key market, hosting several banks and fintech companies. The competitive landscape includes major players like OpenAI and local startups. The business environment is characterized by a focus on mobile banking and AI applications in customer service and fraud detection, reflecting the sector's growth potential.

Rest of APAC : Varied Growth Across Sub-regions

Key markets include Singapore and Vietnam, where fintech innovation is thriving. The competitive landscape features a mix of global players and local firms, each adapting to unique market dynamics. The business environment is characterized by a focus on AI applications in customer service and risk management, reflecting the diverse opportunities across the region.