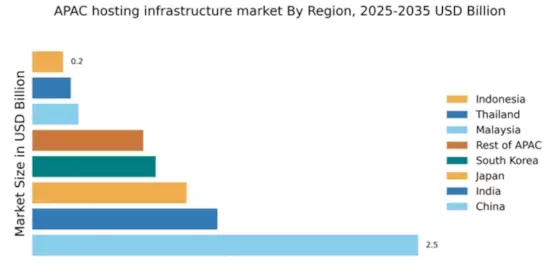

China : Unmatched Growth and Innovation

China holds a commanding 2.5% market share in the APAC hosting infrastructure-services sector, driven by rapid digital transformation and government support for tech innovation. Key growth drivers include the increasing adoption of cloud services across industries, robust demand for data centers, and favorable regulatory policies promoting foreign investment. The government's push for smart city initiatives and infrastructure development further fuels market expansion.

India : Cloud Adoption on the Rise

India's hosting infrastructure-services market is valued at 1.2%, reflecting a surge in demand for cloud solutions driven by the growing startup ecosystem and digitalization across sectors. Government initiatives like Digital India and Make in India are pivotal in fostering a conducive environment for tech investments. The increasing reliance on e-commerce and online services is reshaping consumption patterns, leading to a robust demand for scalable infrastructure.

Japan : Strong Focus on Security and Compliance

Japan's market share stands at 1.0%, characterized by a strong emphasis on security and compliance in cloud services. The growth is propelled by the increasing need for data protection and the adoption of IoT technologies across industries. Government policies promoting digital transformation and investment in smart infrastructure are key drivers. The market is witnessing a shift towards hybrid cloud solutions, catering to diverse business needs.

South Korea : Leading in Technology Adoption

South Korea holds a market share of 0.8%, driven by its advanced technological landscape and high internet penetration. The demand for cloud services is bolstered by the rise of AI and big data analytics, with government initiatives supporting innovation in these areas. The competitive landscape features major players like AWS and Microsoft Azure, alongside local firms. Cities like Seoul and Busan are key markets, showcasing a vibrant tech ecosystem.

Malaysia : Strategic Location for Data Centers

Malaysia's hosting infrastructure-services market is valued at 0.3%, with significant growth potential driven by its strategic location in Southeast Asia. The government is actively promoting the digital economy through initiatives like the Malaysia Digital Economy Corporation (MDEC). Demand for cloud services is rising among SMEs, with Kuala Lumpur and Penang emerging as key hubs for tech investments and data center development.

Thailand : Digital Transformation in Progress

Thailand's market share is 0.25%, reflecting a growing demand for cloud solutions as businesses undergo digital transformation. Government initiatives like Thailand 4.0 aim to enhance the digital landscape, fostering a favorable environment for tech investments. The competitive landscape includes both international and local players, with Bangkok being a key market for cloud services, particularly in e-commerce and fintech sectors.

Indonesia : Rising Cloud Adoption Trends

Indonesia's hosting infrastructure-services market is valued at 0.2%, with significant untapped potential driven by increasing internet penetration and mobile usage. The government is focusing on digital infrastructure development, which is crucial for attracting investments. Jakarta is a key market, with a growing number of startups and SMEs seeking cloud solutions to enhance operational efficiency and scalability.

Rest of APAC : Varied Growth Across Regions

The Rest of APAC holds a market share of 0.72%, characterized by diverse market dynamics and varying levels of cloud adoption. Countries like Vietnam and the Philippines are witnessing rapid growth, driven by increasing digitalization and government support for tech initiatives. The competitive landscape features both global and regional players, with a focus on localized solutions to cater to specific market needs.