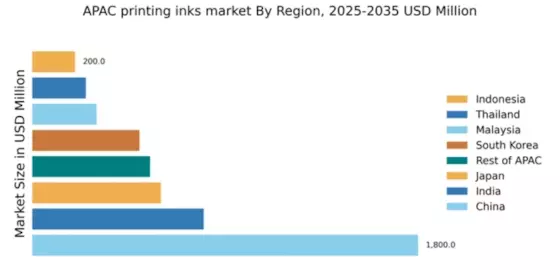

China : Unmatched Growth and Demand Trends

China holds a commanding market share of 36% in the APAC printing inks sector, valued at $1800.0 million. Key growth drivers include rapid industrialization, increasing packaging needs, and a booming e-commerce sector. The demand for eco-friendly inks is rising, supported by government initiatives promoting sustainable practices. Infrastructure development, particularly in logistics and manufacturing, further fuels consumption patterns in urban areas.

India : Rapid Growth in Diverse Sectors

India accounts for 16% of the APAC printing inks market, valued at $800.0 million. The growth is driven by the expanding packaging industry, increasing urbanization, and a rise in consumer goods. Government initiatives like 'Make in India' are fostering local manufacturing, while regulatory policies are gradually becoming more supportive of sustainable practices. The demand for digital printing is also on the rise, reflecting changing consumption patterns.

Japan : Innovation and Quality at Forefront

Japan holds a 12% market share in the APAC printing inks sector, valued at $600.0 million. The market is driven by high-quality standards and technological advancements in printing processes. Demand for specialty inks, particularly in electronics and packaging, is increasing. Regulatory policies emphasize environmental sustainability, pushing manufacturers to innovate. The country's robust infrastructure supports efficient distribution and production.

South Korea : Growth in Packaging and Publishing

South Korea represents 10% of the APAC printing inks market, valued at $500.0 million. Key growth drivers include a thriving packaging industry and a strong publishing sector. The demand for high-quality inks is rising, supported by government initiatives promoting innovation. Urban centers like Seoul and Busan are key markets, with a competitive landscape featuring major players like DIC Corporation and Toyo Ink SC Holdings.

Malaysia : Strategic Location and Development

Malaysia accounts for 6% of the APAC printing inks market, valued at $300.0 million. The growth is driven by increasing demand in packaging and labeling sectors. Government initiatives to boost manufacturing and exports are enhancing market conditions. The local market is characterized by a mix of international and local players, with Kuala Lumpur and Penang being key cities for distribution and production.

Thailand : Focus on Sustainability and Innovation

Thailand holds a 5% market share in the APAC printing inks sector, valued at $250.0 million. The market is driven by growth in packaging and commercial printing. Government policies promoting sustainable practices are influencing demand trends. Key cities like Bangkok and Chiang Mai are central to market activities, with a competitive landscape featuring both local and international players.

Indonesia : Growth Driven by Local Demand

Indonesia represents 4% of the APAC printing inks market, valued at $200.0 million. The growth is fueled by increasing demand in packaging and textiles. Government initiatives to support local manufacturing are enhancing market conditions. Jakarta and Surabaya are key markets, with a competitive landscape that includes both local manufacturers and international players like Siegwerk Druckfarben.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC accounts for 11% of the printing inks market, valued at $550.0 million. Growth is driven by diverse applications across various industries, including packaging and textiles. Regulatory policies vary by country, influencing market dynamics. Key markets include Vietnam and the Philippines, where local players are increasingly competitive, supported by regional infrastructure improvements.