China : Robust Growth and Innovation Hub

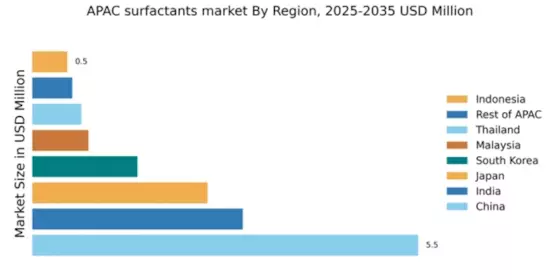

China holds a commanding 5.5% market share in the APAC surfactants market, driven by rapid industrialization and urbanization. Key growth drivers include increasing demand from the personal care and household cleaning sectors, alongside government initiatives promoting sustainable practices. Regulatory policies are becoming more stringent, pushing manufacturers towards eco-friendly surfactants. Infrastructure development, particularly in coastal cities like Shanghai and Shenzhen, supports logistics and distribution, enhancing market accessibility.

India : Rapid Urbanization Fuels Demand

India's surfactants market accounts for 3.0% of the APAC total, reflecting a growing consumer base and increasing disposable incomes. The demand is primarily driven by the expanding personal care and home care industries. Government initiatives like 'Make in India' are fostering local manufacturing, while regulatory frameworks are evolving to ensure product safety and environmental compliance. The rise of e-commerce is also influencing consumption patterns, making products more accessible.

Japan : Innovation and Quality at Forefront

Japan's market share stands at 2.5%, characterized by high-quality standards and technological advancements. The growth is propelled by the demand for specialty surfactants in cosmetics and pharmaceuticals. Regulatory policies are stringent, ensuring product safety and environmental sustainability. The country's robust infrastructure supports efficient supply chains, particularly in urban centers like Tokyo and Osaka, where consumer preferences lean towards premium products.

South Korea : Strong Demand in Multiple Sectors

South Korea holds a 1.5% share in the surfactants market, driven by diverse applications across personal care, automotive, and industrial sectors. The growth is supported by a tech-savvy consumer base and increasing demand for eco-friendly products. Government regulations are promoting sustainable practices, while cities like Seoul and Busan are key markets for innovation. Major players like LG Chem and SK Global Chemical are enhancing competition in this vibrant landscape.

Malaysia : Strategic Location and Investment Opportunities

Malaysia's surfactants market represents 0.8% of the APAC total, with growth driven by increasing demand in the personal care and cleaning sectors. The government is actively promoting foreign investments and local manufacturing through initiatives like the Malaysia Investment Development Authority (MIDA). The country's strategic location facilitates trade, particularly in key markets like Kuala Lumpur and Penang, where industrial development is on the rise.

Thailand : Focus on Eco-Friendly Solutions

Thailand's market share is 0.7%, with growth fueled by rising consumer awareness regarding sustainability. The demand for biodegradable surfactants is increasing, supported by government policies promoting environmental protection. Key markets include Bangkok and Chiang Mai, where urbanization is driving consumption. The competitive landscape features both local and international players, with a focus on innovation in product offerings to meet changing consumer preferences.

Indonesia : Rising Demand Amidst Growth Challenges

Indonesia's surfactants market accounts for 0.5% of the APAC total, with significant growth potential driven by a young population and increasing urbanization. Demand is rising in personal care and household cleaning sectors, although challenges such as regulatory hurdles and infrastructure gaps persist. Key cities like Jakarta and Surabaya are emerging as focal points for market expansion, with local players beginning to gain traction against established international brands.

Rest of APAC : Varied Growth Across Sub-Regions

The Rest of APAC holds a market share of 0.57%, characterized by diverse consumer needs and varying growth rates. Countries like Vietnam and the Philippines are witnessing increased demand for surfactants in personal care and industrial applications. Regulatory environments are evolving, with a focus on sustainability and product safety. The competitive landscape includes both local and international players, adapting to the unique market dynamics of each country.