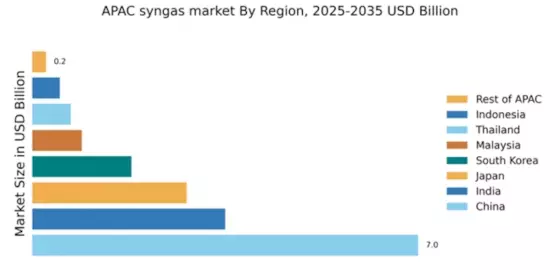

China : Unmatched Growth and Demand Trends

China holds a commanding 7.0% market share in the APAC syngas sector, driven by rapid industrialization and urbanization. Key growth drivers include government initiatives promoting clean energy and investments in infrastructure. The demand for syngas is surging, particularly in the chemical and energy sectors, supported by favorable regulatory policies aimed at reducing carbon emissions. The country is also enhancing its industrial capabilities, with significant advancements in technology and production processes.

India : Strong Demand from Industrial Sectors

India's syngas market accounts for 3.5% of the APAC total, fueled by increasing energy needs and industrial growth. The government is actively promoting syngas production through initiatives like the National Biofuel Policy, which encourages alternative energy sources. Demand is particularly strong in sectors such as fertilizers and power generation, with a growing focus on cleaner technologies and infrastructure development.

Japan : Innovation Driving Market Growth

Japan's syngas market represents 2.8% of the APAC share, characterized by advanced technology and innovation. The country is focusing on hydrogen production from syngas as part of its energy transition strategy. Regulatory support for clean energy initiatives and investments in R&D are key growth drivers. The demand for syngas is rising in sectors like automotive and power generation, aligning with Japan's sustainability goals.

South Korea : Government Support and Industrial Demand

South Korea holds a 1.8% share in the APAC syngas market, driven by strong government backing for clean energy projects. The country is investing in syngas technologies to support its energy transition. Demand is increasing in the petrochemical and power sectors, with a focus on reducing greenhouse gas emissions. Infrastructure development is also enhancing production capabilities, making the market more competitive.

Malaysia : Focus on Sustainable Energy Solutions

Malaysia's syngas market accounts for 0.9% of the APAC total, with growth driven by the government's commitment to sustainable energy. Initiatives like the National Renewable Energy Policy are fostering syngas production. Demand is particularly strong in the chemical and energy sectors, with increasing investments in infrastructure and technology. The market is evolving, with local players expanding their capabilities.

Thailand : Investment in Clean Energy Initiatives

Thailand's syngas market represents 0.7% of the APAC share, with growth fueled by investments in clean energy and government policies promoting alternative fuels. The demand for syngas is rising in sectors such as agriculture and power generation. Infrastructure improvements and industrial development are enhancing market dynamics, making it an attractive region for investment and growth.

Indonesia : Focus on Energy Diversification

Indonesia's syngas market accounts for 0.5% of the APAC total, driven by the need for energy diversification and sustainable solutions. Government initiatives are promoting syngas production, particularly in the agricultural and energy sectors. Demand is increasing as the country seeks to reduce reliance on fossil fuels. Local infrastructure development is also supporting market growth, creating opportunities for investment.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC accounts for 0.25% of the syngas market, with diverse opportunities emerging across various countries. Growth is driven by local initiatives aimed at promoting clean energy and reducing emissions. Demand patterns vary significantly, influenced by regional industrial activities and energy needs. The competitive landscape is evolving, with local players entering the market to capitalize on emerging trends.

Leave a Comment