- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

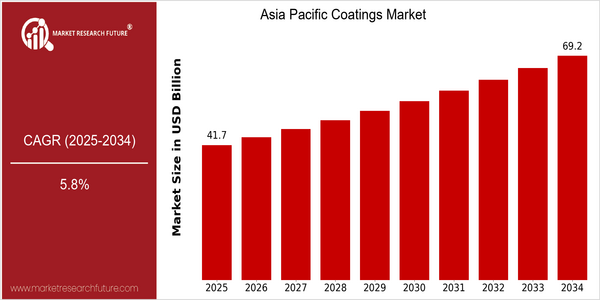

| Year | Value |

|---|---|

| 2025 | USD 41.69 Billion |

| 2034 | USD 69.25 Billion |

| CAGR (2025-2034) | 5.8 % |

Note – Market size depicts the revenue generated over the financial year

The Asia-Pacific coatings market is expected to grow at a CAGR of 3.1 per cent, from $23.17 billion in 2017 to $29.67 billion by 2025. It is projected to grow at a CAGR of 5.8 per cent from now to 2025. The growth is due to the growing demand for sustainable and environment-friendly coatings, technological advancements and increasing applications in the automotive, construction and consumer goods industries. The development of smart and high-performance coatings is expected to drive the market. The coatings are not only improving the appearance and lifespan of products, but also helping to reduce energy consumption and contribute to the energy efficiency of buildings. These coatings are also helping in the reduction of CO2 emissions. Leading players like AkzoNobel, PPG Industries and Sherwin-Williams are investing in research and development to launch new products and improve existing formulations. Strategic alliances are also being entered into to enhance product offerings and reach.

Regional Market Size

Regional Deep Dive

The Asia-Pacific Coatings Market is characterized by a high growth rate, owing to the growing urbanization, increasing development of the country’s transport system and the growing demand for environment-friendly products. The region has some of the world's fastest-growing economies, which are investing heavily in the construction and automobile industries, thus driving the demand for coatings. Furthermore, the trend towards sustainable and low-VOC coatings is reshaping the market, as consumers and governments are increasingly focusing on the environment.

Europe

- In Europe, the coatings market is influenced by the European Union's strict regulations on chemical safety and the environment, which are causing a boom in demand for sustainable and bio-based coatings. Companies such as AkzoNobel and BASF are in the forefront of developing solutions that meet these requirements.

- The rise of the circular economy in Europe is prompting manufacturers to explore recycling and reusing materials in coatings production, which is expected to drive innovation and reduce waste in the industry.

Asia Pacific

- The paint industry is booming in the Asia-Pacific region, especially in China and India where the rate of urbanization and industrialization is very high. To meet this growing demand, Nippon Paint and Asian Paints are increasing their production capacity.

- The Belt and Road initiative is a government-led plan to develop China’s transportation and communication network, and this is expected to spur further growth in the coatings market, primarily by increasing demand for protective and decorative coatings in the construction and transport industries.

Latin America

- In Latin America, the coatings market is slowly recovering, a result of economic recovery and increased investment in the construction and automotive industries. In response to these trends, local companies like Tintas Coral are introducing new, cost-effective coatings solutions.

- Regulatory changes aimed at reducing VOC emissions are prompting manufacturers to invest in greener technologies, which is expected to reshape the competitive landscape and enhance product offerings in the region.

North America

- The North American coatings market is undergoing a major shift towards water-based and low-VOC coatings, driven by increasingly strict regulations and the desire for sustainable products. PPG and Sherwin-Williams are the leading companies in this market, developing advanced formulations that meet the new standards.

- The recent implementation of the Clean Air Act amendments has prompted manufacturers to invest in R&D for eco-friendly coatings, which is expected to enhance product offerings and market competitiveness in the region.

Middle East And Africa

- The market for coatings in the Middle East and Africa is largely determined by the region’s growing construction industry, especially in the Gulf Cooperation Council (GCC) states, where large-scale building projects are under way. Companies like Jotun and National Paints are taking advantage of this growth by supplying specialized products for harsh climates.

- The increasing focus on sustainability and energy efficiency in building materials is leading to a rise in demand for eco-friendly coatings, which is expected to drive innovation and market growth in the region.

Did You Know?

“Did you know that the Asia Pacific region accounts for over 40% of the global coatings market, driven by its booming construction and automotive industries?” — Market Research Future

Segmental Market Size

The Asia-Pacific Coatings Market is growing steadily, especially the architectural coatings market, which is important for enhancing the aesthetics and protecting the surfaces. The demand for architectural coatings is mainly driven by the rapid urbanization in countries like China and India, where the need for new and improved infrastructure is high. Besides, the awareness of sustainable and environment-friendly products is growing among the consumers. The regulatory policies, which encourage the use of low-VOC and water-based coatings, are also contributing to the growth of the market. The advanced coatings technology has already been adopted in the Asia-Pacific region, and Nippon Paint and Asian Paints are leading the market penetration. Architectural coatings are mainly used in the construction of houses, commercial buildings, automobiles, and industries. The construction of smart cities in Singapore is a good example of the market's potential. Besides, the trends like the demand for sustainable coatings and the government policies to promote energy-saving buildings are driving the growth of the market. Nanocoatings and smart coatings are shaping the future of the market.

Future Outlook

From 2025 to 2034, the Asia-Pacific coatings market is expected to grow at a CAGR of 5.8 percent, from 41,694 million to 69,250,000,000. It is mainly due to the increasing urbanization, the increasing demand for construction, and the rising demand for high-tech and green coatings. The market is expected to grow rapidly, especially in emerging economies where the needs for construction are growing rapidly. The proportion of advanced coatings such as water-based and powder coatings will exceed 60 percent of the total market in 2034, mainly driven by the stricter environment and the popularization of green and health products. The development of smart coatings and the emergence of new nano-coatings will reshape the competitive landscape of the coatings industry. It not only improves the performance and service life of the coating, but also realizes the energy conservation and reduction of the cost of the equipment. It is expected that the demand for coatings will continue to increase. The government's green building policies and sustainable development will also stimulate the development of the market. It is expected that the market will be more competitive, and the companies in the industry will have to adapt to the changes in the market and the regulatory environment in order to grasp the big opportunity.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 5.80% (2023-2032) |

Asia Pacific Coatings Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.