- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

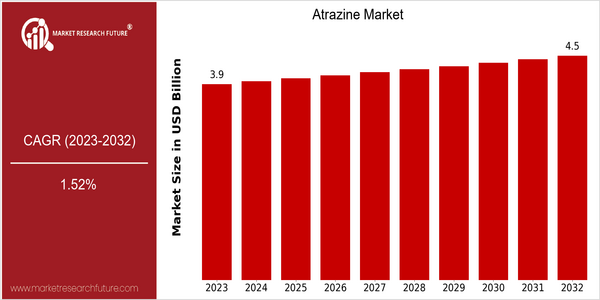

| Year | Value |

|---|---|

| 2023 | USD 3.93 Billion |

| 2032 | USD 4.5 Billion |

| CAGR (2024-2032) | 1.52 % |

Note – Market size depicts the revenue generated over the financial year

The global Atrazine market is currently valued at approximately USD 3.93 billion in 2023, with projections indicating a growth to USD 4.5 billion by 2032. This growth trajectory reflects a compound annual growth rate (CAGR) of 1.52% from 2024 to 2032. The market's steady expansion can be attributed to the increasing demand for effective herbicides in agricultural practices, particularly in the cultivation of corn and sugarcane, where Atrazine is widely utilized. As farmers seek to enhance crop yields and manage weed resistance, the reliance on such herbicides is expected to persist, driving market growth over the coming years. Technological advancements in agricultural practices, including precision farming and integrated pest management, are also contributing to the market's expansion. These innovations enable more efficient use of Atrazine, optimizing its application and minimizing environmental impact. Key players in the Atrazine market, such as Syngenta, Corteva Agriscience, and BASF, are actively engaging in strategic initiatives, including partnerships and investments in research and development, to enhance product efficacy and sustainability. For instance, recent product launches focusing on improved formulations and application techniques are expected to further bolster market growth, aligning with the evolving needs of the agricultural sector.

Regional Market Size

Regional Deep Dive

The Atrazine Market is characterized by diverse dynamics across different regions, influenced by agricultural practices, regulatory frameworks, and environmental concerns. In North America, particularly the United States, Atrazine is widely used in corn production, making it a critical herbicide for farmers. In Europe, stringent regulations and a shift towards sustainable agriculture are reshaping the market, while the Asia-Pacific region is witnessing increased adoption due to rising agricultural demands. The Middle East and Africa present unique challenges and opportunities, with varying levels of regulatory oversight and agricultural development. Latin America, particularly Brazil, is a significant player in the Atrazine market, driven by its extensive agricultural sector. Overall, the market is poised for evolution as it adapts to regulatory changes and shifts in agricultural practices.

Europe

- The European Union's Green Deal and Farm to Fork strategy are pushing for reduced pesticide use, leading to increased scrutiny and potential restrictions on Atrazine, which may drive innovation in alternative herbicides.

- Several countries, including France and Germany, are implementing stricter regulations on Atrazine usage, prompting farmers to seek integrated pest management solutions that could reshape the market landscape.

Asia Pacific

- Countries like India and China are increasing their use of Atrazine due to the growing need for food security and higher agricultural productivity, supported by government initiatives to boost crop yields.

- The rise of agrochemical companies in the region, such as UPL Limited and China National Chemical Corporation, is fostering competition and innovation in the Atrazine market, leading to more effective formulations and application methods.

Latin America

- Brazil remains one of the largest consumers of Atrazine, driven by its extensive soybean and corn production, with local regulations supporting its use while also emphasizing the need for responsible application.

- The Brazilian government is investing in research to develop more sustainable agricultural practices, which may influence the future use of Atrazine and its alternatives in the region.

North America

- The U.S. Environmental Protection Agency (EPA) has recently reaffirmed the safety of Atrazine, which is expected to bolster its continued use in corn and sugarcane production, crucial for the agricultural economy.

- Innovations in precision agriculture are leading to more targeted applications of Atrazine, reducing environmental impact and improving crop yields, with companies like Syngenta investing in technology to enhance application efficiency.

Middle East And Africa

- In Africa, the lack of stringent regulations on herbicides like Atrazine is leading to increased usage, particularly in countries with expanding agricultural sectors, such as South Africa and Kenya.

- Government programs aimed at improving agricultural productivity are encouraging the adoption of Atrazine, but concerns over environmental impact and water contamination are prompting discussions on sustainable practices.

Did You Know?

“Atrazine is one of the most widely used herbicides in the world, with over 70 million pounds applied annually in the United States alone, primarily in corn production.” — U.S. Environmental Protection Agency (EPA)

Segmental Market Size

The Atrazine Market segment plays a crucial role in the agricultural sector, particularly in the herbicide category, and is currently experiencing stable demand. Key drivers include the increasing need for effective weed management in crops such as corn and sugarcane, alongside regulatory policies that support the use of herbicides to enhance agricultural productivity. Additionally, advancements in formulation technologies are improving the efficacy and safety profiles of Atrazine, further driving its adoption among farmers. Currently, the adoption of Atrazine is in a mature stage, with notable examples including its widespread use in the United States and Brazil, where it is integral to crop management practices. Primary applications encompass pre-emergent and post-emergent weed control, particularly in large-scale farming operations. Trends such as sustainability initiatives and the push for integrated pest management are catalyzing growth, as farmers seek to balance productivity with environmental stewardship. Technologies like precision agriculture and data analytics are shaping the segment's evolution, enabling more targeted and efficient use of Atrazine in various agricultural settings.

Future Outlook

The Atrazine Market is poised for steady growth from 2023 to 2032, with a projected market value increase from $3.93 billion to $4.5 billion, reflecting a compound annual growth rate (CAGR) of 1.52%. This growth trajectory is underpinned by the continued demand for effective herbicides in agricultural practices, particularly in the cultivation of corn and sugarcane, where Atrazine remains a critical component for weed management. As global food production needs rise, the reliance on herbicides like Atrazine is expected to persist, ensuring its market penetration remains robust, with usage rates anticipated to stabilize around 30% in key agricultural regions by 2032. Key drivers influencing the Atrazine Market include advancements in agricultural technology and evolving regulatory frameworks. Innovations in precision agriculture and integrated pest management are likely to enhance the efficacy and application of Atrazine, making it a preferred choice among farmers. Additionally, while regulatory scrutiny surrounding herbicide usage continues to increase, particularly concerning environmental and health impacts, the development of safer formulations and application methods is expected to mitigate potential restrictions. Emerging trends such as the shift towards sustainable farming practices and the integration of biopesticides may also shape the market landscape, prompting manufacturers to adapt their strategies to align with consumer preferences for environmentally friendly solutions.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 1.60 Billion |

| Growth Rate | 5.93 % (2023-2032) |

Atrazine Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.