Regulatory Compliance and Standards

The Automated Endoscopy Reprocessor Market is significantly influenced by the stringent regulatory compliance requirements imposed by health authorities. Regulatory bodies mandate rigorous standards for the cleaning, disinfection, and sterilization of endoscopic equipment to prevent healthcare-associated infections. Compliance with these regulations is not only essential for patient safety but also for healthcare facilities to maintain accreditation and avoid penalties. As a result, there is a growing emphasis on investing in automated reprocessing systems that meet these regulatory standards. The market is expected to witness a steady increase in demand for compliant automated reprocessors, as healthcare providers prioritize adherence to regulations while enhancing operational efficiency. This trend indicates a robust growth trajectory for the Automated Endoscopy Reprocessor Market in the coming years.

Increased Demand for Infection Control

The heightened awareness surrounding infection control practices is a key driver for the Automated Endoscopy Reprocessor Market. As healthcare facilities strive to mitigate the risk of infections, the demand for effective reprocessing solutions has surged. Automated endoscopy reprocessors offer a reliable means of ensuring that endoscopic instruments are thoroughly cleaned and disinfected, thereby reducing the likelihood of cross-contamination. Market data suggests that the demand for these systems is expected to rise, particularly in outpatient surgical centers and hospitals, where the volume of endoscopic procedures is increasing. This growing focus on infection control is likely to propel the adoption of automated reprocessing technologies, further solidifying their role in the Automated Endoscopy Reprocessor Market.

Rising Number of Endoscopic Procedures

The Automated Endoscopy Reprocessor Market is poised for growth due to the rising number of endoscopic procedures performed worldwide. As minimally invasive surgical techniques gain popularity, the demand for endoscopy services is increasing, leading to a corresponding rise in the need for efficient reprocessing solutions. According to recent estimates, the number of endoscopic procedures is projected to reach over 30 million annually by 2026. This surge necessitates the implementation of automated reprocessors to handle the increased workload while maintaining high standards of hygiene and safety. Consequently, healthcare facilities are likely to invest in advanced reprocessing technologies to accommodate this growing demand, thereby driving the expansion of the Automated Endoscopy Reprocessor Market.

Cost Efficiency and Resource Optimization

Cost efficiency and resource optimization are becoming critical considerations for healthcare facilities, influencing the Automated Endoscopy Reprocessor Market. As hospitals and clinics face budget constraints, the need to streamline operations and reduce costs is paramount. Automated endoscopy reprocessors can significantly lower labor costs associated with manual cleaning processes and minimize the risk of reprocessing errors. By investing in these systems, healthcare providers can achieve a more efficient workflow, ultimately leading to better resource allocation. Market analysis indicates that facilities adopting automated solutions may experience a reduction in overall operational costs by up to 20%. This potential for cost savings is likely to drive the adoption of automated reprocessing technologies, further propelling the growth of the Automated Endoscopy Reprocessor Market.

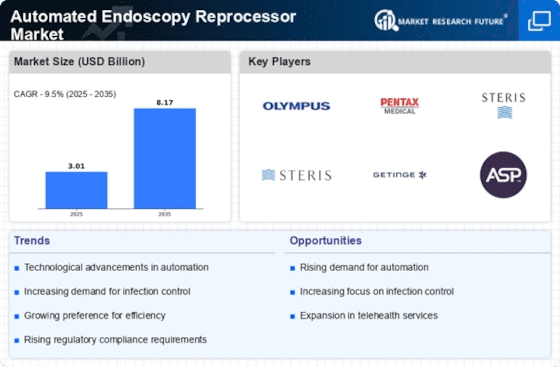

Technological Advancements in Automated Endoscopy Reprocessor Market

The Automated Endoscopy Reprocessor Market is experiencing a surge in technological advancements that enhance the efficiency and effectiveness of endoscope reprocessing. Innovations such as automated cleaning systems, advanced monitoring technologies, and integration with hospital information systems are becoming increasingly prevalent. These advancements not only streamline the reprocessing workflow but also ensure compliance with stringent infection control standards. The market is projected to grow at a compound annual growth rate of approximately 8% over the next few years, driven by the need for improved patient safety and operational efficiency. As healthcare facilities seek to minimize human error and optimize resource utilization, the adoption of these advanced technologies is likely to accelerate, thereby shaping the future landscape of the Automated Endoscopy Reprocessor Market.