Automotive Dealer Management System Market Overview

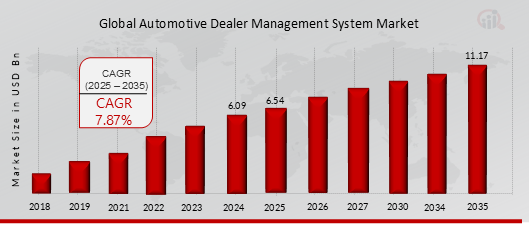

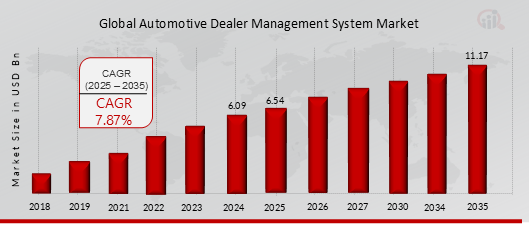

The Automotive Dealer Management System Market was valued at USD 6.09 Billion in 2024. The Automotive Dealer Management System Market industry is projected to grow from USD 6.54 Billion in 2025 to USD 11.17 Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 7.87% during the forecast period (2025-2035).

The increasing demand for operational efficiency in dealerships and rising complexity of automotive retail operations and inventory management are driving the growth of the Automotive Dealer Management System Market.

As per the Analyst at MRFR, the automotive industry has witnessed a significant transformation over the past decade, with dealerships seeking to enhance their operational efficiency to stay competitive in a rapidly evolving market. Operational efficiency, in this context, refers to the ability of a dealership to streamline processes, reduce costs, and improve overall performance. This growing demand for efficiency is driven by several factors that underscore the need for advanced Dealer Management Systems (DMS).

FIGURE 1: GLOBAL AUTOMOTIVE DEALER MANAGEMENT SYSTEM VALUE (2019-2035) USD BILLION

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Automotive Dealer Management System Market Opportunity

Increasing Adoption of Cloud-Based DMS Solutions

The global automotive industry is experiencing a significant shift towards digital transformation, and one of the most impactful changes is the increasing adoption of cloud-based Dealer Management Systems (DMS). Cloud-based DMS solutions are revolutionizing the way automotive dealerships operate by providing a range of benefits that enhance efficiency, scalability, and flexibility. This transformation is driven by the growing need for dealerships to streamline their operations, improve customer experience, and remain competitive in a rapidly evolving market.

One of the primary advantages of cloud-based DMS solutions is their scalability. Traditional on-premises DMS systems often require substantial investments in hardware and infrastructure, which can be both costly and time-consuming to scale. In contrast, cloud-based DMS solutions offer a flexible and scalable infrastructure that can easily accommodate the varying needs of dealerships as they grow. Dealerships can easily add new users, locations, and functionalities without the need for significant capital expenditure. This scalability is particularly advantageous for automotive dealer groups and franchises that operate in multiple locations and require a unified system to manage their operations efficiently.

Additionally, the flexibility of cloud-based DMS solutions allows dealerships to adapt quickly to changing market conditions and technological advancements. With cloud-based systems, dealerships can access the latest features and updates without the need for complex upgrades or downtime. This ensures that dealerships are always equipped with the most current tools and technologies, enabling them to stay ahead of the competition and meet the evolving needs of their customers.

Cost efficiency is another compelling reason for the increasing adoption of cloud-based DMS solutions. Traditional on-premises systems often involve significant upfront costs for hardware, software licenses, and IT infrastructure. Furthermore, ongoing maintenance, upgrades, and support can add to the overall cost of ownership. Cloud-based DMS solutions, on the other hand, operate on a subscription-based model, which eliminates the need for large capital expenditures and reduces the burden of managing IT infrastructure.

Automotive Dealer Management System Market Segment Insights

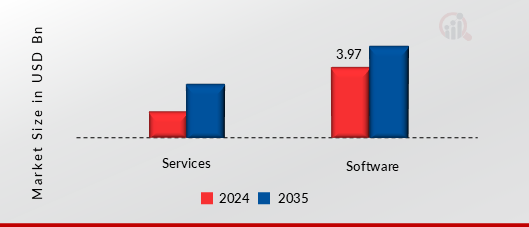

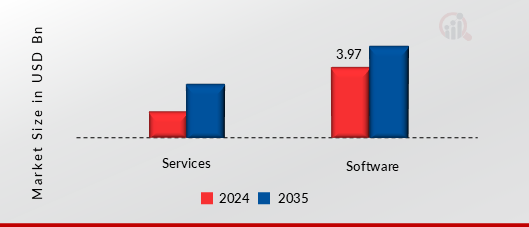

Automotive Dealer Management System by Components Insights

Based on Components, this segment includes Software and Services. The Software segment dominated the global market in 2024, while the Services segment is projected to be the fastest–growing segment during the forecast period. The Software component of the Automotive DMS market includes a suite of applications designed to help automotive dealerships manage their core business processes. These software systems provide an end-to-end solution, enabling dealerships to streamline functions such as sales, finance, customer relationship management (CRM), inventory control, and service management.

DMS software is often integrated with other enterprise resource planning (ERP) systems, offering a comprehensive management tool for the dealership. Key modules include inventory management, which helps track vehicle stock, service history, and parts inventory; sales management, which helps track leads, opportunities, and completed transactions; and CRM systems that keep customer records, preferences, and interaction histories, all of which are essential to customer retention strategies.

FIGURE 2: AUTOMOTIVE DEALER MANAGEMENT SYSTEM MARKET SHARE BY COMPONENTS 2024 AND 2035 (USD BILLION)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Automotive Dealer Management System by Deployment Insights

Based on Deployment, this segment includes On-Cloud and On-Premises. The On-Cloud segment dominated the global market in 2024, while it is projected to be the fastest–growing segment during the forecast period. A cloud-based DMS is hosted on remote servers, and dealerships access the system via the internet. One of the key benefits of a cloud solution is its accessibility. Dealerships can access the system from any device with an internet connection, making it highly adaptable to the modern, flexible working environment.

This has become particularly useful for multi-location dealerships, allowing centralized data management, which enables seamless integration across various branches. Additionally, cloud-based systems require less upfront investment. Dealerships do not need to invest in expensive hardware or dedicated IT staff to managing servers, which significantly reduces capital expenditure. Instead, they typically pay for the service through a subscription model.

Automotive Dealer Management System by Application Insights

Based on Application, this segment includes Sales Management, Finance and Insurance (F&I) Management, Parts Inventory Management, Service Management, Customer Relationship Management (CRM). The Sales Management segment dominated the global market in 2024, while the Finance and Insurance (F&I) Management segment is projected to be the fastest–growing segment during the forecast period. The sales management segment is a vital component of the Automotive DMS market as it helps dealerships manage the entire sales process, from customer inquiry to closing the deal.

A robust DMS solution enables sales teams to track leads, schedule test drives, calculate quotes, and maintain customer communication records, all in one platform.

By integrating data from various sources, the sales management module allows dealerships to provide personalized offers, manage promotions, and create seamless transactions. Furthermore, it automates repetitive tasks, such as updating inventory availability and generating sales reports, allowing sales representatives to focus on building relationships and closing deals. This segment also integrates with financial systems to ensure real-time financial visibility, aiding sales teams in providing accurate information regarding pricing, financing options, and vehicle availability.

Automotive Dealer Management System by Dealer Type Insights

Based on Dealer Type, this segment includes Passenger Car Dealerships, Commercial Vehicle Dealerships, Two-Wheelers Dealerships, Off-Highway Vehicle Dealerships. The Passenger Car Dealerships segment dominated the global market in 2024, while the Two-Wheelers Dealerships segment is projected to be the fastest–growing segment during the forecast period. Passenger car dealerships represent one of the most significant segments within the Automotive Dealer Management System (DMS) market. These dealerships specialize in selling and servicing automobiles designed primarily for personal use, including sedans, hatchbacks, and SUVs.

The primary focus for DMS in this segment is to streamline operations related to vehicle sales, inventory management, service scheduling, and customer relationship management. Advanced DMS solutions help passenger car dealerships manage their extensive vehicle inventories, track sales performance, and enhance customer service through integrated CRM systems. Features such as automated appointment scheduling, digital vehicle management, and sales analytics are essential in helping these dealerships improve operational efficiency and customer satisfaction.

Automotive Dealer Management System by End-Users Insights

Based on the End-Users, this segment includes Franchise Dealerships and Independent Dealerships. The Franchise Dealerships segment dominated the global market in 2024, while the Independent Dealerships segment is projected to be the fastest–growing segment during the forecast period. Franchise dealerships are authorized to sell vehicles and parts from specific automobile manufacturers. They operate under a contractual agreement with these manufacturers, which grants them the right to use the brand name and sell vehicles of a particular make. Franchise dealerships are typically part of a larger network of dealers affiliated with a single automotive brand.

These dealerships benefit from the established brand reputation and customer loyalty of the manufacturer. The primary role of a DMS in franchise dealerships is to streamline and enhance the management of various dealership operations, including sales, inventory management, service and repair, and customer relationship management. A robust DMS helps franchise dealerships maintain consistency in service quality, adhere to manufacturer standards, and optimize their sales processes.

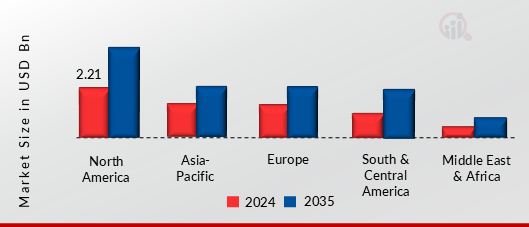

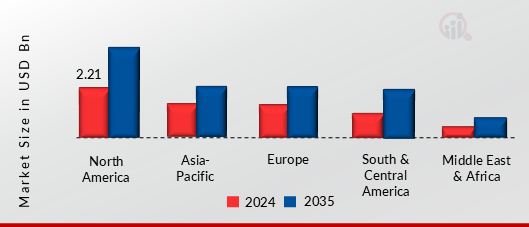

Automotive Dealer Management System Regional Insights

Based on the Region, the global Automotive Dealer Management System is segmented into North America, Europe, Asia-Pacific, Middle East & Africa and South & Central America. The North America dominated the global market in 2024, while the Asia-Pacific is projected to be the fastest–growing segment during the forecast period. Major demand factors driving the North America market are the increasing demand for operational efficiency in dealerships and rising complexity of automotive retail operations and inventory management.

As dealerships seek to streamline operations, enhance customer experiences, and integrate new technologies, the adoption of advanced DMS solutions has become a strategic imperative. The market is characterized by a robust competitive landscape with major players like CDK Global, Reynolds and Reynolds, and Cox Automotive leading the charge. These companies are continuously innovating to offer comprehensive solutions that cover various aspects of dealership operations, including sales, finance, inventory management, and customer relationship management (CRM).

FIGURE 3: AUTOMOTIVE DEALER MANAGEMENT SYSTEM MARKET VALUE BY REGION 2024 AND 2035 (USD BILLION)

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Further, the countries considered in the scope of the Application Tracking System Market are the US, Canada, Mexico, the UK, Germany, France, Italy, Spain, Austria, Netherlands, Belgium, Sweden, Denmark, Norway, Poland, Portugal, Turkey, China, Japan, India, South Korea, Australia, Singapore, Malaysia, Saudi Arabia, UAE, Qatar, South Africa, Brazil, Argentina, Chile and others.

Global Automotive Dealer Management System Key Market Players & Competitive Insights

Many global, regional, and local vendors characterize the Automotive Dealer Management System Market. The market is highly competitive, with all the players competing to gain market share. Intense competition, rapid advances in technology, frequent changes in government policies, and environmental regulations are key factors that confront market growth. The vendors compete based on cost, product quality, reliability, and government regulations. Vendors must provide cost-efficient, high-quality products to survive and succeed in an intensely competitive market.

The major competitors in the market are CDK Global LLC, Dealertrack, Inc., Tekion Corp., Wipro, Incadea, Reynolds & Reynolds, Oasis Auto Complete Systems, VinSolutions Inc., Oracle, GaragePlug Inc., Aspire Systems, Autosoft Inc., Karmak, Inc., Dominion Enterprises, Dealer Socket are among others. The Automotive Dealer Management System Market is a consolidated market due to increasing competition, acquisitions, mergers and other strategic market developments and decisions to improve operational effectiveness.

Key Companies in the Automotive Dealer Management System Market include

- CDK Global LLC

- Dealertrack, Inc.

- Tekion Corp.

- Wipro

- Incadea

- Reynolds & Reynolds

- Oasis Auto Complete Systems

- VinSolutions Inc.

- Oracle

- GaragePlug Inc.

- Aspire Systems

- Autosoft Inc.

- Karmak, Inc.

- Dominion Enterprises

- Dealer Socket

Automotive Dealer Management System Market Industry Developments

-

Q2 2024: Tekion Launches Automotive Retail Cloud 2.0, the Next Generation of its Cloud-Native Platform Tekion announced the launch of Automotive Retail Cloud 2.0, introducing new features and enhancements to its dealer management system platform, aimed at improving operational efficiency and customer experience for automotive retailers.

-

Q2 2024: CDK Global Announces New Integration Partnership with FordDirect CDK Global entered into a partnership with FordDirect to integrate digital retailing tools with CDK’s dealer management system, enabling Ford and Lincoln dealers to streamline sales and service processes.

-

Q1 2024: Reynolds and Reynolds Names Tommy Barras as CEO Reynolds and Reynolds, a major provider of automotive dealer management systems, appointed Tommy Barras as its new Chief Executive Officer, signaling a leadership transition at the company.

-

Q2 2024: DealerSocket Unveils New AI-Powered Inventory Management Module DealerSocket launched an AI-powered inventory management module for its dealer management system, designed to help dealerships optimize stock levels and improve sales forecasting.

-

Q1 2024: Auto/Mate DMS Announces Integration with QuickBooks Online Auto/Mate DMS announced a new integration with QuickBooks Online, allowing automotive dealers to synchronize financial data between their dealer management system and accounting software.

-

Q2 2024: Dealertrack Launches Enhanced Compliance Solution for Automotive Dealers Dealertrack introduced an enhanced compliance solution within its dealer management system, aimed at helping dealerships meet evolving regulatory requirements in automotive retail.

-

Q1 2024: Cox Automotive Acquires Fyusion to Bolster Dealer Management System Capabilities Cox Automotive acquired Fyusion, a computer vision and machine learning company, to enhance imaging and AI features within its dealer management system offerings.

-

Q2 2024: Dominion DMS Announces Partnership with Amazon Web Services Dominion DMS partnered with Amazon Web Services to migrate its dealer management system platform to the AWS cloud, aiming to improve scalability and security for automotive dealers.

-

Q1 2024: PBS Systems Launches New Mobile App for Dealer Management System Users PBS Systems released a new mobile application for its dealer management system, enabling dealership staff to access key functionalities and data remotely.

-

Q2 2024: Keyloop Acquires Rapid RTC to Expand Digital Retailing Capabilities Keyloop acquired Rapid RTC, a digital communications platform, to integrate advanced lead management and customer engagement tools into its dealer management system suite.

-

Q1 2024: DealerBuilt Announces Strategic Investment from ParkerGale Capital DealerBuilt, a provider of dealer management systems, received a strategic investment from ParkerGale Capital to accelerate product development and market expansion.

-

Q2 2024: AutoSoft Launches Next-Generation Service Scheduling Platform AutoSoft introduced a next-generation service scheduling platform as part of its dealer management system, offering enhanced appointment management and customer communication features.

Automotive Dealer Management System Market Segmentation

Automotive Dealer Management System by Components Outlook

Automotive Dealer Management System by Deployment Outlook

Automotive Dealer Management System by Application Outlook

- Sales Management

- Finance And Insurance (F&I) Management

- Parts Inventory Management

- Service Management

- Customer Relationship Management (CRM)

Automotive Dealer Management System by Dealer Type Outlook

- Passenger Car Dealerships

- Commercial Vehicle Dealerships

- Two-Wheelers Dealerships

- Off-Highway Vehicle Dealerships

Automotive Dealer Management System by End-Users Outlook

- Franchise Dealerships

- Independent Dealerships

Automotive Dealer Management System Regional Outlook

-

North America

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Austria

- Netherlands

- Belgium

- Sweden

- Denmark

- Norway

- Poland

- Portugal

- Turkey

- Rest of Europe

-

Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Singapore

- Malaysia

- Rest of Asia-Pacific

-

Middle East & Africa

- Saudi Arabia

- UAE

- Qatar

- South Africa

- Rest of Middle East & Africa

-

South & Central America

- Brazil

- Argentina

- Chile

- Rest of South & Central America

| Report Attribute/Metric |

Details |

| Market Size 2024 |

USD 6.09 Billion |

| Market Size 2025 |

USD 6.54 Billion |

| Market Size 2035 |

USD 11.17 Billion |

| Compound Annual Growth Rate (CAGR) |

7.87% (2025-2035) |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Historical Data |

2019-2023 |

| Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

By Components, By Deployments, By Application, By Dealer Type, By End-Users |

| Geographies Covered |

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America |

| Countries Covered |

The US, Canada, Mexico, the UK, Germany, France, Italy, Spain, Austria, Netherlands, Belgium, Sweden, Denmark, Norway, Poland, Portugal, Turkey, China, Japan, India, South Korea, Australia, Singapore, Malaysia, Saudi Arabia, UAE, Qatar, South Africa, Brazil, Argentina, Chile |

| Key Companies Profiled |

CDK Global LLC, Dealertrack, Inc., Tekion Corp., Wipro, Incadea, Reynolds & Reynolds, Oasis Auto Complete Systems, VinSolutions Inc., Oracle, GaragePlug Inc., Aspire Systems, Autosoft Inc., Karmak, Inc., Dominion Enterprises, Dealer Socket |

| Key Market Opportunities |

· Increasing adoption of cloud-based DMS solutions · Expansion of automotive e-commerce and online sales channels |

| Key Market Dynamics |

· Increasing demand for operational efficiency in dealerships · Rising complexity of automotive retail operations and inventory management |

Frequently Asked Questions (FAQ):

USD 6.09 Billion is the Automotive Dealer Management System Market in 2024

The Software segment by Components hold the largest market share and grows at a CAGR of 7.51 % during the forecast period.

North America holds the largest market share in the Global Automotive Dealer Management System Market.

CDK Global LLC, Dealertrack, Inc., Tekion Corp., Wipro, Incadea, Reynolds & Reynolds, Oasis Auto Complete Systems, VinSolutions Inc., Oracle, GaragePlug Inc., Aspire Systems, Autosoft Inc., Karmak, Inc., Dominion Enterprises, Dealer Socket are the prominent players in the Global Automotive Dealer Management System Market.

The Sales Management segment dominated the market in 2024.