- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

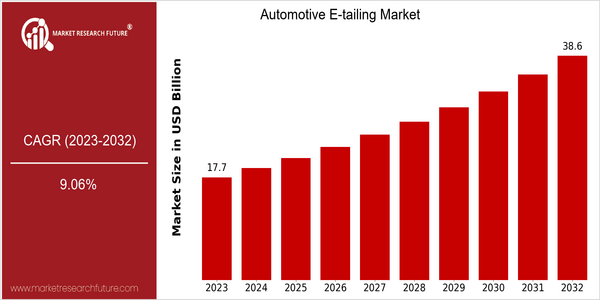

Automotive E-tailing Market Size Snapshot

| Year | Value |

|---|---|

| 2023 | USD 17.68 Billion |

| 2032 | USD 38.6 Billion |

| CAGR (2024-2032) | 9.06 % |

Note – Market size depicts the revenue generated over the financial year

The global automotive e-tail market is expected to reach USD 38.6 billion by 2032, growing at a CAGR of 23.7% between 2018 and 2032. The CAGR from 2024 to 2032 is expected to be 9.06%. The increasing inclination of consumers towards e-shopping, along with the advancements in digital payment solutions and logistics, is driving the market growth. The rising demand for automobiles, parts, and accessories on the e-shopping platforms is expected to further drive the market growth. The technological innovations, such as augmented reality (AR) for virtual product demonstrations and artificial intelligence (AI) for a personalised shopping experience, are further increasing the popularity of the e-shopping platforms. The key players in the market, such as AutoZone, Amazon, and eBay Motors, are investing in digital transformation and strategic collaborations to enhance their e-shopping offerings. The strategic collaborations with the logistics companies to improve the delivery time and the introduction of mobile applications for easy access to the e-shopping platforms are some of the key strategies being adopted by the key players to gain a larger market share. The future growth of the market will depend on the factors mentioned above.

Regional Deep Dive

The market for automobiles on the Internet is growing at a rapid rate, driven by the rising popularity of e-commerce, the changing preferences of consumers and the advancement of technology. The market in North America is characterized by a high penetration of e-commerce platforms and a strong focus on the customer experience. Europe is characterized by a diverse market with different regulations and different buyer habits. The Asia-Pacific region is growing rapidly, mainly due to the increase in Internet access and the use of smart phones. The Middle East and Africa are gradually moving towards e-commerce for automobiles, which is mainly influenced by improved logistics and digital payment systems. Latin America, although still underdeveloped, is experiencing a sharp increase in e-tailing, especially in urban areas, where consumers are looking for the convenience and price of e-commerce.

North America

- The subscription model, such as Carvana and Vroom, is transforming the way people buy cars, allowing for more flexible ownership models.

- E-commerce will also be able to offer a wider range of eco-friendly vehicles, which are more in line with the trend towards sustainable products.

- The omnichannel players are able to offer more and more products in the area of car parts and accessories and, by deploying their logistics expertise, to improve delivery times and customer satisfaction.

Europe

- The Green Deal of the European Union is having an effect on e-retailing. It is promoting electric vehicles and sustainable products for the automobile industry, which in turn is resulting in a rise in the number of e-sales of electric vehicles and accessories.

- BMW and Mercedes-Benz have adopted the use of augmented reality in order to make the online shopping experience more effective and to enable the customer to see the vehicle in his own environment.

- Localized e-commerce platforms like AutoScout24 are offering consumers a choice of specialized offerings that take account of regional preferences and regulations, thus strengthening market competition.

Asia-Pacific

- China's car e-commerce market is booming, and Alibaba and Jingdong are at the forefront. The market is mainly driven by the rise of the Internet and the popularity of smart phones.

- The government’s subsidies and tax breaks for EVs have led to a surge in e-retailing of electric vehicles.

- AI and machine learning are increasingly being incorporated into e-tailing platforms to make shopping more individualized. For example, Tata Motors has been using these tools to better understand its consumers’ preferences.

MEA

- In the United Arab Emirates, the digitalization of the automobile sector is gaining momentum. Platforms like Dubicars and CarSwitch have gained popularity, because they offer a smooth experience of buying cars.

- E-retailing in the region has been facilitated by the development of the Internet and the use of mobile payment systems. This has made it easier for consumers to buy vehicles on the Internet.

- In the wake of the government’s digital drive, the country’s car dealers are adopting e-business strategies, which are expanding their reach.

Latin America

- Brazil has seen a rise in car e-retailing, with local platforms such as Webmotors and OLX Autos gaining popularity as consumers increasingly opt for e-commerce to buy their cars.

- Economic factors, such as currency fluctuations and inflation, have influenced the purchasing behaviour of consumers, causing them to seek better prices and credit opportunities on the Internet.

- Social media are a crucial factor in the growth of e-tailing. Through the use of platforms such as Facebook and Instagram, companies are able to reach potential customers.

Did You Know?

“In 2022, the e-tailing of car parts and accessories in the United States accounted for over a quarter of the total, demonstrating the growing importance of e-tailing in the auto sector.” — Statista

Segmental Market Size

The Automotive E-Tailer Market is currently experiencing a high level of growth, fueled by the increasing consumer preference for vehicle purchases and spare parts procurement over the Internet. The main reasons for this trend are the ease of digital shopping, the rise of mobile commerce, and the growing availability of detailed product information on the Internet. In addition, government policies encouraging e-commerce and digital transactions are a major driver of market dynamics.

At the moment, the market is well established. In the United States, Carvana and Vroom are in the lead, and Europe is a growing market. The most important applications are: the sale of used cars, the sale of spare parts and the subscription to the car. The trend towards e-tailing has been accelerated by the COVID 19 epidemic, whereby consumers are looking for safe shopping alternatives. The technology of augmented reality, virtual tours of the car and the recommendation systems of artificial intelligence are influencing the evolution of the sector and improving the experience and the engagement of consumers.

Future Outlook

The Automotive E-Tailer Market is set to grow significantly from 2023 to 2032, growing from 17.68 billion to 38.6 billion, at a high CAGR of 9.06%. This is mainly due to the growing preference for e-commerce in the automotive industry, which is mainly driven by convenience and the availability of more and more auto products. The penetration of digital platforms will continue to increase as they continue to personalize recommendations and optimize the purchase process. It is expected that by 2032, more than half of the parts and accessories sales will be made through e-commerce, compared to about 35% in 2023.

Augmented reality and artificial intelligence are the two major innovations that will change the landscape of automobile e-tailing. These two technologies can give consumers a real-time and individualized shopping experience, thereby enhancing the conversion rate. Also, the increasing emphasis on the environment and eco-friendly products will influence consumers’ purchasing behavior, which will compel e-tailers to expand their offerings in this area. Governments around the world have also started to implement supportive policies to encourage e-tailing.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | (2022 to 2030 |

Automotive E-tailing Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.