Automotive Ethernet Market Summary

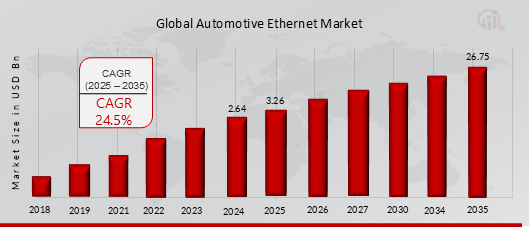

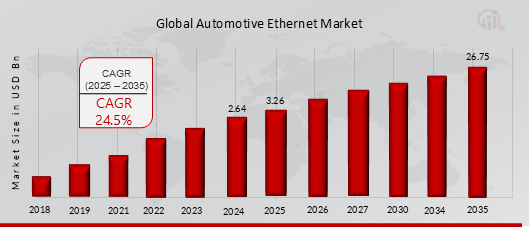

As per MRFR Analysis, the Automotive Ethernet Market was valued at USD 2.64 Billion in 2024 and is projected to reach USD 26.75 Billion by 2035, growing at a CAGR of 24.5% from 2025 to 2035. This technology enables fast data transfer and low delays in vehicles, essential for advanced features like self-driving and infotainment systems. The market is driven by the rising demand for connected cars and the need for high-speed data transmission in applications such as Advanced Driver Assistance Systems (ADAS).

Key Market Trends & Highlights

The Automotive Ethernet market is experiencing rapid growth due to technological advancements and increasing vehicle connectivity.

- Automotive Ethernet Network holds 56.5% market share in 2024, valued at USD 2.64 Billion.

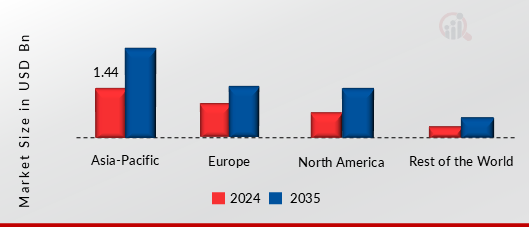

- Asia-Pacific is expected to grow at the highest CAGR of 26.2%, reaching USD 26.75 Million by 2035.

- Passenger cars dominate the market, driven by demand for high-quality multimedia and ADAS features.

- Hardware components lead the market, with significant growth anticipated due to rising infotainment and ADAS demands.

Market Size & Forecast

2024 Market Size:: USD 2.64 Billion

2025 Market Size:: USD 3.26 Billion

2035 Market Size:: USD 26.75 Billion

CAGR (2025-2035):: 24.5%

Largest Regional Market Share in 2024:: Asia-Pacific

Major Players

Key players include Broadcom Inc.,NXP Semiconductors N.V.,Marvell Technology Group Ltd,Microchip Technology Inc.,Texas Instruments Inc.,Cadence Design System Inc.,TTTech Auto AG,Xilinx, Inc. (AMD),TE Connectivity Ltd.,Toshiba Corporation,Keysight Technologies Inc.,Realtek Semiconductor,Rohde & Schwarz,Infineon Technologies,Tektronix (Fortive Corp)

The rising demand for connected cars and rising demand for infotainment system and standardization and interoperability of automotive ethernet technology are driving the growth of the Automotive Ethernet Market.

As per the Analyst at MRFR, with the advent of autonomously connected vehicles, the automotive Ethernet industry is rapidly growing rapidly. These vehicles demand instant and reliable data transmission for critical applications such as advanced driver assistance systems (ADAS), seamless in-car entertainment and real-time sensor connection. Traditional protocols like CAN and FlexRay do not have the capability or speed needed for these tasks.

Automotive Ethernet is becoming increasingly important in the field of connected cars due to its fast speed and minimal delay, which are perfect for sending V2V messages and improving safety and traffic control. Telematics systems utilizing automotive Ethernet help transmit vehicle diagnostics and performance data effectively for remote monitoring and predictive maintenance. Automotive Ethernet allows fast and safe remote access, software updates over the air, and real-time diagnostics.

FIGURE 1: AUTOMOTIVE ETHERNET MARKET VALUE (2019-2035) USD BILLION

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Automotive Ethernet Market Opportunity

ADVANCEMENT IN SOFTWARE-DEFINED VEHICLES

A software-defined vehicle (SDV) is a form of vehicle whose features and functions are mostly supported by software, as autos evolve from primarily hardware-based to software-centric electronic devices with wheels. The SDV is a vehicle that can be updated over time utilizing a centralized architecture, upgrading and integrating new apps to increase its functionality. Automotive Ethernet is critical to this shift because it enables efficient and high-bandwidth data connection within these software-defined systems. In SDVs, a central control unit serves as the core hub, with Ethernet connections to zonal controllers spread throughout the vehicle.

These zonal controllers act as mediators, connecting the main control to particular applications like ADAS, infotainment, and others. Ethernet enables this communication by providing a high-speed, dependable network that provides smooth data transfer between the central control, zonal units, and diverse applications.

Moreover, automotive Ethernet makes it possible to seamlessly integrate and transmit enormous amounts of data between different car systems, which makes it possible to update, reconfigure, and improve SDVS in real time. As these vehicles evolve, strengthening the capabilities and interconnectedness of in-car systems, the automotive Ethernet market is expected to rise in tandem, satisfying rising demands for efficient, high-bandwidth networking in automobiles.

The use of Ethernet to communicate between ECUs, sensors, and control units improves these systems' interoperability and efficiency within a software-defined architecture. The introduction of SDVS provides a profitable opportunity for automotive Ethernet, promoting its progress as a strong networking solution for the automobile industry's more software-centric future.

Automotive Ethernet Market Segment Insights

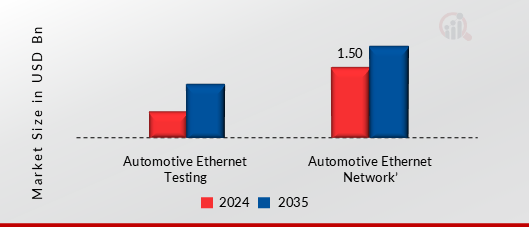

Automotive Ethernet System by Type Insights

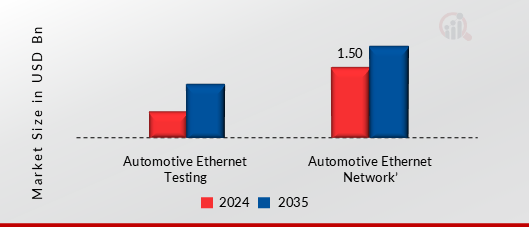

Based on Type, this segment includes Automotive Ethernet Network and Automotive Ethernet Testing. The Automotive Ethernet Network segment dominated the global market in 2024, while it is projected to be the fastest–growing segment during the forecast period. The automotive ethernet network segment is estimated to account for the largest share of the automotive ethernet market throughout the forecast period.

The network segment of automotive ethernet is expanding at a faster rate than other areas as the car landscape shifts toward smart features, connectivity, and autonomous driving. The need for high-bandwidth connections for infotainment and ADAS, ethernet's cost-effectiveness and scalability when compared to earlier CAN bus systems, and its role in enabling critical technologies such as V2X communication are all driving this growth. Automotive ethernet products and solution vendors collaborate closely with automakers to create and deliver effective solutions.

FIGURE 2: AUTOMOTIVE ETHERNET MARKET SHARE BY TYPE 2024 AND 2035 (USD BILLION)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Automotive Ethernet System by Component Insights

Based on Component, this segment includes Hardware, Software, Services. The Hardware segment dominated the global market in 2024, while it is projected to be the fastest–growing segment during the forecast period. Automotive OEMs mostly incorporate ethernet hardware components such as gateways, bridges, routers, repeaters, and so on. This is primarily due to the increased demand for infotainment and ADAS (advanced driver assistance systems). Important enterprises such as NXP are also developing unique products that have a huge impact on the Automotive Ethernet Market.

Automotive Ethernet System by Bandwidth Insights

Based on Bandwidth, this segment includes 10 Mbps, 100 Mbps, 1 Gbps, 2.5/5/10 Gbps. The 1 Gbps segment dominated the global market in 2024, while the 2.5/5/10 Gbps segment is projected to be the fastest–growing segment during the forecast period. 1 Gbps is the 1000Base-T1 automotive Ethernet standard defined by IEEE 802.3bp. It uses PAM3 encoding, full-duplex transmission, and a point-to-point topology, like 100Base-T1.

The 1 Gbps bandwidth in automotive Ethernet provides a major increase in data transfer rates, allowing for high-speed communication, which is critical for demanding applications within vehicles. The high data rate of 1000Base-T1 is suited for active ADAS features like lane departure warning and automated emergency braking. These systems are linked to actuators and can take control of the vehicle. It can also serve as a communications backbone, presenting a virtual "highway" for data transmission within the vehicle.

Automotive Ethernet System by Application Insights

Based on Application, this segment includes Advanced Driver Assistance Systems (ADAS), Infotainment, Powertrain, Chassis, Body and Comfort. The Advanced Driver Assistance Systems (ADAS) segment dominated the global market in 2024, while it is projected to be the fastest–growing segment during the forecast period. ADAS includes clever technology that assists drivers in operating automobiles more safely and comfortably.

Automotive ethernet is critical for managing huge volumes of data from ADAS sensors, with speeds of up to 1 gigabit per second (Gbps) or faster. This high speed is essential for real-time decision-making, as even small delays can be expensive. Furthermore, Driver Assistance Systems have advanced beyond basic functionality, embracing greater complexity to provide a comprehensive array of safety features. As more sensors, cameras, and LiDAR technologies are integrated into these systems, a strong, high-speed communication network becomes increasingly important. Therefore, these features will boost demand in the segment.

Automotive Ethernet System by Vehicle Type Insights

Based on Vehicle Type, this segment includes Passenger Cars and Commercial Vehicles. The Passenger Cars segment dominated the global market in 2024, while it is projected to be the fastest–growing segment during the forecast period. The segment is experiencing an increase in demand for high-quality multimedia content, streaming services, and interactive features. Ethernet's capacity to handle enormous data quantities at high rates offers a smooth and immersive entertainment experience for passengers, adding to their overall driving pleasure. As a result, these variables will accelerate the segment's growth.

The economy's growth, technological advancements in passenger vehicles such as the integration of a driver assistance system, and rising disposable incomes have all contributed to the enormous expansion of the passenger car sub-segment of the automotive ethernet market. Furthermore, the automotive ethernet provides a slew of critical benefits, including low cost, higher bandwidth, and adaptable and scalable technology that allows for the integration of various technologies in automotive cars. For example, ADAS capabilities such as lane departure warning and surround-view parking extensively use automotive ethernet technology. These elements promote the expansion of the passenger car sub-segment during the projection period.

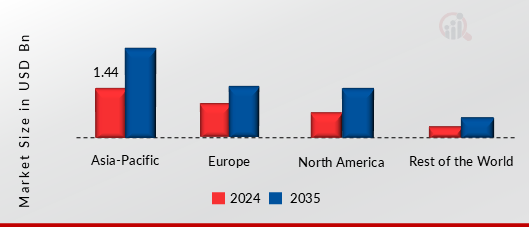

Automotive Ethernet System Regional Insights

Based on the Region, the global Automotive Ethernet is segmented into North America, Europe, Asia-Pacific and Rest of the World. The Asia-Pacific dominated the global market in 2024, while the Rest of the World is projected to be the fastest–growing segment during the forecast period. Major demand factors driving the Asia-Pacific market are the rising demand for connected cars and rising demand for infotainment system and standardization and interoperability of automotive ethernet technology. Asia-Pacific accounted for the major share and emerged as the leading player in the automotive ethernet market, that is ascribed due to several factors, such as growing adoption of connected vehicles, technological developments in the automotive sector, and rapid industrialization across APAC countries.

Furthermore, the growing automotive industries in countries such as China, India, Japan, and South Korea are major countries contributing to Asia Pacific automotive ethernet market growth. Automotive production and sales in these countries have expanded significantly compared to previous decades because of economic growth, government policies and support for the industry, and growing consumer demand. As a result, vehicle manufacturers in Asia Pacific are increasingly incorporating ongoing technology into their vehicles, such as automotive Ethernet, to meet changing consumer desires and regulatory standards.

FIGURE 3: AUTOMOTIVE ETHERNET MARKET VALUE BY REGION 2024 AND 2035 (USD BILLION)

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Further, the countries considered in the scope of the Application Tracking System Market are the US, Canada, Mexico, Germany, France, the UK, Italy, China, India, Japan, South Korea, Middle East & Africa, South America and others.

Global Automotive Ethernet Key Market Players & Competitive Insights

Many global, regional, and local vendors characterize the Automotive Ethernet Market. The market is highly competitive, with all the players competing to gain market share. Intense competition, rapid advances in technology, frequent changes in government policies, and environmental regulations are key factors that confront market growth. The vendors compete based on cost, product quality, reliability, and government regulations. Vendors must provide cost-efficient, high-quality products to survive and succeed in an intensely competitive market.

The major competitors in the market are Broadcom Inc., NXP Semiconductors N.V., Marvell Technology Group Ltd, Microchip Technology Inc., Texas Instruments Inc., Cadence Design System Inc., TTTech Auto AG, Xilinx, Inc. (AMD), TE Connectivity Ltd., Toshiba Corporation, Keysight Technologies Inc., Realtek Semiconductor, Rohde & Schwarz, Infineon Technologies, Tektronix (Fortive Corp) are among others. The Automotive Ethernet Market is a consolidated market due to increasing competition, acquisitions, mergers and other strategic market developments and decisions to improve operational effectiveness.

Key Companies in the Automotive Ethernet Market include

- Broadcom Inc.

- NXP Semiconductors N.V.

- Marvell Technology Group Ltd

- Microchip Technology Inc.

- Texas Instruments Inc.

- Cadence Design System Inc.

- TTTech Auto AG

- Xilinx, Inc. (AMD)

- TE Connectivity Ltd.

- Toshiba Corporation

- Keysight Technologies Inc.

- Realtek Semiconductor

- Rohde & Schwarz

- Infineon Technologies

- Tektronix (Fortive Corp)

Automotive Ethernet Market Industry Developments

January 2024: Infineon Technologies AG and GlobalFoundries (GF) announced a new multi-year agreement on the supply of Infineon's AURIX TC3x 40 nanometer automotive microcontrollers as well as power management and connectivity solutions.

May 2024: Keysight Technologies, Inc. and ETAS are partnering to provide automakers and automotive suppliers with a comprehensive automotive cybersecurity solution.

January 2022: The collaboration between Rohde & Schwarz and Realtek aims to expedite Realtek's foray into the automotive market by ensuring compliance with current and forthcoming OPEN Alliance standards through Automotive Ethernet test solutions.

April 2021: Rohde & Schwarz partners with UNH-IOL to enhance high-speed Ethernet and InfiniBand compliance testing. By combining the UNH-IOL’s expertise in cable assembly and backplane compliance tests with Rohde & Schwarz test solutions, both partners are paving the way for automated compliance tests in line with the latest IEEE 802.3 Ethernet and InfiniBand standards.

Automotive Ethernet Market Segmentation

Automotive Ethernet by Type Outlook

- Automotive Ethernet Network

- Automotive Ethernet Testing

Automotive Ethernet by Component Outlook

- Hardware

- Software

- Services

Automotive Ethernet by Bandwidth Outlook

- 10 Mbps

- 100 Mbps

- 1 Gbps

- 5/5/10 Gbps

Automotive Ethernet by Application Outlook

- Advanced Driver Assistance Systems (ADAS)

- Infotainment

- Powertrain

- Chassis

- Body and Comfort

Automotive Ethernet by Vehicle Type Outlook

- Passenger Cars

- Commercial Vehicles

Automotive Ethernet Regional Outlook

-

North America

-

Europe

- Germany

- France

- UK

- Italy

- Rest of Europe

-

Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

-

Rest of the world

- Middle East & Africa

- South America

| Report Attribute/Metric |

Details |

| Market Size 2024 |

USD 2.64 Billion |

| Market Size 2025 |

USD 3.26 Billion |

| Market Size 2035 |

USD 26.75 Billion |

| Compound Annual Growth Rate (CAGR) |

24.5% (2025-2035) |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Historical Data |

2019-2023 |

| Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

By Type, By Component, By Bandwidth, By Application, By Vehicle Type |

| Geographies Covered |

North America, Europe, Asia Pacific, Rest of the World |

| Countries Covered |

The US, Canada, Mexico, Germany, France, the UK, Italy, China, India, Japan, South Korea, Middle East & Africa, South America |

| Key Companies Profiled |

Broadcom Inc., NXP Semiconductors N.V., Marvell Technology Group Ltd, Microchip Technology Inc., Texas Instruments Inc., Cadence Design System Inc., TTTech Auto AG, Xilinx, Inc. (AMD), TE Connectivity Ltd., Toshiba Corporation, Keysight Technologies Inc., Realtek Semiconductor, Rohde & Schwarz, Infineon Technologies, Tektronix (Fortive Corp) |

| Key Market Opportunities |

· Advancement in software-defined vehicles · Shift towards cloud-based services |

| Key Market Dynamics |

· Rising demand for connected cars · Rising demand for infotainment system · Standardization and interoperability of automotive ethernet technology |

Frequently Asked Questions (FAQ) :

USD 2.64 Billion is the Automotive Ethernet Market in 2024

The Passenger Cars segment by Vehicle Type holds the largest market share and grows at a CAGR of 25.9 % during the forecast period.

Asia-Pacific holds the largest market share in the Automotive Ethernet Market.

Broadcom Inc., NXP Semiconductors N.V., Marvell Technology Group Ltd, Microchip Technology Inc., Texas Instruments Inc., Cadence Design System Inc., TTTech Auto AG, Xilinx, Inc. (AMD), TE Connectivity Ltd., Toshiba Corporation, Keysight Technologies Inc., Realtek Semiconductor, Rohde & Schwarz, Infineon Technologies, Tektronix (Fortive Corp) are prominent players in the Automotive Ethernet Market.

The Advanced Driver Assistance Systems (ADAS) segment dominated the market in 2024.