- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

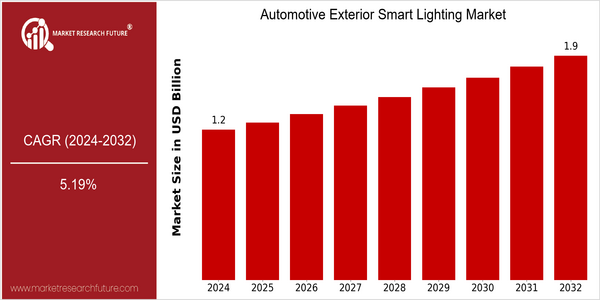

Automotive Exterior Smart Lighting Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 1.24 Billion |

| 2032 | USD 1.86 Billion |

| CAGR (2024-2032) | 5.19 % |

Note – Market size depicts the revenue generated over the financial year

The market for exterior smart lighting is estimated to grow at a CAGR of 4.5% from 2017 to 2024. The market for interior smart lighting is expected to grow at a CAGR of 6% from 2017 to 2024. This market is driven by the increasing demand for advanced lighting solutions in vehicles, owing to the increasing demand for enhanced safety, aesthetics, and energy efficiency. Also, technological advancements, such as the integration of LED and OLED, are expected to make lighting systems more versatile and appealing to consumers. The major players in the market for exterior smart lighting, such as Osram, Valeo, and Hella, are investing heavily in research and development to expand their product offerings. Strategic moves, such as the formation of partnerships with automobile manufacturers and the investment in smart lighting, are becoming increasingly common. In the case of Adaptive Lighting, the industry is working towards developing lighting systems that can automatically adjust to the road conditions. The development of the automotive industry is expected to further increase the demand for smart lighting solutions, thus enhancing the market’s growth potential.

Regional Deep Dive

The market for smart lighting for the outside of automobiles is characterized by a high growth rate in several regions, driven by technological advancements, increasing demand for safety, and the integration of smart technology into vehicles. In North America, the market is characterized by a strong presence of automobile manufacturers and the high uptake of innovative lighting solutions. In Europe, there is a significant rise in regulatory requirements for vehicle safety, while the Asia-Pacific region is rapidly developing due to the emergence of electric vehicles and smart city projects. The Middle East and Africa are adopting smart lighting solutions slowly, while Latin America is beginning to embrace smart lighting technology as part of its overall progress in the auto industry.

North America

- The new rules of the National Highway Traffic Safety Administration (NHTSA) on the advanced lighting of the road for safety reasons are pushing the manufacturers to develop smart lighting technology.

- Major automobile companies like Ford and General Motors are making large investments in research and development of a lighting system that is adapted to the driving conditions and that improves visibility and safety.

- A draught of air from the north-west, a draught of air from the south-west, a draught of air from the east, a draught of air from the south-east, a draught of air from the north-east, a draught of air from the west, a d

Europe

- Despite the fact that the European Union has introduced strict regulations for vehicle lighting, manufacturers have still been slow to adopt smart lighting systems that meet safety and environment standards.

- The Osram and Valeo companies have developed new lighting systems that are both more energy-efficient and more design-friendly.

- In Europe, the growing trend towards the development of automatic vehicles is leading to the development of dynamic lighting systems which adapt to the surroundings and thus improve the safety and comfort of the vehicle.

Asia-Pacific

- The Chinese smart lighting industry is developing rapidly, and companies such as BYD and Geely are also investing in advanced lighting technology to enhance the quality of their electric vehicles.

- Japan and South Korea are undertaking smart city projects that integrate vehicle lighting with urban street lighting, thereby increasing both safety and interactivity.

- Luxury vehicles with advanced lighting features are increasingly in demand, especially in the cities.

MEA

- The United Arab Emirates is investing in smart city initiatives, including the integration of smart lighting systems into vehicles, and the launch of government programmes to improve road safety.

- Local car manufacturers have already started to collaborate with foreign companies to develop smart lighting solutions for the region's special driving conditions.

- In countries like Saudi Arabia, where incomes and the number of vehicles are rising slowly, the demand for the latest lighting technology is growing.

Latin America

- Brazil is developing smart lighting as part of its modernization of the automobile industry, and local manufacturers are entering into partnership with technology companies.

- In this region, in particular in the cities, changes in regulations, aimed at improving vehicle safety, are encouraging the use of modern lighting systems.

- The increasing penetration of electric vehicles in Latin America opens the way to new lighting solutions that enhance energy efficiency and the aesthetics of the car.

Did You Know?

“In the United States, thirty percent of the automobile accidents are due to poor visibility, indicating the importance of the new automobile lighting devices in enhancing the safety of the highways.” — National Highway Traffic Safety Administration (NHTSA)

Segmental Market Size

The segment of smart exterior lighting, which plays a crucial role in vehicle safety and in enhancing the appearance of a vehicle, is growing strongly. A combination of the increased demand for safety features, regulatory standards and technological advances in LED and active lighting systems is driving the growth of the market. These factors are also pushing manufacturers to develop smarter and more advanced lighting solutions.

The current stage of the introduction of this technology is the stage of mass production, with Audi and BMW leading the way in implementing smart lighting in their latest models. In particular, this concerns the use of dynamic bending lights, which change their light distribution depending on the conditions of the road and the ambient light. The trend towards sustainable lighting and government regulations on energy-efficient lighting will further drive growth. IoT and artificial intelligence will shape the development of smart lighting systems, enabling features such as automatic brightness control and a personal lighting experience.

Future Outlook

From 2024 to 2032, the Automotive Exterior Smart Lighting market is expected to grow from $1.24 billion to $1.86 billion, with a CAGR of 5.19%. This growth will be driven by the increasing demand for vehicle safety, comfort and energy efficiency. As the number of new vehicle models increases, the penetration of smart lighting solutions will also increase. It is expected that by 2032, the penetration of smart lighting solutions will reach 40 percent.

The market for weighing and metering equipment is expected to grow at a CAGR of 4.6% from 2018 to 2025, driven by the introduction of smart sensors and wireless communication features. These innovations not only improve visibility and safety but also enable vehicles to communicate with their environment, thereby enhancing the overall driving experience. In addition, government policies to reduce carbon emissions and promote energy-efficient solutions are likely to boost the adoption of smart lighting systems. The growing popularity of electric vehicles and the trend toward automation are also expected to make smart lighting an essential part of vehicle design.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 1.1 Billion |

| Market Size Value In 2023 | USD 1.17 Billion |

| Growth Rate | 6.00% (2023-2032) |

Automotive Exterior Smart Lighting Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.