Top Industry Leaders in the Automotive Heat Shield Market

*Disclaimer: List of key companies in no particular order

Latest Company Updates:

Key Player Strategies:

Diversification: Leading players like T&W Industries, Johns Manville, and Federal-Mogul are broadening their product portfolios beyond traditional metallic shields, investing in lightweight and high-performance materials like ceramic composites and advanced polymers. This caters to the evolving needs of the market, particularly for EVs, where weight reduction is crucial.

Geographical Expansion: Established players are strategically expanding their manufacturing footprint into regions with high automobile production, like Asia-Pacific and South America. This allows them to capitalize on local demand and reduce logistical costs. Emerging players in these regions often offer cost-competitive alternatives, creating dynamic competition.

Technological Innovation: Players are actively involved in research and development, focusing on new material compositions, manufacturing processes, and heat shield designs. Innovations like self-healing and noise-dampening heat shields are generating buzz, with companies like 3M and BASF leading the charge.

Vertical Integration: Some players are integrating vertically, acquiring raw material suppliers or downstream manufacturers of vehicle components that use heat shields. This secures their supply chain and potentially offers cost advantages. However, smaller players can struggle to compete with such vertically integrated giants.

Market Share Analysis:

Material Share: Metallic heat shields currently dominate the market, accounting for over 85% of the share. However, the share of lightweight and advanced materials is expected to grow steadily, driven by stricter fuel efficiency regulations and the rise of EVs.

Vehicle Type Share: Passenger cars hold the largest share of the market, but the commercial vehicle segment is expected to witness faster growth due to increasing investments in infrastructure and logistics.

Regional Share: Asia-Pacific currently holds the largest market share, with China being a major driver. However, Europe and North America are still important markets with significant growth potential.

New and Emerging Trends:

Focus on Sustainability: Eco-friendly materials like bio-based composites and recycled plastics are gaining traction. Additionally, manufacturers are adopting energy-efficient production processes to reduce their environmental footprint.

Integration with Electronic Components: Heat shields are increasingly being integrated with sensors and electronic modules to monitor heat distribution and optimize energy management, particularly in EVs.

Digitalization and Automation: Advanced manufacturing techniques like 3D printing and robotics are being employed to improve production efficiency and quality control, further enhancing competition.

Overall Competitive Scenario:

The automotive heat shield market is becoming increasingly competitive, with established players facing pressure from both innovative newcomers and the rapid evolution of technology. Key success factors include a diversified product portfolio, a strong global presence, a commitment to R&D, and adaptation to environmental and technological trends. Smaller players can succeed by focusing on niche markets, offering specialized solutions, and maintaining cost competitiveness.

While the traditional giants hold a significant advantage, the dynamic nature of the market presents exciting opportunities for disruptive innovation and the emergence of new leaders. Staying agile, responsive to customer needs, and continuously innovating will be crucial for navigating this dynamic competitive landscape and achieving sustainable growth in the automotive heat shield market.

Lydall Inc. (U.S.)

• October 2023: Announced collaboration with the University of Dayton Research Institute to develop lightweight, high-performance thermal insulation materials for electric vehicle batteries. (Source: Lydall Press Release)

Progress-Werk Oberkirch AG (Germany)

• October 2023: Launched new lightweight, multi-layer heat shield for exhaust manifolds, reducing weight by 30% compared to conventional shields. (Source: Progress-WerkOberkirch Press Release)

UGN Inc. (U.S.)

• October 2023: Unveiled new heat shield design using bio-based composite materials at K 2023 plastics trade fair. (Source: Plastics News)

Morgan Advanced Materials (U.K.)

• October 2023: Received major contract from European automaker to supply high-temperature ceramic heat shields for turbochargers. (Source: Morgan Advanced Materials Website)

Dana Holding Corporation (U.S.)

• October 2023: Showcased new thermal management system for electric vehicle powertrains at IAA Mobility conference in Munich. (Source: Dana Holding Corporation Press Release)

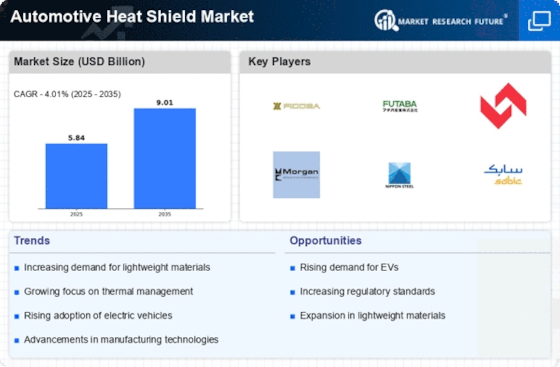

Top listed global companies in the industry are:

Lydall Inc. (U.S.)

Progress-WerkOberkirch AG (Germany)

UGN Inc. (U.S.)

Morgan Advanced Materials (U.K.),

Dana Holding Corporation (U.S.)

Federal-Mogul Holding Corporation (U.S.),

Autoneum Holdings AG (Switzerland),

Zircotec (U.K.)

ThermoTec Automotive (U.S.)

Elringklinger AG (Germany)