- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

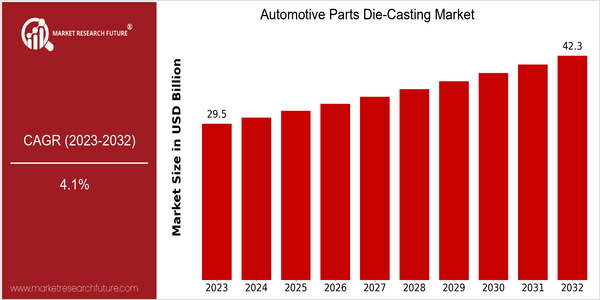

| Year | Value |

|---|---|

| 2023 | USD 29.48 Billion |

| 2032 | USD 42.3 Billion |

| CAGR (2024-2032) | 4.1 % |

Note – Market size depicts the revenue generated over the financial year

The global die-casting industry is expected to be worth $38.3 billion in 2023 and will reach $47.6 billion by 2032, growing at a CAGR of 4.1% from 2023 to 2032. The steady increase in the demand for die-casting components is driven by the automotive industry’s ongoing shift towards lightweighting and fuel efficiency. In the quest for better performance and lower emissions, die-casting has become the method of choice for manufacturers looking to meet increasingly stringent standards. There are a number of other factors that are contributing to the industry’s expansion, such as the increasing use of high-pressure die-casting and automation in manufacturing processes. These innovations have not only improved production efficiency, but also the quality and precision of the finished components. Leading die-casting companies, such as Nemak, Ryobi, and Alcoa, are investing heavily in R&D in order to keep their product offerings at the forefront of the industry and maintain their position at the top. Strategic alliances, such as the development of sustainable die-casting solutions, are a further example of the industry’s commitment to meeting the demands of the market and evolving regulatory requirements.

Regional Market Size

Regional Deep Dive

The global Automotive Parts Die Casting Market is growing significantly at a CAGR of 7%, driven by the increasing demand for lightweight and durable automobile components. The North American market is characterized by the presence of advanced manufacturing and strong automobile industries, especially in the U.S. and Canada. Europe has a strong regulatory framework with a focus on the environment. Asia-Pacific is a rapidly growing market due to the increasing production and consumption of automobiles. The Middle East and Africa are gradually emerging as promising markets, driven by improving economies and the diversification of economies. Latin America is still a developing market, but it is also characterized by increasing investments in the automobile industry, especially in Brazil and Mexico.

Europe

- The European Union's Green Deal is pushing for a transition to electric vehicles, leading to a surge in demand for die-cast components that support battery housing and lightweight structures.

- Companies like Volkswagen and BMW are investing in innovative die-casting techniques, such as 3D printing, to enhance production efficiency and reduce waste.

Asia Pacific

- China remains a dominant player in the die-casting market, with significant investments in automation and smart manufacturing technologies to boost production capacity.

- India's automotive sector is witnessing a shift towards electric vehicles, prompting local die-casting manufacturers to adapt their offerings to meet the evolving needs of the market.

Latin America

- Brazil's automotive industry is recovering, with increased foreign investments in die-casting facilities aimed at supporting local vehicle production.

- Mexico is becoming a hub for automotive manufacturing, with companies like Honda and Nissan establishing die-casting operations to cater to both local and export markets.

North America

- The U.S. automotive industry is increasingly adopting die-casting technologies to meet stringent fuel efficiency standards, with companies like General Motors and Ford investing in advanced die-casting facilities.

- Recent regulatory changes in California aim to reduce greenhouse gas emissions, prompting automakers to seek lightweight die-cast components to enhance vehicle efficiency.

Middle East And Africa

- The UAE is investing heavily in diversifying its economy, with initiatives like the 'Make it in the Emirates' campaign encouraging local production of automotive parts, including die-cast components.

- South Africa's automotive industry is expanding, supported by government incentives aimed at boosting local manufacturing capabilities, which includes die-casting technologies.

Did You Know?

“Did you know that die-casting can produce parts with a surface finish that is often superior to that of parts made using other manufacturing processes, reducing the need for additional machining?” — American Foundry Society

Segmental Market Size

The current growth in the automobile die-casting market is based on the increasing demand for lightweight and durable parts in the automobile industry. The fuel-efficient cars that are becoming more popular and the stricter regulations for reducing emissions are the main driving forces for the growth of the market. Moreover, the advancements in die-casting technology, such as the use of aluminum and magnesium alloys, are enhancing the performance and efficiency of automobile parts. In the current scenario, Ford and General Motors are the frontrunners in the automobile die-casting market. The major applications include engine blocks, transmission cases, and structural parts, which are critical to the performance and safety of vehicles. These parts are manufactured using the die-casting method. Moreover, the increasing demand for electric vehicles and the trend towards sustainable development are expected to increase the demand for lightweight and energy-efficient automobiles. In addition, 3D printing and automation of die-casting processes will further increase the design complexity and speed of production.

Future Outlook

From 2023 to 2032, the global automobile die-casting market is expected to rise from $29.48 billion to $42.30 billion, at a compound annual growth rate (CAGR) of 4.1%. The main reason for this growth is the growing demand for lightweight and high-strength materials in the auto industry, which is driven by the shift to electric vehicles and the tightening of fuel efficiency standards. This has led to an increase in the use of die-casting in the production of critical components such as engine blocks, transmission cases, and structural parts. The development of high-pressure die-casting and the automation of die-casting processes will enhance production efficiency and reduce costs. In addition, the growing emphasis on sustainability and the circular economy will boost the use of recycled aluminum in die-casting applications, which is in line with global sustainable development goals. This means that the market for die-casting of automobile parts is not only growing in size but is also evolving, following the trends towards smart manufacturing and the increasing use of advanced materials. This makes die-casting a key element in the overall supply chain for the auto industry.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD XX Billion |

| Growth Rate | 6.2% (2023-2032)Base Year2022Market Forecast Period2023-2032Historical Data2018- 2022Market Forecast UnitsValue (USD Billion)Report CoverageRevenue Forecast, Market Competitive Landscape, Growth Factors, and TrendsSegments CoveredBy Technology, By Application, By Vehicle type, By End MarketGeographies CoveredNorth America, Europe, Asia Pacific, and the Rest of the WorldCountries CoveredThe US, Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and BrazilKey Companies ProfiledAlcast Company (U.S.), Dynacast, LLC (U.S.), Endurance Technologies Limited (India), Gibbs Die Casting Corp (U.S.), and Rockman Industries (India). Ryobi Die Casting Inc. (U.S.), Kinetic Die Casting Company, Inc. (U.S.), Magic Precision, Inc. (China), Meridian Lightweight Technologies Inc. (England), and Mino Industry USA, Inc. (U.S.)Key Market OpportunitiesGovernment initiatives are inclined towards energy saving Lowering the carbon footprint for the automobile manufacturing processKey Market DynamicsPrecise component specification manufactured in the shortest time possible. |

Automotive Parts Die Casting Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.