- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

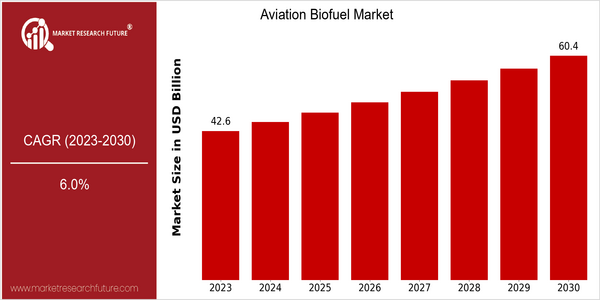

| Year | Value |

|---|---|

| 2023 | USD 42.612 Billion |

| 2030 | USD 60.4459 Billion |

| CAGR (2023-2030) | 6.0 % |

Note – Market size depicts the revenue generated over the financial year

The global aviation biofuel market is currently valued at approximately USD 42.612 billion in 2023 and is projected to reach USD 60.4459 billion by 2030, reflecting a compound annual growth rate (CAGR) of 6.0% during this period. This growth trajectory indicates a robust demand for sustainable aviation fuels as the aviation industry increasingly prioritizes environmental sustainability and regulatory compliance. The rising awareness of climate change and the need to reduce greenhouse gas emissions are significant factors propelling the adoption of biofuels in aviation, as airlines seek to meet stringent emissions targets and enhance their corporate social responsibility profiles. Technological advancements in biofuel production, such as improvements in feedstock conversion processes and the development of drop-in fuels compatible with existing aircraft engines, are further driving market growth. Key players in the aviation biofuel sector, including companies like Neste, Gevo, and World Energy, are actively engaging in strategic initiatives such as partnerships with airlines and investments in production facilities to scale up biofuel production. For instance, collaborations between airlines and biofuel producers have led to successful test flights using sustainable aviation fuels, showcasing the feasibility and benefits of these alternatives. As the market evolves, continued innovation and investment will be crucial in meeting the growing demand for sustainable aviation solutions.

Regional Market Size

Regional Deep Dive

The Aviation Biofuel Market is experiencing significant growth across various regions, driven by increasing environmental concerns, regulatory support, and technological advancements. In North America, Europe, Asia-Pacific, the Middle East and Africa, and Latin America, the market dynamics are shaped by unique cultural, economic, and regulatory factors that influence the adoption of biofuels in aviation. The push for sustainable aviation fuels (SAFs) is becoming a priority for airlines and governments alike, as they seek to reduce carbon emissions and meet international climate goals.

Europe

- The European Union has set ambitious targets for reducing greenhouse gas emissions, with the Fit for 55 package aiming for a 55% reduction by 2030, which is driving investments in aviation biofuels.

- Airlines in Europe, including KLM and Lufthansa, are actively participating in initiatives like the Clean Skies for Tomorrow coalition, promoting the use of SAF and collaborating with biofuel producers to enhance supply chains.

Asia Pacific

- Countries like Japan and Australia are investing heavily in research and development of aviation biofuels, with Japan's Ministry of the Environment supporting projects that aim to produce SAF from waste materials.

- The Asia-Pacific region is witnessing a rise in partnerships between airlines and biofuel producers, such as Qantas' collaboration with biofuel company Biojet, to explore sustainable fuel options and reduce emissions.

Latin America

- Brazil is a leader in biofuel production, leveraging its extensive sugarcane industry to produce ethanol-based aviation fuels, supported by government policies promoting renewable energy.

- The region is seeing increased interest from international airlines in sourcing biofuels from Latin American producers, driven by the need for sustainable fuel options and favorable climatic conditions for biofuel crops.

North America

- The U.S. government has implemented the Sustainable Aviation Fuel Grand Challenge, aiming to produce 3 billion gallons of SAF annually by 2030, which is expected to significantly boost the market.

- Major airlines like United Airlines and Delta Air Lines are investing in biofuel production partnerships, such as United's collaboration with Fulcrum BioEnergy, to secure a sustainable fuel supply and reduce their carbon footprint.

Middle East And Africa

- The Middle East is focusing on diversifying its energy sources, with countries like the UAE investing in biofuel production facilities, such as the Abu Dhabi National Oil Company's initiative to produce SAF.

- African nations are beginning to explore biofuels as a means to enhance energy security and reduce reliance on fossil fuels, with initiatives like South Africa's collaboration with local universities to develop biofuel technologies.

Did You Know?

“Did you know that aviation biofuels can reduce greenhouse gas emissions by up to 80% compared to traditional jet fuels when produced sustainably?” — International Air Transport Association (IATA)

Segmental Market Size

The Aviation Biofuel Market segment is experiencing significant growth, driven by increasing environmental concerns and regulatory pressures aimed at reducing carbon emissions in the aviation sector. Key factors propelling demand include stringent government policies, such as the European Union's Green Deal and the U.S. Sustainable Aviation Fuel (SAF) initiatives, which mandate lower carbon footprints for airlines. Additionally, technological advancements in biofuel production processes enhance efficiency and reduce costs, making biofuels more competitive against traditional jet fuels. Currently, the adoption of aviation biofuels is in the scaled deployment stage, with notable examples including major airlines like United Airlines and Delta Air Lines, which have committed to using sustainable aviation fuels in their operations. Primary applications of aviation biofuels include commercial flights and cargo transport, where airlines are increasingly integrating biofuels into their fuel supply chains. Trends such as the global push for sustainability and the impact of the COVID-19 pandemic, which has heightened awareness of environmental issues, are accelerating growth in this segment. Technologies like hydroprocessed esters and fatty acids (HEFA) and alcohol-to-jet (ATJ) processes are shaping the future of aviation biofuels, enabling more efficient production and broader adoption.

Future Outlook

The Aviation Biofuel Market is poised for significant growth from 2023 to 2030, with a projected market value increase from approximately $42.612 billion to $60.4459 billion, reflecting a robust compound annual growth rate (CAGR) of 6.0%. This growth trajectory is underpinned by a rising global emphasis on sustainability and the aviation industry's commitment to reducing carbon emissions. By 2030, it is anticipated that biofuels could account for up to 10% of total aviation fuel consumption, driven by increasing regulatory support and the implementation of carbon offsetting schemes such as CORSIA (Carbon Offsetting and Reduction Scheme for International Aviation). Key technological advancements in feedstock production and processing methods are expected to enhance the efficiency and cost-effectiveness of biofuel production. Innovations such as the development of advanced biofuels from non-food sources, including waste oils and agricultural residues, will play a crucial role in meeting the growing demand. Furthermore, partnerships between airlines, biofuel producers, and governments are likely to foster a more integrated supply chain, facilitating greater market penetration. As the aviation sector continues to prioritize sustainability, the Aviation Biofuel Market is set to become a cornerstone of the industry's transition towards greener operations, aligning with global climate goals and consumer expectations for environmentally responsible travel.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 42.612 billion |

| Growth Rate | 6.00% (2023-2030) |

Aviation Biofuel Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.