Research Methodology on Baby Diapers Market

Abstract

This research methodology focuses on establishing a method for determining the market size and structure of the Baby Diapers Market. This research study is intended to provide readers with an overview of current trends, drivers, restraints, opportunities, and forecasting the future of the Baby Diapers Market. The research methodology includes a collection of primary and secondary data sources, which will be used to draw meaningful insights and understand the Baby Diapers Market size. The research methodology also details the market research approach and method, pricing model, information sources, and assumptions.

Research Methodology

1. Scope of the Study

The scope of this research report is to understand the analysis market size of the Baby Diapers Market, with forecast till 2030. This report includes information pertaining to the use of baby diapers as well as the supply chain of the product.

2. Research Objectives

The objectives of this research are as follows:

- To identify the major drivers and restraints influencing the Baby Diapers Market.

- To estimate the overall size of the Baby Diapers Market in terms of value (USD Million)

- To identify the major segments and sub-segments in the Baby Diapers Market

- To identify the regional trends related to the growth of the industry

- To identify the current trends related to the Baby Diapers Market.

- To analyze competitive developments and strategies in the market

3. Research Methodology

The following research methodology was used to draw meaningful insights from the Baby Diapers Market.

- Primary Research: Primary research was conducted using industry experts, including interviews with primary respondents. Primary research was conducted to validate and update the data collected from secondary sources.

- Secondary Research: Secondary research was conducted to identify the drivers, restraints, industry trends, and technological advancements in Baby Diapers Market, which include market share by product category, pricing trends, competitive landscape, and regional market. The secondary research was conducted through several sources such as journals, books, industry associations, and government websites, among other sources.

- Market Size Estimation: The total Baby Diapers Market was established by calculating the revenue of the key players in the market and by applying the unit price and volume data. Various assumptions and limitations were made for the estimation of the market size.

4. Data Analysis

The market size was estimated by using various techniques, including:

- Top-down and Bottom-up approach

- Data triangulation

The data was analyzed using Porter’s Five Forces Model, which analyzes the competitive structure and bargaining power of each participant in the market

- Market Segmentation: The data was analyzed and projected for each product by application, distribution channel, and geography.

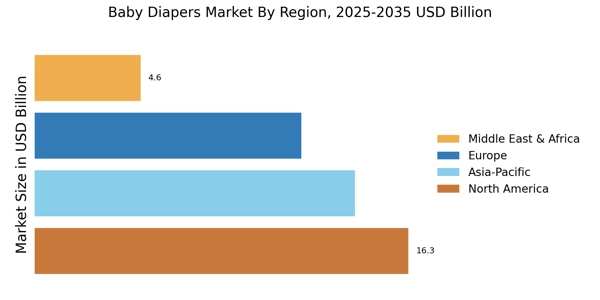

- Regional Analysis: The Baby Diapers Market size was projected for each region based on the country-level market size.

- Profiling: The competitive landscape of the market was analyzed based on financial analysis and pricing analysis. The players were profiled based on their market share in the Baby Diapers Market for each region.

5. Assumption

- The Growth of the Baby Diapers Market in the forecast period depends on the economic condition, consumer purchasing power, biases, and environmental factors.

- Geographic Analysis: The assumptions and limitations which had been considered while preparing the Baby Diapers Market report include such as political stability, economic growth, acceptance of the innovation, and consumer spending power.

- Regulatory Framework: The regulations such as import and export regulations, deemed duty, government regulations, and production policies will affect the Baby Diapers Market size and dynamics in the forecast period.

6. Key Insights

The key insights gathered from this report are:

- The Baby Diapers Market is expected to grow at a healthy CAGR during 2023-2030.

- The Asia-Pacific region is projected to be the fastest-growing market for Baby Diapers in the forecast period.

- Product innovations, such as the introduction of eco-friendly diapers, are expected to play a major role in boosting growth in the Baby Diapers Market.

- Key players, such as P&G and Unicharm, are expected to play a major role in driving the Baby Diapers Market.