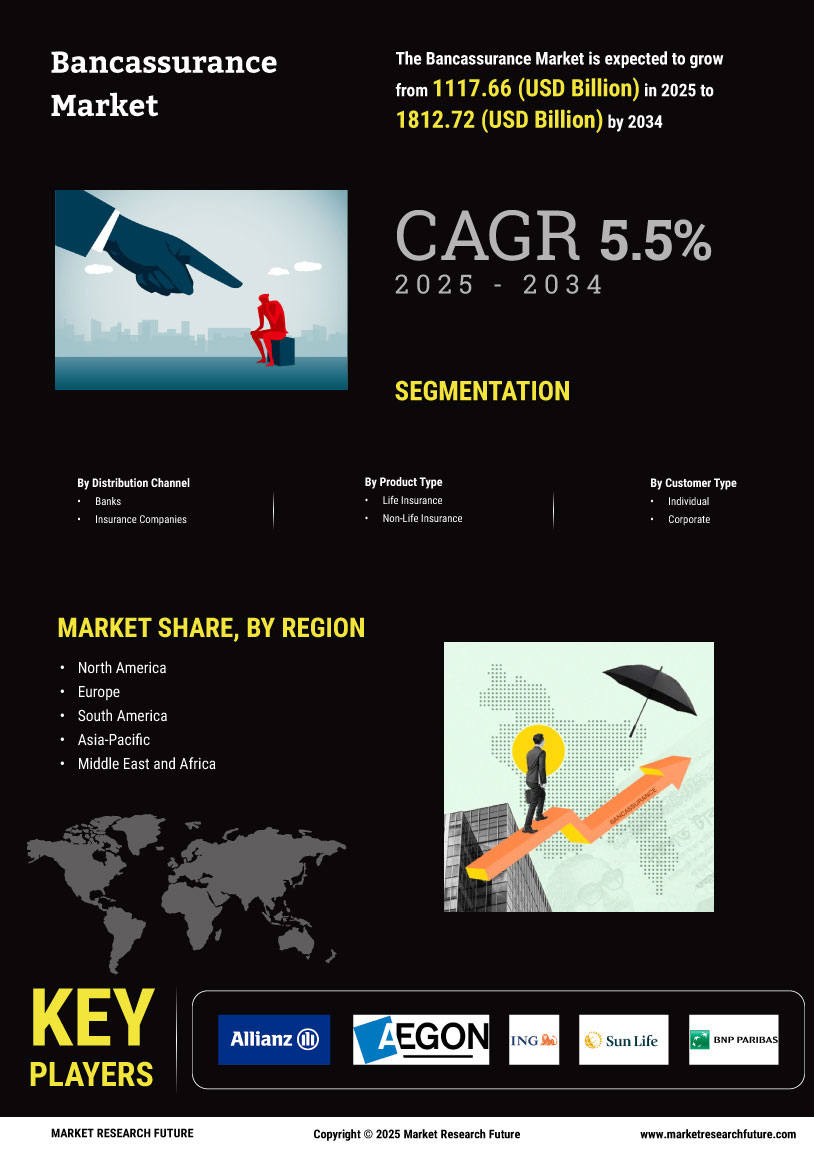

Market Growth Projections

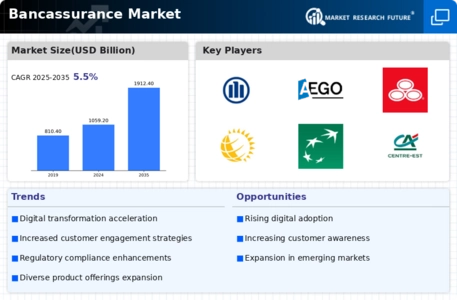

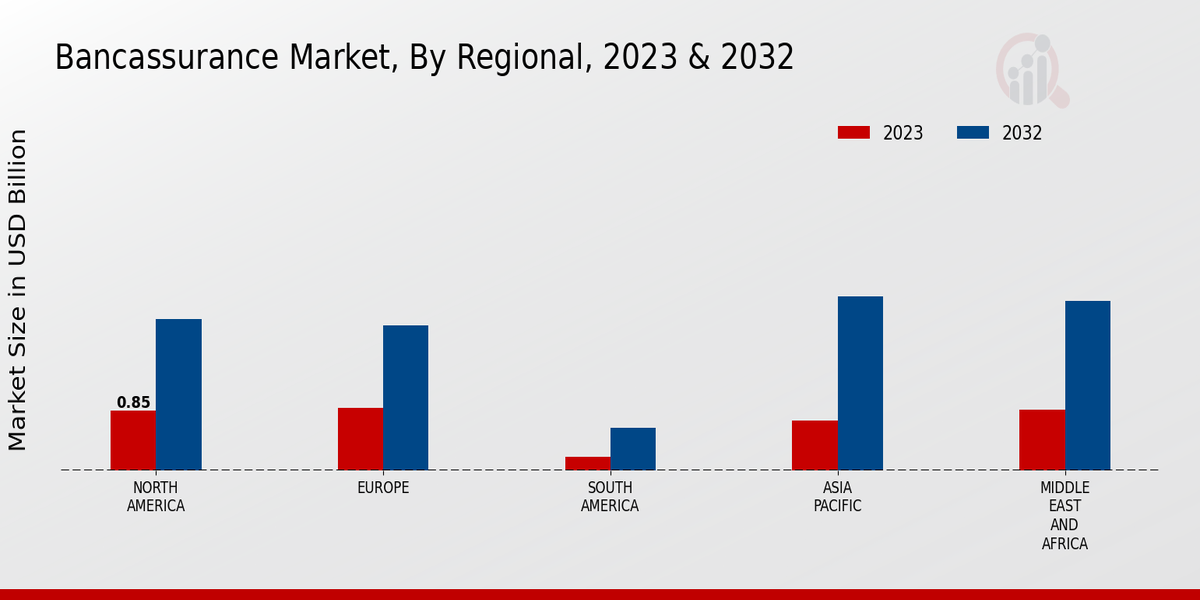

The Global Bancassurance Market Industry is poised for substantial growth, with projections indicating a market size of 1912.4 USD Billion by 2035. This anticipated growth underscores the increasing integration of banking and insurance services, driven by various factors such as consumer demand, regulatory support, and technological advancements. The projected compound annual growth rate of 5.52% from 2025 to 2035 further emphasizes the industry's potential for expansion. As banks and insurers continue to innovate and adapt to changing market dynamics, the bancassurance sector is likely to become an integral component of the global financial landscape.

Rising Consumer Awareness

Consumer awareness regarding the benefits of insurance products is steadily increasing, which is a significant driver for the Global Bancassurance Market Industry. As individuals become more informed about financial planning and risk management, they are more likely to seek insurance solutions that complement their banking services. This heightened awareness is particularly pronounced among younger demographics, who are more inclined to explore innovative financial products. Consequently, banks that effectively communicate the advantages of their bancassurance offerings may capture a larger market share. This trend suggests a promising future for the industry as consumer education continues to evolve.

Technological Advancements

Technological innovations are transforming the Global Bancassurance Market Industry, enabling banks to streamline operations and enhance customer experiences. The adoption of digital platforms for insurance sales and management is becoming more prevalent, allowing banks to reach a broader audience. For example, the integration of artificial intelligence and big data analytics is facilitating personalized product offerings and improving risk assessment processes. This technological shift is expected to contribute to the market's growth, with projections indicating a compound annual growth rate of 5.52% from 2025 to 2035. As banks leverage technology, they may enhance their competitive edge in the bancassurance sector.

Regulatory Support and Frameworks

Regulatory bodies across various regions are increasingly supporting the integration of banking and insurance services, which is a key driver for the Global Bancassurance Market Industry. Governments are recognizing the benefits of bancassurance in promoting financial inclusion and stability. For instance, initiatives aimed at simplifying compliance requirements for banks offering insurance products are being implemented. This regulatory support not only encourages banks to diversify their offerings but also fosters a competitive environment that benefits consumers. As the market evolves, these frameworks are likely to play a crucial role in shaping the future landscape of bancassurance.

Expansion of Distribution Channels

The expansion of distribution channels is a notable driver for the Global Bancassurance Market Industry. Banks are increasingly collaborating with insurance companies to enhance their product offerings and reach a wider customer base. This collaboration often involves leveraging existing branch networks and digital platforms to distribute insurance products effectively. As a result, the market is likely to benefit from improved accessibility and convenience for consumers. The strategic partnerships formed between banks and insurers may lead to innovative product designs and marketing strategies, ultimately driving growth in the bancassurance sector.

Increasing Demand for Financial Products

The Global Bancassurance Market Industry is experiencing a surge in demand for integrated financial products. Consumers are increasingly seeking convenience and efficiency, prompting banks to offer insurance products alongside traditional banking services. This trend is particularly evident in emerging markets, where financial literacy is improving, and consumers are more open to bundled offerings. As a result, the market is projected to reach 1059.2 USD Billion in 2024, reflecting a growing acceptance of bancassurance as a viable financial solution. This shift indicates a potential for banks to enhance customer loyalty and retention through comprehensive financial services.

Leave a Comment