- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

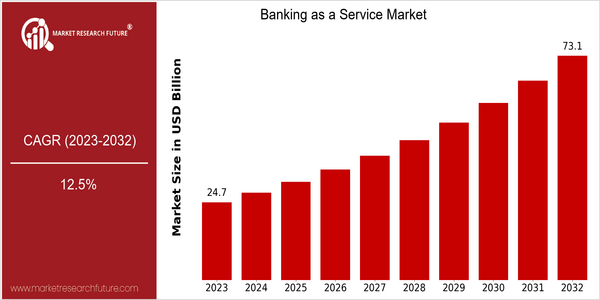

Banking as a Service Market Size Snapshot

| Year | Value |

|---|---|

| 2023 | USD 24.7 Billion |

| 2032 | USD 73.06 Billion |

| CAGR (2024-2032) | 12.5 % |

Note – Market size depicts the revenue generated over the financial year

The banking-as-a-service (BaaS) market is expected to grow to a value of $24 billion in 2023 and to a value of $ 73 billion by 2032. The annual growth rate of 12.5% from 2024 to 2032 is strong and reflects the high degree of uptake of BaaS in various industries. The growth is driven by the increasing demand for digital banking solutions and the emergence of fintechs, as companies seek to improve customer experience and optimize operations through integrated banking services. Several technological trends are driving the growth of the BaaS market, including the proliferation of open APIs, the development of cloud technology, and the increasing focus on financial inclusion. These trends are enabling banks and fintechs to work together more closely to develop new products and services that meet the diverse needs of customers. Strategic initiatives by major BaaS players such as Solarisbank, Synapse, and Galileo Financial Technologies, such as strategic alliances and investments, are enhancing their service offerings and expanding their market presence. Recent collaborations between fintechs and established banks have facilitated the development of tailored financial solutions and are contributing to the growth of the BaaS market.

Regional Deep Dive

The BaaS market is growing strongly across regions, driven by the increasing demand for digital banking solutions and the rise of fintech companies. In North America, the market is characterised by a mature financial ecosystem, in which the established banks and the new players work together to offer a seamless customer experience. In Europe, the regulatory environment is diverse and promotes innovation while ensuring the protection of consumers. Asia-Pacific is characterised by its large population, many of whom are unbanked, and increasing smartphone penetration. In the Middle East and Africa, digital banking is flourishing, backed by financial inclusion programmes. Latin America is also gaining in importance, as a growing number of fintechs are using BaaS to increase access to financial services.

North America

- Chime and Varo are among the most notable non-banks which have accelerated the growth of BaaS. They use the existing banking structures to offer new financial products.

- The regulatory changes are conducive to BaaS and to the development of the business.

- A collaboration between Goldman Sachs and Apple to create the Goldman Sachs–Apple Card is reshaping the competitive landscape and improving customer experience.

Europe

- The banking sector is open to third parties under the second payment services directive (PSD2). Competition and innovation are a driving force in the BaaS market.

- Europe is already leading the way with companies like Solarisbank and Railsbank, which provide a modular banking system, enabling companies to offer financial services as part of their platforms.

- This has a direct effect on the development of BaaS solutions, ensuring that consumers trust the solution.

Asia-Pacific

- The emergence of fintech in India and China is a clear indication of the need for a new system. Paytm and Ant Financial have used BaaS to deliver financial services to millions of unbanked people.

- The digital financial and digitalization programs of the government, such as the “Digital India” program, are promoting the digital financial and digitalization in the country, which is expected to promote the use of BaaS in the region.

- The rapid development of mobile banking and digital wallets is a good opportunity for BaaS suppliers to develop and expand their services.

MEA

- The government of the United Arab Emirates has set itself the goal of establishing the region as a global financial technology hub. In this respect, BaaS will also be a significant factor.

- In the region, companies such as Yap and Zand are developing as important players in the BaaS space, offering solutions tailored to the specific needs of the region’s consumers.

- In the case of financial services, the main driver of demand for BaaS solutions is the need to include underserved populations in countries such as Kenya and Nigeria.

Latin America

- The advent of fintechs like Nubank and Creditas has changed the landscape of financial services in Brazil.

- It is clear that the BaaS model is gaining ground. The regulatory changes that are taking place in countries such as Mexico, for example, which aim to encourage innovation and competition, are creating a favourable environment for BaaS operators.

- The increasing penetration of mobile phones and the Internet in the region is making it easier for digital banking to grow and BaaS to be attractive to local companies.

Did You Know?

“In 2022, over 60% of American consumers were already using at least one digital banking service, a strong indication of the rapid transition to digital solutions.” — Statista

Segmental Market Size

The banking as a service (BaaS) sector is a crucial part of the financial services sector, enabling the seamless integration of banking functionality into non-banking platforms. The current growth in the sector is being driven by the increasing demand for digital banking services and the need for financial institutions to rapidly innovate. The demand for digital services is being driven by the trend towards a more individualized banking experience and the regulatory push for open banking, which encourages the collaboration between banks and fintechs.

In the field of BaaS, we are currently in the stage of deployment, with a number of significant players, such as Solarisbank in Europe and Synapse in the United States, in the vanguard. The main applications are to support neobanks, facilitate payments, and provide compliance solutions for fintechs. The trend is towards a more rapid digital transformation, in the light of the COVID-19 pandemic, as well as the growing emphasis on financial inclusion. The evolution of this field is largely determined by the use of new technological tools, such as application programmer’s interfaces and cloud computing, which make banking more agile and more efficient.

Future Outlook

“The banking as a service market is expected to grow from $24 billion in 2023 to $ 73 billion in 2032, a CAGR of 12.5%. The growth is driven by the increasing demand for seamless digital banking solutions from both fintechs and traditional banks. As more and more businesses realize the value of integrating banking into their platforms, the penetration of banking as a service will increase. By 2032, it is estimated that over 30% of financial services will be provided by banking as a service.

Among the newest developments in IT, the most important are the cloud, the application program interface (API), and artificial intelligence. These three are enabling financial institutions to offer a broader and more individualized range of services, thereby improving both the customer experience and the operating efficiency of the bank. Regulatory support and evolving policies designed to promote innovation in the financial sector will also be crucial to the future of BaaS. Embedded finance and the growing focus on financial inclusion will also help to grow the market. In the future, companies will use BaaS to provide financial services to underserved populations.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 21.47 Billion |

| Market Size Value In 2023 | USD 24.70 billion |

| Growth Rate | 15.1% (2022-2030) |

Banking as a Service Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.