Global Battery As A Service Market Overview

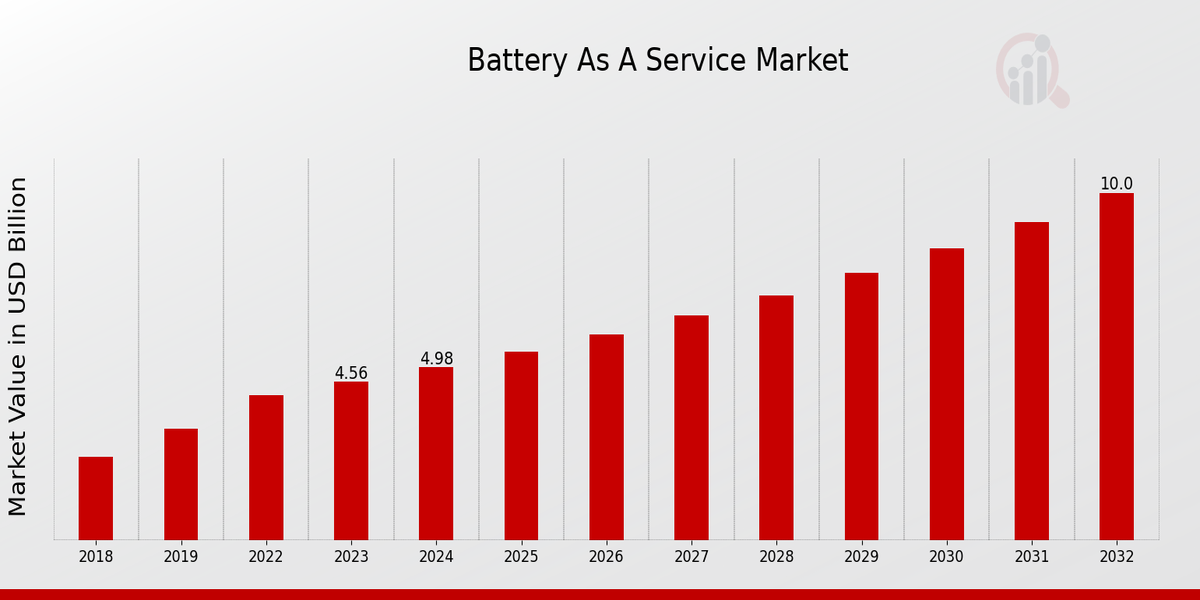

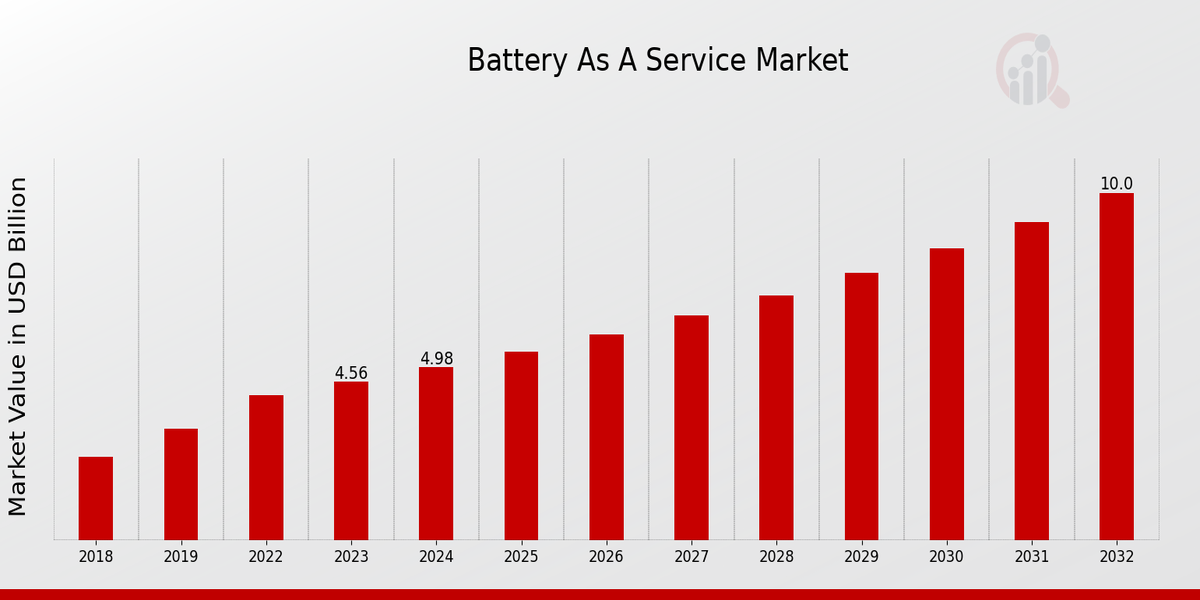

As per MRFR analysis, the Battery As A Service Market Size was estimated at 4.18 (USD Billion) in 2022. The Battery As A Service Market Industry is expected to grow from 4.56(USD Billion) in 2023 to 10.0 (USD Billion) by 2032. The Battery As A Service Market CAGR (growth rate) is expected to be around 9.11% during the forecast period (2024 - 2032).

Key Battery As A Service Market Trends Highlighted

Among the most significant market drivers for the battery-a-service (BaaS) market are rising concerns regarding environmental sustainability and the growing popularity of electric vehicles. Governments worldwide are implementing stringent regulations to promote the adoption of eco-friendly transportation, creating a favorable environment for BaaS solutions. Additionally, technological advancements have enhanced battery performance and reduced costs, making BaaS a cost-effective option for consumers and businesses.

Key opportunities in the BaaS market include the expansion into emerging markets, where infrastructure for electric vehicles is rapidly developing. Strategic partnerships between BaaS providers and automotive manufacturers can drive market growth by providing integrated offerings. Partnerships with charging infrastructure providers can also create a comprehensive charging ecosystem for electric vehicle users.Recent market trends indicate a growing demand for flexible and affordable battery leasing options. Consumers are increasingly opting for subscription-based models that offer lower upfront costs and the convenience of battery replacement and maintenance.

The BaaS market is expected to witness a shift towards longer lease agreements to accommodate the increasing battery life of electric vehicles.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Battery As A Service Market Drivers

Rising Adoption of Electric Vehicles

A significant factor driving the Battery as a Service market is the increasing prevalence of electric vehicles. These vehicles require large batteries, which need to be entirely rebuilt from scratch when the old ones lose their charging capacity. The high cost of purchasing EVs and the batteries needed to operate them is one of the main obstacles in the way of the commercial spread of this technology.

Currently, the main volume of BAAS market demand will come from EV manufacturers that want to make their batteries more accessible to their customers without lowering their price.The growing demand for charging EVs will likely produce demand for the development of the BaaS network. The electric vehicle market is growing rapidly – Market Insights Reports forecasts that the global EV market will increase from 10.6 million units in 2021 to 36.6 million units in 2025, with a compound annual growth rate of 32.1%.

The increase in demand for EVs is caused by a number of factors, including rising gas prices and government incentives, allowing the spread of BaaS to be relatively synonymous with the growing demand for the electric vehicles' primary component.

Increasing Focus on Sustainability

The rise of BaaS market is sustained by the growing attention to sustainability. In recent years, customers have started paying more consideration to the environmental outcomes of their products. Among all benefits that BaaS offers, sustainability is probably the most valuable one. It pertains to a more responsible and rational approach to the use of battery resources, which deploys recycling to minimize the output of hazardous waste. In addition, multiple governments worldwide are moving towards sustainability-oriented policies, offering fiscal benefits to EV owners and charging companies.

Technological Advancements

Technological advancements are also driving the growth of the BaaS market. Battery technology is constantly improving, and new battery types are being developed that are more efficient and have a longer lifespan. These advancements are making BaaS a more attractive option for consumers.

Battery As A Service Market Segment Insights

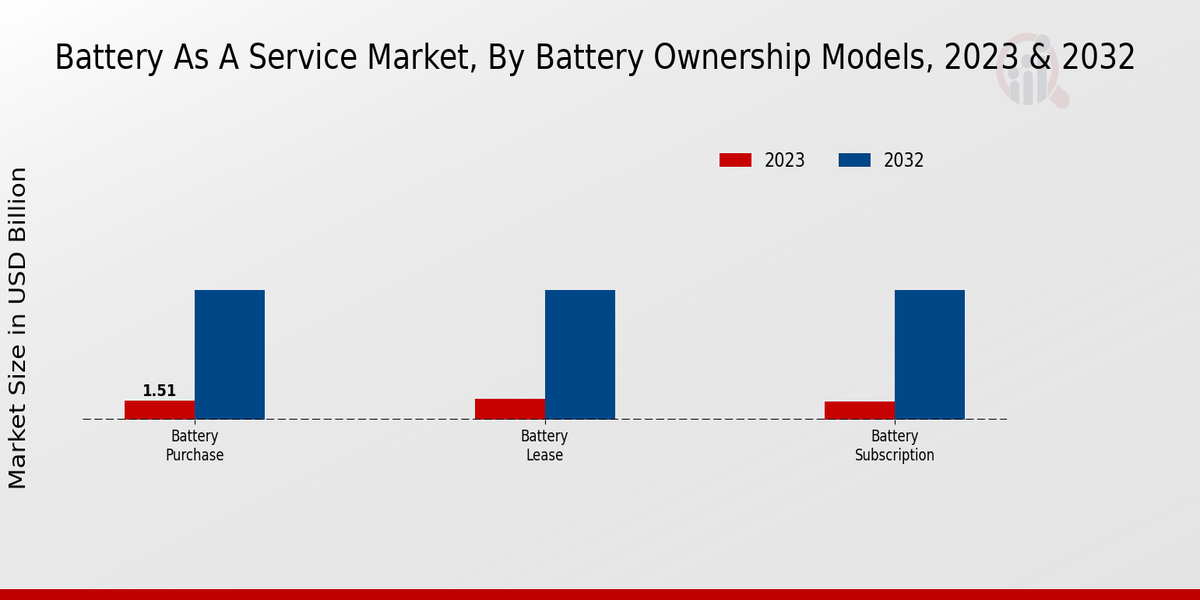

Battery As A Service Market Battery Ownership Models Insights

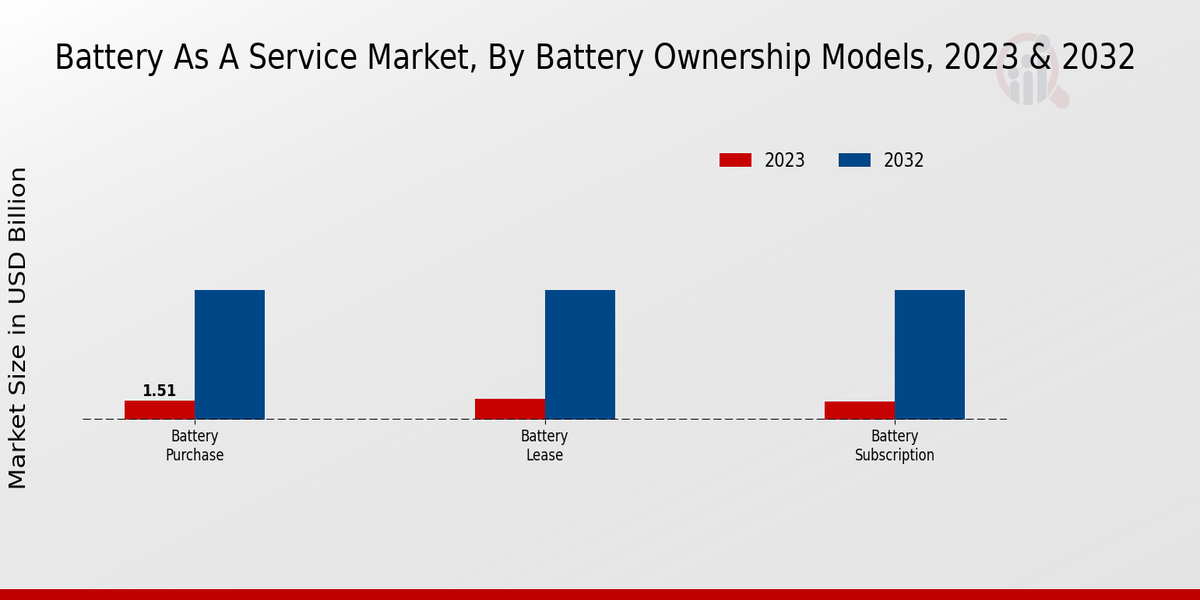

The Global Battery A Service Market is segmented by Battery Ownership Models into Battery Purchase, Battery Lease, and Battery Subscription. The Battery Purchase model appears to be the dominant segment over the forecast period, with a substantial market share expected by 2023. This model’s dominance is expected to continue over the forecast period, attributed to the end-users preference for owning batteries, particularly in regions with extensive EV charging infrastructure.

The alternative models, such as Battery Lease and Battery Subscription, are gaining popularity in lesser MNCS with initial investment constraints, as they are less expensive and less risky to implement across younger EV markets.Under the Battery Lease model, customers lease the Battery from the service provider on a monthly charge that covers battery replacement and maintenance.

The Battery Lease model offers a low-risk solution for businesses and fleet operators that want reliable batteries without having to pay for equipment upfront. The Battery Subscription model provides the customers with a complete service, including batteries, charging, and maintenance, and is a versatile model with the highest flexibility in both leasing and maintenance.

Users who are not interested in owning batteries would likely drive the Battery Subscription model, which is the lowest revenue-generating segment in 2023 but will serve as the largest growth lever.All three business models’ advantages appeal to all categories of customers, taking advantage of the total market opportunity and shaping the total market dynamics for BaaS in terms of market share.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Battery As A Service Market Energy Storage Capacity Insights

The Battery As A Service Market is likely to witness the fastest growth in the 50-100 kWh segment, owing to the increasing adoption of the Battery as a service model by manufacturers of electric vehicles and hybrid electric vehicles. In this particular automotive sector, batteries with storage capacities ranging between 50 and 100 kWh are widely used. However, the growth of the over 100 kWh segment is also likely to be substantial, owing to the increasing demand witnessed by large-scale batteries for energy storage.

Battery As A Service Market Application Insights

Application Segment Insight and Overview The Battery As A Service Market is segmented based on application into electric vehicles, stationary energy storage, and portable electronics. Among these segments, electric vehicles are projected to hold the largest market share by 2024, primarily driven by the increasing adoption of electric vehicles globally. The stationary energy storage segment is also expected to experience significant growth due to the increasing demand for reliable and sustainable energy storage solutions.

Portable electronics, including smartphones, laptops, and tablets, are expected to account for a considerable portion of the market as the demand for portable devices continues to rise.The Battery As A Service Market revenue is expected to reach a substantial value by 2024, owing to the rising demand for battery-powered devices and the growing adoption of renewable energy sources.

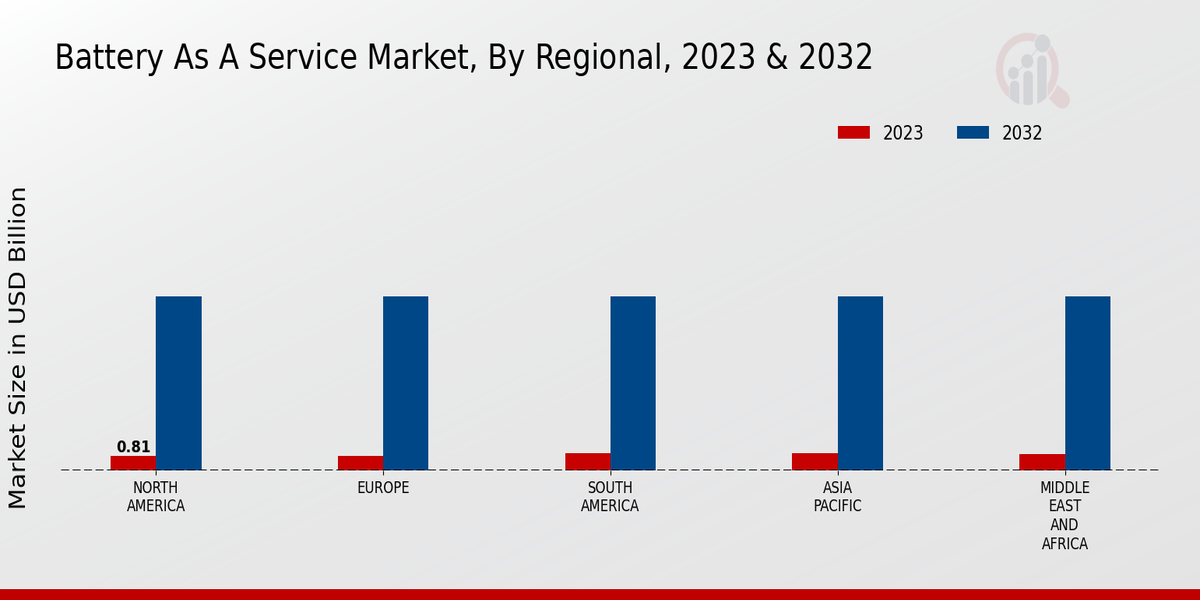

Battery As A Service Market Regional Insights

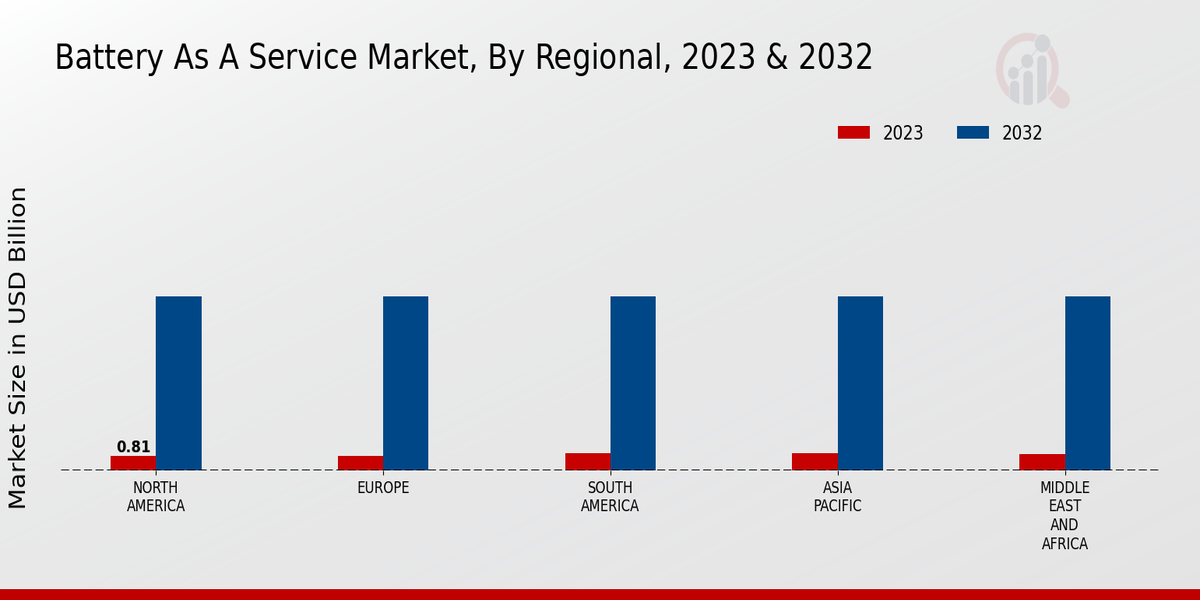

The regional market for Battery As A Service Market is segmented into North America, Europe, APAC, South America, and MEA. North America held the largest market share in 2023 and is expected to continue to dominate the market during the forecast period due to the presence of major automotive manufacturers and the early adoption of electric vehicles. Europe is expected to be the second-largest market for Battery As A Service due to government initiatives promoting electric vehicle adoption and the presence of a large automotive industry.

The APAC region is expected to witness significant growth during the forecast period due to the increasing demand for electric vehicles in countries such as China and India.South America and MEA are expected to have a smaller market share compared to other regions due to the lower adoption of electric vehicles and less developed automotive industries.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Battery As A Service Market Key Players And Competitive Insights

Major players in the Battery As A Service Market industry are continuously involved in implementing partnerships, and guest activations to expand their global reach and to gain the market share of the concerned product. Global market service providers are focusing on developing their products and services to cope with the changing demands and preferences of the customers. Development of the Battery As A Service Market is supported by the growing demand for cost-effective and sustainable storage solutions across various industries such as automotive, energy, and telecommunications.

Leading players in the Battery As A Service Market are also focusing on global expansion through partnerships and collaborations with service providers and technology companies.

However, the Battery As A Service Market is highly competitive, with the presence of few large enterprises with economies of scale and many small and medium-sized businesses in the market, each focusing on a particular segment. Specifically, the major implementation activations are obtained through the innovative technology and network service that they offer to their customers.Ample is one of the highly recognizable players in the Battery As A Service Market also known for offering end-to-end electric vehicle charging and Battery swapping infrastructure.

It offers batteries for commercial fleets and provides a swapping solution that helps to reduce operational costs, enhances business profit, and minimizes economic and environmental impact. Ample offers services for the commercial fleet providing AMPLIFY, this Battery As A Service Market offers the first of its kind of fully automated swapping network across the United States by deploying and networking thousands of Battery swapping systems in major metro cities. The company is focused on customer services and experiences through innovations and offers one of the best services in swapping battery services.

Key Companies in the Battery As A Service Market Include

Battery As A Service Market Industry Developments

-

Q2 2024: NIO launches new battery swap station in Germany, expanding Battery-as-a-Service footprint in Europe NIO announced the opening of its latest battery swap station in Germany, marking a significant step in its European expansion and reinforcing its commitment to the Battery-as-a-Service model for electric vehicles.

-

Q2 2024: Ample raises $100 million Series C to scale battery swapping technology for EV fleets Ample secured $100 million in Series C funding to accelerate the deployment of its modular battery swapping stations, targeting commercial EV fleets and expanding its Battery-as-a-Service offerings.

-

Q2 2024: CATL partners with Komatsu to provide battery leasing solutions for electric construction equipment CATL announced a partnership with Komatsu to deliver battery leasing and swapping services for electric construction machinery, aiming to reduce upfront costs and promote electrification in the sector.

-

Q3 2024: VinFast launches battery leasing program for new EV models in Europe VinFast introduced a battery leasing program for its latest electric vehicle models in Europe, allowing customers to subscribe to battery services and lower the initial purchase price of their vehicles.

-

Q3 2024: NIO signs strategic partnership with Shell to expand battery swap network in the UK NIO and Shell entered a strategic partnership to co-develop and deploy battery swap stations across the UK, enhancing the Battery-as-a-Service infrastructure for EV users.

-

Q3 2024: Ample opens new battery swapping facility in Los Angeles for ride-hailing fleets Ample inaugurated a new battery swapping station in Los Angeles, specifically designed to serve ride-hailing and delivery fleets, furthering its Battery-as-a-Service market presence.

-

Q4 2024: Sun Mobility secures $50 million investment to expand battery swapping services in India Sun Mobility received a $50 million investment to scale its battery swapping infrastructure for electric two- and three-wheelers, supporting the growth of Battery-as-a-Service in India.

-

Q4 2024: BYD unveils battery leasing service for commercial EVs in China BYD launched a battery leasing service for its commercial electric vehicles in China, enabling fleet operators to access flexible battery solutions and reduce capital expenditure.

-

Q1 2025: NIO opens first battery swap station in Norway, expanding European Battery-as-a-Service network NIO announced the opening of its first battery swap station in Norway, marking a milestone in its European Battery-as-a-Service expansion strategy.

-

Q1 2025: Renault partners with Mobilize to launch battery subscription service for urban EVs Renault and Mobilize launched a battery subscription service for urban electric vehicles, allowing customers to lease batteries and benefit from regular upgrades and maintenance.

-

Q2 2025: Sun Mobility opens new battery swapping hub in Bengaluru for electric three-wheelers Sun Mobility inaugurated a new battery swapping hub in Bengaluru, India, dedicated to serving electric three-wheelers and supporting the Battery-as-a-Service ecosystem.

-

Q2 2025: Ample announces partnership with Uber to provide battery swapping for electric ride-hailing vehicles Ample entered a partnership with Uber to offer battery swapping services for electric ride-hailing vehicles, aiming to reduce downtime and improve operational efficiency for drivers.

Battery As A Service Market Segmentation Insights

Battery As A Service Market Battery Ownership Models Outlook

Battery As A Service Market Energy Storage Capacity Outlook

Battery As A Service Application Outlook

- Stationary Energy Storage

Battery As A Service Regional Outlook

| Report Attribute/Metric |

Details |

| Market Size 2022 |

4.18(USD Billion) |

| Market Size 2023 |

4.56(USD Billion) |

| Market Size 2032 |

10.0(USD Billion) |

| Compound Annual Growth Rate (CAGR) |

9.11% (2024 - 2032) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year |

2023 |

| Market Forecast Period |

2024 - 2032 |

| Historical Data |

2019 - 2022 |

| Market Forecast Units |

USD Billion |

| Key Companies Profiled |

PowerHe, Clarios, Valence U, Custom, EnerSys, GS Yuasa, Renewable Energy Systems, Trojan Battery, Varta, Northstart, LeClanche, JCI, Exide, Saft, REDT |

| Segments Covered |

Battery Ownership Models, Energy Storage Capacity, Application, Regional |

| Key Market Opportunities |

Battery sharing as a revenue generator for utilities and other providers Integration of Battery as a service with renewable energy sources Demand for Battery as a service from data centers and telecom industries Growing popularity of electric vehicles and their compatibility with the Battery as a service Government incentives and regulations promoting Battery as a service adoption |

| Key Market Dynamics |

Rising electric vehicle adoption Government incentives for clean energy Increasing demand for energy storage Growing popularity of subscription-based services Technological advancements in battery technology |

| Countries Covered |

North America, Europe, APAC, South America, MEA |

Frequently Asked Questions (FAQ):

The Battery As A Service Market is expected to reach a valuation of USD 10.0 billion by 2032, exhibiting a CAGR of 9.11% between 2024 and 2032.

North American region is projected to dominate the Battery As A Service Market, followed by North America and Europe. The growth in the Asia-Pacific region is attributed to the increasing adoption of electric vehicles and the presence of a large automotive industry in the region.

Battery As A Service is primarily used in electric vehicles, but it also has applications in stationary energy storage systems, such as those used in homes and businesses to store excess solar or wind energy.

Some of the key competitors in the Battery As A Service Market include Tesla, NIO, Volkswagen, General Motors, and Hyundai.

The growth of the Battery As A Service Market is primarily driven by the increasing adoption of electric vehicles, government incentives for electric vehicles, and the decreasing cost of battery technology.

The Battery As A Service Market faces challenges such as the high upfront cost of electric vehicles, the limited range of electric vehicles, and the lack of charging infrastructure.

The Battery As A Service Market presents opportunities for the development of new battery technologies, the expansion of charging infrastructure, and the integration of Battery As A Service with other mobility services.

Key trends shaping the Battery As A Service Market include the increasing popularity of subscription-based services, the development of solid-state batteries, and the integration of Battery As A Service with renewable energy sources.

The COVID-19 pandemic had a negative impact on the Battery As A Service Market in the short term due to disruptions in the automotive industry and supply chains. However, the long-term impact is expected to be positive, as the pandemic has accelerated the adoption of electric vehicles.

The Battery Service Market is expected to continue to grow steadily in the coming years, driven by the increasing adoption of electric vehicles and the development of new battery technologies.