- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

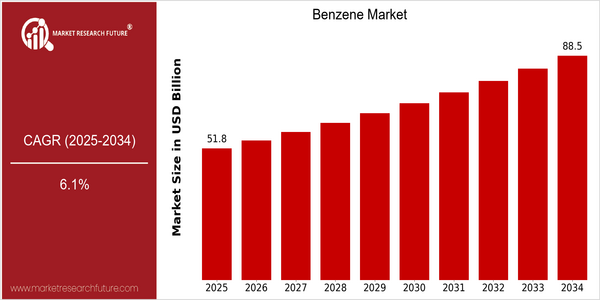

| Year | Value |

|---|---|

| 2025 | USD 51.84 Billion |

| 2034 | USD 88.49 Billion |

| CAGR (2025-2034) | 6.1 % |

Note – Market size depicts the revenue generated over the financial year

The benzene market is expected to grow significantly, reaching a volume of 51.84 billion dollars in 2025, and expected to reach 88.49 billion in 2034. This represents a CAGR of 6.1% over the forecast period. This growth can be attributed to a number of factors, including the rising demand for benzene derivatives in industries such as automobiles, construction and consumer goods, which are increasingly dependent on benzene-based products for their manufacturing processes. Also driving this growth are technological developments in production and the growing focus on sustainable development. In particular, the development of benzene alternatives from bioresources and the introduction of new catalytic processes are expected to increase the efficiency of production and reduce its negative impact on the environment. Several companies, such as ExxonMobil, BASF and Sinopec, are taking advantage of these trends by investing in research and development and entering into strategic alliances. ExxonMobil, for example, is expanding its petrochemicals capacity to meet the growing demand for benzene and its derivatives. This is expected to further support the market's positive outlook.

Regional Market Size

Regional Deep Dive

The benzene market is characterized by a varied dynamic in different regions, depending on the industrial demand, the regulatory framework and the economic conditions. In North America, the petrochemical industry is the main source of demand, with a high production capacity and a focus on the environment. In Europe, stricter regulations and a shift towards bio-based chemicals prevail, while the Asia-Pacific region is experiencing rapid industrialization and urbanization, which is expected to increase the consumption of benzene. The Middle East and Africa are also growing due to the increase in refining capacity, while Latin America is gradually gaining ground through the development of the chemical industry.

Europe

- The European Union's Green Deal is pushing for a transition to sustainable chemicals, leading companies like BASF and INEOS to innovate in bio-based benzene production.

- Regulatory changes regarding the REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) framework are influencing the market, as companies must comply with stringent safety and environmental standards.

Asia Pacific

- China's rapid industrial growth has resulted in a surge in benzene demand, with major players like Sinopec and China National Petroleum Corporation (CNPC) expanding their production capacities.

- The region is also seeing increased investment in petrochemical complexes, such as the Pengerang Integrated Complex in Malaysia, which aims to enhance benzene production and supply.

Latin America

- Brazil is focusing on enhancing its chemical industry, with government initiatives aimed at attracting foreign investment in benzene production, particularly in the biofuels sector.

- Mexico's energy reforms are opening up opportunities for private investment in the petrochemical sector, which is expected to boost benzene production in the coming years.

North America

- The U.S. Environmental Protection Agency (EPA) has implemented stricter regulations on benzene emissions, prompting companies like ExxonMobil and Chevron to invest in cleaner technologies and processes.

- Recent advancements in shale gas extraction have led to increased benzene production in North America, with companies such as Phillips 66 expanding their operations to capitalize on this resource.

Middle East And Africa

- Saudi Arabia's National Industrial Development and Logistics Program is fostering growth in the petrochemical sector, with companies like SABIC investing heavily in benzene production facilities.

- The UAE is also expanding its refining capabilities, with projects like the Ruwais Refinery aiming to increase the output of benzene and other petrochemicals.

Did You Know?

“Benzene is not only a key industrial chemical but also a natural component of crude oil, making up about 1-2% of its composition.” — U.S. Energy Information Administration (EIA)

Segmental Market Size

The benzene market is stable. Benzene is a necessary constituent of many chemicals and materials, including plastics, resins, and synthetic fibers. The need for lightweight materials in the automobile and aeronautical industries, and the growing demand for solvents in paints and coatings, are the main reasons for benzene's continuing demand. The regulatory pressure to reduce the use of volatile organic compounds is also having an effect on the market. It is driving manufacturers to find new uses for benzene that are compatible with the new environment regulations. The benzene market is currently at a mature stage. It is dominated by the majors, BASF and ExxonMobil, which are both active in production and in research and development. The most important end uses are the synthesis of styrene for the production of polystyrene and the synthesis of phenol for the manufacture of epoxy resins. The trends towards greater responsibility and the bio-based chemicals trend are also having a stimulating effect on the market. In the meantime, a number of new production techniques, such as the use of new catalysts and new separation methods, are improving the efficiency and reducing the environmental impact of benzene production.

Future Outlook

The benzene market is expected to grow significantly from 2025 to 2034, with a projected increase from 51,842,000,000 to 88,490,000,000, a robust compound annual growth rate (CAGR) of 6.1%. The high growth rate is driven by the rising demand for benzene derivatives, such as phenol, styrene and cyclohexane, which are essential for many industries, such as the auto, construction and household appliances. The global economy is recovering and expanding, and benzene demand is also expected to rise, driven by industrialization and urbanization, especially in the emerging economies of Asia-Pacific and Latin America. Also, the development of new technology and the implementation of policies will play an important role in shaping the benzene market. The development of new extraction and refining methods will increase the efficiency of production and reduce the impact on the environment, which is in line with the sustainable development strategy. Also, the reduction of carbon emissions in the future is expected to encourage the use of more efficient production methods. In addition, the shift towards bio-based chemicals and the circular economy will also have an impact on the market, as companies diversify their feedstock sources and reduce their reliance on fossil fuels. In the next ten years, the benzene market will face new challenges and opportunities as it adapts to changing consumer preferences and regulatory environments.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 40.87 Billion |

| Growth Rate | 6.12 % (2022-2030) |

Benzene Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.