Advancements in Genomic Technologies

Technological advancements in genomic sequencing and analysis are propelling the Biomarkers Market forward. Innovations such as next-generation sequencing (NGS) and CRISPR technology have revolutionized the way biomarkers are identified and utilized in clinical settings. These technologies enable researchers to analyze vast amounts of genetic data quickly and accurately, facilitating the discovery of novel biomarkers for various diseases. The integration of these advanced technologies is expected to enhance the efficiency of biomarker development processes, thereby reducing time-to-market for new diagnostic tests. As a result, the Biomarkers Market is likely to witness substantial growth, with the genomic biomarker segment anticipated to account for a significant share of the overall market by 2025. This trend underscores the importance of continuous investment in research and development within the biomarker domain.

Growing Demand for Personalized Medicine

The shift towards personalized medicine is a significant driver of the Biomarkers Market. As healthcare evolves, there is an increasing recognition of the need for tailored treatment approaches that consider individual patient characteristics. Biomarkers serve as essential tools in this paradigm, enabling healthcare providers to select the most effective therapies based on a patient's unique biological profile. This trend is reflected in the rising number of biomarker-based companion diagnostics, which are designed to identify patients who are most likely to benefit from specific treatments. The market for personalized medicine is projected to grow substantially, with estimates suggesting it could reach over 2 trillion USD by 2025. This growth is likely to further stimulate the Biomarkers Market, as the demand for innovative diagnostic solutions continues to rise.

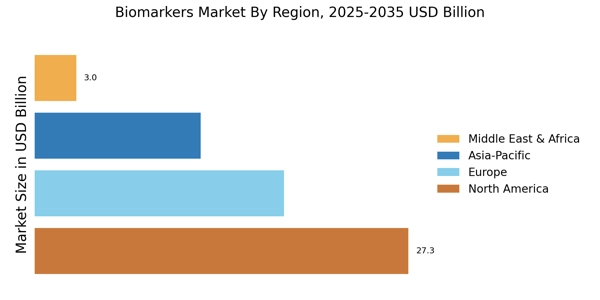

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases such as cancer, diabetes, and cardiovascular disorders is a primary driver of the Biomarkers Market. As these conditions become more prevalent, the demand for effective diagnostic tools and personalized treatment options intensifies. Biomarkers play a crucial role in early detection and monitoring of these diseases, thereby enhancing patient outcomes. According to recent estimates, the market for biomarkers is projected to reach approximately 60 billion USD by 2026, reflecting a compound annual growth rate of around 12%. This growth is largely attributed to the increasing focus on precision medicine, which relies heavily on biomarker identification and validation. Consequently, the Biomarkers Market is expected to expand significantly as healthcare providers seek innovative solutions to manage chronic diseases.

Regulatory Support for Biomarker Development

Regulatory agencies are increasingly recognizing the importance of biomarkers in drug development and patient care, which is positively impacting the Biomarkers Market. Initiatives aimed at streamlining the approval process for biomarker-based diagnostics are being implemented, thereby encouraging innovation and investment in this field. For instance, the FDA has established guidelines for the development and validation of biomarkers, which facilitate their integration into clinical practice. This regulatory support not only enhances the credibility of biomarker applications but also fosters collaboration between industry stakeholders and regulatory bodies. As a result, the Biomarkers Market is likely to experience accelerated growth, with more companies entering the market to develop novel biomarker solutions that meet regulatory standards.

Rising Investment in Research and Development

Investment in research and development (R&D) within the biomarker sector is a crucial driver of the Biomarkers Market. Increased funding from both public and private sectors is enabling researchers to explore new biomarker candidates and develop innovative diagnostic tools. This influx of capital is particularly evident in the fields of oncology and rare diseases, where the need for effective biomarkers is paramount. According to recent reports, R&D spending in the biomarker space is expected to exceed 10 billion USD by 2025, reflecting a growing commitment to advancing biomarker science. This trend is likely to result in the discovery of novel biomarkers that can improve disease detection and treatment, thereby further propelling the Biomarkers Market.