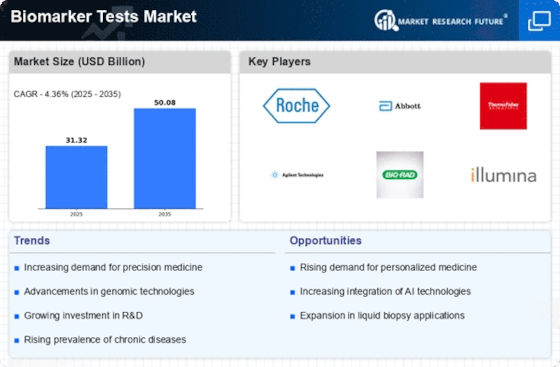

Advancements in Genomic Technologies

Technological innovations in genomic sequencing and analysis are significantly influencing the Biomarker Tests Market. The advent of next-generation sequencing (NGS) has revolutionized the ability to identify and validate biomarkers with unprecedented precision. This has led to a surge in the development of companion diagnostics, which are essential for personalized medicine approaches. Market data indicates that the NGS segment is expected to witness substantial growth, with projections suggesting a compound annual growth rate (CAGR) of over 20% in the coming years. As these technologies become more accessible and cost-effective, their integration into clinical practice is anticipated to drive the demand for biomarker tests.

Rising Incidence of Chronic Diseases

The increasing prevalence of chronic diseases such as cancer, diabetes, and cardiovascular disorders is a primary driver of the Biomarker Tests Market. As healthcare systems strive to improve patient outcomes, the demand for early detection and personalized treatment options intensifies. According to recent statistics, chronic diseases account for approximately 70% of all deaths, underscoring the urgent need for effective diagnostic tools. Biomarker tests facilitate the identification of disease at earlier stages, allowing for timely interventions. This trend is likely to propel the market forward, as healthcare providers increasingly adopt biomarker testing to enhance diagnostic accuracy and treatment efficacy.

Growing Demand for Point-of-Care Testing

The shift towards point-of-care testing (POCT) is emerging as a significant driver in the Biomarker Tests Market. Patients and healthcare providers are increasingly favoring rapid diagnostic solutions that can be administered outside traditional laboratory settings. This trend is fueled by the need for timely decision-making in clinical environments. Market analysis suggests that the POCT segment is poised for robust growth, with expectations of a CAGR exceeding 15% over the next few years. The convenience and efficiency of biomarker tests that can be performed at the point of care are likely to enhance patient satisfaction and improve health outcomes.

Regulatory Support for Biomarker Development

Regulatory bodies are playing a pivotal role in shaping the Biomarker Tests Market by providing frameworks that facilitate the development and approval of biomarker tests. Initiatives aimed at streamlining the regulatory process for diagnostic tests are encouraging innovation and expediting market entry. Recent guidelines from regulatory agencies have emphasized the importance of biomarkers in drug development and personalized medicine, which is likely to foster a more favorable environment for biomarker testing. As regulatory support continues to evolve, it is expected that the market will witness an influx of new biomarker tests, enhancing diagnostic capabilities across various therapeutic areas.

Increased Investment in Research and Development

The Biomarker Tests Market is experiencing a surge in investment directed towards research and development initiatives. Pharmaceutical companies and biotechnology firms are increasingly allocating resources to discover and validate new biomarkers, which are crucial for drug development and patient stratification. This trend is supported by government funding and public-private partnerships aimed at fostering innovation in the healthcare sector. Recent reports indicate that R&D spending in the life sciences sector has reached new heights, with billions of dollars being invested annually. Such financial commitment is likely to accelerate the introduction of novel biomarker tests, thereby expanding the market.