Global Blockchain Finance Market Overview:

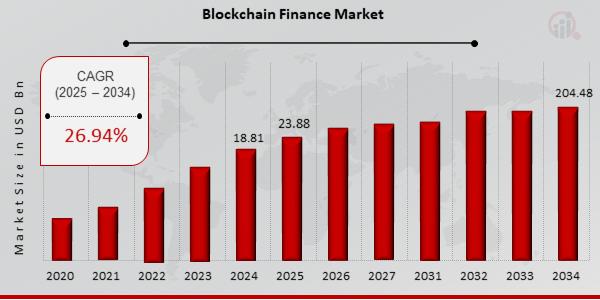

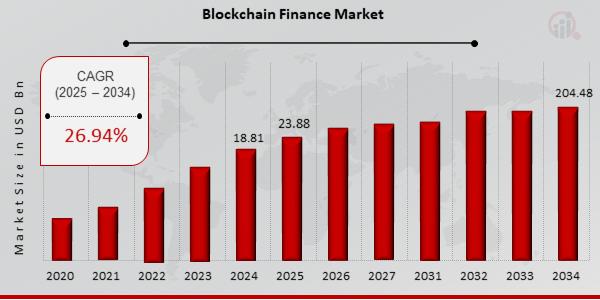

Blockchain Finance Market Size was estimated at 18.81 (USD Billion) in 2024. The Blockchain Finance Market Industry is expected to grow from 23.88 (USD Billion) in 2025 to 204.48 (USD Billion) till 2034, exhibiting a compound annual growth rate (CAGR) of 26.94% during the forecast period (2025 - 2034)

Key Blockchain Finance Market Trends Highlighted

The increasing demand for transparency, security, and efficiency in financial transactions is driving the growth of the blockchain finance market. The technology's potential to streamline processes, reduce costs, and enhance trust is attracting significant attention from financial institutions, startups, and governments. Blockchain finance is revolutionizing cross-border payments, trade finance, and supply chain management. The use of smart contracts automates processes and reduces transaction times, while the decentralized nature of blockchain ensures data integrity and security. Moreover, the immutability of blockchain records provides a single source of truth, reducing the risk of fraud and disputes.

Recent trends in blockchain finance include the emergence of decentralized finance (DeFi) and tokenization of assets. DeFi applications offer a range of financial services, such as lending, borrowing, and trading, without the need for intermediaries. Tokenization converts physical assets into digital representations, enabling fractional ownership and increased liquidity.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Blockchain Finance Market Drivers

Decentralization and Transparency

Blockchain technology offers a decentralized and transparent platform for financial transactions, fostering trust and accountability. By eliminating intermediaries and creating a shared, immutable ledger, blockchain enhances the transparency of financial operations, reducing the risk of fraud, manipulation, and errors. This increased transparency contributes to improved financial stability, strengthens investor confidence, and promotes ethical practices within the financial industry. Additionally, blockchain's decentralized nature empowers individuals and businesses with greater control over their financial assets. It eliminates the reliance on centralized institutions, reducing the risk of censorship, discrimination, and financial exclusion.

This promotes financial inclusion, enabling individuals and small businesses to participate in the global financial ecosystem on an equal footing. Overall, the decentralization and transparency offered by blockchain technology are key drivers of its adoption in the Blockchain Finance Market Industry, fostering trust, accountability, and inclusivity in financial transactions.

Cost Reduction and Efficiency

Blockchain technology has the potential to significantly reduce costs and improve efficiency in the financial sector. By automating and streamlining processes, blockchain eliminates the need for intermediaries, reduces paperwork, and simplifies reconciliation processes. This leads to cost savings for financial institutions and their customers, as well as faster and more efficient transactions. For example, cross-border payments, which are typically slow and expensive due to the involvement of multiple intermediaries and currency conversions, can be significantly streamlined using blockchain. Blockchain-based payment systems can automate the process, reducing transaction times and fees while providing real-time settlement.

Additionally, blockchain can improve operational efficiency by providing a single, shared platform for financial transactions. This eliminates the need for multiple systems and data reconciliation, reducing the risk of errors and improving overall efficiency within the Blockchain Finance Market Industry.

Security and Immutability

Blockchain technology offers enhanced security and immutability for financial transactions, mitigating the risk of fraud, cyberattacks, and data breaches. The distributed and encrypted nature of blockchain makes it virtually impossible to tamper with or alter transaction records, providing a secure and reliable platform for financial operations. Traditional financial systems are vulnerable to cyberattacks and fraud due to centralized data storage and reliance on intermediaries. Blockchain, on the other hand, distributes data across a network of computers, making it more resistant to hacking and unauthorized access.

Additionally, the immutability of blockchain ensures that transaction records are tamper-proof, providing a secure and auditable trail for financial activities within the Blockchain Finance Market Industry.

Blockchain Finance Market Segment Insights:

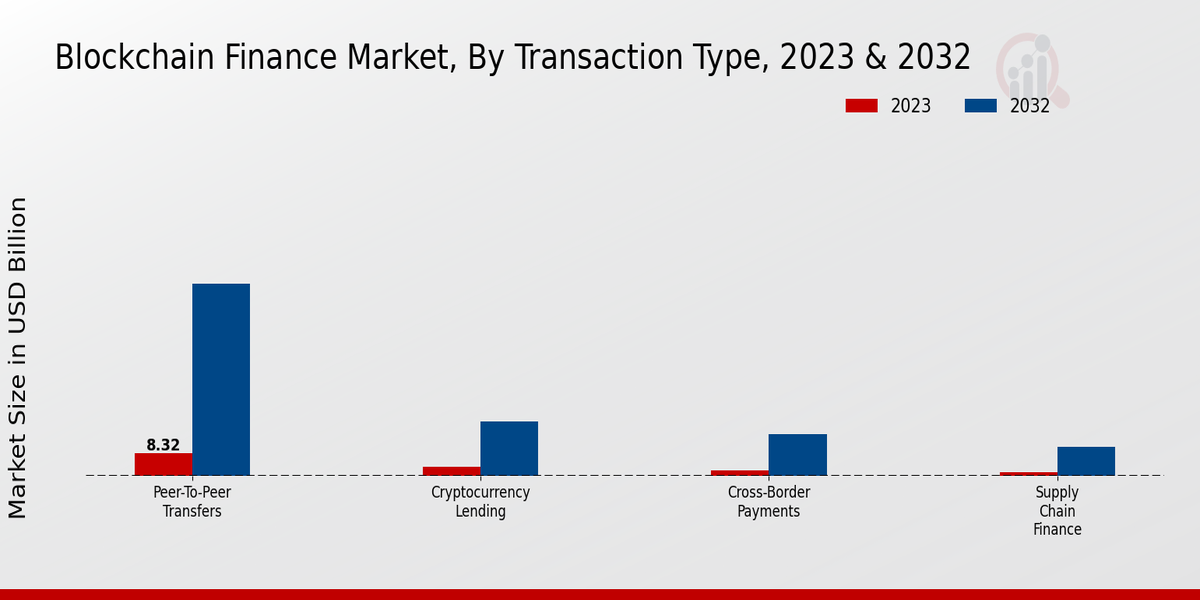

Blockchain Finance Market Transaction Type Insights

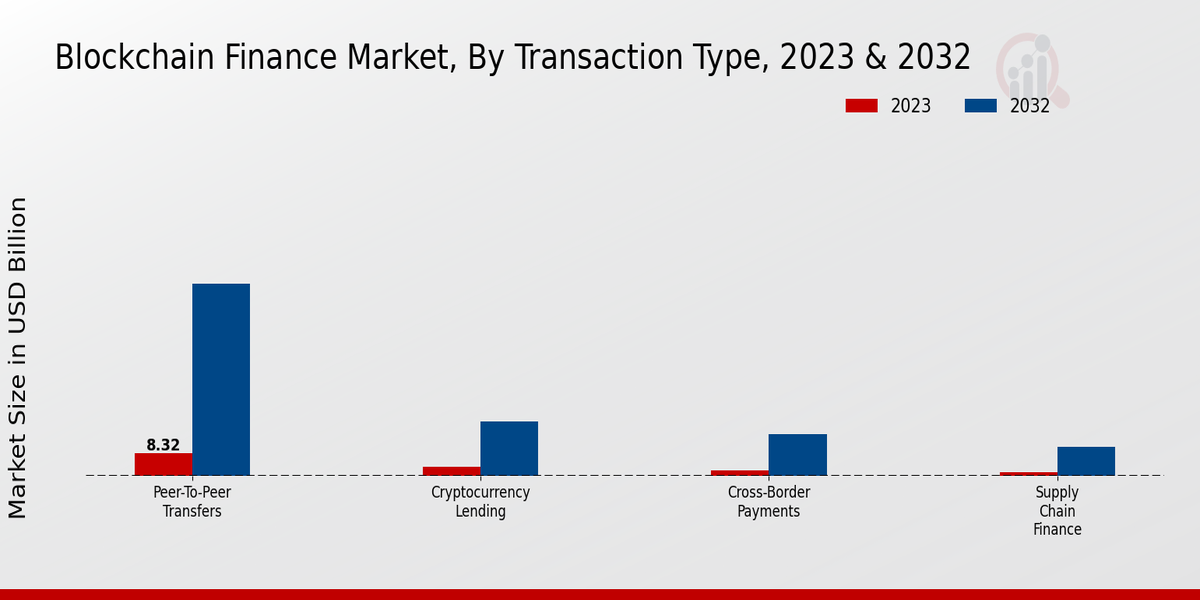

The Blockchain Finance Market is segmented by Transaction Type into Peer-to-Peer Transfers, Cryptocurrency Lending, Cross-Border Payments, and Supply Chain Finance. Peer-to-peer transfers accounted for the largest share of the Blockchain Finance Market in 2023 and is projected to continue its dominance during the forecast period. The growth of this segment can be attributed to the increasing adoption of cryptocurrencies for remittances and cross-border payments. Cryptocurrency Lending is another significant segment of the Blockchain Finance Market. The growth of this segment is driven by the increasing demand for crypto-backed loans.

Cryptocurrency lending platforms offer attractive interest rates and flexible loan terms, making them a popular option for crypto investors. Cross-Border Payments is a rapidly growing segment of the Blockchain Finance Market. Traditional cross-border payments can be slow and expensive, but blockchain technology can significantly reduce costs and time. Blockchain-based cross-border payment solutions offer faster, cheaper, and more transparent transactions. Supply Chain Finance is a promising segment of the Blockchain Finance Market. Blockchain can improve the efficiency and transparency of supply chain finance processes.

The growth of the market is driven by increasing adoption of blockchain technology in the financial sector, rising demand for cryptocurrency lending, and growing popularity of cross-border payments.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Blockchain Finance Market Protocol Insights

The Protocol segment is a crucial component of the Blockchain Finance Market, contributing significantly to its revenue growth. Among the major protocols, Bitcoin and Ethereum stand out as the most prominent players, capturing a significant market share. Bitcoin, known for its decentralized digital currency, has established a strong foothold in the market, while Ethereum's blockchain platform and smart contract capabilities have fueled its widespread adoption. Hyperledger, an open-source blockchain framework, is gaining traction in enterprise applications, particularly in the financial industry. Ripple, another notable protocol, is recognized for its cross-border payment solutions, facilitating seamless and cost-effective international transactions.

As the market evolves, these protocols continue to drive innovation and shape the landscape of Blockchain Finance.

Blockchain Finance Market Application Insights

The Blockchain Finance Market segmentation by Application can be divided into Digital Asset Management, Trade Finance, Digital Identity, RegTech, and others. Digital Asset Management is expected to hold the largest market share in 2023 and is projected to continue its dominance throughout the forecast period. Digital asset management platforms leverage blockchain technology to securely store, manage, and track digital assets, such as cryptocurrencies and digital collectibles. Trade Finance is another significant application segment in the Blockchain Finance Market. Blockchain-based trade finance solutions streamline and secure international trade processes, reducing costs and improving efficiency.

Digital Identity applications utilize blockchain to create secure and verifiable digital identities for individuals and organizations. By leveraging blockchain's immutability and transparency, digital identity solutions prevent identity theft and fraud and enhance trust in online transactions. RegTech applications employ blockchain technology to improve compliance and regulatory processes in the financial industry. Blockchain-based RegTech solutions enhance transparency, reduce operational costs, and streamline regulatory reporting, enabling financial institutions to meet compliance requirements more efficiently.

Blockchain Finance Market Asset Class Insights

The Blockchain Finance Market is segmented by Asset Class into Cryptocurrencies, Security Tokens, Stablecoins, and Non-Fungible Tokens (NFTs). Cryptocurrencies are digital or virtual currencies that use cryptography for security and operate independently of a central bank. Security tokens are digital assets that represent ownership or rights to an underlying asset, such as a stock or bond. Stablecoins are cryptocurrencies that are pegged to a fiat currency, such as the US dollar, to reduce price volatility. NFTs are unique digital assets that represent ownership of a specific item, such as a piece of art or a collectible.

In 2023, the Cryptocurrencies segment accounted for the largest share of the Blockchain Finance Market revenue, at approximately 55%. The Stablecoins segment is also expected to grow rapidly, with a projected CAGR of 25.8% during the same period. The NFTs segment is a relatively new and emerging segment, but it is expected to grow rapidly in the coming years, driven by increasing demand for digital collectibles and art.

Blockchain Finance Market Industry Vertical Insights

The Blockchain Finance Market segmentation by Industry Vertical includes Financial Services, Healthcare, Supply Chain Management, Public Sector, and Media and Entertainment. Among these, Financial Services held the largest market share in 2023 and is projected to maintain its dominance throughout the forecast period. The growth of the Financial Services vertical can be attributed to the increasing adoption of blockchain technology for payments, trade finance, and asset management. For instance, in 2023, the global blockchain spending in financial services was valued at USD 1.1 billion. Healthcare is another promising vertical, with the market expected to grow significantly over the forecast period.

The increasing use of blockchain technology for patient data management, drug traceability, and clinical trials is driving the growth of this vertical.

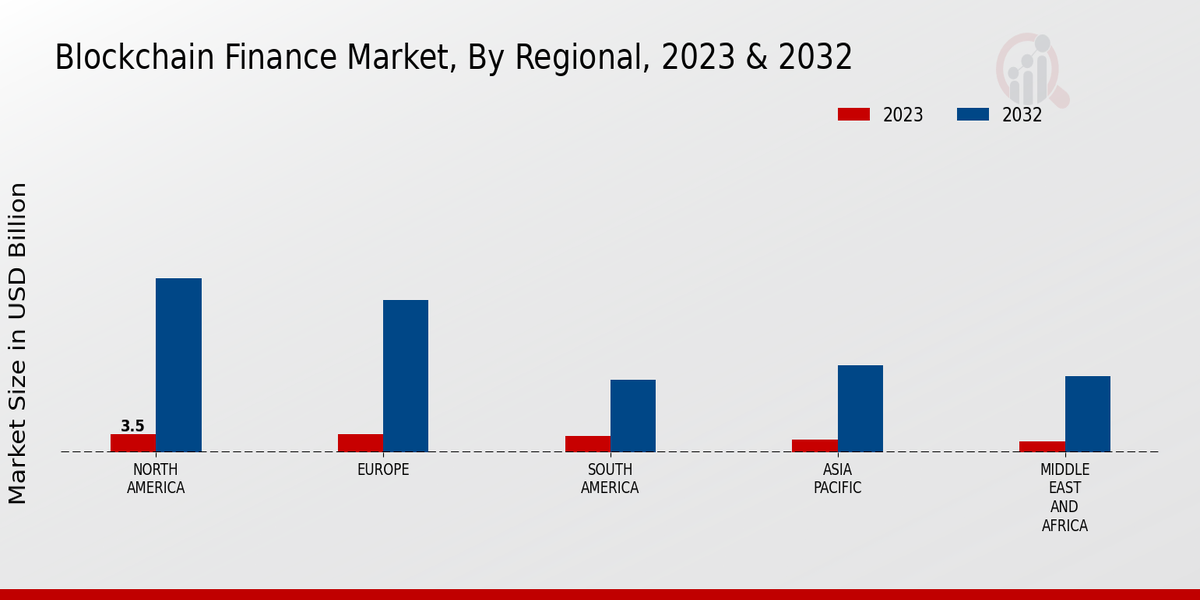

Blockchain Finance Market Regional Insights

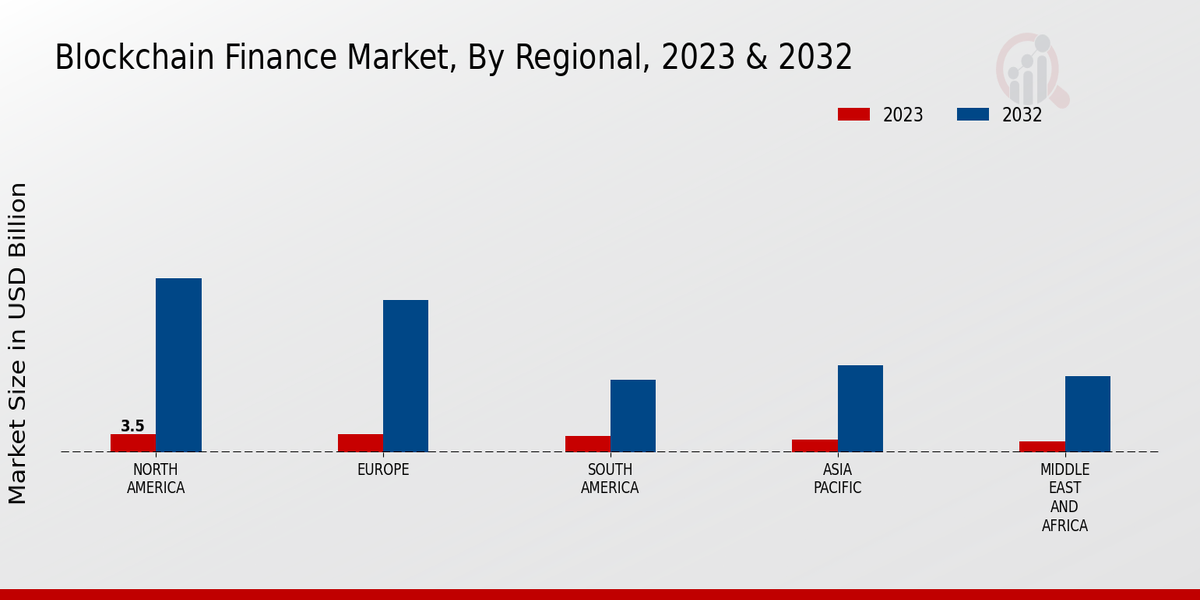

The regional segment of the Blockchain Finance Market offers valuable insights into the market's geographical distribution and growth dynamics. North America is expected to dominate the market in the coming years, driven by the presence of major technology hubs and early adoption of blockchain technology in the financial sector. The region is projected to account for over 35% of the Blockchain Finance Market revenue in 2024. Europe follows closely, with a significant market share attributed to the region's strong financial infrastructure and growing adoption of blockchain-based solutions in various industries.

The APAC region is anticipated to witness substantial growth in the coming years, owing to the increasing adoption of blockchain technology in emerging economies such as China, India, and Japan. South America and MEA are expected to contribute a smaller but growing share to the Blockchain Finance Market, driven by government initiatives and increasing awareness of blockchain's potential.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Blockchain Finance Market Key Players And Competitive Insights:

Major players in the Blockchain Finance Market industry are continuously investing in research and development to stay ahead of the competition. Leading Blockchain Finance Market players are also focusing on strategic partnerships and acquisitions to expand their market reach and strengthen their position in the market. The Blockchain Finance Market industry is expected to witness significant growth in the coming years, driven by the increasing adoption of blockchain technology in the financial sector. A leading player in the Blockchain Finance Market, Ripple, is a provider of enterprise blockchain solutions for global payments.

The company's blockchain-based platform, RippleNet, enables financial institutions to make faster, cheaper, and more transparent cross-border payments. In 2023, Ripple announced a partnership with Santander, one of the largest banks in the world, to use RippleNet for cross-border payments. Another major player in the Blockchain Finance Market is Coinbase, a cryptocurrency exchange and wallet provider. The company offers a variety of services, including the ability to buy, sell, and store cryptocurrencies. In 2023, Coinbase launched a new product called Coinbase Prime, which provides institutional investors with access to advanced trading tools and services.

Key Companies in the Blockchain Finance Market Include:

Blockchain Finance Industry Developments

-

Q2 2024: JPMorgan launches blockchain-based collateral settlement system JPMorgan announced the launch of a blockchain-based platform for collateral settlements, enabling clients to use tokenized versions of traditional assets for intraday transactions.

-

Q2 2024: Deutsche Bank Partners With Taurus to Offer Crypto Custody Services Deutsche Bank entered into a partnership with Swiss crypto firm Taurus to provide digital asset custody and tokenization services to institutional clients.

-

Q2 2024: UBS launches tokenized money market fund on Ethereum blockchain UBS Asset Management launched a live pilot of a tokenized money market fund on the Ethereum blockchain, allowing real-time settlement and transparency for institutional investors.

-

Q1 2024: LayerZero Labs raises $120M at $3B valuation to expand cross-chain messaging protocol LayerZero Labs, a blockchain interoperability startup, secured $120 million in Series B funding to accelerate development of its cross-chain messaging infrastructure.

-

Q1 2024: BlackRock launches first tokenized fund on Ethereum BlackRock announced the launch of its first tokenized fund, the BlackRock USD Institutional Digital Liquidity Fund, on the Ethereum blockchain, marking a major move into blockchain-based finance.

-

Q2 2024: HSBC launches digital asset custody service for institutional clients HSBC introduced a digital asset custody service, enabling institutional clients to securely store tokenized securities and other blockchain-based assets.

-

Q2 2024: Standard Chartered launches blockchain-based trade finance platform in Singapore Standard Chartered Bank launched a blockchain-powered trade finance platform in Singapore, aiming to streamline and digitize trade document processing for corporate clients.

-

Q1 2024: Societe Generale issues first euro-denominated stablecoin on Ethereum Societe Generale issued the first euro-denominated stablecoin on the Ethereum blockchain, designed for use in on-chain settlement and digital asset transactions.

-

Q2 2024: Visa launches pilot of blockchain-based cross-border payment solution Visa announced a pilot program for a blockchain-based cross-border payment solution, enabling faster and more transparent international transactions for business clients.

-

Q1 2024: Circle secures $400 million funding round led by BlackRock and Fidelity Circle, the issuer of the USDC stablecoin, raised $400 million in a funding round led by BlackRock, Fidelity, and other major investors to expand its blockchain-based financial infrastructure.

-

Q2 2024: Goldman Sachs launches digital asset platform for institutional clients Goldman Sachs launched a digital asset platform, providing institutional clients with access to tokenized securities and blockchain-based financial products.

-

Q1 2024: Fireblocks raises $150M Series D to expand institutional crypto infrastructure Fireblocks, a provider of blockchain-based custody and settlement infrastructure, raised $150 million in Series D funding to scale its platform for institutional finance clients.

Blockchain Finance Market Segmentation Insights

Blockchain Finance Market Transaction Type Outlook

Blockchain Finance Market Protocol Outlook

Blockchain Finance Market Application Outlook

Blockchain Finance Market Asset Class Outlook

- Non-Fungible Tokens (NFTs)

Blockchain Finance Market Industry Vertical Outlook

Blockchain Finance Market Regional Outlook

| Report Attribute/Metric |

Details |

| Market Size 2024 |

USD 18.81 Billion |

| Market Size 2025 |

USD 23.88 Billion |

| Market Size 2034 |

USD 204.48 Billion |

| Compound Annual Growth Rate (CAGR) |

26.94% (2025-2034) |

| Base Year |

2024 |

| Market Forecast Period |

2025-2034 |

| Historical Data |

2020-2023 |

| Market Forecast Units |

USD Billion |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Companies Profiled |

Bitstamp, Coinbase, FTX, Deribit, Liquid, Poloniex, Circle, Huobi, OKX, Bybit, Gate.io, Ripple, Kraken, Binance, Gemini |

| Segments Covered |

Transaction Type, Protocol, Application, Asset Class, Industry Vertical, Regional |

| Key Market Opportunities |

Automated lending Remittance optimization Cross border transactions Supply chain management Trade finance |

| Key Market Dynamics |

Growing adoption of cryptocurrencies. Increasing demand for transparency and security. Expanding use cases in supply chain management. Collaboration between financial institutions and blockchain startups. Government regulations and initiatives. |

| Countries Covered |

North America, Europe, APAC, South America, MEA |

Frequently Asked Questions (FAQ):

The Blockchain Finance Market was valued at USD 18.81 billion in 2024 and is expected to reach USD 204.48 billion by 2034, exhibiting a CAGR of 26.94% during the forecast period.

North America is expected to account for the largest market share due to the presence of a significant number of technology providers and early adopters of blockchain technology in the region.

The increasing adoption of blockchain technology in the financial sector, rising demand for transparency and security in financial transactions, and government initiatives to promote blockchain adoption are driving the market growth.

Blockchain technology is used in various applications in the finance industry, including cross-border payments, trade finance, supply chain management, and digital asset management.

Key competitors in the market include IBM, R3 Corda, Ripple, Hyperledger, and Ethereum.

The Blockchain Finance Market is projected to grow at a CAGR of 26.94% from 2025 to 2034.

The banking and financial services industry is expected to contribute the highest revenue to the Blockchain Finance Market.

Challenges faced by the market include regulatory uncertainties, scalability issues, and the need for interoperability between different blockchain platforms.

The adoption of blockchain technology is expected to revolutionize the financial industry by increasing transparency, reducing costs, and improving efficiency.

Businesses can benefit from blockchain technology through increased security, reduced costs, and improved transparency in their operations.