Top Industry Leaders in the Boiler Water Treatment Chemical Market

The boiler water treatment chemical market, where potent concoctions keep industrial giants humming, simmers with fierce competition. Understanding this landscape requires peering into the bubbling cauldrons of strategy, market share determinants, and the volatile brew of recent developments.

Competitive Strategies Boiling Over:

Diversification and Specialization: Giants like Solenis and Ecolab Inc. are expanding their portfolios, catering to various boiler types and industries. Niche players like BWA Water Additives are carving out unique spaces by specializing in eco-friendly or corrosion-specific chemicals.

Technological Alchemy: Innovation boils at the core. Companies like Kurita Water Industries Ltd. and Veolia Water Technologies are brewing next-generation chemistries based on nanotechnology, bio-based inhibitors, and AI-powered monitoring systems.

Sustainability Focus: Green steam is rising. Suez SA and Buckman are leading the charge with biodegradable chemicals, low-toxicity formulations, and water-recycling technologies, winning favor with environmentally conscious stakeholders.

Regional Expansion: Global aspirations fuel growth. ChemTreat Inc. and Ion Exchange LLC. are aggressively expanding their footprint in emerging markets like Asia and Africa, where rapid industrialization creates a thirsty demand for boiler water treatment.

Strategic Partnerships and Acquisitions: Mergers and collaborations accelerate change. The recent partnership between BASF SE and Thermax Limited aims to develop advanced scale inhibitors, while the acquisition of Wetico by Metito strengthens their presence in the Middle East.

Factors Influencing Market Share:

Chemical Efficacy: The ability of chemicals to combat corrosion, scale formation, and other boiler woes is paramount.

Cost Competitiveness: Efficient production, optimized supply chains, and access to low-cost raw materials define price-sensitive contracts.

Regulatory Compliance: Meeting stringent environmental and safety regulations is crucial for market access.

Technical Expertise and Customer Service: Proactive support, customized solutions, and deep boiler knowledge differentiate players.

Industry Specialization: Understanding specific boiler types and industry challenges strengthens customer trust.

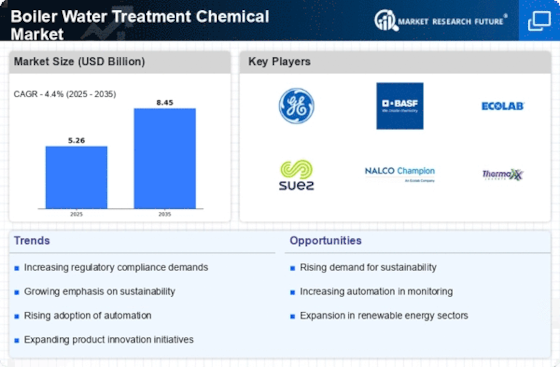

Key PlayersSome of the manufacturers operating in the global boiler water treatment chemicals market are BASF SE (Germany), Akzo Nobel N.V. (Netherlands), DowDuPont (U.S.), Ecolab (U.S.), Kemira OYJ (Finland), Suez (France), King Lee Technologies (U.S.), Lennetch BV (Netherlands), Bond Water Technologies, Inc. (U.S.), ChemTreat (U.S.), Wilh. Wilhelmsen Holding ASA (Norway), Kurita Water Industries Ltd. (Japan), and Arkema (France).

Recent Developments:

August 2023: Nalco Water, an Ecolab company, acquires WaterSep, a provider of specialty water treatment chemicals and services. This acquisition expands Nalco Water's portfolio and strengthens its presence in the boiler treatment market.

November 2023: Suez announces a partnership with Veolia to develop and commercialize new sustainable water treatment solutions, including boiler treatment chemicals. This collaboration aims to accelerate innovation in the industry.

December 2023: The European Union implements stricter regulations on the use of certain chemicals in water treatment, including some boiler treatment chemicals. This is expected to drive the development of more environmentally friendly alternatives.