Brazil Ferro Alloys Market Overview

The Brazil Ferro Alloys Market Size was estimated at 5.97 (USD Billion) in 2023. The Brazil Ferro Alloys Industry is expected to grow from 6.33(USD Billion) in 2024 to 9.74 (USD Billion) by 2035. The Brazil Ferro Alloys Market CAGR (growth rate) is expected to be around 3.83% during the forecast period (2025 - 2035).

Key Brazil Ferro Alloys Market Trends Highlighted

The Brazil Ferro Alloys Market is currently experiencing numerous substantial trends driven by a variety of market drivers. Brazil's economy is significantly influenced by the growing demand for ferroalloys in the steelmaking industry, which is one of the world's largest steel producers. The demand for ferroalloys is further bolstered by the drive for infrastructure development in Brazil, as the construction and automotive sectors heavily rely on steel, which in turn requires alloying. Potential growth in renewable energy applications is one of the opportunities that should be investigated.

There is a growing interest in sophisticated materials that integrate ferroalloys, particularly in the production of batteries and other energy storage solutions, as Brazil strives to improve its renewable energy sources. Furthermore, Brazil's ferroalloys industry is well-positioned to expand due to its substantial reserves of chromium, manganese, and graphite, as well as its abundant mineral resources. Sustainability has become a significant trend in recent years, with a greater emphasis on environmentally favorable production processes. By investing in technologies that reduce emissions and improve recycling efforts within ferroalloy manufacturing, Brazilian companies are adapting.

This change not only appeals to global consumers who prioritize sustainable procurement but also satisfies regulatory pressures. Another trend is the increasing collaboration among industry stakeholders to improve supply chain efficiency and enhance product quality, thereby ensuring that Brazil can maintain its competitive advantage in the global market.In general, the ferroalloys market in Brazil is characterized by a favorable regulatory environment, sustainable practices, and increasing industrial activity, which creates a conducive environment for growth.

,

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Brazil Ferro Alloys Market Drivers

Rising Demand from the Steel Industry

The Brazil Ferro Alloys Market Industry is significantly driven by the surging demand from the steel manufacturing sector. Brazil stands as one of the top global producers of steel, with the Brazilian Steel Institute reporting a production of approximately 34 million tons of steel in 2021.

The demand for ferro alloys, which are crucial for steel production as they help in improving steel qualities and performance, is anticipated to grow correspondingly.An increasing focus on infrastructure development, backed by government initiatives such as the Growth Acceleration Program (PAC), is further bolstering the demand for steel, thereby elevating the need for ferro alloys. These initiatives aim to enhance Brazil's infrastructure, which has seen investments exceeding USD 100 billion, thus solidifying the steel industry's growth outlook and, consequently, the ferro alloys market in Brazil.

Government Support and Policy Incentives

The Brazilian government has been actively promoting the ferrous metals sector through various supportive policies and incentives. Policies aimed at fostering mining activities include simplified licensing processes and investment in technological advancements. Government initiatives such as the National Mineral Production Policy have resulted in significant improvements in the mining sector, including a reported 5% increase in mineral production output in 2022.Such government backing not only boosts investor confidence but also ensures sustainable growth in the Brazil Ferro Alloys Market Industry by enabling mining companies to expand their operations and improve service delivery to end-users.

Technological Advancements in Production Processes

Innovations in production processes and technologies for ferro alloy manufacturing are instrumental in enhancing efficiency and reducing operational costs. Several Brazilian companies have been investing in modernizing their production facilities. For instance, the implementation of electric arc furnace (EAF) technology has reduced energy consumption by approximately 20% compared to traditional processes. These advancements not only lower production costs but also align with global sustainability goals.The increased efficiency attracts more investment into the Brazil Ferro Alloys Market Industry, and as companies continue adopting these advanced technologies, the production output is expected to rise, fostering further market growth.

Growing Export Opportunities

Brazil is inherently positioned as a key player in the global ferro alloys market due to its abundant natural resources and established mining infrastructure. The country has seen a marked increase in ferro alloys exports, primarily to Asia and Europe, in response to the rising demand in regions with rapid industrialization and urbanization.

In 2021, Brazil's exports of ferro manganese increased by nearly 15%, highlighting the country's solid foothold in international markets.With global initiatives targeting reduced carbon emissions, the export of high-quality ferro alloys from Brazil is anticipated to thrive as the country continues to market itself as a source of sustainably-produced ferro alloys, thus driving the growth of the Brazil Ferro Alloys Market Industry.

Brazil Ferro Alloys Market Segment Insights

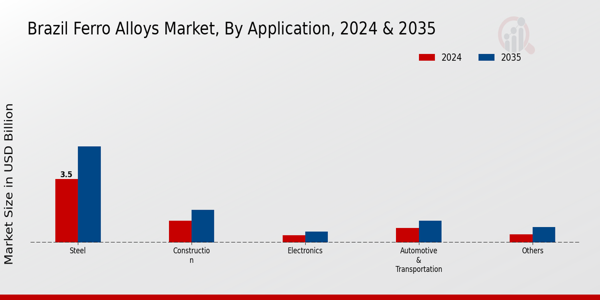

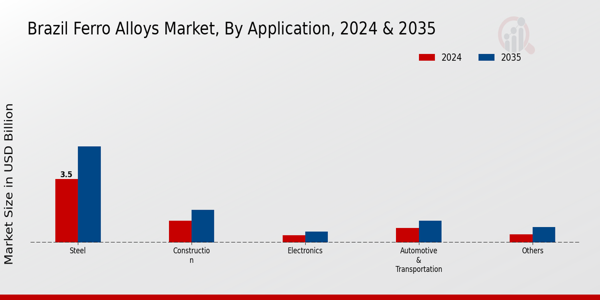

Ferro Alloys Market Application Insights

The Brazil Ferro Alloys Market encompasses a diverse range of applications pivotal to various industries, significantly contributing to the nation's economic landscape. The steel industry stands out as a dominant player, benefiting from Brazil's robust iron ore reserves and playing a vital role in steel production where ferro alloys enhance durability and strength.

In the Construction sector, ferro alloys serve an essential purpose, particularly in reinforcing materials, thereby facilitating the growth of infrastructure projects across Brazil, especially with government initiatives aimed at improving transportation and urban development.The Electronics segment utilizes ferro alloys mainly in the production of components, enhancing electrical conductivity and thermal stability, which is crucial as Brazil's technology sector expands. The Automotive Transportation sector relies on ferro alloys for manufacturing components that meet strict safety and performance standards, reflecting the growing demand for more sustainable transportation solutions in Brazil.

Other applications in diverse sectors reinforce the versatility of ferro alloys, catering to various industrial needs. Various growth drivers, such as increasing industrialization and urbanization in Brazil, translate into an uptrend in the demand for ferro alloys across these applications.Furthermore, Brazil's strategic position in the global market provides opportunities for exporting ferro alloys to other countries, enhancing its trade dynamics. However, the industry faces challenges such as fluctuating raw material prices and environmental regulations that necessitate sustainable practices.

Overall, as Brazil continues to advance in its industrial capabilities, the Application segment in the Ferro Alloys Market will likely experience significant growth, driven by the diverse needs of its expanding economy and a focus on innovation across various sectors.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Ferro Alloys Market Product Type Insights

The Product Type segment of the Brazil Ferro Alloys Market showcases a diverse range of materials, each playing a significant role in various industrial applications. Ferro-Manganese and Silico-Manganese are particularly crucial for steel production, enhancing strength and alloying properties, and they often dominate the landscape due to their widespread usage in the metallurgical sector. Ferro-Silicon finds importance as a refining agent and deoxidizer in steelmaking, making it another key player in the market.

Ferro-Chrome, known for its critical function in producing stainless steel, contributes to the market's growth as the demand for high-quality stainless steel continues to rise in Brazil's construction and automotive sectors.Moreover, Ferro-Molybdenum and Ferro-Vanadium offer specialized properties that improve the corrosion resistance and durability of steel, which is essential for infrastructure projects across the region. Other alloys such as Ferro-Tungsten, Ferro-Titanium, and Ferro-Niobium are valued for their roles in enhancing material properties, making them important for high-performance applications.

The increasing demand for advanced materials supports the growth of products like Magnesium Ferro-Silicon and Ferro-Silicon-Zirconium, which are utilized in niche applications.Overall, the Brazil Ferro Alloys Market segmentation underscores the importance of these varied products in driving industrial innovation and meeting growing market needs.

Ferro Alloys Market End User Industry Insights

The End User Industry segment of the Brazil Ferro Alloys Market plays a vital role in driving demand across multiple sectors such as Steel, Construction, Electronics, Automotive Transportation, and Others. The steel industry remains a key consumer, accounting for a substantial portion of ferro alloys due to their essential role in enhancing steel strength and quality. Meanwhile, the construction sector significantly benefits from the properties of ferro alloys, which are pivotal for infrastructure development and urbanization initiatives within Brazil.In the electronics realm, the use of ferro alloys is gaining traction as manufacturers strive for better conductivity and improved material properties.

The automotive and transportation industry leverages ferro alloys for manufacturing lightweight, durable components that contribute to fuel efficiency and safety. Collectively, these industries showcase the importance of ferro alloys in various applications, underscoring their contribution to Brazil's industrial growth and technological advancement. As these sectors continue to evolve, the Brazil Ferro Alloys Market is expected to reflect rising needs and innovations tailored to enhance material performance.

Brazil Ferro Alloys Market Key Players and Competitive Insights

The Brazil Ferro Alloys Market is characterized by a diverse landscape of competitors driven by the increasing demand for ferroalloys in various industrial applications, particularly in steel production and metallurgy. This market has been shaped by local and international players, each contributing to the competitive dynamics. The competition is influenced by several factors, including production capacity, technological advancements, resource availability, and sustainability practices. Companies are also focusing on enhancing their operational efficiencies and product offerings to remain relevant and meet the evolving needs of customers.

With the growing emphasis on environmentally sustainable practices, companies that effectively integrate green technologies and methodologies into their production processes are likely to gain a competitive edge in this market.Erg Resources has established a significant presence in the Brazil Ferro Alloys Market, leveraging its strong operational capabilities and expertise in the production of ferroalloys. The company's strengths lie in its robust supply chain management systems and a well-developed distribution network that enables it to meet customer demands promptly. Erg Resources is known for its commitment to quality and customer satisfaction, which has helped build long-term relationships with clients in Brazil.

Furthermore, the organization has embraced technological innovations in production processes that not only enhance efficiency but also align with sustainable practices. This approach has positioned Erg Resources favorably in a competitive landscape where environmental considerations are increasingly becoming a criterion for selection among key stakeholders.China Minmetals has made significant strides in the Brazil Ferro Alloys Market, capitalizing on its expansive portfolio of ferroalloys and commitment to high production standards. The company has established a strong market presence through strategic partnerships, mergers, and acquisitions, which have allowed it to expand its operational footprint across Brazil.

China Minmetals offers a range of key products, including ferrosilicon and ferromanganese, which are essential for various metallurgical processes. The company's strengths are highlighted by its technological advancements in production, as well as its proactive approach to sustainability, which resonates well with the growing demand for eco-friendly solutions in the industry. Moreover, China Minmetals' focus on innovation and customer-centric approaches has further solidified its competitive positioning in Brazil, enabling it to address the dynamic needs of its clients effectively.

Key Companies in the Brazil Ferro Alloys Market Include:

- Erg Resources

- China Minmetals

- Brazilian Ferro Alloys

- Nippon Denko

- Samancor Chrome

- Tianjin Jintrin Special Steel

- Cavico

- Ceará Ferro Alloys

- Vale

- Shaanxi Jinchang Ferroalloy

- Metalloinvest

- Ferrostaal

Brazil Ferro Alloys Market Industry Developments

The Brazil Ferro Alloys Market has witnessed several significant developments recently. The country remains a prominent player due to the strong production capabilities in the sector. In September 2023, Brazil's government announced new incentives to boost ferro alloy production, aiming to enhance sustainability and reduce emissions in line with global environmental standards. Erg Resources has been focusing on expanding its production capacity amid growing demand, while Vale continues to be a key contributor, especially in nickel and ferro nickel production.

In terms of mergers and acquisitions, there were discussions in July 2023 about a potential collaboration between Tianjin Jintrin Special Steel and Brazilian Ferro Alloys, though details are still forthcoming. The rise in steel production in Brazil has positively impacted ferro alloy demand, with major companies like Metalloinvest expressing interest in enhancing their market footprint in the region. Additionally, Brazil has witnessed fluctuations in ferro manganese prices over the past year, reflecting global market trends and impacting domestic producers’ strategies.

Over the last two years, the Brazilian ferro alloys sector has notably expanded, benefitting from increased investment and strategic partnerships that prioritize technological advancements.

Ferro Alloys Market Segmentation Insights

Ferro Alloys Market Application Outlook

- Steel

- Construction

- Electronics

- Automotive Transportation

- Others

Ferro Alloys Market Product Type Outlook

- Ferro-Manganese

- Silico-Manganese

- Ferro-Silicon

- Ferro-Chrome

- Ferro-Molybdenum

- Ferro-Vanadium

- Ferro-Tungsten

- Magnesium Ferro-Silicon

- Ferro-Silicon-Zirconium

- Ferro-Titanium

- Ferro-Boron

- Ferro-Niobium

Ferro Alloys Market End User Industry Outlook

- Steel

- Construction

- Electronics

- Automotive Transportation

- Others

|

Report Attribute/Metric

|

Details

|

|

Market Size 2018

|

5.97(USD Billion)

|

|

Market Size 2024

|

6.33(USD Billion)

|

|

Market Size 2035

|

9.74(USD Billion)

|

|

Compound Annual Growth Rate (CAGR)

|

3.83% (2025 - 2035)

|

|

Report Coverage

|

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

|

|

Base Year

|

2024

|

|

Market Forecast Period

|

2025 - 2035

|

|

Historical Data

|

2019 - 2024

|

|

Market Forecast Units

|

USD Billion

|

|

Key Companies Profiled

|

Erg Resources, China Minmetals, Brazilian Ferro Alloys, Nippon Denko, Samancor Chrome, Tianjin Jintrin Special Steel, Cavico, Ceará Ferro Alloys, Vale, Shaanxi Jinchang Ferroalloy, Metalloinvest, Ferrostaal

|

|

Segments Covered

|

Application, Product Type, End-User Industry

|

|

Key Market Opportunities

|

Rising steel production demand, Growing renewable energy investments, Expansion of the automotive industry, Increasing infrastructure development initiatives, Growing export potential in global markets

|

|

Key Market Dynamics

|

Increasing steel production demand, Environmental regulations and policies, Competitive pricing pressures, Technological advancements in production, Supply chain disruptions

|

|

Countries Covered

|

Brazil

|

Frequently Asked Questions (FAQ):

The Brazil Ferro Alloys Market is expected to be valued at 6.33 billion USD in 2024.

By 2035, the market is projected to reach a value of 9.74 billion USD.

The expected CAGR for the Brazil Ferro Alloys Market from 2025 to 2035 is 3.83 percent.

The Steel application is expected to account for the largest market share, valued at 3.5 billion USD in 2024.

The Construction application is projected to reach a market size of 1.8 billion USD by 2035.

Key players include Erg Resources, China Minmetals, Brazilian Ferro Alloys, and Nippon Denko.

The market size for the Electronics application is valued at 0.4 billion USD in 2024.

The Automotive & Transportation application is expected to grow to 1.2 billion USD by 2035.

The 'Others' application is valued at 0.43 billion USD in 2024 and is anticipated to reach 0.84 billion USD by 2035.

Market growth may be influenced by fluctuating raw material prices and global demand shifts.