Brazil Generative AI in BFSI Market Overview

As per MRFR analysis, the Brazil Generative AI in BFSI Market Size was estimated at 29.04 (USD Million) in 2023.The Brazil Generative AI in BFSI Market Industry is expected to grow from 36.72(USD Million) in 2024 to 87.77 (USD Million) by 2035. The Brazil Generative AI in BFSI Market CAGR (growth rate) is expected to be around 8.244% during the forecast period (2025 - 2035).

Key Brazil Generative AI in BFSI Market Trends Highlighted

The Brazil Generative AI in BFSI market is witnessing significant trends driven by the increasing demand for automation and enhanced customer experience in the financial services sector. With a rapidly digitalizing economy, banks and financial institutions in Brazil are leveraging generative AI to streamline operations, improve decision-making processes, and provide personalized services.

The Brazilian government is also promoting digital transformation within the financial sector, which further fuels this trend. Regulatory frameworks are evolving to accommodate new technologies, making it easier for institutions to adopt AI solutions. Opportunities to be explored include the integration of AI in fraud detection and risk management.

Given Brazil's vast financial landscape, the ability to analyze large volumes of data quickly is paramount in identifying fraudulent activities. Moreover, the rise of fintech startups in Brazil presents a unique opportunity for generative AI to foster innovation in payment solutions, lending services, and customer service automation. These companies are more agile and often more willing to adopt cutting-edge technologies, which contributes to the competitive environment.

In recent times, there has been a noticeable shift in the mindset of traditional banks in Brazil towards embracing digital solutions. Many institutions now recognize the importance of staying relevant in a technology-driven market and are actively investing in AI-based tools to improve their offerings.The growing penetration of mobile and internet services also plays a crucial role in facilitating the uptake of these technologies among consumers. As a result, these shifts are likely to continue shaping the Brazilian BFSI landscape for years to come.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Brazil Generative AI in BFSI Market Drivers

Increasing Demand for Cost Efficiency and Operational Efficiency

Financial institutions in Brazil are facing pressure to increase operational efficiency while cutting expenses. The demand to increase productivity through automation and better analytics is a major driver of the Brazil Generative AI in BFSI Market Industry. According to a survey by the Central Bank of Brazil, banks want to use technology like artificial intelligence (AI) and machine learning to cut operating expenses by around 15% over the course of the next five years.

Important companies like Ita Unibanco and Banco do Brasil have adopted generative AI to improve customer service and expedite decision-making. Increased expenditures in AI technologies are a result of this emphasis on efficiency, indicating a developing trend in which financial institutions are using generative AI to satisfy regulatory standards as well as customer expectations.

Regulatory Compliance and Risk Management

Brazil has stringent regulations governing the financial industry, and compliance is crucial for institutions. The Central Bank of Brazil has mandated numerous requirements, which often require significant resources to manage effectively. Generative AI can help banks identify potential compliance issues through advanced analytics and predictive modeling. A report from the Brazilian Federation of Banks indicates that the cost of compliance for banks in Brazil has risen by over 10% in recent years.

The use of Generative AI technologies can support institutions in managing risks efficiently and ensuring adherence to regulations, particularly as the regulatory environment continues to evolve. This focus on compliance and risk management underlines the increasing importance of Generative AI in the Brazil Generative AI in BFSI Market Industry, leading to enhanced investment.

Rising Demand for Personalized Financial Services

In Brazil, customers are increasingly expecting personalized services from financial institutions. A survey conducted by the Brazilian Institute of Geography and Statistics reveals that 67% of consumers prefer tailored financial products and services. This growing demand is driving the adoption of Generative AI technologies, enabling banks to analyze customer data effectively and create personalized offers.

Institutions such as Bradesco and Santander Brazil are leveraging AI capabilities to enhance customer experience by offering targeted products based on individual behaviors and preferences.The focus on personalization is a key driver of growth within the Brazil Generative AI in BFSI Market Industry, emphasizing the transformative impact of AI on enhancing consumer relationships.

Brazil Generative AI in BFSI Market Segment Insights

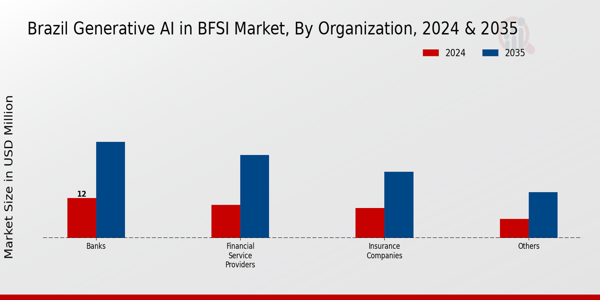

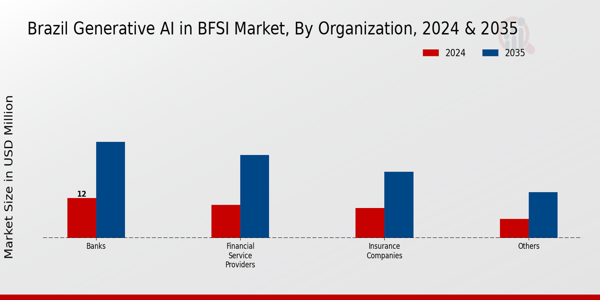

Generative AI in BFSI Market Organization Insights

The Brazil Generative AI in BFSI Market is progressing significantly, particularly within the Organization segment. This segment encompasses essential players such as Banks, Insurance Companies, Financial Service Providers, and other entities that contribute to the overall ecosystem. These organizations are increasingly leveraging generative AI technologies to enhance operational efficiency, improve customer experience, and drive innovative solutions. The banking sector stands out as a critical player, utilizing AI for more accurate credit scoring, fraud detection, and personalized service delivery, which in turn boosts customer satisfaction and retention.

Insurance companies are also finding substantial benefits by implementing automated claims processing and risk assessment solutions powered by AI, which streamline operations and reduce operational costs. Financial service providers are leveraging AI to offer predictive insights and personalized financial advice, which enhances the customer decision-making process.

The overall trend indicates that with advancements in AI capabilities, these organizations are keenly adapting to a rapidly changing financial landscape, aiming to achieve a competitive edge.Furthermore, Brazil’s commitment to technological advancement through government initiatives and supportive regulations fosters a conducive environment for these organizations to thrive.

The growth in digital banking and financial inclusion initiatives in Brazil is driving organizations to adopt generative AI solutions more aggressively, thereby shaping the future of the BFSI sector in the region. Each of these segments plays a pivotal role, contributing to the optimization of services and operational models, which collectively enhance the Brazil Generative AI in BFSI Market landscape.As the market continues to evolve, these organizations are expected to be at the forefront of integrating AI technologies, paving the way for innovation and transformation in the financial services industry.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Generative AI in BFSI Market Application Insights

The Brazil Generative AI in BFSI Market is witnessing substantial expansion in its Application segment, driven by the increasing need for advanced technology in financial services. With a projected market growth, areas such as Fraud Detection are gaining attention, as financial institutions prioritize security solutions to combat rising cyber threats. Risk Assessment tools are also becoming critical, enabling organizations to leverage data analysis for improved decision-making processes and regulatory compliance.

Customer Experience enhancements through personalized services and chatbots are reshaping interactions in banking and finance, leading to higher customer satisfaction.Algorithmic Trading represents another vital aspect of this segment, where AI algorithms optimize trading strategies, allowing firms to make swift decisions based on vast market data, thereby enhancing their competitiveness.

Other applications further reflect diverse opportunities in the market, catering to various needs and innovations within the financial sector in Brazil. The Brazilian government has been promoting technological advancements in the BFSI sector, creating an encouraging environment for these applications to develop and thrive, ultimately contributing to the digital transformation of financial services.

Generative AI in BFSI Market Deployment Insights

The Deployment segment of the Brazil Generative AI in BFSI Market is a crucial component, reflecting the growing adoption of advanced technologies within the financial and banking sectors. Companies in Brazil are increasingly relying on both On-Premise and Cloud-Based solutions to enhance their operational efficiencies and customer service offerings. On-Premise deployments provide organizations with greater control over their data and processes, often preferred by enterprises with stringent regulatory compliance requirements.

Conversely, Cloud-Based solutions offer flexibility, scalability, and lower upfront costs, thereby attracting smaller banking institutions and FinTech companies seeking rapid deployment and innovation.The increasing digitization in the Brazilian BFSI industry, driven by the government's push for financial inclusion and digital transformation, supports the heightened interest in these deployment strategies.

As the demand for real-time data processing, enhanced security, and seamless transactions grows, organizations that embrace these deployment methods are likely to position themselves favorably in the competitive landscape. With Brazil's focus on improving technological infrastructure and investments in AI capabilities, both deployment approaches are expected to play significant roles in the evolution of the financial services sector.

Brazil Generative AI in BFSI Market Key Players and Competitive Insights

The Brazil Generative AI in BFSI Market is experiencing notable growth and innovation as financial institutions increasingly leverage advanced Artificial Intelligence technologies to optimize operations, enhance customer experiences, and ensure compliance with regulatory standards.

The competitive landscape is characterized by a diverse range of players, each striving to harness the power of generative AI to provide tailored solutions that address the unique challenges faced by banks, insurance companies, and financial service providers in Brazil. In this sector, firms are focusing on developing cutting-edge applications, analytics tools, and intelligent automation that align with local market dynamics, regulatory frameworks, and shifting consumer preferences.

This competitive environment is driving continuous advancements and fostering collaborations, ultimately propelling the market forward.Palantir Technologies is making significant inroads into the Brazil Generative AI in BFSI Market through its robust data integration and analytics capabilities.

The company’s strength lies in its advanced software platforms that facilitate data connectivity, and visualization, allowing financial institutions to make informed decisions quickly and effectively. With a focus on security and data compliance, Palantir Technologies offers solutions that assist organizations in addressing complex regulatory requirements and risk management challenges within Brazil’s rapidly evolving financial landscape.

The company has established a strong presence in the region, gaining the trust of various stakeholders through its innovative approaches and commitment to data-centric strategies tailored to meet specific needs of banks and financial services.Cognizant has also positioned itself as a formidable player in the Brazil Generative AI in BFSI Market by providing a range of digital solutions, IT services, and consulting expertise. The company's key offerings include AI-driven automation, data analytics, and process optimization tailored specifically for the financial sector.

Cognizant's strength is evident in its ability to blend technology with deep industry knowledge, enabling financial institutions to enhance operational efficiency and customer engagement. The company has been involved in strategic partnerships and mergers in Brazil to bolster its market presence and augment its capabilities in AI-driven services. By continuously advancing its product portfolio and embracing innovations, Cognizant is well-equipped to address the growing demands of the BFSI sector in Brazil, making it a key competitor in the generative AI landscape.

Key Companies in the Brazil Generative AI in BFSI Market Include

- Palantir Technologies

- Cognizant

- SAP

- NVIDIA

- OpenAI

- ThoughtSpot

- Nu Bank

- Accenture

- Amazon

- Google

- Microsoft

- SAS Institute

- IBM

- Zebra AI

- Salesforce

Brazil Generative AI in BFSI Industry Developments

In recent months, the Brazil Generative AI in the Banking, Financial Services, and Insurance (BFSI) market has witnessed a surge in interest and investment from leading companies. Palantir Technologies and Cognizant have expanded their operations in Brazil, focusing on enhancing AI-powered analytics for financial institutions. OpenAI has also made strides in the region by collaborating with local banks to improve customer interactions using generative AI technologies. Additionally, SAP and IBM are integrating their platforms with AI capabilities to optimize business processes in the financial sector.

Recent developments have seen Nu Bank, one of Brazil's largest digital banks, leveraging AI to offer personalized financial services to its customers. As for mergers and acquisitions, in June 2023, Accenture acquired a Brazilian AI startup, enhancing its capabilities in the BFSI sector. The market valuation for companies involved in generative AI in BFSI has been growing significantly, driven by the demand for automation and increased customer insights. In the past couple of years, the Brazilian National Data Protection Authority has also implemented regulations impacting the deployment of AI in financial services, reflecting the country's focus on responsible AI use.

Brazil Generative AI in BFSI Market Segmentation Insights

-

Generative AI in BFSI Market Organization Outlook

- Banks

- Insurance Companies

- Financial Service Providers

- Others

-

Generative AI in BFSI Market Application Outlook

- Fraud Detection

- Risk Assessment

- Customer Experience

- Algorithmic Trading

- Others

-

Generative AI in BFSI Market Deployment Outlook

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2023 |

29.04(USD Million) |

| MARKET SIZE 2024 |

36.72(USD Million) |

| MARKET SIZE 2035 |

87.77(USD Million) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

8.244% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Million |

| KEY COMPANIES PROFILED |

Palantir Technologies, Cognizant, SAP, NVIDIA, OpenAI, ThoughtSpot, Nu Bank, Accenture, Amazon, Google, Microsoft, SAS Institute, IBM, Zebra AI, Salesforce |

| SEGMENTS COVERED |

Organization, Application, Deployment |

| KEY MARKET OPPORTUNITIES |

Personalized customer experiences, Fraud detection automation, Regulatory compliance assistance, Credit risk assessment, Cost reduction in operations |

| KEY MARKET DYNAMICS |

Rapid technological adoption, Regulatory compliance challenges, Rising cybersecurity concerns, Demand for personalized services, Increased operational efficiency |

| COUNTRIES COVERED |

Brazil |

Frequently Asked Questions (FAQ) :

The Brazil Generative AI in BFSI Market is expected to be valued at 36.72 million USD by 2024.

By 2035, the Brazil Generative AI in BFSI Market is anticipated to reach a total value of 87.77 million USD.

The expected CAGR for the Brazil Generative AI in BFSI Market from 2025 to 2035 is 8.244%.

By 2035, the Banks segment is projected to be the largest, valued at 29.0 million USD.

The Insurance Companies segment is expected to reach a value of 20.0 million USD by 2035.

In 2024, the Financial Service Providers segment is valued at 10.0 million USD.

The 'Others' segment is projected to be valued at 13.77 million USD by 2035.

Major players include Palantir Technologies, Cognizant, SAP, NVIDIA, OpenAI, and Accenture among others.

Key applications include fraud detection, customer service automation, and risk assessment.

Growth is driven by increased digital transformation, demand for automation, and enhanced data analytics capabilities.