Brazil Offshore Drilling Rigs Market Overview

As per MRFR analysis, the Brazil Offshore Drilling Rigs Market Size was estimated at 4.35 (USD Billion) in 2023. The Brazil Offshore Drilling Rigs Market Industry is expected to grow from 5.4 (USD Billion) in 2024 to 11.1 (USD Billion) by 2035. The Brazil Offshore Drilling Rigs Market CAGR (growth rate) is expected to be around 6.77% during the forecast period (2025 - 2035).

Key Brazil Offshore Drilling Rigs Market Trends Highlighted

The demand for oil and gas in Brazil, especially in the offshore areas, has a strong impact on the Brazil Offshore Drilling Rigs Market. This is attributed to the vast crude oil reserves within the nation, particularly the pre-salt layer, which has received extensive investments from both foreign and domestic firms. As a result, there is competition and new innovation in pre-salt oil drilling technologies. Moreover, the other side of the coin is that Brazil’s government has not lagged behind in fostering exploration activity via legislative measures that assist in accessing offshore resources. Stricter guidelines focused on achieving lower carbon footprints are leading to new technologies being created to make drilling more efficient and environmentally friendly.

The Brazil Offshore Drilling Rigs Market is expected to experience growth opportunities driven by the diversification of company portfolios in the offshore drilling segment due to an increase in renewables. With regards to hybrid energy, the government initiated policies that may signal a nexus where offshore drilling could merge with renewables. This change may unlock new investment opportunities, especially concerning the changes that could be made to existing rig structures designed for dual use. Recent developments auger well for the offshore drilling industry in Brazil as there seems to be a move towards automation and the use of digital technologies. Remote monitoring and data analytics are some of the advanced technologies being pursued by Brazilian companies to improve operational efficiency and reduce expenditures.

There is also a noticeable interest among industry participants for collaboration to share learnings and foster innovation. The latest trends in Brazil demonstrate the focus on staying flexible to ensure that the Offshore Drilling Rigs Market continues to grow with changes to global energy systems, shifts in the needs of the industry, and market dynamics.

Brazil Offshore Drilling Rigs Market Drivers

Increasing Demand for Oil and Gas

The Brazil Offshore Drilling Rigs Market is driven significantly by the growing demand for oil and gas resources. Brazil's government has projected a steady increase in oil production, with plans to boost production capacity from offshore reserves. According to the National Agency of Petroleum, Natural Gas and Biofuels, Brazil's demand for oil is expected to reach approximately 3.3 million barrels per day by 2025, reflecting a growing need for offshore drilling operations.

This uptick in production is supported by major players like Petrobras, who have invested heavily in deepwater drilling technology and infrastructure, enabling the expansion of Brazil's offshore oil production capabilities. Furthermore, new exploration activities are being highlighted, with the government auctioning additional oilfields, further intensifying the competition and demand within the Brazil Offshore Drilling Rigs Market Industry. This increase in offshore activities will thereby drive the growth of drilling rigs to meet rising oil demand.

Technological Advancements in Drilling Techniques

Advancements in drilling technology have significantly impacted the Brazil Offshore Drilling Rigs Market. Innovations such as automated drilling systems, real-time monitoring, and enhanced safety measures are enabling more efficient operations. National oil companies and international energy firms are investing in Research and Development to improve drilling efficiency and reduce operational costs.

According to the Brazilian Petroleum Institute, the application of new drilling technologies has increased recovery rates of oil reserves by up to 15%, optimizing production and making it economically viable even with fluctuating oil prices.With established firms such as TechnipFMC and Schlumberger collaborating on developing cutting-edge drilling rigs specifically tailored for Brazilian offshore conditions, this technological leap is poised to propel the market forward.

Supportive Government Policies and Regulations

The Brazilian government has been actively promoting the offshore oil sector through favorable policies and frameworks that encourage investment. Recent legislative changes, including the introduction of the new production sharing framework, have attracted foreign investments in exploration and production activities.

The Ministry of Mines and Energy has reported that such reforms have led to an influx of investments exceeding USD 10 billion in the offshore sector in the past two years.This government-backed initiative is setting a strong foundation for the expansion of the Brazil Offshore Drilling Rigs Market Industry. Additionally, heightened efforts in regulatory support to streamline operations are further encouraging drilling investments, making Brazil an attractive destination for both domestic and foreign players in the offshore drilling landscape.

Growing Investment in Renewable Energy Integration

As Brazil strives to balance its energy portfolio, growing investment in renewable energy integration is influencing the Offshore Drilling Rigs Market. The country is ranked among the top in the world for renewable energy utilization, with a significant focus on wind and solar power. The Brazilian Electricity Regulatory Agency has noted that investments in these green energies are expected to exceed USD 10 billion by 2025.

This convergence between fossil fuel exploration and renewable energy initiatives creates opportunities for Offshore Drilling Rig companies to innovate in hybrid systems that can adapt to fluctuating energy demands. By aligning with sustainability goals, companies like Petrobras and Equinor are focusing on developing green technology solutions within their offshore projects, which is driving the growth of the Brazil Offshore Drilling Rigs Market.

Brazil Offshore Drilling Rigs Market Segment Insights

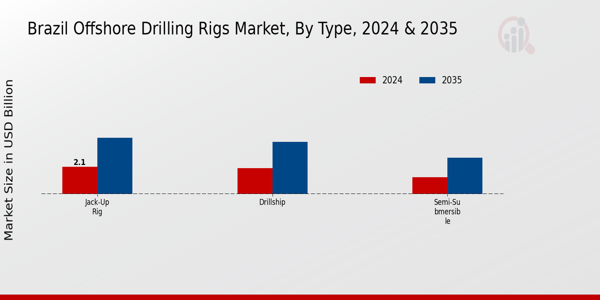

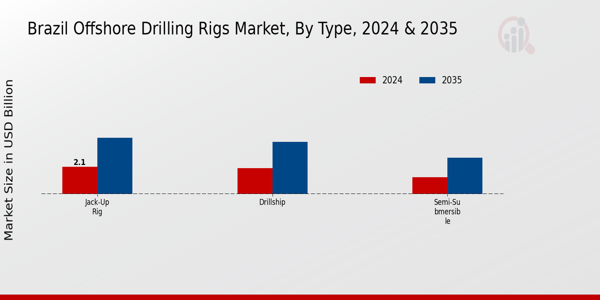

Offshore Drilling Rigs Market Type Insights

The Brazil Offshore Drilling Rigs Market is characterized by various types of rigs, notably including Jack-Up Rigs, Drillships, and Semi-Submersibles. Each type plays a significant role in the offshore oil and gas exploration and production landscape. Jack-Up Rigs are crucial due to their ability to operate in shallow waters and are often deployed in Brazil's more accessible offshore fields, enabling effective drilling operations while minimizing costs. Drillships, known for their versatility, are essential for deepwater drilling activities. Their advanced technology and ability to navigate various oceanic conditions make them invaluable, especially as Brazil continues to explore its pre-salt oil reserves, which demand sophisticated drilling capabilities.

Semi-Submersibles, on the other hand, are recognized for their stability in harsh weather conditions, allowing for efficient drilling in deeper waters. This makes them particularly significant in regions like Brazil, where ocean currents and weather patterns can be unpredictable. As the demand for energy resources rises globally, these rig types become more pivotal in helping Brazil maintain its position as a leading oil producer in the Americas. The need for reliability and performance in challenging environments drives the importance and investment in these rig types, underlining their integral part in the Brazil Offshore Drilling Rigs Market. Continued advancements in technology and operational expertise further position these types of rigs to tackle new challenges and capitalize on opportunities in Brazil's vast offshore resources, reflecting the dynamic nature of the market alongside its segmentation strategies.

Offshore Drilling Rigs Market Operating Depth Insights

The Brazil Offshore Drilling Rigs Market has a significant focus on the Operating Depth segment, which comprises various depths of operation including Shallow Water, Deep Water, and Ultra-Water drilling. Each of these depths reflects unique challenges and opportunities that are crucial to the overall efficiency and productivity of drilling operations in Brazil. Shallow Water drilling has historically been important due to Brazil's extensive continental shelf, allowing for exploration in less challenging environments, which usually translates to lower operational costs. On the other hand, Deep Water and Ultra-Water drilling represent the frontier of exploration, where Brazil has made notable investments, particularly in the pre-salt layer discoveries, known for their high-quality oil reserves.

These depths require advanced technology and specialized rigs, which drives market growth and presents opportunities for innovation. The continued demand for oil and gas in both domestic and international markets fuels the expansion of drilling capabilities across all depth categories in Brazil. Additionally, the government's support for offshore projects through regulatory reforms and investment incentives enhances the attractiveness of the Brazil Offshore Drilling Rigs Market, creating a favorable environment for operators to engage in deeper exploration activities. As a result, the Operating Depth segment remains a pivotal aspect of the overall market dynamics.

Brazil Offshore Drilling Rigs Market Key Players and Competitive Insights

The Brazil Offshore Drilling Rigs Market demonstrates a dynamic landscape characterized by various competitive factors, helping to propel the growth and innovation within the sector. This market is heavily influenced by the country's vast offshore oil reserves and new exploratory drilling activities, attracting both local and international players. The competition is not solely based on the availability of rigs but also encompasses technological advancements, operational efficiency, and strategic partnerships. Key players are increasingly focused on optimizing their service offerings while adhering to regulatory standards, which further intensifies the competition. Developing sustainable drilling practices while meeting the increasing demand for energy remains a collective challenge that shapes the competitive dynamics among the participants in this market.

Vantage Drilling, as a prominent entity within the Brazil Offshore Drilling Rigs Market, has established a robust presence characterized by its advanced drilling technology and strong operational capabilities. The company's strengths lie in its innovative fleet of modern drilling units, which are tailored to operate efficiently in the challenging offshore environments of Brazil. Vantage Drilling's commitment to safety and performance has earned it a reputable standing, enabling it to attract diverse clients across various segments of the energy sector. Through strategic investments in skilled personnel and state-of-the-art technology, Vantage Drilling continues to enhance its service delivery in the region, thereby solidifying its competitive edge and fostering long-term relationships with key stakeholders.

Aker Solutions maintains a significant foothold in the Brazil Offshore Drilling Rigs Market, recognized for its comprehensive range of products and services designed to meet the specific needs of the offshore sector. The company specializes in providing equipment and technologies that enhance drilling efficiency, including subsea solutions and rig upgrades. Aker Solutions prides itself on a strong commitment to sustainability and innovation, leveraging its engineering expertise to deliver custom solutions that tackle the challenges faced by companies operating in Brazil's offshore oil fields. The company has engaged in strategic partnerships and collaborations with various regional players to expand its operational footprint and capitalize on growth opportunities. Additionally, Aker Solutions has pursued mergers and acquisitions to enhance its technological capabilities and market presence, ensuring it remains a competitive force within the Brazilian offshore drilling landscape.

Key Companies in the Brazil Offshore Drilling Rigs Market Include:

- Vantage Drilling

- Aker Solutions

- EnscoRowan

- Songa Offshore

- Petrobras

- Cosco Shipping

- Shelf Drilling

- Valaris

- McDermott International

- Transocean

- Seadrill

- Noble Corporation

- Ocyan

- Borr Drilling

- Diamond Offshore

Brazil Offshore Drilling Rigs Market Industry Developments

Recent developments in Brazil's Offshore Drilling Rigs Market indicate a dynamic landscape as Petrobras has announced an increase in its deepwater drilling activities to enhance oil recovery from the pre-salt layer, illustrating its pivotal role in the region's energy sector. In September 2023, Petrobras awarded significant contracts to companies including Transocean and Noble Corporation to operate new rigs, expanding operational capabilities.

Furthermore, the emergence of Borr Drilling has brought additional competitive pressures, with the company securing drilling contracts that underscore the potential of Brazil's offshore resources. In terms of mergers and acquisitions, Aker Solutions has officially completed its acquisition of a stake in a service company, further consolidating its position in Brazilian offshore services as of August 2023.

Market valuation for companies like EnscoRowan and Seadrill has seen steady growth, driven by increasing global demand for energy and Brazil's rich offshore reserves. Major happenings over the past two years, including government initiatives to facilitate foreign investments in offshore infrastructure, have positively impacted market dynamics, attracting interest from global players and boosting technological advancements in drilling operations.

Brazil Offshore Drilling Rigs Market Segmentation Insights

Offshore Drilling Rigs Market Type Outlook

- Jack-Up Rig

- Drillship

- Semi-Submersible

Offshore Drilling Rigs Market Operating Depth Outlook

- Shallow Water

- Deep Water

- Ultra-Water

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2023 |

4.35(USD Billion) |

| MARKET SIZE 2024 |

5.4(USD Billion) |

| MARKET SIZE 2035 |

11.1(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

6.77% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Billion |

| KEY COMPANIES PROFILED |

Vantage Drilling, Aker Solutions, EnscoRowan, Songa Offshore, Petrobras, Cosco Shipping, Shelf Drilling, Valaris, McDermott International, Transocean, Seadrill, Noble Corporation, Ocyan, Borr Drilling, Diamond Offshore |

| SEGMENTS COVERED |

Type, Operating Depth |

| KEY MARKET OPPORTUNITIES |

Increased deep-water exploration, Technological advancements in drilling, Rising oil demand post-pandemic, Favorable government policies, Investments in renewable energy integration |

| KEY MARKET DYNAMICS |

Increasing oil demand, Government regulations, Technological advancements, Environmental concerns, Investment in renewable energy |

| COUNTRIES COVERED |

Brazil |

Frequently Asked Questions (FAQ) :

The expected market size of the Brazil Offshore Drilling Rigs Market in 2024 is 5.4 USD Billion.

The anticipated CAGR for the Brazil Offshore Drilling Rigs Market from 2025 to 2035 is 6.77%.

The estimated market value of the Brazil Offshore Drilling Rigs Market by 2035 is 11.1 USD Billion.

The Jack-Up Rig is projected to have the largest market share, valued at 4.3 USD Billion in 2035.

The Drillship segment is expected to be valued at 4.0 USD Billion in 2035.

The market value of Semi-Submersible rigs in 2024 was 1.3 USD Billion.

Major players in the Brazil Offshore Drilling Rigs Market include Vantage Drilling, Aker Solutions, and Petrobras.

The growth of the Brazil Offshore Drilling Rigs Market is driven by increasing energy demands and investments in offshore exploration.

Current global scenarios are influencing supply chains and operational costs within the Brazil Offshore Drilling Rigs Market.

There are opportunities in advancements in drilling technologies and increased deepwater exploration in the Brazil Offshore Drilling Rigs Market.