- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

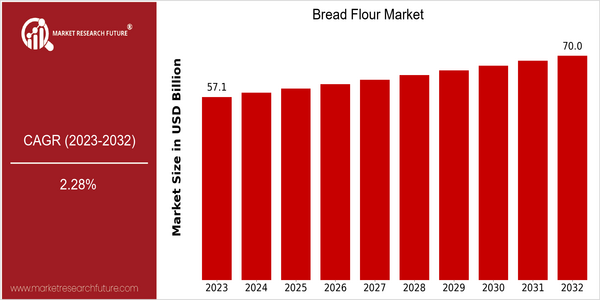

| Year | Value |

|---|---|

| 2023 | USD 57.13 Billion |

| 2032 | USD 70.0 Billion |

| CAGR (2024-2032) | 2.28 % |

Note – Market size depicts the revenue generated over the financial year

The global bread flour market is currently valued at approximately USD 57.13 billion in 2023 and is projected to reach USD 70.0 billion by 2032, reflecting a compound annual growth rate (CAGR) of 2.28% from 2024 to 2032. This steady growth trajectory indicates a resilient demand for bread flour, driven by the increasing consumption of baked goods and the rising trend of home baking, particularly post-pandemic. As consumers continue to seek high-quality ingredients for their culinary endeavors, the market is poised for sustained expansion. Several factors are contributing to this growth, including advancements in milling technology, which enhance the quality and consistency of flour products. Additionally, the growing awareness of health and nutrition is prompting consumers to opt for specialty flours, such as whole grain and organic options, further diversifying the market. Key players in the industry, such as Ardent Mills, King Arthur Baking Company, and General Mills, are actively engaging in strategic initiatives, including partnerships and product innovations, to capture emerging consumer preferences. For instance, recent product launches focusing on gluten-free and high-protein flour variants are indicative of the market's responsiveness to evolving dietary trends, positioning these companies favorably in a competitive landscape.

Regional Market Size

Regional Deep Dive

The Bread Flour Market is characterized by diverse consumer preferences and a growing inclination towards artisanal and health-oriented products across various regions. In North America, the market is driven by a strong baking culture and increasing demand for organic and specialty flours. Europe showcases a rich tradition of bread-making, with a rising trend towards gluten-free options and innovative flour blends. The Asia-Pacific region is witnessing rapid urbanization and a shift towards convenience foods, which is boosting the demand for bread flour. Meanwhile, the Middle East and Africa are experiencing growth due to an expanding population and increasing disposable incomes, while Latin America is seeing a rise in the popularity of traditional bread products, further fueling the market.

Europe

- The European market is witnessing a surge in gluten-free bread flour options, driven by rising health awareness and dietary restrictions, with brands like Schär leading the way in product development.

- Regulatory changes in food labeling and safety standards are prompting manufacturers to invest in quality assurance processes, ensuring transparency and trust among consumers.

Asia Pacific

- The rapid urbanization in countries like China and India is leading to a growing demand for convenience foods, which is driving the sales of pre-mixed bread flour products from companies like ITC Limited.

- Innovative marketing strategies, including collaborations with local chefs and influencers, are being employed by brands to promote traditional bread-making practices, thereby enhancing consumer engagement.

Latin America

- The resurgence of traditional bread-making practices in countries like Brazil is leading to a renewed interest in local flour varieties, with companies like Moinho Globo promoting regional grains.

- Government initiatives aimed at improving food security are encouraging investments in local flour mills, which is expected to enhance the availability of bread flour in rural areas.

North America

- The rise of health-conscious consumers has led to an increased demand for whole grain and organic bread flours, with companies like King Arthur Baking Company expanding their product lines to meet this trend.

- Innovations in packaging, such as resealable bags and eco-friendly materials, are being adopted by major players like General Mills to enhance product shelf life and appeal to environmentally conscious consumers.

Middle East And Africa

- The increasing population and urbanization in the Middle East are driving demand for affordable and accessible bread products, with local companies like Almarai investing in expanding their flour production capabilities.

- Cultural preferences for traditional bread types are influencing product offerings, with manufacturers focusing on developing flours that cater to local tastes and baking methods.

Did You Know?

“Did you know that the global consumption of bread flour is estimated to exceed 200 million tons annually, making it one of the most widely used ingredients in the food industry?” — International Grains Council

Segmental Market Size

The Bread Flour Market segment is currently experiencing stable growth, driven by increasing consumer demand for artisanal and homemade bread products. Key factors propelling this demand include a rising interest in baking as a hobby, particularly during the pandemic, and a shift towards healthier eating habits, with consumers seeking high-quality, whole grain, and organic flour options. Additionally, regulatory policies promoting clean label products are influencing manufacturers to innovate and diversify their offerings. Currently, the market is in a mature adoption stage, with notable players like King Arthur Baking Company and Bob's Red Mill leading the way in product development and consumer engagement. Primary applications of bread flour include commercial baking, home baking, and specialty products like gluten-free and high-protein bread. Trends such as the growing popularity of plant-based diets and sustainability initiatives are catalyzing further growth, as consumers increasingly seek out environmentally friendly and health-conscious options. Technologies such as advanced milling processes and quality control methods are shaping the segment's evolution, ensuring consistent product quality and meeting diverse consumer preferences.

Future Outlook

The Bread Flour Market is poised for steady growth from 2023 to 2032, with a projected market value increase from $57.13 billion to $70.0 billion, reflecting a compound annual growth rate (CAGR) of 2.28%. This growth trajectory is underpinned by rising consumer demand for artisanal and specialty breads, as well as an increasing trend towards home baking, which has gained momentum post-pandemic. As consumers become more health-conscious, the demand for whole grain and organic bread flour options is expected to rise, further driving market expansion. By 2032, it is anticipated that specialty flour products will account for approximately 25% of the total market, up from 18% in 2023, indicating a significant shift in consumer preferences towards healthier alternatives. Key technological advancements in milling processes and flour fortification are expected to enhance product quality and nutritional value, thereby attracting a broader consumer base. Additionally, supportive government policies promoting local agriculture and sustainable practices are likely to bolster the market. The integration of e-commerce platforms for flour distribution is also anticipated to reshape the retail landscape, making bread flour more accessible to consumers. As these trends converge, the Bread Flour Market is set to evolve, driven by innovation and changing consumer behaviors, positioning itself for a robust future through 2032.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 7.3% (2024-2032) |

Bread Flour Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.