- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

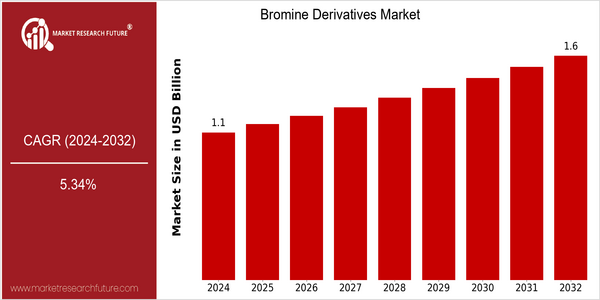

| Year | Value |

|---|---|

| 2024 | USD 1.06 Billion |

| 2032 | USD 1.6 Billion |

| CAGR (2024-2032) | 5.34 % |

Note – Market size depicts the revenue generated over the financial year

The global bromine derivatives market is poised for significant growth, with a current market size of USD 1.06 billion in 2024, projected to reach USD 1.6 billion by 2032. This growth trajectory reflects a compound annual growth rate (CAGR) of 5.34% over the forecast period. The increasing demand for bromine derivatives in various applications, including flame retardants, pharmaceuticals, and water treatment, is a key driver of this market expansion. As industries continue to prioritize safety and environmental sustainability, the adoption of bromine-based solutions is expected to rise, further propelling market growth. Technological advancements and innovations in bromine extraction and processing are also contributing to the market's upward trend. Companies are investing in research and development to enhance the efficiency of bromine production and to develop new applications for bromine derivatives. Notable players in the market, such as Albemarle Corporation, Israel Chemicals Ltd., and Chemtura Corporation, are actively pursuing strategic initiatives, including partnerships and product launches, to strengthen their market position. For instance, Albemarle's recent investments in expanding its bromine production capacity highlight the company's commitment to meeting the growing demand in key sectors, thereby reinforcing the overall market growth outlook.

Regional Market Size

Regional Deep Dive

The Bromine Derivatives Market is characterized by diverse applications across various industries, including pharmaceuticals, agriculture, and flame retardants. Each region exhibits unique dynamics influenced by local demand, regulatory frameworks, and technological advancements. The market is poised for growth, driven by increasing environmental regulations and the demand for sustainable products, particularly in the Asia-Pacific and North American regions. The interplay of innovation and regulatory changes is expected to shape the market landscape significantly.

Europe

- Europe is focusing on sustainability, with the European Union implementing regulations that restrict the use of certain brominated flame retardants, pushing manufacturers to innovate and develop safer alternatives. This has led to increased investment in research by companies like ICL Group.

- The region is also seeing a rise in demand for bromine derivatives in the agricultural sector, particularly for crop protection products, driven by initiatives from the European Food Safety Authority to enhance food safety and security.

Asia Pacific

- The Asia-Pacific region is experiencing rapid industrialization, leading to increased demand for bromine derivatives in various applications, particularly in electronics and automotive industries. Companies like Tosoh Corporation are expanding their production capabilities to meet this growing demand.

- Regulatory changes in countries like China are promoting the use of bromine derivatives in environmentally friendly applications, which is expected to drive innovation and market growth in the region.

Latin America

- Latin America is witnessing a growing interest in bromine derivatives for agricultural applications, particularly in countries like Brazil, where there is a push for sustainable farming practices. This trend is supported by local agricultural policies promoting the use of safer chemicals.

- The region's regulatory landscape is evolving, with governments implementing stricter controls on chemical usage, which is driving manufacturers to innovate and develop more environmentally friendly bromine derivatives.

North America

- The North American market is witnessing a surge in demand for bromine derivatives due to stringent environmental regulations that promote the use of safer flame retardants. Companies like Albemarle Corporation are investing in R&D to develop eco-friendly bromine products.

- Recent innovations in the pharmaceutical sector, particularly in the development of brominated compounds for drug formulations, are being spearheaded by organizations such as the American Chemical Society, which is fostering collaboration between academia and industry.

Middle East And Africa

- In the Middle East and Africa, the bromine derivatives market is influenced by the oil and gas industry, with companies like Gulf Resources, Inc. leveraging bromine for oil drilling applications. This sector's growth is expected to bolster the demand for bromine derivatives.

- The region is also seeing increased investment in chemical manufacturing, with government initiatives aimed at diversifying economies away from oil dependency, which is likely to enhance the market for bromine derivatives.

Did You Know?

“Bromine is one of the few elements that is liquid at room temperature, and it has been used in various applications since the 19th century, including as a disinfectant and in photography.” — American Chemical Society

Segmental Market Size

Bromine derivatives play a crucial role in the chemical industry, primarily serving as flame retardants, biocides, and intermediates in pharmaceuticals. This segment is currently experiencing stable growth, driven by increasing demand in various end-use industries such as electronics, automotive, and agriculture. Key factors propelling this demand include stringent fire safety regulations that necessitate the use of flame retardants and the rising need for effective agricultural solutions amid global food security challenges. The adoption of bromine derivatives is in a mature stage, with companies like Albemarle Corporation and Israel Chemicals Ltd. leading the way in production and innovation. Notable applications include their use in manufacturing electronic components, where flame retardants are essential for compliance with safety standards. Additionally, the ongoing trend towards sustainability is catalyzing the development of eco-friendly bromine derivatives, aligning with global initiatives to reduce environmental impact. Technologies such as advanced synthesis methods and recycling processes are shaping the evolution of this segment, ensuring that bromine derivatives remain relevant in a rapidly changing market landscape.

Future Outlook

The Bromine Derivatives Market is poised for significant growth from 2024 to 2032, with a projected market value increase from $1.06 billion to $1.6 billion, reflecting a compound annual growth rate (CAGR) of 5.34%. This growth trajectory is underpinned by the rising demand for bromine derivatives in various applications, including flame retardants, pharmaceuticals, and water treatment solutions. As industries increasingly prioritize safety and environmental sustainability, the adoption of bromine-based products is expected to rise, particularly in the electronics and automotive sectors, where stringent regulations on fire safety are driving innovation and usage rates. Key technological advancements and policy drivers will play a crucial role in shaping the market landscape. The development of more efficient and environmentally friendly bromine extraction and processing methods is anticipated to enhance production capabilities and reduce costs. Additionally, government regulations aimed at reducing hazardous materials in consumer products are likely to spur demand for safer bromine derivatives. Emerging trends, such as the increasing focus on sustainable practices and the integration of bromine compounds in renewable energy technologies, will further bolster market growth. As a result, stakeholders in the bromine derivatives market should prepare for a dynamic environment characterized by evolving consumer preferences and regulatory frameworks, positioning themselves to capitalize on the anticipated opportunities through 2032.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 1 Billion |

| Market Size Value In 2023 | USD 1.0 Billion |

| Growth Rate | 5.50% (2023-2032) |

Bromine Derivatives Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.