Global Bronchoscopy Market Overview

The bronchoscopy market size was valued at USD 2.3 billion in 2021 and is projected to grow from USD 2.5 Billion in 2022 to USD 4.1 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 7.6% during the forecast period (2022 - 2030). The rising prevalence of lung cancer, increasing research and development activity, and increasing business expansion activity by major key players deployment are driving the market growth.

May 2024 saw the introduction of two new bronchoscopes by the Olympus Corporation. They are compatible with the EVIS X1 Endoscopy System, which is now the latest in diagnosis and treatment technology, and boast advanced imaging. Unlike previous models, the two new bronchoscopes possess slim outer diameters which enable better usability by physicians.

Bronchoscopy Market Trends

- The increasing prevalence of respiratory disease boosts market growth.

The increasing prevalence of respiratory disease is propelling the market growth of bronchoscopy. The increasing prevalence of respiratory disease such as lung cancer, asthma, chronic obstructive pulmonary disease (COPD). In addition, rising demand for advanced therapeutics further boosts the growth of this market. For Instance, in 2020, as per the World Cancer Research Fund International lung cancer is the second most common cancer across the globe. It is the most common cancer in men and second most common cancer in women. There were more than 2.2 million new cases of lung cancer reported in 2020.

The ten countries including Hungary, Serbia, France, Turkey, Montenegro, Belgium, Bosnia and Herzegovina, and Denmark are the highest number of deaths from lung cancer in 2020. Moreover in 2020, around 545 million patients will live with a chronic respiratory condition which represents 7.4% of world population which increasing burden on healthcare sector as well as directly influence the market demand of bronchoscopy.

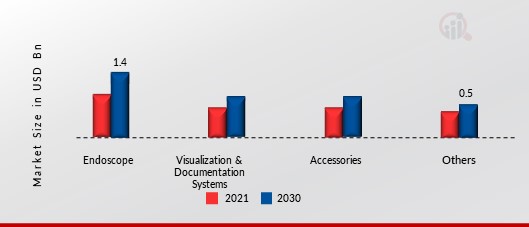

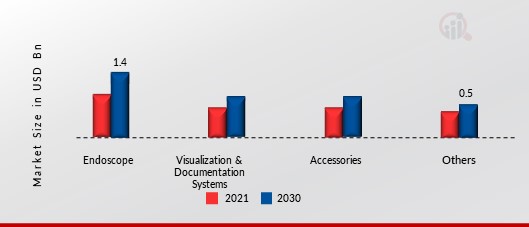

Figure 1: Global Bronchoscopy by Product 2021 & 2030 (USD BILLION)

Bronchoscopy Market Segment Insights:

Bronchoscopy Product Insights

The market segments of bronchoscopy, based on product is further segmented into endoscope, visualization & documentation systems, accessories, and other. The endoscope segment is to hold the majority share in 2021 in the Bronchoscopy Market revenue. This is due to the rising prevalence of lung cancer, increase the use of endoscopy equipment and technological development. For instance: In 2023, around 238,340 adults (117,550 men and 120,790 women) in the US were diagnosed with lung cancer. Worldwide, approximately 2,206,771 people were diagnosed with lung cancer in 2020. These statistics involve both small cell lung cancer and non-small cell lung cancer.

In addition, visualization & documentation systems are expected to grow at a healthy CAGR of 6.5% over the forecast period.

In August 2023, Ambu reported that it had received a 510k notification from the FDA for its Ambu aScope 5 Broncho, fifth-generation bronchoscope series. The two new models are single-use endoscopes intended for high-complexity procedures.

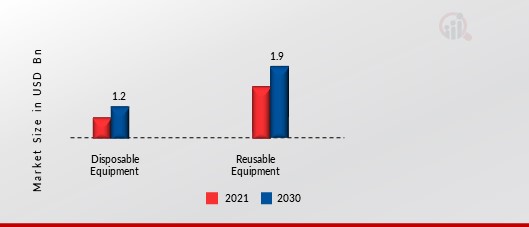

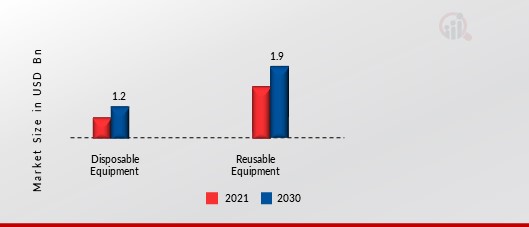

Bronchoscopy Usability Insights

The Bronchoscopy Market segmentation is based on usability that includes disposable equipment and reusable equipment. The reusable equipment segment has dominated the market in multi-usage and cost-effectiveness are the key advantages these devices offer. As a result, more than 500 bronchoscopy procedures are performed in a year.

Figure 2: BRONCHOSCOPY MARKET, BY USABILITY, 2021 & 2030 (USD BILLION)

Bronchoscopy Application Insights

The Market segmentation of Bronchoscopy is based on application that bronchial diagnosis and bronchial treatment. The bronchial treatment has dominated the market in 2021 and is projected to be the fastest-growing segment during the forecast period, 2022-2030. This is due to the increasing awareness about lung cancer, availability of advance treatment solutions is further driving the growth of bronchial treatment in the market.

Bronchoscopy End User Insights

The market segmentation of bronchoscopy is based on end-user that includes hospitals & clinics, ambulatory surgery centers. The hospitals & clinics segment has dominated the market in 2021 and is projected to be the fastest-growing segment during the forecast period, 2022-2030. This is due to the availability of easy availability of patient advance treatment, increasing patient pool in hospitals. Moreover, the increasing government support for development of better medical facility also drives the growth of hospitals and clinics segment.

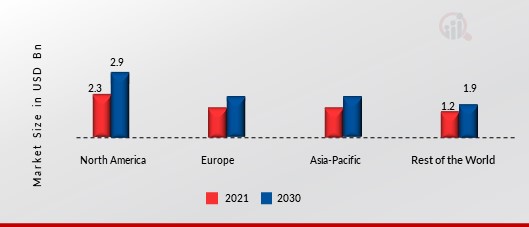

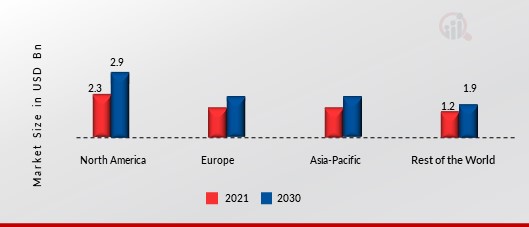

Bronchoscopy Regional Insights

By Region, the study segments the market into North America, Europe, Asia-Pacific, and the Rest of the World. The North America bronchoscopy market accounted for USD 1.5 billion in 2021 and is expected to exhibit a 5.2% CAGR during the study period. This is attributed to the presence of key players, high prevalence rate of lung cancer, increasing cases of COPD disease in US, availability of advance treatment is further boosting the market growth of bronchoscopy in North America.

For instance: In 2021 more than 25 million patients in US suffered from asthma as well as more than 16 million people in the US had COPD (chronic obstructive pulmonary disease), which is cause of death. Moreover, the American Cancer Society in 2023 approximate 238,340 new cases of lung cancer as well as 127,070 deaths from lung cancer reported in US. Thus, increasing prevalence of lung cancer, rising new cases of asthma, and the presence of major key players is further boosting the market growth in North America.

As per the Canadian Cancer Society approximate 30,000 Canadians was diagnosed with lung cancer and bronchus cancer. This indicates 13% of all new cancer cases in 2022.

Further, the major countries studied are the U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: BRONCHOSCOPY MARKET SHARE BY REGION, 2021 & 2030 (USD BILLION)

Europe bronchoscopy market is expected to account for the second-largest market share due to increasing investment in healthcare expenditure, technological advancements, increasing advancement in bronchoscopy, a rising regulatory approval for bronchoscope portfolio. For instance: In May 2021, Pantax Medical Europe received CE mark for its single use bronchoscope PulmoONE. This advanced technological product offers high quality care with advanced care in pulmonary care. The PulmoONE is a single use bronchoscope with advance power and HD image quality. Thus, rising product approval, technological developments, rising healthcare expenditure are further boosting the market growth of bronchoscopy in Europe region.

The Asia-Pacific bronchoscopy market is expected to fastest be growing from 2022 to 2030. This Asia-Pacific is expected to grow at the fastest CAGR of 7.0% during the forecast period. Rising research and development activity, easy availability of labour cost, growing use of advance bronchoscopy technology use in hospitals, increasing statergic alliance such as merger, acquisition, agreement, and collaboration are rising market scope of bronchoscopy in Asia-Pacific region. For instance: In March 2023, Yashoda Hospitals in India, and Asia to utilize advance diagnostic bronchoscopy technology with LungVision AI driven intraoperative CT imaging.

Thus, rising strategic decision by key players, highly investment major key players for research and development activity are drive the market growth of bronchoscopy in Asia-Pacific region.

The rest of the world is comprised of the Middle East, Africa, and Latin America. This segment is projected to hold the least market share. In this region, the Middle East is anticipated to dominate due to the improving medical facility, growing investment in healthcare infrastructure, rising consumption of tobacco leads to the risk of lung cancer which is directly influence the market demand of bronchoscopy in the Rest of the World.

Bronchoscopy Key Market Players & Competitive Insights

The Bronchoscopy Market is characterized by the presence of many global, regional, and local vendors catering to the demand created by medical devices and research scientists operating in the industry. The major players heavily invest in research and development activity across the globe with varied product portfolios.

Companies such as Olympus Corporation (Japan), Teleflex, Inc. (US), Ambu A/S (Denmark), Karl Storz GmbH (Germany), Fujifilm Holdings Corporation (Japan) dominate the Market of Bronchoscopy due to strong brand image, extensive business network across the globe, heavily investment in research and development activity, financial stability, statergic alliance, and wide business presence in across the globe. The key players are focused on the development of new products. Moreover, they adopt growth initiatives, such as collaboration, product launches, mergers, and acquisition, to strengthen their market position and gain a large customer base.

One of the primary business strategies adopted by manufacturers in the global bronchoscopy industry to benefit clients and expand the market sector is to manufacture locally to reduce operating costs. Olympus Corporation (Japan) is a global medical device company which is engage in development of optics and reprography products. The company distributes its products in more than 40 countries. The company holds around 17,000 patents as well as acquiring new technology to build up its business across the globe.

For instance: In May 2022, Olympus Corporation, a Japanese manufacturer of optics and reprography products signed a group purchasing agreement with Premier, Inc. in the Single-Use Visualization Devices category for their single-use bronchoscope portfolio.

Teleflex Incorporated (US) is a medical technology company which design and develop various healthcare products. The company product portfolio is diverse around emergency medicine, surgical, vascular access, interventional cardiology and radiology, anaesthesia, and respiratory care. It offers product under the segment of surgical, respiratory, interventional urology, and urology. The company operated its business in more than 150 countries.

Key Companies in the Market of Bronchoscopy Include.

- Teleflex Incorporated (US)

- Fujifilm Holdings Corporation (Japan)

- Boston Scientific Corporation (US)

Bronchoscopy Market Industry Developments

-

Q2 2024: Olympus launches EVIS X1, its most advanced endoscopy system, in the United States Olympus announced the U.S. launch of its EVIS X1 endoscopy system, which includes advanced bronchoscopy capabilities designed to improve diagnostic and therapeutic procedures for respiratory diseases.

-

Q1 2024: Ambu receives FDA 510(k) clearance for Ambu® aScope™ 5 Broncho Ambu announced it received FDA 510(k) clearance for its aScope 5 Broncho, a single-use bronchoscope designed for advanced bronchoscopy procedures in the U.S. market.

-

Q2 2024: Boston Scientific launches EXALT Model B single-use bronchoscope in Europe Boston Scientific announced the commercial launch of its EXALT Model B single-use bronchoscope in select European markets, expanding its portfolio of disposable endoscopy solutions.

-

Q1 2024: Fujifilm launches new ELUXEO Ultra bronchoscopy system in Japan Fujifilm introduced the ELUXEO Ultra bronchoscopy system in Japan, featuring enhanced imaging technology for improved detection and diagnosis of pulmonary diseases.

-

Q2 2024: Medtronic acquires privately held bronchoscopy device maker InterVapor for $350 million Medtronic announced the acquisition of InterVapor, a company specializing in minimally invasive bronchoscopy devices for lung disease treatment, to strengthen its respiratory portfolio.

-

Q1 2024: Olympus and Veran Medical Technologies announce strategic partnership for advanced bronchoscopy navigation Olympus and Veran Medical Technologies entered a partnership to integrate Veran’s navigation technology with Olympus’ bronchoscopy systems, aiming to improve accuracy in lung cancer diagnosis.

-

Q2 2024: Ambu opens new manufacturing facility for single-use endoscopes in Mexico Ambu inaugurated a new manufacturing facility in Mexico to increase production capacity for its single-use bronchoscopes and meet growing global demand.

-

Q1 2024: Boston Scientific receives CE Mark for EXALT Model B single-use bronchoscope Boston Scientific announced it received CE Mark approval for its EXALT Model B single-use bronchoscope, allowing commercialization in the European Union.

-

Q2 2024: Fujifilm opens new R&D center for endoscopy innovation in Germany Fujifilm opened a new research and development center in Germany focused on advancing endoscopy and bronchoscopy technologies for the European market.

-

Q1 2024: Karl Storz appoints new CEO to drive digital transformation in endoscopy Karl Storz announced the appointment of a new CEO, emphasizing a strategic focus on digital innovation and expansion in the bronchoscopy and endoscopy sectors.

-

Q2 2024: Olympus receives FDA clearance for BF-UC190F endobronchial ultrasound bronchoscope Olympus announced it received FDA clearance for its BF-UC190F endobronchial ultrasound bronchoscope, expanding its portfolio of advanced diagnostic tools for lung cancer.

-

Q1 2024: Ambu secures contract to supply single-use bronchoscopes to major U.S. hospital network Ambu announced it secured a multi-year contract to supply its single-use bronchoscopes to a leading U.S. hospital network, supporting infection control and procedural efficiency.

Bronchoscopy Market Segmentation

Bronchoscopy Product Outlook

- Visualization & Documentation Systems

Bronchoscopy Usability Outlook

Bronchoscopy Application Outlook

Bronchoscopy End User Outlook

- Ambulatory Surgery Centers

Bronchoscopy Regional Outlook

| Report Attribute/Metric |

Details |

| Market Size 2021 |

USD 2.3 billion |

| Market Size 2022 |

USD 2.5 billion |

| Market Size 2030 |

USD 4.1 billion |

| Compound Annual Growth Rate (CAGR) |

7.6% (2022-2030) |

| Base Year |

2021 |

| Forecast Period |

2022-2030 |

| Historical Data |

2018 & 2020 |

| Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Product, Usability, Application, End User, and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered |

The U.S, Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Olympus Corporation (Japan), Teleflex Incorporated (US), Karl Storz (Germany), Fujifilm Holdings Corporation (Japan), Ambu A/S (Denmark), Boston Scientific Corporation (US), Medtronic (Ireland), Johnson & Johnson (US), Hoyo Corporation (Japan), Richard Wolf GmbH (Germany), and Cook Medical (US). |

| Key Market Opportunities |

Increasing research and development activity |

| Key Market Dynamics |

Increase in number of cases related to respiratory diseases. The growing demand for bronchoscopy devices Rising prevalence of lung cancer |

Frequently Asked Questions (FAQ):

The Bronchoscopy Market is anticipated to reach USD 4.1 billion at a CAGR of 7.6% during the forecast period of 2022 to 2030.

The U.S. bronchoscopy market is anticipated to reach USD 1.2 billion at a CAGR of 5.3% during the forecast period of 2022 to 2030.

The Bronchoscopy Market is expected to register a CAGR of 7.6% during the forecast period of 2022 to 2030.

The North America bronchoscopy market accounted for USD 2.3 billion in 2021 and is expected to exhibit a 5.3% CAGR during the study period.

Olympus Corporation (Japan), Teleflex Incorporated (US), Karl Storz (Germany), Fujifilm Holdings Corporation (Japan), Ambu A/S (Denmark), Boston Scientific Corporation (US), Medtronic (Ireland), Johnson & Johnson (US), Hoyo Corporation (Japan), Richard Wolf GmbH (Germany), and Cook Medical (US).

The endoscope segment held the majority share in 2021 contributing to around 6.2% with respect to the Bronchoscopy Market.

The reusable equipment segment dominated the market in 2021 and is projected to be the fastest-growing segment during the forecast period, 2022-2030.

The bronchial treatment segment dominated the market in 2021 and is projected to be the fastest-growing segment during the forecast period, 2022-2030.

The hospitals & clinics segment dominated the market in 2021 and is projected to be the fastest-growing segment during the forecast period, 2022-2030.