Building Integrated Photovoltaics Market Summary

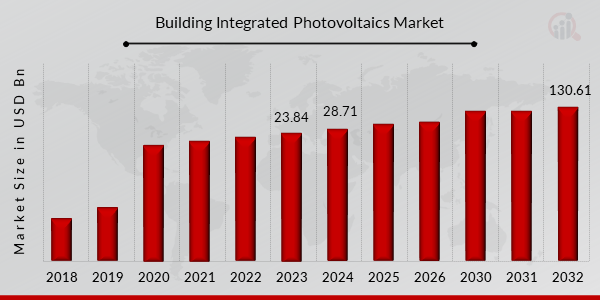

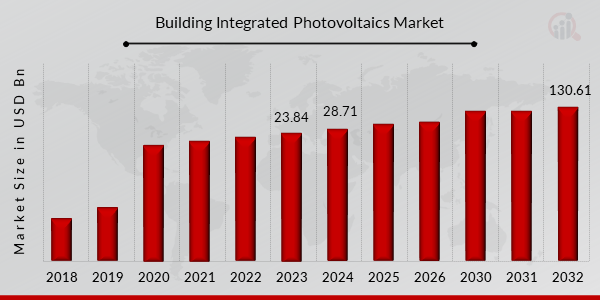

As per Market Research Future Analysis, the global Building Integrated Photovoltaics (BIPV) market was valued at USD 23.84 billion in 2023 and is projected to reach USD 130.61 billion by 2032, growing at a CAGR of 18.33% from 2024 to 2032. The market is driven by the increasing adoption of renewable energy sources and government initiatives aimed at achieving carbon neutrality. BIPV systems, which integrate solar power generation into building materials, are gaining traction in various sectors including residential, commercial, and industrial applications. The COVID-19 pandemic has impacted the market, but recovery is anticipated as governments push for solar energy installations. Major players are focusing on R&D and strategic partnerships to enhance their market presence.

Key Market Trends & Highlights

The BIPV market is witnessing significant growth driven by technological advancements and regulatory support.

- Market Size in 2023: USD 23.84 billion.

- Projected Market Size by 2032: USD 130.61 billion.

- CAGR from 2024 to 2032: 18.33%.

- Majority of BIPV applications are in industrial buildings, expected to grow rapidly.

Market Size & Forecast

2023 Market Size: USD 23.84 billion

2024 Market Size: USD 28.71 billion

2032 Market Size: USD 130.61 billion

CAGR from 2024 to 2032: 18.33%.

Major Players

Scheuten Solar (The Netherlands), Wurth Solar (Germany), Dow Solar (US), Suntench Power (China), Belectric (Germany), Carmanah Technologies Corporation (Canada), Dyesol Ltd. (Australia), Hanergy Holding Group Limited (China), Ertex Solartechnik GmbH (Germany), Canadian Solar Inc. (Canada), Tesla Inc. (US), NanoPV Solar Inc. (US), Solaria Corporation (US), ML System (Poland).

They are used in building parts, including roofs, skylights, and facades, as well. Building-integrated photovoltaics, also known as solar panels, are incorporated into the construction sector. They offer different things like thin-film solar panels, flexible thin-film solar panels, followed by some others like thin-film or crystalline-based solar panels, and semi-transparent solar panels to add to differentiation in market innovation. BIPV is currently one of the rapidly expanding global solar PV industry segments.

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

The global inclination towards renewables-based power generation is an enormous opportunity for the BIPV systems. The regional governments are planning to move towards renewables-oriented energy policies to reach their carbon neutrality goals. The industrial and commercial sectors are even incentivized to adopt cleaner energy generation methods.

Building-integrated photovoltaics (BIPVs) are solar power producing components utilised in the construction of building facades, roofs, and skylights. In general, these components comprise photovoltaic module integration, a backup generators supply system, a charge controller, a power storage system, and other supporting gear.

BIPV materials outperform their traditional equivalents in numerous ways, including onsite power production, zero emissions, high energy saving, improved architectural incorporation, and optimum shading. Furthermore, by replacing gable roof membranes, skylight glass, façade cladding, and so on, BIPVs assist to reduce labour and installation costs. Because of these advantages, building integrated photovoltaic materials are widely used in the corporate, domestic, and manufacturing industries.

National governments' growing efforts to instal solar energy panels are expected to boost the industry during the next seven years. The greater awareness of infrastructure development, particularly energy-efficient buildings, is projected to increase demand for Building Integrated Photovoltaics Market. BIPV is a long-term and cost-effective option for improving the structure's fuel efficiency, retrofitting the structure's façade, and offering considerable savings in conventional power usage.

Furthermore, greater consumer conscious of the health benefits of BIPV has resulted in increased household adoption of solar energy harvesting systems. Aside from that, the introduction of favourable government regulations backed up by a number of efforts stressing the need to reduce carbon footprints has spurred worldwide demand for building-integrated photovoltaics market growth.

This report contains all the information on the Building Integrated Photovoltaics Market value and strengths. The report also contains the culmination of dynamics, segmentation, key players, regional analysis, and other important factors. And a detailed analysis of the Building Integrated Photovoltaics Market outlook and forecast for 2027 is also included in the report.

Building Integrated Photovoltaics Market Covid 19 Analysis

There is no market in the planet that has not been impacted by the present epidemic. The COVID-19 epidemic has affected several businesses, including the worldwide Building Integrated Photovoltaics industry. To battle the epidemic, the government and nations have implemented a number of severe measures, such as lockdowns and modifications to a few industrial regulations, to assist various enterprises in remaining competitive.

Building Integrated Photovoltaics Market Competitive landscape

To expand their worldwide footprint, industry participants are pursuing strategic initiatives such as new product development and mergers and acquisitions. Furthermore, industry participants are spending in research and development to lower the overall cost of BIPV installations. Local production is used by industry to provide local jobs, save transport costs, and reduce pollution. Because manufacturers are set up with end-users obtaining BIPV in large amounts, forward integration is projected to minimize firms' sensitivity to investment risk.

Building Integrated Photovoltaics Market Major Key Players

- Scheuten Solar (The Netherlands) Wurth Solar (Germany)

- Hanergy Holding Group Limited (China)

- Ertex Solartechnik GmbH (Germany)

- Canadian Solar Inc. (Canada)

Recent Developments in Building Integrated Photovoltaics Market Insights

July 2023- the U.S. Department of Energy (DOE), as part of President Biden's Investing in America agenda, in the first week of July has disclosed USD 45 million, including USD18 million from the Bipartisan Infrastructure Law, to back pilot manufacturing of solar components that can contribute to a domestic manufacturing sector capable of meeting the Administration's solar installment goals without relying on imported products. The investment will also back the development of new dual-use solar technologies, such as building-integrated photovoltaics and agrivoltaics, to generate new markets for American products.

Reviving the U.S. manufacturing sector is vital to President Biden's economic strategy, Bidenomics, and is crucial to attaining a clean energy future that benefits all Americans. The U.S. Secretary of Energy Jennifer M. Granholm stated that President’s Investing in America agenda had caused a rise in solar manufacturing announcements and produced thousands of good paying, union jobs in solar deployment. He added that with these new launches, made-in-America technologies, the Biden-Harris Administration is running the clean energy transition, reducing electricity costs for hardworking Americans, and safeguarding the nation's children's future from the climate crisis's impacts.

July 2023- The U.S.-founded solar tracking, racking, and building-integrated photovoltaics (BIPV) supplier, Arctech, will propose an 11.457-megawatt (MW) SkyLine II solar tracking solution for a project by Nextcom Ltd in Israel. The project signifies Arctech's first solar tracking effort in Israel and indicates a substantial breakthrough in the Middle East market. Israel has been keenly progressing toward renewable energy and has set a detailed aim of attaining 30% renewable energy by 2030. The nation focuses on developing nearly 12 GW of solar plants to fulfill the motive, leveraging its abundant sunshine and solar power as the main renewable energy source.

The rise in demand for building integrated photovoltaic materials can be attributed to the integration of solar energy solutions in commercial infrastructures for architectural optimization and energy conservation. Moreover, growth in environmental concerns toward depleting non-renewable power resources, such as oil and coal, further propel the demand for solar power generation. In addition, rapid modernization in the construction and building sector and an increase in focus on clean energy have led to a rise in demand for green or zero-emission buildings.

According to the Fraunhofer Institute for Solar Energy Systems, Germany's global annual monocrystalline PV production share was around 80%, the highest among all other technologies. The percentage explicitly reflects the demand for the technology at the global level due to its low prices and technical maturity. Spanish BIPV systems manufacturer Onyx Solar started the construction of a giant BIPV solar facade to refurbish the Sterling Bank headquarters in Lagos, Nigeria. The company will install around 3,250 crystalline solar modules on the building facade.

Building Integrated Photovoltaics Market Dynamic

The growing integration of solar energy solutions in commercial structures for architectural optimization and energy saving can be linked to the increased demand for building integrated photovoltaic materials. Furthermore, rising environmental worries about the depletion of non-renewable energy supplies such as oil, coal, and others have increased competition for solar power generation. Furthermore, a dramatic rise in the design and construction sectors, as well as an increased emphasis on clean energy, have driven demand for green or zero-emission structures.

Futuristic breakthroughs in mainstream solar and other related technologies are anticipated to increase investor trust in the industry, resulting in increased investment for R&D operations. Technology start-ups are likely to enter the market for developing integrated photovoltaics and use innovative and current technology with proven characteristics. Existing suppliers will continue to update their product portfolios. Thus, over the predicted period, new and efficient solar panels will provide opportunities.

One of the key constraints of the BIPV industry is the falling cost and increasing technology of rooftop solar PV, which is significantly faster than that of BIPV, resulting in the majority of customers preferring rooftop solar over BIPV.

The absence of uniformity in photovoltaic tiles is posing a challenge to the sharp growth in demand for BIPV roof solutions. Because of the slanting roof designs, the roof goods have a great potential in Major nations. Thin-film BIPV and facade applications, on the other hand, are more prevalent in APAC and MEA areas where the roof design is typically flat.

-

Building Integrated Photovoltaics Market Outlook - Cumulative Growth Analysis

In recent years, the European Union, the United States, and other developed nations have moved their attention considerably toward net-zero-energy building design or construction (or nearly zero energy building). Furthermore, numerous goals and targets for implementing zero-energy buildings have either been declared or are being considered and suggested at the worldwide level. This, in turn, is projected to provide considerable future possibilities for BIPV technology vendors.

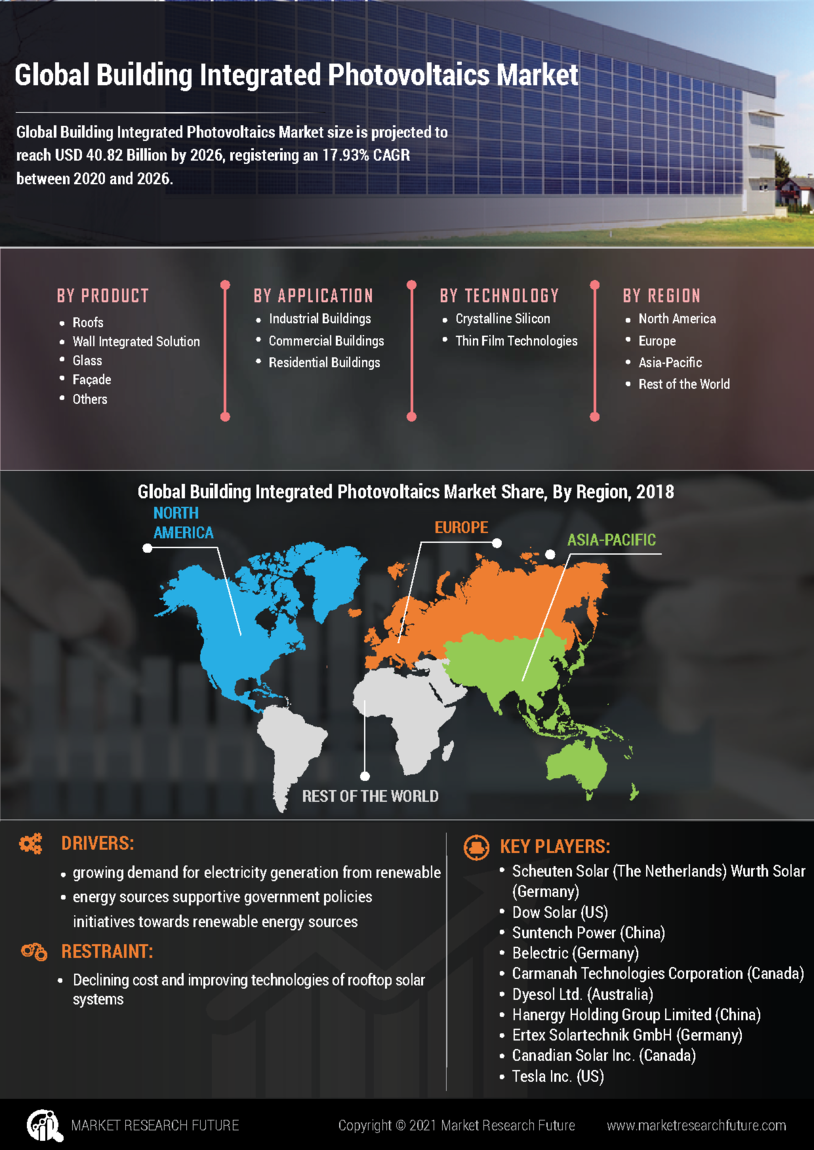

Europe dominated the global market due to the region's clean energy ambitions and the lofty standards established to guarantee that all new buildings utilize very little net energy by 2020, giving rise to the term "nearly zero-energy building" or nZEB.

The crystalline module is the most common solar photovoltaic (PV) technology utilized in the BIPV industry. Aside from that, traditional solar technology based on crystalline silicon accounts for more than 80% of the solar business. As the most developed and commonly used material for BIPV, crystalline silicon is employed in the majority of solar panels used for facades, curtain walls, and rooftops. Crystalline silicon photovoltaic modules are constructed from crystalline silicon produced utilizing microelectronics technologies. Mono-crystalline silicon and polycrystalline silicon are the two kinds of crystalline silicon solar cells utilized in crystalline silicon photovoltaics.

-

Building Integrated Photovoltaics Market Growth - Value Chain Analysis

The global market for building integrated photovoltaics market has been divided into product, application, technology, and region segments. The worldwide market is segmented by product into roofing, wall integrated solutions, glass, façade, and others. During the projected period, the roof segment is predicted to have the highest building integrated photovoltaics market share. The glass category, on the other hand, is anticipated to develop at the quickest rate in the worldwide market.

The global market is divided into three applications: industrial buildings, office properties, and housing developments. The industrial buildings sector is expected to expand at the quickest rate during the projected period, owing to the increasing use of solar systems to reduce reliance on non - renewable energy sources for power generation. The worldwide market has been split into crystalline silicon and thin-film technologies based on technology. The crystalline category is projected to account for a higher part of the worldwide market for constructing integrated photovoltaics.

Building Integrated Photovoltaics Market Industry Developments

- Q2 2024: Sunovation launches new transparent BIPV glass for commercial buildings Sunovation announced the launch of its next-generation transparent building-integrated photovoltaic (BIPV) glass, designed for facades and skylights in commercial buildings, aiming to boost energy efficiency and architectural aesthetics.

- Q2 2024: Onyx Solar secures contract for BIPV installation at Paris Charles de Gaulle Airport Onyx Solar won a major contract to supply and install BIPV glass panels for the renovation of Paris Charles de Gaulle Airport, marking one of the largest BIPV deployments in European transportation infrastructure.

- Q3 2024: Tesla announces expansion of Solar Roof production facility in Buffalo, NY Tesla revealed plans to expand its Buffalo, NY Gigafactory to increase production capacity for its Solar Roof BIPV product, responding to rising demand in the North American residential market.

- Q3 2024: AGC Glass Europe partners with Soltech to develop BIPV facade solutions AGC Glass Europe entered a strategic partnership with Soltech to co-develop advanced BIPV facade systems for commercial and public buildings, targeting the European green building sector.

- Q4 2024: ClearVue Technologies receives regulatory approval for BIPV window panels in Germany ClearVue Technologies announced that its transparent BIPV window panels have received regulatory approval for use in German commercial construction, paving the way for broader European market entry.

- Q4 2024: Heliatek opens new BIPV film manufacturing plant in Dresden Heliatek inaugurated a new manufacturing facility in Dresden dedicated to producing flexible BIPV films for integration into building facades and roofs, aiming to scale up production for European markets.

- Q1 2025: Onyx Solar wins contract for BIPV glass installation at Dubai Green Tower Onyx Solar secured a contract to supply and install BIPV glass for the Dubai Green Tower project, a flagship sustainable skyscraper in the Middle East.

- Q1 2025: Solaria raises $80M in Series C funding to expand BIPV product line Solaria completed an $80 million Series C funding round to accelerate development and commercialization of its next-generation BIPV modules for global markets.

- Q2 2025: Ertex Solar launches colored BIPV modules for architectural integration Ertex Solar introduced a new line of colored BIPV modules designed for seamless integration into building facades, offering architects greater design flexibility.

- Q2 2025: Saint-Gobain acquires BIPV startup SolarWindow Technologies Saint-Gobain announced the acquisition of SolarWindow Technologies, a US-based BIPV startup specializing in transparent solar coatings for windows and facades.

- Q2 2025: Romag secures contract for BIPV glass supply to London’s Net Zero Office Park Romag was awarded a contract to supply BIPV glass panels for the Net Zero Office Park development in London, supporting the city’s sustainable building initiatives.

- Q3 2025: Kingspan partners with Hanergy to integrate BIPV into modular building systems Kingspan announced a partnership with Hanergy to incorporate BIPV technology into its modular building systems, targeting commercial and industrial clients seeking energy-efficient solutions.

Building Integrated Photovoltaics Market Segmentation Overview

The market is segmented on the basis of product, application, technology, and region. The building integrated photovoltaics market trends is expected to witness decent growth during the forecast period. Based on the application, the Building Integrated Photovoltaics Market is segmented into industrial buildings, office properties, and housing developments. Based on the propulsion types, the market is segmented into crystalline silicon and thin-film technologies.

BIPV Modules Technology Outlook

Building Integrated Photovoltaics Market Application Outlook

Building Integrated Photovoltaics Market End-use Outlook

Building Integrated Photovoltaics Market Regional Analysis

According to the reports, on the basis of region, the market is divided into five regions: Asia-Pacific, North America, Europe, the Middle East, and Africa, and South America. Due to the cheap cost of production in countries like China and India, Asia-Pacific has the biggest building integrated photovoltaics market share. Furthermore, the market in Asia-Pacific is anticipated to expand at the highest rate during the study period, owing to a slew of government programs launched in the area to boost renewable energy installations.

Europe is expected to maintain its lead in the global BIPV market in terms of installation, owing to an increased customer willingness to adopt practices as a result of progressively strict government regulations, as well as rising pressure to reduce net energy usage from buildings in order to reduce CO2 emissions.

Based on its new energy policy, the European Union wants to attain at least a 27 percent proportion of renewable energy consumption by 2030 and to have all new buildings be virtually zero energy buildings (NZEB) by 2020. The European BIPV market is in transition, and the regulatory framework is having a beneficial influence. The European Union (EU) established the Directive on Energy Usage in Buildings (EPBD) (Directive 2010/31/EU) and the Renewable Power Directive (1/77/EC), opening the path for near-zero and positive energy buildings.

Building Integrated Photovoltaics Market Regional Outlook

| Report Attribute/Metric |

Details |

| Market Size 2023 |

USD 23.84 Billion |

| Market Size 2024 |

USD 28.71 Billion |

| Market Size 2032 |

USD 130.61 Billion |

| CAGR |

18.33% (2024-2032) |

| Base Year |

2023 |

| Forecast Period |

2024 to 2032 |

| Historical Data |

2019 & 2020 |

| Forecast Units |

Value (USD Million) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Product, Application and Technology |

| Geographies Covered |

North America, Europe, Asia-Pacific, and Rest of the World (RoW) |

| Key Vendors |

Scheuten Solar (The Netherlands) Wurth Solar (Germany), Dow Solar (US), Suntench Power (China), Belectric (Germany), Carmanah Technologies Corporation (Canada), Dyesol Ltd. (Australia), Hanergy Holding Group Limited (China), Ertex Solartechnik GmbH (Germany), Canadian Solar Inc. (Canada), Tesla Inc. (US), NanoPV Solar Inc. (US), Solaria Corporation (US), and ML System (Poland) |

| Key Market Opportunities |

declining cost and improving technologies of rooftop solar systems |

| Key Market Drivers |

growing demand for electricity generation from renewable energy sources supportive government policies initiatives towards renewable energy sources |

Building Integrated Photovoltaics Market Highlights:

Frequently Asked Questions (FAQ):

Suntech Power, Hanergy Holding Group Limited, Belectric, Ertex Solartechnik GmbH, Dow Solar, Carmanah Technologies Corporation, Dyesol Ltd., Canadian Solar Inc., Scheuten Solar, ML System, Tesla Inc., Wurth Solar, NanoPV Solar Inc., and Solaria Corporation are prime players in the global integrated building photovoltaics market.

The building integrated photovoltaics market is expected to enjoy a CAGR of 18.33% from 2024 to 2032.

Generation of electricity from renewable sources, focus on reducing carbon emissions, and renovation of existing buildings are major drivers of the building integrated photovoltaics market.

Industrial buildings can net high returns for the building integrated photovoltaics market till 2032.

Asia Pacific can dominate the building integrated photovoltaics market.

The building integrated photovoltaics market size is estimated to reach USD 130.61 Billion by 2032.