- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

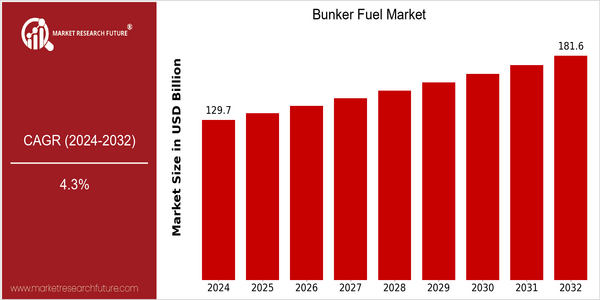

| Year | Value |

|---|---|

| 2024 | USD 129.69 Billion |

| 2032 | USD 181.64 Billion |

| CAGR (2024-2032) | 4.3 % |

Note – Market size depicts the revenue generated over the financial year

The bunker fuel market is growing at a steady rate. The market is expected to reach $181.64 billion by 2032. The growth is projected to be at a CAGR of 4.3% from 2024 to 2032. The rising demand for maritime transportation and the growing need for fuels that are both efficient and compliant are the major reasons for this growth. The shipping industry is still recovering from the impact of the flu pandemic and is expected to grow. The bunker fuel market is expected to grow accordingly. There are several factors that are contributing to the growth of the bunker fuel market. The implementation of the sulfur cap by the International Maritime Organization in 2020 has prompted shipping companies to invest in cleaner fuel alternatives and technologies. Moreover, technological advancements in the fuel industry and the development of low sulfur fuels have a positive impact on the market. ExxonMobil, BP, and Shell are the leading players in the industry. They are focusing on developing strategic initiatives, such as strategic alliances and investment in new fuel technology, to meet the changing needs of the market. These efforts not only meet the regulatory requirements but also help these companies to be the leaders in the transition to more sustainable marine fuels.

Regional Market Size

Regional Deep Dive

The bunker fuel market is characterized by a complex interplay of regulatory frameworks, economic conditions, and technological developments across various regions. In North America, the market is characterized by stricter regulatory frameworks and a shift towards cleaner fuels. Europe has taken the lead in adopting low-sulfur fuels under IMO regulations. Asia-Pacific is experiencing rapid growth driven by the rise in shipping and industrial activity. The Middle East and Africa are focusing on increasing their refining capacities to meet rising demand. Latin America, with its diverse economies, is gradually adopting more sustainable practices, in line with the global trend towards greater environmental responsibility.

Europe

- In the field of the use of substitutes, the Europeans are at the forefront. The European Green Deal, which aims at reducing the CO2 emissions of maritime transport by at least 20 per cent, is a major incentive for Total Energy to develop low-carbon solutions.

- The Port of Rotterdam has launched several projects aimed at becoming a hub for sustainable shipping fuels, including biofuels and hydrogen, which are expected to reshape the bunker fuel landscape in Europe.

Asia Pacific

- China's increasing maritime trade and investments in port infrastructure are driving the demand for bunker fuel, with state-owned enterprises like Sinopec expanding their production capabilities to meet this growing need.

- The region is also witnessing a surge in the adoption of scrubber technology among shipping companies, as they seek to comply with international regulations while continuing to use high-sulfur fuel oil.

Latin America

- Countries like Brazil and Mexico are beginning to implement stricter environmental regulations, which are pushing local companies to explore cleaner bunker fuel alternatives and invest in research and development.

- The Panama Canal expansion has significantly increased shipping traffic in the region, leading to a higher demand for bunker fuel and prompting local suppliers to enhance their service offerings.

North America

- North American ports are investing in the installation of the necessary equipment to accommodate low-sulfur bunker fuels. ExxonMobil and Chevron are at the forefront in developing these fuels.

- The U.S. Coast Guard has increased its focus on enforcing compliance with environmental regulations, which has led to a rise in demand for cleaner bunker fuels and innovative technologies aimed at reducing emissions from shipping.

Middle East And Africa

- The Middle East is enhancing its refining capabilities, with projects like the expansion of the Jazan Economic City in Saudi Arabia aimed at increasing the production of high-quality bunker fuels to cater to both regional and global markets.

- In Africa, the establishment of the African Continental Free Trade Area (AfCFTA) is expected to boost intra-regional shipping activities, thereby increasing the demand for bunker fuel across the continent.

Did You Know?

“Did you know that the shipping industry accounts for approximately 2-3% of global greenhouse gas emissions, prompting significant regulatory changes aimed at reducing the environmental impact of bunker fuels?” — International Maritime Organization (IMO)

Segmental Market Size

The bunker market is currently stable, and is an essential component of both maritime shipping and energy production. The demand for bunkers is primarily driven by the increasing activity in world trade and the need for cost-effective solutions in maritime operations. In addition, sulfur-emission regulations, such as the IMO 2020 sulfur cap, will push the industry towards cleaner alternatives, which will affect the use of bunker fuels. The shift towards low-sulfur bunker fuels is currently at a stage of limited implementation, with the larger shipping companies such as Maersk and MSC taking the lead. The main use of low-sulfur bunker fuels is to power large container ships and bulk carriers, where the compliance with regulations is of particular importance. The trend towards decarbonization and sustainability is also a driving force in the industry, as companies seek to align with international climate goals. Scrubbers and alternative fuels such as LNG and biofuels will shape the industry’s development and create opportunities for cleaner maritime operations.

Future Outlook

The bunker-oil market is slated for significant growth from 2024 to 2032, with an estimated value increase from $129 billion to $181 billion, reflecting a CAGR of 4.3%. This growth is due to the rising demand for maritime transport, which is expected to increase as world trade continues to expand. The International Maritime Organization’s (IMO) regulations to reduce sulfur emissions are also driving the shift toward low-sulfur bunker fuels, which is also driving market growth. By 2032, low-sulfur bunker oil is expected to make up more than 50% of total bunker-fuel consumption, as shipping companies respond to the IMO’s stricter regulations and strive to enhance their reputations for sustainable practices. Also, technological advancements in the production of fuels and the development of alternative fuels such as natural gas and biofuels are expected to change the industry. These innovations not only provide cleaner fuels, but they also align with the decarbonization trend in the shipping industry. The emergence of digitalization and smart-shipping technology will also enable the optimization of fuel consumption and reduce operating costs. As the market evolves, it is crucial for industry players to remain agile, and to be able to respond quickly to regulatory changes and technological advancements in order to capitalize on emerging opportunities in this dynamic industry.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 112.90 Billion |

| Market Size Value In 2023 | USD 124.35 billion |

| Growth Rate | 4.32 % (2022-2030) |

Bunker Fuel Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.