Rising Incidence of Burns

The increasing incidence of burns, particularly in households and workplaces, appears to be a primary driver for the Burn Gel and Burn Dressing Market. According to health statistics, burn injuries account for a substantial number of emergency room visits annually. This trend is likely to escalate demand for effective burn treatment solutions, including gels and dressings. The prevalence of cooking accidents, industrial mishaps, and fire-related incidents contributes to this rise. As awareness of proper burn care grows, consumers are more inclined to seek out specialized products, thereby expanding the market. The need for immediate and effective treatment options is crucial, as timely intervention can significantly reduce recovery time and improve outcomes for burn victims. Consequently, the market is poised for growth as healthcare providers and consumers alike prioritize effective burn management solutions.

Advancements in Product Formulation

Innovations in product formulation are likely to play a pivotal role in shaping the Burn Gel and Burn Dressing Market. Recent developments in the formulation of burn gels and dressings have led to enhanced efficacy and safety profiles. For instance, the incorporation of natural ingredients and advanced polymers has shown promise in improving healing rates and reducing pain. Market data indicates that products with superior absorption and antimicrobial properties are gaining traction among consumers. This trend suggests a shift towards more sophisticated and effective treatment options, which could potentially drive market growth. As manufacturers invest in research and development to create next-generation products, the competitive landscape is expected to evolve. The introduction of novel formulations that cater to diverse consumer needs may further stimulate demand, positioning the market for sustained expansion in the coming years.

Growing Focus on Wound Care Management

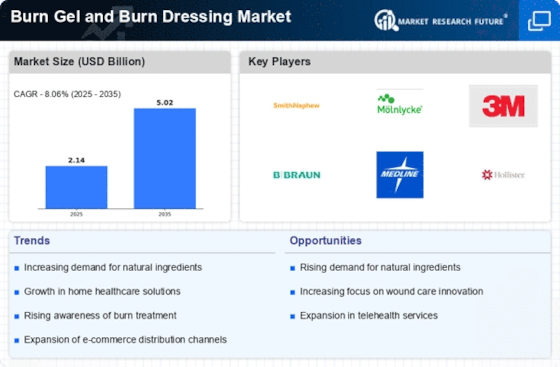

The increasing emphasis on comprehensive wound care management is emerging as a significant driver for the Burn Gel and Burn Dressing Market. Healthcare professionals are recognizing the importance of specialized products in promoting optimal healing and preventing complications. This focus is reflected in the rising adoption of advanced wound care protocols that incorporate burn gels and dressings. Market analysis suggests that The Burn Gel and Burn Dressing is projected to witness substantial growth, with burn care products being a key segment. As healthcare systems prioritize patient outcomes, the demand for effective burn treatment solutions is likely to rise. Furthermore, educational initiatives aimed at improving awareness of proper burn care practices are expected to enhance consumer confidence in using these products. This trend indicates a robust market potential as stakeholders increasingly invest in effective wound management strategies.

Rising Consumer Demand for Natural Products

The growing consumer preference for natural and organic products is emerging as a notable driver for the Burn Gel and Burn Dressing Market. As individuals become more health-conscious, there is a marked shift towards products that are perceived as safer and more effective. Market Research Future indicates that consumers are increasingly seeking burn gels and dressings formulated with natural ingredients, such as aloe vera and herbal extracts. This trend suggests a potential for market expansion as manufacturers respond to consumer demands by developing products that align with these preferences. Furthermore, the rise of e-commerce platforms has facilitated access to a wider range of natural burn care products, enhancing consumer choice. As the market adapts to these evolving preferences, the emphasis on natural formulations is likely to shape the future landscape of burn treatment solutions.

Increased Investment in Healthcare Infrastructure

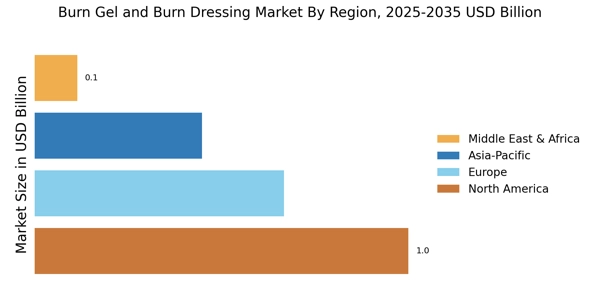

The ongoing investment in healthcare infrastructure is likely to bolster the Burn Gel and Burn Dressing Market. Governments and private entities are channeling resources into enhancing healthcare facilities, particularly in regions with high burn injury rates. This investment is expected to improve access to quality burn care products, including gels and dressings. Market data suggests that as healthcare facilities expand and modernize, the demand for advanced burn treatment solutions will increase correspondingly. Additionally, the establishment of specialized burn units and clinics is anticipated to create a more favorable environment for the adoption of innovative products. As healthcare systems evolve, the emphasis on providing comprehensive burn care services is likely to drive market growth. This trend underscores the importance of aligning product offerings with the needs of an expanding healthcare landscape.

Leave a Comment