Rising Business Travel Activities

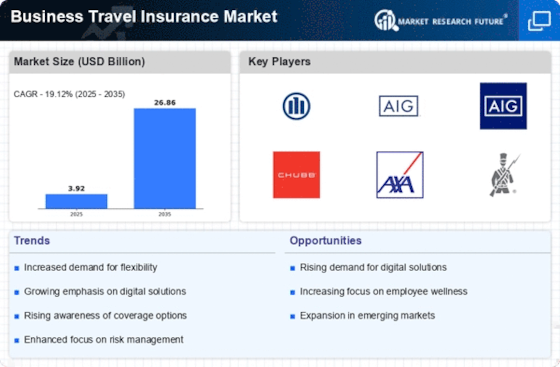

The Business Travel Insurance Market is experiencing a notable surge in business travel activities as companies expand their operations internationally. This increase in travel necessitates comprehensive insurance coverage to protect employees from unforeseen events. According to recent data, the number of business trips is projected to rise by approximately 20% over the next five years. This trend indicates a growing recognition among organizations of the importance of safeguarding their workforce while traveling. As businesses prioritize employee well-being, the demand for tailored insurance solutions is likely to escalate, thereby driving growth in the Business Travel Insurance Market.

Increased Awareness of Travel Risks

There is a growing awareness among businesses regarding the various risks associated with travel, which is significantly impacting the Business Travel Insurance Market. Companies are increasingly recognizing that travel can expose employees to health risks, accidents, and other unforeseen events. This heightened awareness is prompting organizations to prioritize travel insurance as a critical component of their risk management strategies. Data suggests that nearly 60% of companies are now investing in comprehensive travel insurance policies to safeguard their employees. This trend indicates a shift towards a more proactive approach in managing travel-related risks, thereby driving demand within the Business Travel Insurance Market.

Regulatory Compliance and Legal Requirements

The Business Travel Insurance Market is significantly influenced by the evolving regulatory landscape surrounding travel insurance. Many countries are implementing stricter regulations that mandate businesses to provide adequate insurance coverage for their traveling employees. This regulatory push is compelling organizations to invest in comprehensive travel insurance policies to ensure compliance and mitigate potential legal liabilities. As a result, the market is witnessing an uptick in demand for insurance products that meet these regulatory standards. The need for compliance not only protects employees but also enhances the reputation of businesses, thereby contributing to the growth of the Business Travel Insurance Market.

Technological Integration in Insurance Services

The integration of technology into the Business Travel Insurance Market is transforming how insurance services are delivered and managed. Innovations such as mobile applications and online platforms are enhancing accessibility and convenience for businesses and their employees. These technological advancements allow for real-time policy management, claims processing, and customer support, which are increasingly valued by organizations. As businesses seek efficient solutions to streamline their travel insurance processes, the demand for tech-enabled insurance products is likely to grow. This trend not only improves customer experience but also positions companies to respond swiftly to travel-related incidents, thereby fostering growth in the Business Travel Insurance Market.

Customization and Flexibility in Insurance Offerings

The Business Travel Insurance Market is witnessing a trend towards customization and flexibility in insurance offerings. Businesses are increasingly seeking tailored insurance solutions that cater to their specific travel needs and employee profiles. This demand for personalized insurance products is driven by the diverse nature of business travel, which varies across industries and regions. Insurers are responding by developing flexible policies that allow organizations to select coverage options that align with their unique requirements. This trend towards customization not only enhances employee satisfaction but also ensures that businesses are adequately protected during travel, thereby propelling growth in the Business Travel Insurance Market.