Rising Security Concerns

The The biometric ATM market in Canada is experiencing growth driven by increasing security concerns among consumers and financial institutions. in Canada is experiencing growth driven by increasing security concerns among consumers and financial institutions. With the rise in identity theft and fraud, banks are seeking advanced solutions to protect their customers' financial information. Biometric technologies, such as fingerprint and facial recognition, offer enhanced security features that traditional PIN-based systems cannot match. According to recent data, financial institutions that have adopted biometric systems report a reduction in fraud incidents by up to 30%. This heightened focus on security is likely to propel the biometric atm market forward, as more banks invest in these technologies to safeguard their operations and customer trust.

Technological Advancements

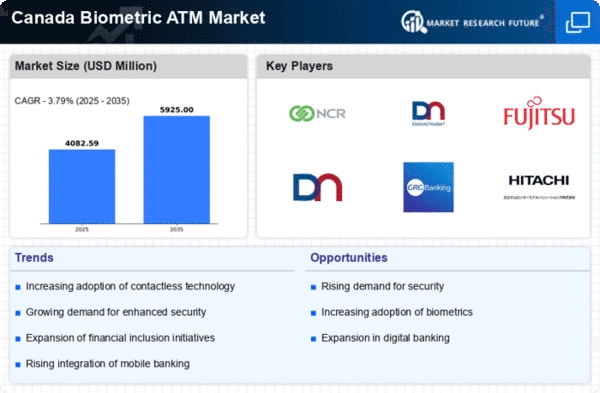

Technological advancements play a crucial role in the expansion of the biometric atm market in Canada. Innovations in biometric recognition technologies, such as improved algorithms and faster processing speeds, are making these systems more efficient and user-friendly. The integration of artificial intelligence and machine learning is enhancing the accuracy of biometric systems, thereby increasing their reliability. As a result, financial institutions are more inclined to invest in these advanced solutions. The market is projected to grow at a CAGR of 15% over the next five years, indicating a strong trend towards the adoption of cutting-edge biometric technologies in ATMs.

Consumer Demand for Convenience

The biometric atm market in Canada is also being driven by consumer demand for convenience and faster transaction processes. Customers increasingly prefer quick and seamless banking experiences, and biometric authentication provides a solution that eliminates the need for remembering complex PINs. This shift in consumer behavior is prompting banks to adopt biometric systems to enhance customer satisfaction. A survey indicated that 70% of consumers are more likely to use ATMs equipped with biometric features due to the ease of access. As banks respond to this demand, the biometric atm market is expected to see significant growth in the coming years.

Regulatory Compliance and Standards

Regulatory compliance is a significant driver for the biometric atm market in Canada. Financial institutions are required to adhere to strict regulations regarding data protection and customer privacy. Biometric systems offer a way to enhance compliance with these regulations by providing secure and verifiable methods of customer identification. The Canadian government has been actively promoting the adoption of biometric technologies to improve security in the financial sector. As banks strive to meet these regulatory requirements, the demand for biometric ATMs is likely to increase, further propelling the market's growth.

Competitive Pressure Among Financial Institutions

The competitive landscape among financial institutions in Canada is intensifying, which is driving the biometric atm market. Banks are increasingly looking for ways to differentiate themselves and attract customers. The implementation of biometric ATMs is seen as a strategic move to enhance service offerings and improve customer loyalty. As more institutions adopt these technologies, others are compelled to follow suit to remain competitive. This trend is expected to lead to a rapid increase in the number of biometric ATMs deployed across Canada, thereby expanding the overall market.