Rising Cybersecurity Threats

The cloud encryption market is also being propelled by the rising cybersecurity threats faced by organizations in Canada. With the increasing sophistication of cyberattacks, businesses are recognizing the necessity of robust encryption solutions to protect sensitive data stored in the cloud. Reports indicate that cybercrime costs Canadian businesses over $3 billion annually, highlighting the urgent need for effective security measures. As a result, organizations are investing heavily in cloud encryption technologies to mitigate risks associated with data breaches and unauthorized access. This heightened awareness of cybersecurity risks is likely to drive the market's growth, as companies seek to implement comprehensive security strategies that include encryption as a fundamental component.

Growing Adoption of Cloud Services

The cloud encryption market is witnessing growth due to the increasing adoption of cloud services among Canadian enterprises. As organizations migrate their operations to the cloud, the need for securing sensitive information becomes paramount. According to recent statistics, approximately 70% of Canadian businesses are utilizing cloud services, which necessitates the implementation of encryption solutions to safeguard data. This trend is further supported by the fact that the cloud services market in Canada is projected to reach $12 billion by 2025. Consequently, the demand for cloud encryption solutions is expected to rise, as businesses prioritize data protection in their cloud strategies. This shift towards cloud adoption is likely to create new opportunities for encryption providers, enhancing the overall market landscape.

Increasing Regulatory Requirements

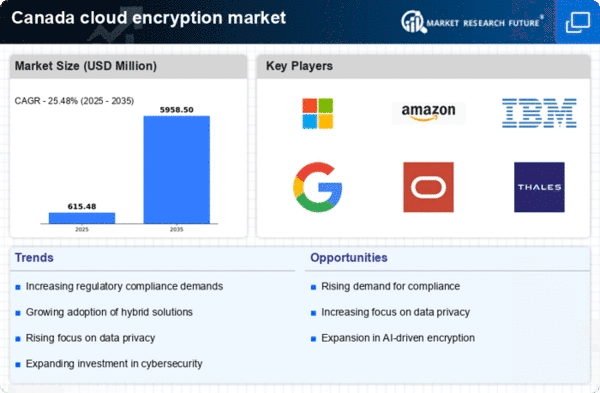

The cloud encryption market in Canada is experiencing a surge in demand due to increasing regulatory requirements. Organizations are compelled to comply with various data protection laws, such as the Personal Information Protection and Electronic Documents Act (PIPEDA). This legislation mandates stringent measures for safeguarding personal data, thereby driving the adoption of encryption solutions. As businesses strive to meet compliance standards, the market for cloud encryption is projected to grow significantly. In fact, it is estimated that the market could reach a valuation of $1.5 billion by 2026, reflecting a compound annual growth rate (CAGR) of approximately 15%. This trend indicates that organizations are prioritizing data security, which is essential for maintaining customer trust and avoiding hefty fines associated with non-compliance.

Increased Awareness of Data Privacy

In Canada, there is a growing awareness of data privacy issues among consumers and businesses alike, which is significantly influencing the cloud encryption market. As individuals become more conscious of how their data is handled, organizations are compelled to adopt encryption solutions to ensure data confidentiality and integrity. This shift in consumer expectations is prompting businesses to prioritize data protection measures, thereby driving the demand for cloud encryption technologies. Surveys indicate that over 80% of Canadians are concerned about their online privacy, which is likely to push organizations to invest in encryption solutions. This heightened focus on data privacy is expected to foster a more secure environment, ultimately benefiting the cloud encryption market.

Technological Advancements in Encryption Solutions

The cloud encryption market is benefiting from technological advancements that enhance the effectiveness and efficiency of encryption solutions. Innovations such as homomorphic encryption and quantum-resistant algorithms are emerging, providing organizations with more robust options for securing their data in the cloud. These advancements not only improve security but also address performance concerns that have historically hindered encryption adoption. As Canadian businesses seek to leverage cutting-edge technologies, the demand for advanced encryption solutions is likely to increase. This trend suggests that the cloud encryption market will continue to evolve, driven by the need for more sophisticated security measures that can keep pace with the rapidly changing technological landscape.