Global Trade Dynamics

The canada contract logistics market. Changes in trade agreements, tariffs, and international relations can impact logistics operations and supply chain strategies. For instance, the recent updates to the Canada-United States-Mexico Agreement (CUSMA) have implications for cross-border logistics, necessitating adjustments in compliance and operational procedures. As companies navigate these complexities, those that can adapt swiftly to changing trade conditions are likely to thrive. This adaptability is essential for maintaining competitiveness within the Canada contract logistics market, as global trade continues to evolve.

Regulatory Compliance

Regulatory compliance plays a crucial role in shaping the Canada contract logistics market. The government has established various regulations aimed at ensuring safety, environmental sustainability, and fair trade practices. For example, the Transportation of Dangerous Goods Act mandates strict guidelines for the handling and transportation of hazardous materials. Compliance with these regulations not only mitigates risks but also enhances the reputation of logistics providers. As the industry evolves, companies that prioritize adherence to regulatory standards are likely to gain a competitive edge, thereby influencing the overall dynamics of the Canada contract logistics market.

Technological Advancements

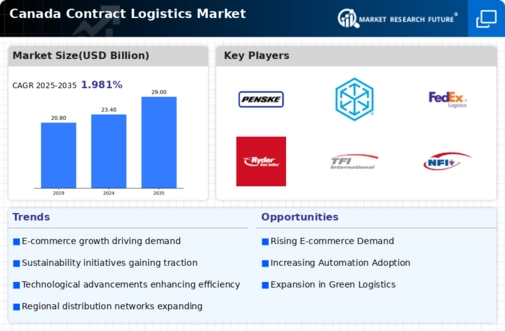

The Canada contract logistics market is experiencing a notable transformation driven by technological advancements. Automation, artificial intelligence, and data analytics are increasingly being integrated into logistics operations. For instance, the adoption of warehouse management systems has improved inventory accuracy and operational efficiency. According to recent data, approximately 60% of logistics companies in Canada have implemented some form of automation, which has led to a reduction in operational costs by up to 20%. This trend is likely to continue as companies seek to enhance their service offerings and streamline processes, thereby positioning themselves competitively within the Canada contract logistics market.

Sustainability and Green Logistics

Sustainability has emerged as a pivotal driver in the Canada contract logistics market. Companies are increasingly adopting green logistics practices to reduce their carbon footprint and meet consumer demand for environmentally friendly solutions. Initiatives such as optimizing transportation routes and utilizing electric vehicles are gaining traction. According to recent reports, approximately 40% of logistics firms in Canada have implemented sustainability measures, which not only enhance their brand image but also lead to cost savings in the long run. This trend is expected to shape the future of the Canada contract logistics market as stakeholders prioritize eco-friendly practices.

Growing Demand for Last-Mile Delivery

The growing demand for last-mile delivery services is significantly impacting the Canada contract logistics market. With the rise of e-commerce, consumers increasingly expect faster and more reliable delivery options. Recent statistics indicate that last-mile delivery accounts for nearly 30% of total logistics costs, prompting companies to innovate their delivery strategies. As urbanization continues to rise, logistics providers are exploring various solutions, such as micro-fulfillment centers and advanced routing technologies, to meet consumer expectations. This shift is likely to drive investment and operational changes within the Canada contract logistics market.