- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

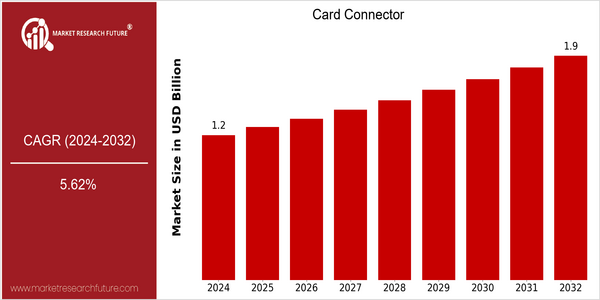

| Year | Value |

|---|---|

| 2024 | USD 1.24 Billion |

| 2032 | USD 1.93 Billion |

| CAGR (2024-2032) | 5.62 % |

Note – Market size depicts the revenue generated over the financial year

The Card Connector Market is expected to reach USD 1.24 billion in 2024 and is estimated to reach USD 1.93 billion by 2032. This growth will be reflected in a CAGR of 5.62% during the forecast period. The increasing demand for compact and efficient electronic devices, along with the increasing adoption of advanced technology such as IoT and 5G, is driving the growth of this market. The industries are developing rapidly, and the need for reliable and high-performance card connectors is also increasing, which will further drive the market. The key players in the card connector market, such as Molex, TE Connectivity, and Amphenol, have taken strategic initiatives such as investment, acquisition, and product launch to enhance their market presence. These companies have collaborated to develop the next generation of card connectors for the automotive and consumer electronics industries. The card connector market is expected to grow steadily, driven by the continuous development of technology and the increasing integration of connection solutions in various industries.

Regional Market Size

Regional Deep Dive

The Card Connectors Market is expected to grow significantly in the coming years, owing to the increasing demand for electronic devices and the technological advancements. In North America, the market is characterized by a strong presence of key players and a focus on innovation, particularly in the automotive and consumer electronics industries. Europe features a regulatory framework that supports the adoption of advanced card connectors. Asia-Pacific is fast emerging as a manufacturing hub, owing to the low cost of production and a growing consumer base. The Middle East and Africa are characterized by a gradual market development, owing to the increasing investment in technology and infrastructure. Latin America, although less developed, is experiencing a growing demand for card connectors, owing to the increasing use of mobile payment systems and smart devices.

Europe

- The European Union's push for sustainability has led to innovations in eco-friendly card connector materials, with companies like Amphenol and Harting leading the charge in developing sustainable solutions.

- The implementation of the General Data Protection Regulation (GDPR) has heightened the focus on data security in card connectors, prompting manufacturers to adopt more secure designs and technologies.

Asia Pacific

- China's rapid urbanization and the growth of its middle class are driving demand for consumer electronics, leading to increased production of card connectors by companies like Foxconn and JAE.

- The region is witnessing significant investments in 5G technology, which is expected to boost the demand for high-speed card connectors, with major telecom companies like Huawei and ZTE actively involved in this transition.

Latin America

- The expansion of mobile banking and digital payment solutions in Brazil is creating a surge in demand for card connectors, with local startups and fintech companies driving innovation in this space.

- Government initiatives aimed at improving digital infrastructure in countries like Mexico are expected to enhance the adoption of card connectors in various sectors, including retail and telecommunications.

North America

- The rise of electric vehicles (EVs) has led to increased demand for specialized card connectors, with companies like TE Connectivity and Molex investing in innovative solutions tailored for the automotive sector.

- Recent regulatory changes in data security standards have prompted manufacturers to enhance the security features of card connectors, with organizations such as the PCI Security Standards Council playing a pivotal role in shaping these developments.

Middle East And Africa

- The UAE's Vision 2021 initiative is fostering technological advancements, leading to increased investments in smart city projects that require advanced card connector solutions.

- The growing adoption of mobile payment systems in Africa is driving demand for secure card connectors, with companies like Interswitch and Flutterwave playing key roles in this transformation.

Did You Know?

“Approximately 70% of all card connectors produced globally are used in consumer electronics, highlighting the critical role they play in everyday devices.” — Market Research Future

Segmental Market Size

The Card Connectors Market is an important segment in the broader electronics and connectivity landscape, currently undergoing a stable growth owing to the increasing demand for compact and efficient electronic devices. Among the key factors driving this market is the rising consumer preference for portable devices such as smartphones and wearables, as well as the ongoing advancements in connectivity technology such as 5G and IoT applications. Also playing a significant role in the market are the various regulations aimed at promoting energy efficiency and a sustainable future. In terms of industry maturity, the Card Connectors Market is currently at a fairly advanced stage of development, with notable players such as Molex and TE Connectivity currently leading the way. In terms of applications, card connectors are primarily used in areas such as consumer electronics, automotive systems, and industrial automation, where a high level of reliability is required. The ongoing trend towards smart devices, and the increasing integration of advanced technology such as artificial intelligence and machine learning, are also driving the market’s growth. In addition, the ongoing trend towards eco-friendly and sustainable products is encouraging manufacturers to develop new, more eco-friendly solutions.

Future Outlook

The card-to-card connection market is expected to see significant growth between 2024 and 2032, from $1.24 billion to $1.93 billion, at a CAGR of 5.6%. The growth is mainly due to the increased adoption of contactless payment solutions and the rising demand for safe and efficient transactions in various sectors, such as retail, banking, and transport. The integration of card-to-card connections into digital wallets and IoT devices will improve the convenience of users and thus drive the penetration rate in the relevant market segments. Meanwhile, the development of chip technology and the implementation of biometrics will also boost the card-to-card connection market. In addition, the favorable policies that encourage digital transactions and financial access will create a favorable environment for market growth. Moreover, the trend towards sustainable payment solutions and the focus on security will also drive the industry, and the companies must continue to develop and change to meet the needs of consumers. The card-to-card connection market is set to thrive, driven by a combination of technological innovation and changing consumer behavior.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 1.1 Billion |

| Market Size Value In 2023 | USD 1.17 Billion |

| Growth Rate | 6.50% (2023-2032) |

Card Connector Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.