- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

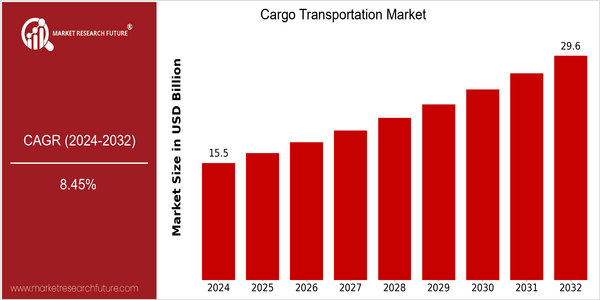

| Year | Value |

|---|---|

| 2024 | USD 15.46 Billion |

| 2032 | USD 29.6 Billion |

| CAGR (2024-2032) | 8.45 % |

Note – Market size depicts the revenue generated over the financial year

The market for cargo transportation is projected to reach a value of $ 15.46 billion in 2024 and $ 29.6 billion in 2032. The growth rate of this market is a robust CAGR of 8.46% during the forecast period. The demand for efficient logistics solutions, mainly driven by the growth of e-commerce and the growing importance of globalization, is the main driving force of this market. The development of new technologies such as automation, the Internet of Things and artificial intelligence also contributes to the growth of this market. The leading companies in the field of cargo transportation, such as DHL, FedEx and Maersk, are actively investing in new technology and forming strategic alliances to enhance their service capabilities. FedEx uses big data and artificial intelligence to optimize delivery routes, while Maersk is developing sustainable shipping solutions to meet the needs of the times. These strategic initiatives not only help these companies compete better, but also help the overall growth of the cargo transportation market, which is in line with the increasing demand for fast and efficient delivery.

Regional Market Size

Regional Deep Dive

The Cargo Transportation Market is experiencing considerable growth in the market across the world. This growth is being driven by increasing trade, technological advancements in logistics, and changing customer preferences. The North American market is characterized by a strong transport network and a high reliance on cargo transportation, while Europe is characterized by strict regulations to promote sustainable development. The Asia-Pacific region is characterized by rapid urbanization and industrialization, which has increased the demand for cargo transportation solutions. The Middle East and Africa are emerging markets with unique challenges and opportunities. Latin America, with its varied economies, is also adapting to new trends in logistics, particularly e-commerce and cross-border trade.

Europe

- The Green Deal in the European Union is pushing for a sharp reduction in transport emissions, which is leading to a significant increase in the investment in electric and hybrid transport vehicles, with Daimler and Volvo being at the forefront of this transition.

- Regulatory changes, such as the introduction of the Mobility Package, are reshaping the logistics landscape by enforcing stricter driving and working time regulations for truck drivers, which is expected to impact operational costs and efficiency.

Asia Pacific

- China's Belt and Road Initiative continues to expand, enhancing connectivity and trade routes across Asia and beyond, which is expected to significantly increase cargo transportation volumes in the region.

- The rise of e-commerce in countries like India and Southeast Asia is driving demand for efficient logistics solutions, prompting companies like Flipkart and Alibaba to invest heavily in their supply chain capabilities.

Latin America

- Brazil's recent regulatory reforms in the transportation sector are aimed at improving the efficiency of cargo transport, particularly in the trucking industry, which is crucial for the country's vast agricultural exports.

- The growth of e-commerce in Latin America, particularly in countries like Mexico and Argentina, is driving demand for innovative logistics solutions, with companies like Mercado Libre investing in their delivery networks.

North America

- The U.S. government has recently invested in infrastructure improvements, including the Infrastructure Investment and Jobs Act, which aims to enhance freight corridors and reduce congestion, thereby boosting the efficiency of cargo transportation.

- Technological innovations such as the adoption of autonomous vehicles and drone deliveries are gaining traction, with companies like Amazon and UPS leading pilot programs that could revolutionize last-mile delivery in urban areas.

Middle East And Africa

- The UAE is positioning itself as a logistics hub with the development of the Dubai Logistics City, which aims to streamline cargo operations and attract global logistics companies, enhancing the region's cargo transportation capabilities.

- Political stability in certain areas, such as Saudi Arabia's Vision 2030 initiative, is leading to increased investments in infrastructure projects, which are expected to improve cargo transport efficiency and connectivity.

Did You Know?

“Approximately 90% of the world's goods are transported by sea, highlighting the critical role of maritime cargo transportation in global trade.” — International Maritime Organization (IMO)

Segmental Market Size

The Cargo Transport Market is currently undergoing steady growth, which is being driven by the growing demand for efficient logistics. The emergence of e-commerce, which requires rapid delivery, is also driving the market. Moreover, the introduction of regulations that support sustainable transport methods is also expected to drive the market. In addition, technological advancements in logistics management and tracking systems are expected to drive the market. At present, the market is at a mature stage of development, with DHL and FedEx leading the way in the implementation of advanced logistics systems. North America and Europe are the regions that are leading the way in terms of the implementation of these systems. The primary applications of the market include last-mile delivery, freight forwarding, and intermodal transportation, whereby companies are utilizing multimodal strategies to optimize their supply chains. The market is also being driven by trends such as the need for sustainable transport and the implementation of regulations that support low-emission transport. Moreover, the implementation of IoT, artificial intelligence, and blockchain technology is reshaping the operational methodologies of the industry, thereby ensuring transparency and efficiency.

Future Outlook

The Cargo Transport Market is expected to increase from $17.4 billion to $29.6 billion by 2032, at a CAGR of 8.56%. The growth of this market is mainly due to the growing need for efficient logistics solutions due to the increase in e-commerce, globalization of supply chains and the need for faster delivery times. The Cargo Transport Market is expected to grow with the penetration of advanced logistics technology reaching over 60% in 2032, compared to the current penetration of about 30% in 2024. Artificial intelligence and the Internet of Things will revolutionize the transport industry. Real-time tracking, data mining and automatic routing will optimize operations and reduce costs. The government's policy to improve the transport system and its green initiatives will also drive the market. Green logistics, electric and driverless vehicles will play a crucial role in shaping the future of the Cargo Transport Market, making it more flexible and responsive to the needs of consumers.

Cargo Transportation Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.