Rising Demand for Healthy Snacks

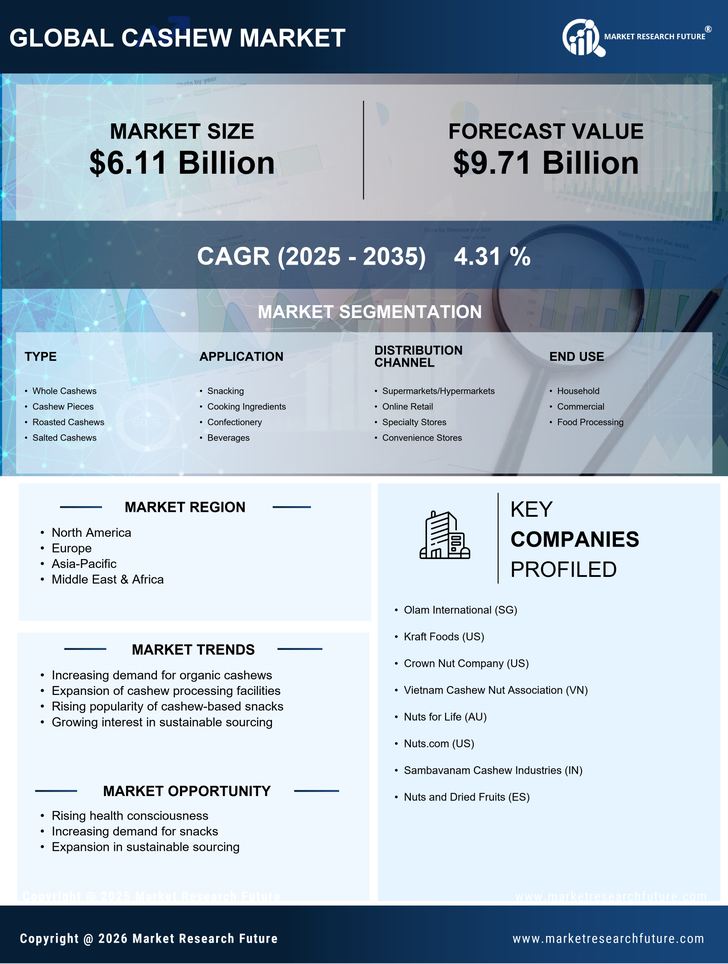

The cashew Market is experiencing a notable increase in demand for healthy snack options. As consumers become more health-conscious, they are gravitating towards nuts, particularly cashews, due to their nutritional benefits. Cashews are rich in healthy fats, protein, and essential minerals, making them an attractive choice for those seeking nutritious snacks. Recent data indicates that The Cashew Market is projected to grow at a compound annual growth rate of approximately 5.5% over the next five years. This trend suggests that the Cashew Market is well-positioned to capitalize on the growing preference for healthier snack alternatives, potentially leading to increased sales and market expansion.

Expansion of Vegan and Plant-Based Diets

The Cashew Market is likely to benefit from the rising popularity of vegan and plant-based diets. As more individuals adopt these dietary preferences, the demand for plant-based protein sources is increasing. Cashews serve as an excellent alternative to dairy products, particularly in the production of cashew-based cheeses and creams. Market analysis shows that the plant-based food sector is expected to reach a valuation of over 74 billion dollars by 2027. This growth indicates a substantial opportunity for the Cashew Market to expand its product offerings and cater to a broader audience seeking plant-based options.

Growing Awareness of Nutritional Benefits

The Cashew Market is benefiting from a growing awareness of the nutritional benefits associated with cashew consumption. Educational campaigns and health-focused marketing strategies are effectively informing consumers about the advantages of incorporating cashews into their diets. Research indicates that cashews can aid in weight management, heart health, and overall well-being. This heightened awareness is driving consumer interest and demand, leading to an increase in sales within the Cashew Market. As more individuals recognize the health benefits of cashews, the industry is likely to experience sustained growth and expansion.

Sustainability and Ethical Sourcing Trends

The Cashew Market is increasingly influenced by sustainability and ethical sourcing trends. Consumers are becoming more discerning about the origins of their food, leading to a demand for products that are sourced responsibly. The cashew supply chain is evolving to meet these expectations, with many producers adopting sustainable farming practices and fair trade certifications. This shift not only appeals to environmentally conscious consumers but also enhances brand loyalty. Market data suggests that products with sustainability certifications can command higher prices, indicating a potential for increased profitability within the Cashew Market as it aligns with consumer values.

Innovations in Cashew Processing Techniques

The Cashew Market is witnessing advancements in processing techniques that enhance product quality and efficiency. Innovations such as improved roasting methods and packaging technologies are contributing to better flavor retention and shelf life of cashew products. These developments not only improve the overall consumer experience but also reduce waste during production. Furthermore, the introduction of automated processing equipment is streamlining operations, potentially lowering production costs. As the industry embraces these innovations, it is likely to see increased competitiveness and profitability, thereby attracting more investment and interest in the Cashew Market.