- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

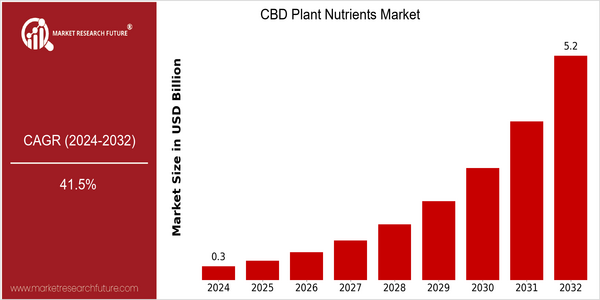

| Year | Value |

|---|---|

| 2024 | USD 0.326 Billion |

| 2032 | USD 5.25 Billion |

| CAGR (2024-2032) | 41.5 % |

Note – Market size depicts the revenue generated over the financial year

The CBD plant nutrients market is poised for remarkable growth, with the current market size estimated at USD 0.326 billion in 2024 and projected to surge to USD 5.25 billion by 2032. This impressive growth trajectory reflects a compound annual growth rate (CAGR) of 41.5% over the forecast period. Such rapid expansion can be attributed to the increasing adoption of CBD in various sectors, including agriculture, wellness, and cosmetics, driven by a growing consumer awareness of the benefits associated with CBD products. Additionally, the legalization of cannabis in several regions has further catalyzed market demand, as more growers seek specialized nutrients to optimize their CBD yields. Technological advancements in nutrient formulations and delivery systems are also playing a crucial role in this market's evolution. Innovations such as slow-release fertilizers and organic nutrient blends are enhancing the efficiency of CBD cultivation, thereby attracting more farmers and producers. Key players in the industry, such as Advanced Nutrients and General Hydroponics, are actively investing in research and development to create tailored nutrient solutions for CBD plants. Strategic partnerships and collaborations, such as those between nutrient manufacturers and agricultural technology firms, are expected to further bolster market growth, ensuring that the CBD plant nutrients market remains a dynamic and rapidly evolving sector.

Regional Market Size

Regional Deep Dive

The CBD Plant Nutrients Market is experiencing significant growth across various regions, driven by increasing consumer awareness of the benefits of CBD in agriculture and horticulture. In North America, particularly the United States, the market is characterized by a robust regulatory framework that supports the cultivation of hemp and the use of CBD products. In Europe, the market is influenced by diverse regulations across countries, with some nations leading in organic farming practices. The Asia-Pacific region is witnessing a surge in demand due to the rising popularity of CBD in wellness and health products, while the Middle East and Africa are gradually opening up to CBD cultivation, influenced by changing perceptions and regulatory shifts. Latin America is also emerging as a potential market, driven by favorable agricultural conditions and increasing interest in sustainable farming practices.

Europe

- The European Union has implemented regulations that allow for the use of CBD in agricultural practices, with countries like Germany and the Netherlands leading in research and development of CBD plant nutrients.

- The rise of organic farming in Europe has prompted companies like Biobizz to create specialized CBD nutrient lines, reflecting the region's commitment to sustainability and health.

Asia Pacific

- Countries like Australia and New Zealand are witnessing a growing acceptance of CBD, with regulatory bodies like the Therapeutic Goods Administration (TGA) paving the way for the use of CBD in agriculture.

- Innovative startups in the region, such as Cannasouth in New Zealand, are focusing on developing high-quality CBD plant nutrients tailored to local agricultural practices.

Latin America

- Countries like Colombia are emerging as key players in the CBD market, with government initiatives supporting hemp cultivation and companies like Khiron Life Sciences leading in the development of CBD plant nutrients.

- The region's favorable climate for hemp cultivation is attracting international investments, which is expected to enhance the availability of CBD plant nutrients.

North America

- The U.S. has seen a surge in CBD plant nutrient products due to the 2018 Farm Bill, which legalized hemp cultivation, leading to increased investment from companies like Scotts Miracle-Gro and Aurora Cannabis.

- Innovations in nutrient formulations, such as organic and bio-based products, are being developed by companies like Advanced Nutrients, catering to the growing demand for sustainable agriculture.

Middle East And Africa

- The UAE has recently introduced regulations that allow for the cultivation of hemp, which is expected to boost the CBD plant nutrients market, with companies like Emirates Bio Farm leading the charge.

- Cultural shifts towards acceptance of CBD for wellness are being observed, with local governments exploring the economic benefits of hemp cultivation.

Did You Know?

“In the U.S., the CBD market is projected to reach $20 billion by 2024, driven largely by the agricultural sector's adoption of CBD plant nutrients.” — Brightfield Group

Segmental Market Size

The CBD Plant Nutrients Market is experiencing robust growth, driven by increasing consumer awareness of sustainable agriculture and the benefits of CBD in enhancing plant health. Key factors propelling demand include the rising popularity of organic farming practices and the regulatory push towards natural fertilizers. Companies like Advanced Nutrients and General Hydroponics are at the forefront, providing innovative nutrient solutions tailored for CBD cultivation. Currently, the market is in a mature adoption stage, with significant uptake in regions such as North America and Europe, where regulatory frameworks support CBD cultivation. Primary applications include nutrient formulations for hydroponic systems and soil-based cultivation, enhancing yield and quality of CBD-rich plants. Trends such as the shift towards eco-friendly farming and the growing emphasis on health and wellness are catalyzing market expansion. Technologies like precision agriculture and biostimulants are shaping the segment's evolution, enabling more efficient nutrient delivery and improved crop resilience.

Future Outlook

The CBD Plant Nutrients Market is poised for remarkable growth from 2024 to 2032, with a projected market value soaring from $0.326 billion to $5.25 billion, reflecting a robust compound annual growth rate (CAGR) of 41.5%. This explosive growth is driven by increasing consumer awareness of the benefits of CBD in agriculture, particularly in enhancing plant health and yield. As more farmers and cultivators recognize the advantages of integrating CBD plant nutrients into their practices, penetration rates are expected to rise significantly, potentially reaching over 30% of the agricultural nutrient market by 2032. Key technological advancements, such as the development of bioavailable CBD formulations and precision agriculture techniques, will further propel market expansion. Additionally, supportive regulatory frameworks and growing acceptance of CBD products in various regions will create a conducive environment for market players. Emerging trends, including the rise of organic farming and sustainable agricultural practices, are likely to shape consumer preferences, leading to increased demand for eco-friendly CBD nutrient solutions. As the market evolves, stakeholders must remain agile to capitalize on these trends and leverage data-driven insights to inform their strategies.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 0.15 Billion |

| Market Size Value In 2023 | USD 0.22 Billion |

| Growth Rate | 48.46% (2023-2032) |

CBD Plant Nutrients Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.