Global Chemical Licensing Market Overview

The Chemical Licensing Market Size was estimated at 17.55 (USD Billion) in 2024. The Chemical Licensing Industry is expected to grow from 18.41 (USD Billion) in 2025 to 28.25 (USD Billion) by 2034. The Chemical Licensing Market CAGR (growth rate) is expected to be around 4.87% during the forecast period (2025 - 2034).

Key Chemical Licensing Market Trends Highlighted

Key market drivers for the Chemical Licensing Market include increasing R&D expenditure by pharmaceutical and biotechnology companies, rising demand for novel and innovative therapies, and government initiatives to promote innovation. Emerging biopharmaceutical companies are also driving demand for chemical licensing as they seek access to novel technologies and expertise. Advancements in computational chemistry, artificial intelligence (AI), and machine learning (ML) are creating new opportunities for the discovery and development of novel chemical entities, further fueling market growth. The trend toward personalized medicine and targeted therapies is also driving demand for specialized chemical entities, leading to increased licensing activity.

Additionally, the increasing prevalence of chronic diseases and the emergence of new infectious diseases are creating a need for new chemical therapies, stimulating the chemical licensing market.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Chemical Licensing Market Drivers

Increasing Demand for Specialty Chemicals

The chemical licensing market is primarily driven by the increasing demand for specialty chemicals across various end-use industries. Specialty chemicals are high-value-added chemicals used in a wide range of applications, including automotive, aerospace, electronics, and pharmaceuticals. The growing demand for these chemicals is attributed to the increasing complexity and sophistication of products in these industries.

Specialty chemicals offer unique properties that enable manufacturers to enhance the performance, durability, and efficiency of their products.As a result, the demand for chemical licensing is expected to rise significantly in the coming years as companies seek access to innovative and specialized chemical technologies to meet the evolving needs of their customers. The Chemical Licensing Market Industry is expected to witness substantial growth due to the increasing demand for specialty chemicals.

Growing Adoption of Bio-based Chemicals

Another key driver of the Chemical Licensing Market Industry is the growing adoption of bio-based chemicals. Bio-based chemicals are derived from renewable resources, such as plant biomass and agricultural waste, and offer a sustainable alternative to traditional petrochemical-based chemicals. The use of bio-based chemicals has gained traction due to increasing environmental concerns and the need to reduce the carbon footprint of various industries.Chemical companies are investing in research and development to develop and commercialize bio-based chemicals, which is expected to drive the demand for chemical licensing agreements.

The Chemical Licensing Market Industry is expected to witness substantial growth due to the growing adoption of bio-based chemicals.

Advancements in Chemical Process Technologies

The Chemical Licensing Market Industry is also driven by advancements in chemical process technologies. The development of new and innovative chemical processes enables companies to produce chemicals more efficiently and cost-effectively. These advancements include the use of catalysts, enzymes, and novel reactor designs. The adoption of these technologies allows chemical companies to improve their production yields, reduce energy consumption, and minimize waste generation.As a result, companies are increasingly seeking to license these advanced chemical process technologies to gain a competitive advantage in the market.

The Chemical Licensing Market Industry is expected to witness substantial growth due to advancements in chemical process technologies.

Chemical Licensing Market Segment Insights

Chemical Licensing Market Product Type Insights

Product Type holds a significant share in the market, driven by the increasing demand for various chemical substances across diverse industries. Technical Grade Chemicals are widely used in industrial applications such as manufacturing, construction, and mining. Their cost-effectiveness and versatility contribute to their high demand. The segment held a market value of USD 4.2 billion in 2023 and is projected to grow steadily in the coming years. AR/GR Grade Chemicals are essential in research and development, particularly in the pharmaceutical and biotechnology sectors.Their high purity levels are crucial for accurate experimentation and analysis.

The segment is expected to witness significant growth due to the increasing investment in research activities. Bulk Chemicals are produced in large quantities for use in various industries, including plastics, fertilizers, and detergents. The segment accounted for a substantial market share of USD 5.1 billion in 2023 and is anticipated to maintain its dominance throughout the forecast period. Fine Chemicals are specialized chemicals used in the production of pharmaceuticals, agrochemicals, and other high-value products.Their complex synthesis and high-purity requirements drive the demand for fine chemicals.

The segment is projected to expand at a steady pace, driven by the growth of the pharmaceutical industry. Specialty Chemicals are tailored to meet specific performance requirements in various applications, such as coatings, adhesives, and electronics. Their unique properties and ability to enhance product performance contribute to the growth of this segment. The market value of specialty chemicals is estimated to reach USD 3.8 billion by 2032.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review Chemical Licensing Market Application Insights

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review Chemical Licensing Market Application Insights

The Chemical Licensing Market is segmented into various applications, including Pharmaceuticals, Agrochemicals, Cosmetics, Personal Care, Industrial, and Automotive. The Pharmaceuticals segment is expected to account for the largest share of the market in 2023, driven by the growing demand for new and innovative drugs and therapies. The Agrochemicals segment is also expected to experience significant growth as the demand for crop protection products increases. The Cosmetics Personal Care segment is expected to benefit from the rising demand for natural and organic products.The Industrial segment is expected to grow steadily, driven by the demand for chemicals used in manufacturing processes.

The Automotive segment is expected to experience modest growth as the demand for lightweight and fuel-efficient vehicles increases.

Chemical Licensing Market IP Type Insights

The Chemical Licensing Market is segmented by IP Type into Patent Licensing, Copyright Licensing, Trade Secret Licensing, Trademark Licensing, and Design Patent Licensing. Among these, Patent Licensing held the largest market share of 30% in 2023. This dominance can be attributed to the increasing emphasis on protecting intellectual property and the growing trend of companies acquiring patents to gain a competitive edge.

Copyright Licensing is projected to witness the highest CAGR of 5.2% during the forecast period, owing to the rising demand for content protection in the digital age.Trade Secret Licensing is another significant segment, accounting for a market share of 25% in 2023. This segment is expected to grow steadily as companies seek to protect their confidential information and know-how. Trademark Licensing and Design Patent Licensing are also expected to contribute to the overall market growth, albeit at a slower pace compared to the other segments.

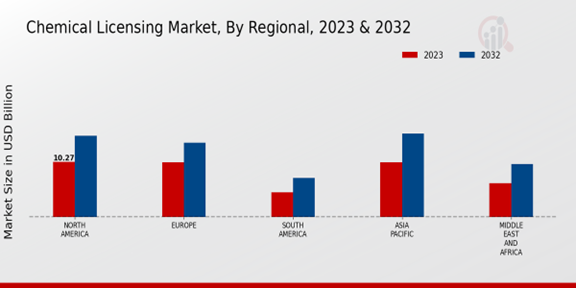

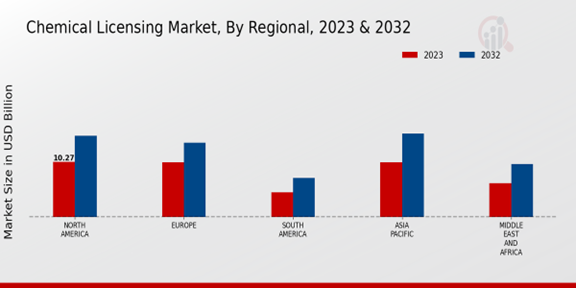

Chemical Licensing Market Regional Insights

The Chemical Licensing Market is segmented into North America, Europe, Asia-Pacific (APAC), South America, and the Middle East and Africa (MEA) based on region. North America held the largest market share in 2023 and is expected to maintain its dominance throughout the forecast period. The growth in this region can be attributed to the increasing demand for chemicals from various industries such as pharmaceuticals, automotive, and electronics.

Europe is the second-largest market for chemical licensing and is expected to witness steady growth over the forecast period.The growth in this region is primarily driven by the presence of a large number of chemical companies and the increasing demand for specialty chemicals. APAC is expected to be the fastest-growing region over the forecast period. The growth in this region is attributed to the increasing demand for chemicals from emerging economies such as China and India. South America and MEA are expected to witness moderate growth over the forecast period.

The growth in these regions is driven by the increasing demand for chemicals from various industries such as agriculture and construction.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Chemical Licensing Market Key Players And Competitive Insights

Major players in Chemical Licensing Market industry are constantly innovating and developing new technologies to gain a competitive edge. Leading Chemical Licensing Market players are focusing on expanding their product portfolios and geographical reach to cater to the growing demand for chemical licensing. The Chemical Licensing Market is highly competitive, with a number of established players and new entrants vying for market share. Some of the key players in the Chemical Licensing Market include BASF, Dow, DuPont, Evonik, and SABIC. These companies offer a wide range of chemical licensing services, including technology licensing, process licensing, and product licensing.

The Chemical Licensing Market is expected to witness significant growth in the coming years, driven by the increasing demand for specialty chemicals and the growing need for sustainable chemical technologies.BASF is a leading chemical company that offers a wide range of chemical licensing services. The company has a strong track record of innovation and has developed a number of proprietary technologies that it licenses to other companies.

BASF's chemical licensing business is a key part of its growth strategy, and the company is constantly looking for new opportunities to expand its portfolio.LyondellBasell is a chemical company that offers a wide range of chemical licensing services. The company has a strong focus on sustainability and is committed to developing technologies that reduce the environmental impact of chemical production. LyondellBasell's chemical licensing business is a key part of its growth strategy, and the company is constantly looking for new opportunities to expand its portfolio.

Key Companies in the Chemical Licensing Market Include

- Sumitomo Chemical Company Limited

- LyondellBasell Industries Holdings B.V.

- Mitsubishi Chemical Holdings Corporation

- Air Products and Chemicals, Inc.

Chemical Licensing Industry Developments

-

Q2 2024: Lummus Technology and T.EN secure major ethylene technology licensing contract in China Lummus Technology and Technip Energies announced a joint contract win to license their advanced ethylene production technology to a new mega-scale petrochemical complex in China, marking a significant expansion of Western chemical process licensing in Asia.

-

Q2 2024: BASF licenses new catalyst technology to Indian Oil Corporation BASF announced the successful licensing of its next-generation FCC catalyst technology to Indian Oil Corporation, enabling improved efficiency and lower emissions at IOCL’s flagship refinery.

-

Q3 2024: Honeywell UOP signs licensing agreement with Saudi Aramco for clean fuels project Honeywell UOP secured a technology licensing deal with Saudi Aramco to provide its Ecofining process for a new clean fuels facility, supporting Saudi Arabia’s push for lower-carbon fuel production.

-

Q2 2024: INEOS licenses HDPE process to new U.S. Gulf Coast plant INEOS announced a licensing agreement for its high-density polyethylene (HDPE) process technology to a new U.S. Gulf Coast chemical plant, expanding its technology footprint in North America.

-

Q3 2024: ExxonMobil and SABIC expand chemical licensing partnership in Asia ExxonMobil and SABIC revealed an expanded partnership to license advanced polyolefin production technologies to multiple Asian chemical producers, aiming to meet surging regional demand for specialty plastics.

-

Q2 2024: Dow licenses UNIPOL™ PE Process to new plant in Vietnam Dow announced the licensing of its UNIPOL™ Polyethylene Process to a new Vietnamese petrochemical facility, supporting the country’s growing plastics manufacturing sector.

-

Q3 2024: Clariant signs licensing deal for sunliquid® cellulosic ethanol technology in Brazil Clariant entered into a licensing agreement with a Brazilian biofuels producer to deploy its sunliquid® technology, enabling commercial-scale production of cellulosic ethanol from agricultural residues.

-

Q2 2024: Chevron Phillips Chemical licenses proprietary 1-hexene technology to Chinese JV Chevron Phillips Chemical announced a licensing deal for its proprietary 1-hexene production technology to a new joint venture in China, supporting the country’s growing demand for high-performance plastics.

-

Q3 2024: Technip Energies wins contract to license blue hydrogen technology in Europe Technip Energies secured a contract to license its blue hydrogen production technology to a major European energy company, advancing the region’s decarbonization goals.

-

Q2 2024: Axens licenses advanced bio-naphtha process to Japanese refiner Axens announced a licensing agreement with a leading Japanese refiner for its advanced bio-naphtha production process, supporting Japan’s transition to sustainable fuels.

-

Q3 2024: Shell licenses new olefins process to Middle East petrochemical consortium Shell signed a licensing agreement for its latest olefins production process with a Middle Eastern petrochemical consortium, enabling higher efficiency and lower emissions at the new facility.

-

Q2 2024: Honeywell licenses carbon capture technology to European chemicals group Honeywell announced a licensing deal for its carbon capture technology with a major European chemicals group, supporting the group’s efforts to reduce industrial CO2 emissions.

Chemical Licensing Market Segmentation Insights

Chemical Licensing Market Product Type Outlook

- Technical Grade Chemicals

Chemical Licensing Market Application Outlook

Chemical Licensing Market IP Type Outlook

Chemical Licensing Market Regional Outlook

| Report Attribute/Metric |

Details |

| Market Size 2024 |

17.55 (USD Billion) |

| Market Size 2025 |

18.41 (USD Billion) |

| Market Size 2034 |

28.25 (USD Billion) |

| Compound Annual Growth Rate (CAGR) |

4.87% (2025 - 2034) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year |

2024 |

| Market Forecast Period |

2025 - 2034 |

| Historical Data |

2020 - 2024 |

| Market Forecast Units |

USD Billion |

| Key Companies Profiled |

Shell plc, Solvay, Evonik Industries AG, SABIC, Eastman Chemical Company, The Dow Chemical Company, INEOS Group Limited, BASF SE, Exxon Mobil Corporation, Sumitomo Chemical Company Limited, LyondellBasell Industries Holdings B.V., Mitsubishi Chemical Holdings Corporation, DuPont, Air Products and Chemicals, Inc. |

| Segments Covered |

Product Type, Application, IP Type, Regional |

| Key Market Opportunities |

1. Growing demand for specialty chemicals 2. Rising focus on sustainability 3. Technological advancements 4. Expansion into emerging markets 5. Increasing collaborations and partnerships |

| Key Market Dynamics |

1. Increasing environmental regulations 2. Technological advancements 3. Rising demand for specialty chemicals 4. Growing pharmaceutical industry 5. Expanding applications in various industries |

| Countries Covered |

North America, Europe, APAC, South America, MEA |

Frequently Asked Questions (FAQ):

The Chemical Licensing Market was anticipated to reach a valuation of approximately 17.55 billion USD in 2024.

The Chemical Licensing Market is estimated to grow at a CAGR of around 4.87% from 2025 to 2034.

The Chemical Licensing Market is projected to reach a valuation of approximately 28.25 billion USD by 2034.

The Asia-Pacific region is anticipated to account for the largest share of the Chemical Licensing Market in 2024.

Chemical licensing finds applications in various industries, including pharmaceuticals, agriculture, and manufacturing.

Major players in the Chemical Licensing Market include BASF, Merck, and Dow.

Rising demand for specialty chemicals and increasing investment are among the key factors propelling the growth of the Chemical Licensing Market.

Stringent environmental regulations and intellectual property concerns pose challenges to the Chemical Licensing Market.

Growing demand from emerging economies and advancements in biotechnology present opportunities for expansion in the Chemical Licensing Market.

Sustainability, digitalization, and the rise of bio-based chemicals are key trends influencing the Chemical Licensing Market.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review Chemical Licensing Market Application Insights

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review Chemical Licensing Market Application Insights  Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review