China Ammonia Market Overview

The China Ammonia Market Size was estimated at 9.1 (USD Billion) in 2023. The China Ammonia Industry is expected to grow from 9.56(USD Billion) in 2024 to 16.58 (USD Billion) by 2035. The China Ammonia Market CAGR (growth rate) is expected to be around 5.133% during the forecast period (2025 - 2035).

Key China Ammonia Market Trends Highlighted

The China Ammonia Market is witnessing significant trends driven by the country's increasing industrial demands and environmental regulations. The rising need for ammonia, primarily due to its application in fertilizers, is a crucial market driver as China continues to be a global leader in agricultural production. The focus on food security has led to heightened fertilizer consumption, thus promoting ammonia production. Moreover, the government has been actively encouraging the use of renewable energy sources, which has prompted ammonia production processes to adapt to cleaner technologies. This shift presents opportunities for green ammonia production, aligning with China’s goals for carbon neutrality by 2060.There has recently been an increase in investment in research and development that seeks to improve ammonia synthesis methods and their efficiency, as well as mitigate emissions. Furthermore, with the increase in urbanization and the efforts towards industrial modernization, the demand for chemical substances besides fertilizers, such as those used in the production of synthetic fibers and pharmaceuticals, is almost directly impacting China ammonia market. The focus on local production rather than imports equally brings attention to the need for more effective supply chain management as well as cooperation among other producers. In general, the situation of the China Ammonia Market is in flux, shaped by regulatory policies, new technologies, and changing client demands, which makes the market more active for participants in the sector.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

China Ammonia Market Drivers

Growing Demand for Fertilizers

The China Ammonia Market Industry is significantly driven by the increasing demand for fertilizers, primarily due to the growing agricultural sector in China, which is a major contributor to the national economy. According to the National Bureau of Statistics of China, the total area of arable land in the country is approximately 120 million hectares, with a need for enhanced crop yields to ensure food security for its vast population. Fertilizer consumption has been rising, with ammonia playing a crucial role in boosting agricultural productivity.The Ministry of Agriculture and Rural Affairs (MARA) indicated a steady increase in fertilizer usage of around 1.5% annually, reflecting the ongoing enhancement of agricultural techniques and practices - vital factors propelling the China Ammonia Market. This trend is further supported by government policies encouraging sustainable agriculture, which increases ammonia demand, as it is a key ingredient in nitrogen-based fertilizers, essential for optimal crop growth.

Industrial Applications Growth

The expansion of industrial applications for ammonia, especially in chemical production, is a prominent driver of the China Ammonia Market. As per the China National Chemical Corporation, there has been a notable growth in sectors using ammonia for producing chemicals such as methanol, explosives, and refrigeration. The emerging demand for these ammonia-derived products in various industries showcases a positive trend for ammonia production. Moreover, with China pushing for modernization in its industrial practices, there is an ongoing transition towards more efficient processes, which increases the consumption of ammonia.The chemical industry's output value in China has been projected to increase significantly in the coming years, aligning with the growth in ammonia usage across diverse sectors.

Government Policies Supporting Ammonia Production

China's government has established various policies that promote the development of the ammonia sector, positively impacting the China Ammonia Market Industry. The Ministry of Ecology and Environment demonstrates increasing support for clean and sustainable chemical production approaches, including ammonia, through subsidy programs and emission reduction incentives. The government is actively pushing for the reduction of harmful emissions within industrial processes, which can indirectly elevate ammonia demand as a cleaner alternative within certain applications.The Chinese government's commitment to minimizing environmental impacts while ensuring industrial growth fosters a favorable environment for the ammonia market's expansion, contributing to an estimated CAGR that aligns with the national focus on sustainability.

Innovations in Ammonia Production Technologies

The advancement in ammonia production technologies significantly influences the China Ammonia Market Industry, paving the way for more efficient and environmentally friendly methods. Major organizations, such as the China Petroleum Chemical Corporation, are investing in research and development to innovate production processes, minimizing energy consumption and emissions. Techniques like the Haber-Bosch process enhancements have been increasingly adopted to improve yield while reducing carbon footprints.With China's emphasis on technological advancement in its five-year plans, the ammonia market is poised for growth as these innovations not only promise higher efficiency but also align with the global trend toward sustainability in chemical production, further enhancing the market prospects.

China Ammonia Market Segment Insights

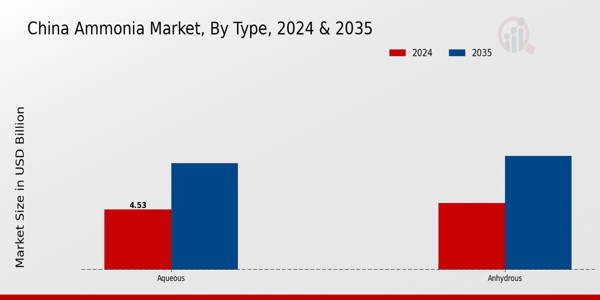

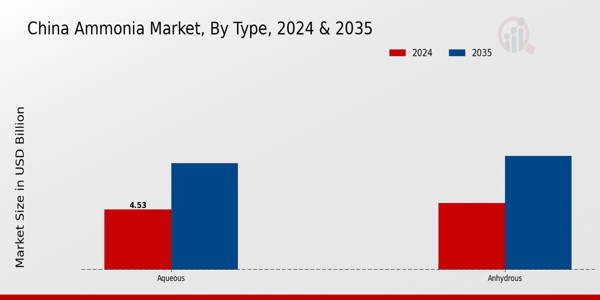

Ammonia Market Type Insights

The Type segment of the China Ammonia Market showcases a dynamic interplay between different forms of ammonia, notably Aqueous and Anhydrous ammonia, both essential to various industrial processes and agricultural applications. Aqueous ammonia, often utilized in cleaning agents and fertilizers, offers an advantageous ease of handling, which contributes to its widespread adoption in the agricultural sector. This segment plays a pivotal role in supporting China's agricultural productivity by serving as an effective nitrogen source, thus enhancing soil fertility and crop yields. Furthermore, it aligns with China's increasing emphasis on sustainable agricultural practices, echoing the government’s push towards modernizing the agricultural sector while reducing environmental impact. On the other hand, Anhydrous ammonia is widely recognized for its high nitrogen content, making it a critical input in the production of nitrogen-based fertilizers. This segment plays a significant role in addressing the growing food demands driven by China's expanding population. The importance of Anhydrous ammonia in facilitating optimal plant growth cannot be understated, as it directly correlates with crop performance and output efficiency. It is particularly favored for its capacity to be injected into the soil during the planting season, ensuring maximized uptake by crops. Both Aqueous and Anhydrous segments contribute to the robust overall growth and diversification of the China Ammonia Market. The diverse nature of ammonia applications across industries such as chemicals, explosives, and wastewater treatment further underscores the expansive potential of these segments, driving innovation and development within the market. The continuous advancements in production technologies also enhance the efficacy and safety of these ammonia types, which are crucial in a market increasingly focused on compliance with environmental standards. As the industry evolves, the Type segment is poised to capitalize on emerging trends focused on sustainable agricultural practices and the demand for high-efficiency fertilizers, thereby shaping the future of the China Ammonia Market.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Ammonia Market End Use Insights

The China Ammonia Market, particularly within the End Use segment, showcases a diverse range of applications that are essential for various industries. The fertilizer sector represents a significant portion of this market due to China's robust agricultural production and the increasing need for food security. Chemicals also play a vital role, as ammonia is a key feedstock in the manufacture of various chemical products, boosting industrial output. The refrigeration industry benefits from ammonia's efficient cooling properties, making it a preferred choice for both domestic and commercial refrigeration systems.In the realms of fibers and plastics, ammonia's utility in synthetic fiber production further underscores its importance in the textile and packaging sectors. Additionally, it finds applications in pharmaceuticals where it's utilized in the synthesis of different compounds. The pulp and paper industry leverages ammonia in processing steps, enhancing the quality of the final product. Overall, each segment illustrates the versatility and necessity of ammonia in supporting various economic activities in China. The market dynamics are driven by growth in manufacturing and a focus on sustainable practices, as well as increasing investments in related infrastructure and technology.

China Ammonia Market Key Players and Competitive Insights

The China Ammonia Market is characterized by dynamic competition and a rapidly evolving landscape, driven by increasing demand for ammonia across various sectors, including agriculture, chemicals, and pharmaceuticals. The market features a blend of large state-owned enterprises and private companies, each striving to enhance their production capabilities, expand their market presence, and innovate product offerings. Competitive insights indicate that players within this market are not only focusing on efficient production processes but are also investing in sustainable technologies to reduce environmental impact. As a result, companies are adopting various strategies such as partnerships, joint ventures, and technology integration to maintain and enhance their competitive edge, striving to meet the growing requirements for ammonia both domestically and internationally.Tianjin Bohai Chemical has established itself as a prominent player in the China Ammonia Market, leveraging its strong production capabilities and strategic locations. The company has focused on optimizing its supply chain and integrating advanced technologies to enhance operational efficiency. Its strengths lie in its robust infrastructure, advanced production methods, and commitment to quality, which enable it to produce high-grade ammonia tailored for diverse industrial applications. The company continuously invests in innovation and research to stay ahead in the competitive landscape, ensuring a steady supply of ammonia to meet the demands of its extensive clientele. Additionally, Tianjin Bohai Chemical has strategically positioned itself as a reliable supplier, building strong relationships with customers, which further bolsters its market presence.Jincheng Anthracite Mining Group is another key player in the China Ammonia Market, renowned for its comprehensive offerings in the production of ammonia and associated products. The company specializes in the extraction and refining of anthracite coal, which serves as a critical raw material for ammonia synthesis. With its significant market presence, Jincheng Anthracite Mining Group stands out due to its strong supply chain management and efficient utilization of resources, allowing for competitive pricing. The company has also engaged in mergers and acquisitions to consolidate its position within the market, expanding its operational capabilities and market reach. This strategic expansion has enabled Jincheng Anthracite Mining Group to enhance its portfolio of products and services, ensuring a comprehensive competitive advantage against its rivals in the China Ammonia Market. Its commitment to sustainable practices and innovation further fortifies its standing in an increasingly environmentally conscious market, allowing the company to meet both current and future demands effectively.

Key Companies in the China Ammonia Market Include

Tianjin Bohai Chemical

Jincheng Anthracite Mining Group

Sinopec

China National Petroleum Corporation

Zhengzhou Aohua Chemical

China National Chemical Corporation

Nutrien

Shandong Hualu Hengsheng Chemical

CF Industries

Jiangsu Huachang Chemical

Hubei Yihua Chemical Industry

Yara International

Lanzhou Chemical

Shandong Fengyuan Chemical

Shaanxi Yanchang Petroleum Group

China Ammonia Market Industry Developments

Recent developments in the China ammonia market indicate heightened activity among key players such as Tianjin Bohai Chemical and Sinopec, particularly amid the ongoing shift towards sustainable practices and the demand for green ammonia. In October 2023, China National Petroleum Corporation announced plans to enhance its ammonia production capacity, aligning with national directives for increased fertilizer output. Further, Jincheng Anthracite Mining Group has been focusing on expanding its chemical processes, which may bolster ammonia availability.Current affairs reveal that Zhengzhou Aohua Chemical has successfully implemented technology upgrades that have improved production efficiency. Meanwhile, Shandong Hualu Hengsheng Chemical is investing in infrastructure to support larger ammonia production units, which could significantly impact supply chains by 2024. Merger activities are notable as CF Industries confirmed its acquisition of Jiangsu Huachang Chemical in September 2023, aiming to strengthen its market position in China. The overall market valuation has seen growth, driven by international trade relations and governmental support for the fertilizer sector, while companies like Hubei Yihua Chemical Industry are expected to benefit from rising domestic demand. The landscape has evolved with various entities also focusing on eco-friendly ammonia production methodologies in response to stringent environmental regulations.

China Ammonia Market Segmentation Insights

Ammonia Market Type Outlook

Ammonia Market End Use Outlook

- Fertilizer

- Chemicals

- Refrigeration

- Fibers and Plastics

- Pharmaceutical

- Pulp and Paper

- Others

Report Scope:,,,,,,,,,,,,,

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2018 |

9.1(USD Billion) |

| MARKET SIZE 2024 |

9.56(USD Billion) |

| MARKET SIZE 2035 |

16.58(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

5.133% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Billion |

| KEY COMPANIES PROFILED |

Tianjin Bohai Chemical, Jincheng Anthracite Mining Group, Sinopec, China National Petroleum Corporation, Zhengzhou Aohua Chemical, China National Chemical Corporation, Nutrien, Shandong Hualu Hengsheng Chemical, CF Industries, Jiangsu Huachang Chemical, Hubei Yihua Chemical Industry, Yara International, Lanzhou Chemical, Shandong Fengyuan Chemical, Shaanxi Yanchang Petroleum Group |

| SEGMENTS COVERED |

Type, End Use |

| KEY MARKET OPPORTUNITIES |

Increasing demand for fertilizers, Expansion of green ammonia technologies, Growth in industrial applications, Rising environmental regulations compliance, Enhanced logistics and distribution networks |

| KEY MARKET DYNAMICS |

growing fertilizer demand, environmental regulations, production cost fluctuations, government policies, technological advancements |

| COUNTRIES COVERED |

China |

Frequently Asked Questions (FAQ) :

The China Ammonia Market is expected to be valued at 9.56 USD Billion in 2024.

By 2035, the China Ammonia Market is projected to reach a value of 16.58 USD Billion.

The anticipated CAGR for the China Ammonia Market from 2025 to 2035 is 5.133%.

Major players in the market include Tianjin Bohai Chemical, Sinopec, and CF Industries.

The Aqueous segment is valued at 4.53 USD Billion, while the Anhydrous segment is valued at 5.03 USD Billion in 2024.

The Aqueous ammonia market is projected to be valued at 8.02 USD Billion by 2035.

The Anhydrous ammonia segment is expected to reach 8.56 USD Billion by 2035.

The primary applications include agricultural fertilizers and chemical manufacturing.

Challenges include environmental regulations and fluctuating raw material costs.

Emerging opportunities include increased demand for sustainable farming and technological advancements in ammonia production.