China Car Rental Market Overview:

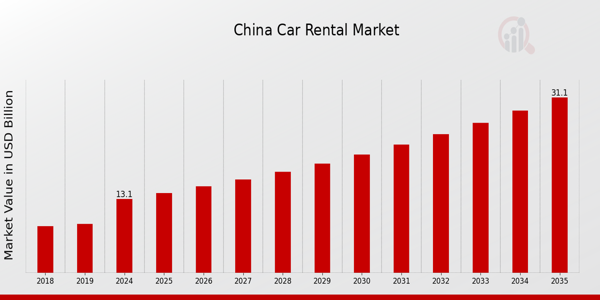

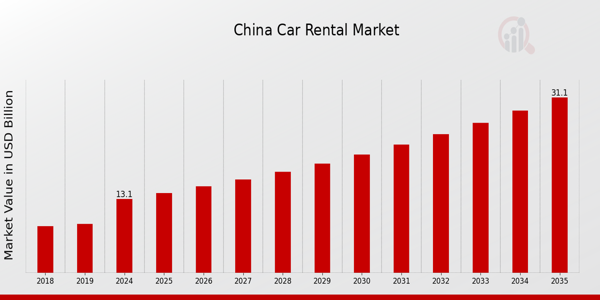

As per MRFR analysis, the China Car Rental Market Size was estimated at 12.2 (USD Billion) in 2023. The China Car Rental Market Industry is expected to grow from 13.1(USD Billion) in 2024 to 31.1 (USD Billion) by 2035. The China Car Rental Market CAGR (growth rate) is expected to be around 8.177% during the forecast period (2025 - 2035).

Key China Car Rental Market Trends Highlighted

In the China car rental market, the rise of digital platforms significantly influences consumer behavior and accessibility. The increasing use of mobile apps to book rentals allows for convenience, appealing especially to the tech-savvy younger generation. This trend shows a move toward a more digitalized rental experience, where customers prefer instant access to cars at their convenience. Additionally, as urbanization continues across Chinese cities, the need for flexible transportation solutions also increases.

This urban shift propels the growth of car rental services, primarily in metropolitan areas where owning a car becomes less viable due to the high costs associated with parking and maintenance. The key market drivers include a spike in domestic tourism as people prefer road trips rather than traditional travel methods. This growth is partially funded by government programs directed towards enhancing highway systems and boosting tourism to China. Additionally, the green movement has caught on full steam, which has resulted in electric cars being added to rental fleets. With consumers becoming more environmentally responsible, rental companies are motivated to broaden their green services. There are untapped opportunities with target users, for example, business clients needing lease services for brief durations, as well as families looking for holiday let houses.

By creating tailored packages and enhancing customer service, rental companies can capture a larger market share. The trend towards sustainability can also be tapped into by developing programs that incentivize the use of eco-friendly vehicles. Overall, the recent emphasis on enhanced customer experience and technological integration positions the China car rental market for continuous growth, reflecting broader economic shifts and changing consumer preferences. As these trends evolve, companies in this space must adapt to maintain competitive advantage.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

China Car Rental Market Drivers

Rapid Urbanization

China is witnessing rapid urbanization, with around 60% of its population now living in urban areas, according to the National Bureau of Statistics of China. This trend continues to drive demand for convenient mobility solutions, including car rentals. The urban population growth creates larger customer bases for the China Car Rental Market Industry, as urban residents seek reliable transportation options for both personal and business needs. Furthermore, the government has been promoting the development of transport infrastructure, which includes enhancing road networks and public transport systems, further facilitating the use of rental vehicles. Organizations involved in urban planning and transportation have recognized the need for adaptable transport options to cater to the growing urban population. Cities such as Beijing and Shanghai have also implemented measures to incentivize rental services, positively impacting market growth.

Technological Advancements

The incorporation of advanced technologies, such as mobile apps and online booking platforms, is transforming the China Car Rental Market Industry. As of 2022, over 80% of car rental transactions in China were conducted through digital platforms, according to data from the Ministry of Industry and Information Technology. This shift not only enhances customer experience but also streamlines operations for rental companies. Established firms like Didi Chuxing and other ride-hailing services are investing in technology to create seamless rental solutions, attracting users who prefer hassle-free booking and vehicle management experiences.The continuous advancements in mobile technology and artificial intelligence are expected to further boost efficiency and customer satisfaction, propelling market growth.

Increase in Disposable Income

With the rising disposable income among the middle-class population in China, there is an increase in spending on rental services. According to the China Statistical Yearbook, the per capita disposable income in urban areas rose by more than 8% annually over the past five years. This economic growth has led to greater consumer confidence and a willingness to spend on travel and leisure activities, including car rentals. Additionally, as domestic tourism continues to grow, more locals are opting for rental cars for vacations and business trips, which has prompted established car rental companies to expand their fleets and services nationwide.This increase in disposable income has stimulated demand for a variety of car rental options, thus driving the growth of the China Car Rental Market Industry.

Government Policies Supporting Shared Mobility

The Chinese government has been actively promoting shared mobility solutions, including car rentals, as part of its broader goal to improve urban traffic and reduce emissions. Recently, national policies have encouraged the development and adoption of car-sharing services. The Ministry of Transport has issued regulations supporting the growth of shared mobility, reflecting a commitment to sustainable transportation solutions. For instance, by 2030, the central government aims for 25% of urban trips to be made using shared mobility options. Established companies in the car rental industry are strategically aligning with these regulations to enhance their services and adopt greener vehicles, thus propelling the growth of the China Car Rental Market Industry as they cater to environmentally conscious consumers.

China Car Rental Market Segment Insights:

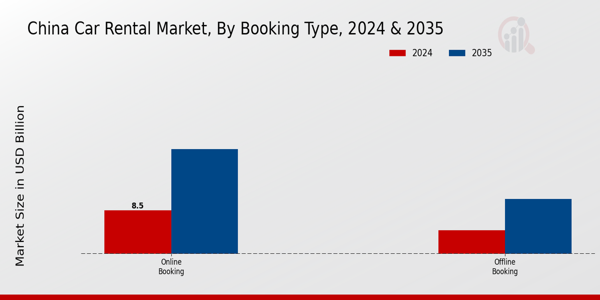

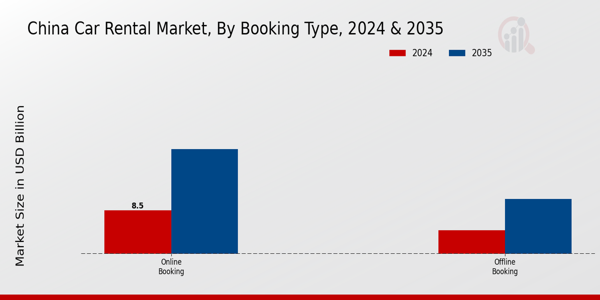

Car Rental Market Booking Type Insights

The China Car Rental Market is experiencing substantial evolution, particularly around the Booking Type segment, which includes both online and offline booking methods. As the digital landscape matures in China, there is a noticeable shift towards online booking due to its convenience, speed, and efficiency. The rise of smartphones and improved internet accessibility contribute to this trend, enabling a higher number of consumers to engage with car rental services through mobile applications and websites. This shift is significant as these platforms not only provide a broader range of options but also facilitate instant comparisons and bookings, enhancing customer satisfaction. Meanwhile, offline booking continues to hold its ground, particularly among older demographics and those who prefer the traditional approach of speaking to an agent.

This method often provides a personal touch and immediate assistance, which can be comforting for certain segments of the population who may be less acquainted with technology. Alongside these dynamics, the China Car Rental Market is witnessing increasing integration of technology in both booking types, with features such as AI chatbots for online inquiries and enhanced data systems for offline services. Companies are taking advantage of data analytics to understand consumer behavior better and accordingly adapt their offerings. In China, where urbanization and domestic travel are peaking, this segment is poised for further development, with an increasing demand for flexibility and varied options.

The competitive landscape is continuously reshaping as new entrants focus on enhancing user experiences through innovative technologies and robust customer support frameworks. Furthermore, promotional offers and loyalty programs significantly impact consumer preferences within this market, driving engagement with both booking methods. The distinct role of different demographic groups further highlights the diverse needs within the booking segment, emphasizing the potential for tailored marketing strategies. As the industry evolves, both online and offline booking systems will likely co-exist, each catering to different segments of the market, showcasing the adaptability of the China Car Rental Market to meet varied consumer demands while factoring in the cultural nuances and travel habits unique to this region.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Car Rental Market Duration Insights

The China Car Rental Market is a dynamic industry with a significant focus on the Duration segment, which includes both Short Term and Long Term rentals. The Short Term segment is gaining traction, driven by urbanization and an increasing number of travelers seeking flexible transport options. This segment is particularly popular among tourists and business professionals who need cars for a few days to weeks, facilitating easy access to various destinations. In contrast, the Long Term segment appeals to customers looking for extended rental periods, such as expatriates, corporate clients, or individuals not ready to commit to car ownership.This segment often includes favorable pricing structures, making it an attractive option for those needing reliable transportation for longer periods. The market dynamics are influenced by the growing gig economy and increased domestic tourism in China, which fuels demand across these Duration divisions. As urban mobility continues to evolve, the segmentation of the China Car Rental Market is expected to reflect changing consumer preferences, adapting to the varying needs of short-term flexibility and long-term commitments in transportation.

Car Rental Market Vehicle Type Insights

The Vehicle Type segmentation within the China Car Rental Market showcases a diverse array of options catering to various consumer preferences, with luxury, executive, economy, SUVs, and additional choices playing pivotal roles. Luxury vehicles have seen notable demand, appealing to affluent consumers seeking unique experiences and comfort during rental periods. Executive vehicles are popular among business professionals looking for reliable and prestigious transport options, especially in urban areas.

Economy cars dominate the market due to their affordability and practicality, making them a preferred choice for budget-conscious travelers.SUVs have gained significant traction, driven by their versatility and suitability for families or groups traveling in China's varied landscapes. The 'others' category encapsulates a range of vehicles, including hybrids and electric cars, reflecting the growing environmental consciousness within the market. This increasing diversification in vehicle type corresponds to trends in urbanization and tourism expansion in China, as rental services adapt to a wider consumer base and changing commuting needs. Overall, the segmentation within the China Car Rental Market highlights the sector's adaptation to consumer preferences, economic dynamics, and geographical considerations, underscoring its role in enhancing mobility across the region.

Car Rental Market Application Insights

The China Car Rental Market is primarily segmented into applications serving Leisure/Tourism and Business demands, reflecting distinct consumer needs and preferences. The leisure and tourism segment remains crucial, driven by the rising influx of domestic and international tourists seeking convenient transportation options to explore diverse attractions across China, such as scenic landscapes and cultural sites. This growing tourism trend is bolstered by government initiatives aimed at enhancing travel accessibility and infrastructure development.In parallel, the business segment significantly contributes to the market, fueled by a burgeoning economy and increased demand for corporate travel. Business professionals frequently opt for car rentals to facilitate mobility between meetings and events, preferring flexibility and efficiency in transportation. Furthermore, the adoption of technology in booking and managing rentals is reshaping the industry's landscape, indicating a shift towards more user-friendly experiences. Overall, both segments play vital roles in driving the growth of the China Car Rental Market, showcasing the industry's adaptability to meet diverse customer requirements and changing market dynamics.

Car Rental Market End User Insights

The China Car Rental Market has showcased robust growth, driven largely by the diverse needs of its end users. In the realm of self-driven car rentals, the trend reflects a shift in consumer preference towards flexibility and independence, enabling users to explore urban and rural destinations without reliance on public transport. This segment has gained traction among younger travelers and business professionals, fostering a demand for vehicles that cater to both leisure and work-related journeys. Meanwhile, the chauffeur-driven segment is experiencing significant interest, particularly among corporate clients and tourists seeking comfort and convenience.

This option tends to dominate in metropolitan areas with high demand for luxury services, as it provides an effortless travel experience amidst bustling city environments. Overall, the growing urbanization and increasing disposable income in China contribute to the expanding potential of both segments within the car rental industry, allowing for diverse offerings and service enhancements that meet the evolving expectations of consumers. As the market continues to mature, strategic investment and innovation in service delivery are critical to capturing the shifting dynamics of these end user segments.

China Car Rental Market Key Players and Competitive Insights:

The China Car Rental Market has become an increasingly competitive landscape as consumer preferences shift towards flexible mobility solutions. The rapid urbanization and economic growth in China have led to a rising demand for car rental services, which has prompted both established companies and new entrants to innovate and differentiate their offerings. Increased accessibility to digital platforms, along with changing consumer behavior favoring convenience and cost-effectiveness, has further fueled the growth of this market. Competitors are leveraging technology and expanding their service portfolios to enhance customer experience while also addressing the burgeoning demands for sustainability and eco-friendly options among consumers.

The competitive dynamics reflect a blend of local and international players, each striving to capture market share through varying strategies, ranging from pricing to customer service enhancements. Tujia has carved a niche for itself in the China Car Rental Market by leveraging its expertise in travel and accommodation services, focusing on providing a seamless user experience. As a platform known for vacation rentals, Tujia has effectively integrated car rental options to cater to its existing customer base, thus enhancing travel convenience for users and fostering customer loyalty. Its strong digital infrastructure and mobile app presence allow for easy booking and management of rental services.

Furthermore, Tujia has harnessed partnerships with various service providers to augment its offerings and ensure comprehensive customer satisfaction. The brand's understanding of the local market is a significant strength, aiding in its ability to tailor services to meet the specific preferences of Chinese consumers and capitalize on emerging rental trends.CAR Inc. holds a prominent position in the China Car Rental Market through its extensive fleet and diversified service offerings, catering to both individual travelers and corporate clients.

The company has established a robust network across major cities, allowing for widespread accessibility to its rental services. CAR Inc. provides a range of vehicles that meet varying customer needs, from economy to luxury options, positioning itself as a versatile solution for different travel requirements. Strengths include a strong brand reputation, a focus on customer-centric services, and an effective utilization of technology to streamline rental processes. The company's strategic moves include partnerships and collaborations aimed at enhancing its service capabilities alongside mergers and acquisitions that bolster its market presence in China. This approach facilitates CAR Inc. to remain competitive, swiftly adapt to market changes, and enhance operational efficiency.

Key Companies in the China Car Rental Market Include:

- Tujia

- CAR Inc.

- Grab

- UCar

- Gofun Mobility

- Lalamove

- Tianjin Longlong Car Rental

- Yongche

- Zhuanche

- Xinda

- eHi Car Services

- Didi Chuxing

- Shouqi Car Rental

- Beijing Zhaoshang Car Rental

- T3 Mobility

China Car Rental Market Industry Developments

The China Car Rental Market has seen significant developments recently. Notably, Tujia has expanded its services to cater to rising demand from both domestic and international tourists, while CAR Inc. is enhancing its fleet with new energy vehicles to align with China’s green initiatives. Companies such as Didi Chuxing and Gofun Mobility are increasing their market presence through innovative app-based car rental solutions and partnerships that streamline consumer access to transport services.

In September 2023, eHi Car Services announced a collaboration with several tech firms to integrate AI into their rental systems, optimizing user experience. Meanwhile, UCar is focusing on strengthening its logistics services, targeting more enterprise clients to diversify its customer base. There have been no significant mergers or acquisitions reported recently among the specific companies of interest. However, market valuations remain robust, driven by an uptick in consumer preferences for shared mobility options and a greater emphasis on digital solutions within the sector. Over the past two years, particularly in early 2022, the market experienced rapid growth as urbanization and e-commerce surged in China.

China Car Rental Market Segmentation Insights

Car Rental MarketBooking TypeOutlook

- Online Booking

- Offline Booking

Car Rental MarketDurationOutlook

Car Rental MarketVehicle TypeOutlook

- Luxury

- Executive

- Economy

- SUV's

- Others

Car Rental MarketApplicationOutlook

- Leisure/Tourism

- Business

- Car Rental MarketEnd UserOutlook

- Self- Driven

- Chauffeur-Driven

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2018 |

12.2 (USD Billion) |

| MARKET SIZE 2024 |

13.1 (USD Billion) |

| MARKET SIZE 2035 |

31.1 (USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

8.177% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Billion |

| KEY COMPANIES PROFILED |

Tujia, CAR Inc., Grab, UCar, Gofun Mobility, Lalamove, Tianjin Longlong Car Rental, Yongche, Zhuanche, Xinda, eHi Car Services, Didi Chuxing, Shouqi Car Rental, Beijing Zhaoshang Car Rental, T3 Mobility |

| SEGMENTS COVERED |

Booking Type, Duration, Vehicle Type, Application, End User |

| KEY MARKET OPPORTUNITIES |

Growing tourism demand, Urbanization and infrastructure development, Electric vehicle rentals, Technology integration and app-based services, Corporate leasing solutions |

| KEY MARKET DYNAMICS |

growing domestic tourism demand , increasing online booking platforms , competitive pricing strategies , expansion of electric vehicle rentals , heightened focus on customer experience |

| COUNTRIES COVERED |

China |

Frequently Asked Questions (FAQ) :

The China Car Rental Market is expected to be valued at 13.1 billion USD in 2024.

By 2035, the China Car Rental Market is projected to reach 31.1 billion USD.

The expected CAGR for the China Car Rental Market from 2025 to 2035 is 8.177 percent.

Major players in the China Car Rental Market include Tujia, CAR Inc., Grab, UCar, and Didi Chuxing among others.

The online booking segment of the China Car Rental Market is valued at 8.5 billion USD in 2024.

The offline booking segment of the China Car Rental Market is anticipated to reach 10.7 billion USD by 2035.

Key growth drivers for the China Car Rental Market include increasing urbanization, tourism growth, and convenience in transportation.

The offline booking segment is expected to have a market share valued at 4.6 billion USD in 2024.

Challenges in the China Car Rental Market include regulatory issues, competition, and changing consumer preferences.

The China Car Rental Market is experiencing significant changes driven by technology integration and new consumer trends.