China Critical Illness Insurance Market Research Report By Application (Cancer, Heart Attack, Stroke, others) - Forecast to 2035

ID: MRFR/HC/47864-HCR | 200 Pages | Author: Rahul Gotadki| July 2025

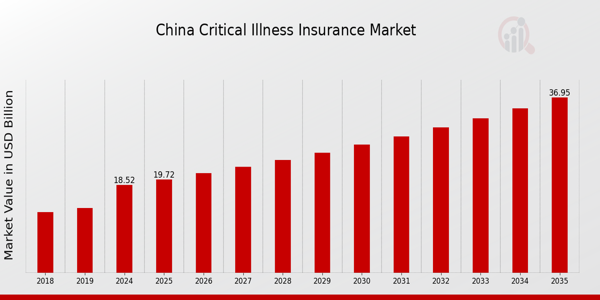

As per MRFR analysis, the China Critical Illness Insurance Market Size was estimated at 17.48 (USD Billion) in 2023.The China Critical Illness Insurance Market Industry is expected to grow from 18.52(USD Billion) in 2024 to 36.96 (USD Billion) by 2035. The China Critical Illness Insurance Market CAGR (growth rate) is expected to be around 6.481% during the forecast period (2025 - 2035)

Key China Critical Illness Insurance Market Trends Highlighted

The China Critical Illness Insurance Market is experiencing significant growth driven by several key factors. The aging population in China is a primary market driver, as an increasing number of elderly individuals heightens the demand for critical illness insurance products. The rise in chronic diseases among the population is also a crucial factor, as more individuals seek protection against health risks that could lead to severe financial burdens. Furthermore, growing public awareness about medical expenses and the importance of having insurance coverage ensures an upward trajectory for the market. Opportunities for further development in the market can be captured through the integration of digital platforms and products.

Insurance companies have the opportunity to introduce more personalised and accessible plans that cater to the specific requirements of their customers as a result of the increasing prevalence of health technology and telemedicine. Furthermore, insurers may consider establishing partnerships with healthcare providers to develop comprehensive packages that encompass preventive care services, which are increasingly alluring to consumers in China. Recent trends suggest that there is a trend towards personalised insurance policies that are tailored to specific health risks, which is indicative of the evolving preferences of Chinese consumers, particularly those in the younger demographic. This trend underscores the importance of adaptability in policy design, such as the provision of riders that provide coverage for a variety of critical ailments.

The critical illness insurance market is on the brink of further evolution, as the Chinese government provides regulatory support to increase insurance penetration, thereby addressing the country's healthcare challenges and meeting consumer expectations.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

China Critical Illness Insurance Market Drivers

Rising Incidence of Chronic Diseases

The increasing prevalence of chronic diseases such as cancer, cardiovascular diseases, and diabetes in China is a significant driver for the China Critical Illness Insurance Market Industry. According to China's National Health Commission, the number of cancer patients in the country has surged to over 4.5 million. This represents a projected annual increase of 12%, translating to about 540,000 new cases each year. Major organizations such as the Chinese Center for Disease Control and Prevention are emphasizing the importance of proactive health management.

As a result, individuals are recognizing the necessity of critical illness insurance to mitigate the financial impact of such severe health issues, thus propelling market growth. The government is also advocating for healthcare reforms that allow more citizens to access private insurance plans, further enhancing the significance of critical illness insurance in the overall healthcare landscape.

Increasing Middle-Class Population

China's rapid economic growth has led to an expansion of the middle-class populace, which is projected to reach over 550 million by 2025, according to the National Bureau of Statistics of China. This demographic shift has increased awareness around health-related financial security and prompted a greater demand for critical illness insurance products. With more disposable income, this emerging middle class is increasingly investing in insurance products to protect themselves from unforeseen health crises.

Organizations such as the China Insurance Regulatory Commission are facilitating this growth by easing market entry regulations for insurance providers, thereby creating a more competitive environment which benefits consumers.

Government Policy Support for Health Insurance

The Chinese government has been actively promoting health insurance schemes to improve national healthcare coverage. Recent policies from the State Council encourage the integration of critical illness insurance into broader health insurance offerings. For instance, under the Healthy China 2030 initiative, the government targets to significantly increase the number of citizens covered by insurance. Current estimates suggest that only about 30% of the population is covered by critical illness insurance, leaving substantial room for growth.

As government initiatives continue to support the insurance market, this will drive greater participation in the China Critical Illness Insurance Market Industry.

China Critical Illness Insurance Market Segment Insights

Critical Illness Insurance Market Application Insights

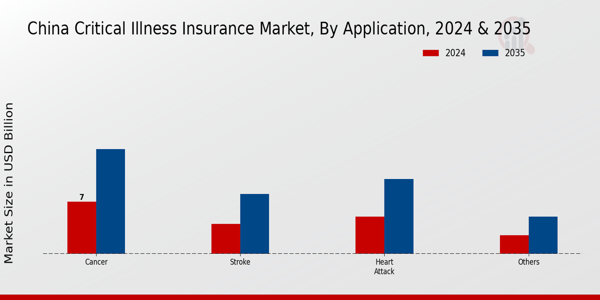

The China Critical Illness Insurance Market, particularly within the Application segment, is experiencing notable growth, driven by the rising incidence of chronic diseases among its population. With the overview showcasing an expected market value of 18.52 billion USD in 2024, the segmentation of this market reveals crucial insights into various categories including Cancer, Heart Attack, Stroke, and others. Cancer is becoming an increasingly significant concern, considering that it impacts a considerable portion of the population, thereby pushing individuals to seek financial protection through critical illness insurance.

The importance of coverage against heart attacks is also prominent, given the lifestyle changes and stresses prevalent in urban settings across China. Furthermore, the high prevalence of strokes, often due to dietary habits and lack of exercise, emphasizes the necessity for appropriate insurance plans within this segment. The growing awareness about health risks and the importance of financial planning for critical illnesses is promoting demand across all these areas. The China Critical Illness Insurance Market data reflects a health-conscious society that seeks to mitigate the financial burden of medical treatments.

Consequently, this trend presents robust market growth opportunities as more individuals are motivated to secure their health and finances against the potentially devastating impacts of critical illnesses. Market statistics indicate a transformative approach towards health insurance, with education and awareness campaigns paving the way for heightened engagement in such coverage, thus indicating the growing relevance of each application area, especially in a country where health challenges are evolving rapidly. As the demographic shifts and healthcare needs change, the articulation of these segments within the China Critical Illness Insurance Market industry provides a comprehensive picture of how this insurance landscape is developing.

There is a clear movement toward integrating comprehensive critical illness insurance plans as part of a holistic health management strategy, further enhancing the importance of these applications in society's health and financial security frameworks.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

China Critical Illness Insurance Market Key Players and Competitive Insights

The China Critical Illness Insurance Market has been experiencing significant growth due to the increasing awareness of health risks and the rising incidence of critical illnesses among the population. This growth has prompted a competitive landscape where various insurance providers aim to capture market share through innovative products and tailored policies. The emergence of new entrants alongside established players has intensified competition, leading to a diversification of offerings targeting consumers' specific needs. As the Chinese government continues to promote healthcare reforms and enhance social security systems, the demand for critical illness insurance remains robust, attracting more companies to invest in this segment. Competitors in this market are leveraging advanced technology and digital platforms to improve customer engagement and streamline the claims process, thereby enhancing overall consumer satisfaction.

Sino Life Insurance stands out in the China Critical Illness Insurance Market due to its strong brand reputation and extensive distribution network, which includes a vast number of agents and brokers. The company has successfully positioned itself as a key player by offering a range of critical illness insurance products that cater to various customer segments. Its commitment to customer service and support has led to increased policyholder trust and loyalty. Additionally, Sino Life Insurance invests in digital transformation initiatives, enhancing their online presence and accessibility to customers. Their understanding of local market dynamics and customer needs has enabled them to maintain a competitive edge, allowing them to adapt their offerings promptly in response to changing market conditions while striving to provide comprehensive coverage.

ZhongAn Online P/C Insurance is another prominent player in the China Critical Illness Insurance Market, known for its innovative use of technology in insurance services. The company primarily focuses on delivering a variety of insurance products tailored to modern consumers, including critical illness coverage that is often bundled with its health and wellness services. ZhongAn's strength lies in its digital-first approach, offering customers seamless online purchasing experiences and fast claim processing through their digital platform. Additionally, the company has made strategic moves through partnerships and potential mergers that strengthen its market position and expand its product offerings. Its focus on data analytics enables ZhongAn to understand customer behaviors better, allowing it to fine-tune its insurance solutions and remain competitive. By continuously engaging with technological advancements, ZhongAn Online P/C Insurance is positioned to capture significant market share while adapting to evolving customer expectations in the Chinese insurance landscape.

Key Companies in the China Critical Illness Insurance Market Include

China Critical Illness Insurance Market Industry Developments

The China Critical Illness Insurance Market has been bustling with notable developments recently. In September 2023, Ping An Insurance announced a rise in policyholder demand, reporting a 25% increase in critical illness policy sales compared to the previous year. In August 2023, China Life Insurance implemented a digital transformation strategy to enhance customer engagement, releasing a new mobile app tailored to critical illness coverage. Furthermore, in July 2023, Sino Life Insurance entered a strategic partnership with ZhongAn Online P/C Insurance to offer comprehensive health management tools along with insurance products.

Mergers and acquisitions have also shaped the market, with Huatai Insurance acquiring a majority stake in New China Life Insurance in April 2023 to expand its product offerings, drawing substantial attention in the industry. The overall market is fueled by the increasing prevalence of chronic diseases, prompting companies like Taikang Life Insurance and Evergrande Group to innovate their coverage plans. Over the last two years, the market has witnessed a significant boost from regulatory support by the China Banking and Insurance Regulatory Commission, encouraging product diversification and improved risk management practices among insurers.

Critical Illness Insurance Market Segmentation Insights

| Report Attribute/Metric Source: | Details |

| MARKET SIZE 2023 | 17.48(USD Billion) |

| MARKET SIZE 2024 | 18.52(USD Billion) |

| MARKET SIZE 2035 | 36.96(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) | 6.481% (2025 - 2035) |

| REPORT COVERAGE | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR | 2024 |

| MARKET FORECAST PERIOD | 2025 - 2035 |

| HISTORICAL DATA | 2019 - 2024 |

| MARKET FORECAST UNITS | USD Billion |

| KEY COMPANIES PROFILED | Sino Life Insurance, ZhongAn Online P/C Insurance, Taikang Life Insurance, Fosun International, Xiaohe Life Insurance, Anbang Insurance Group, China Pacific Insurance, China Minmetals Corporation, New China Life Insurance, Evergrande Group, CIRC of China, Ping An Insurance, China Taiping Insurance, China Life Insurance, Huatai Insurance |

| SEGMENTS COVERED | Application |

| KEY MARKET OPPORTUNITIES | Aging population demand, Rising healthcare costs, Increased urbanization effects, Growing middle-class awareness, Digital insurance platform adoption |

| KEY MARKET DYNAMICS | aging population, rising healthcare costs, increasing health awareness, government support initiatives, product innovation and customization |

| COUNTRIES COVERED | China |

Frequently Asked Questions (FAQ) :

The projected market size of the China Critical Illness Insurance Market in 2024 is 18.52 USD Billion.

The expected compound annual growth rate, or CAGR, for the market from 2025 to 2035 is 6.481 percent.

The estimated market size of the China Critical Illness Insurance Market in 2035 is expected to reach 36.96 USD Billion.

The cancer application segment is projected to have the highest value, estimated at 14.0 USD Billion in 2035.

The market value for heart attack-related critical illness insurance in 2024 is 5.0 USD Billion.

Major players in the market include Sino Life Insurance, Ping An Insurance, and ZhongAn Online P/C Insurance among others.

The stroke application segment is projected to reach a value of 8.0 USD Billion by 2035.

The 'others' segment is anticipated to achieve a market size of 4.96 USD Billion in 2035.

While several players compete, organizations such as CIRC of China and Taikang Life Insurance are considered significant competitors.

Growth drivers include an increasing prevalence of diseases, rising healthcare costs, and greater awareness regarding health insurance among consumers.

Leading companies partner with us for data-driven Insights.

Kindly complete the form below to receive a free sample of this Report

© 2025 Market Research Future ® (Part of WantStats Reasearch And Media Pvt. Ltd.)