China E-Wallet Market Overview

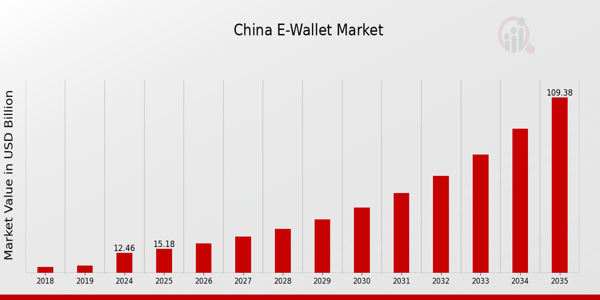

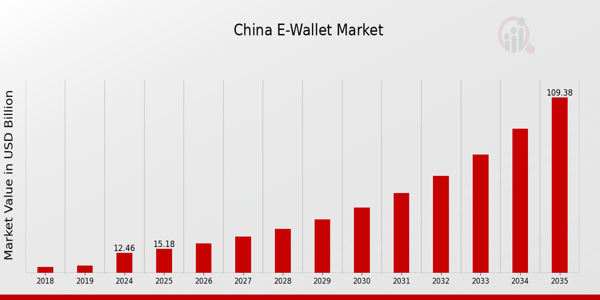

As per MRFR analysis, the China E-Wallet Market Size was estimated at 10.2 (USD Billion) in 2023. The China E-Wallet Market Industry is expected to grow from 12.46(USD Billion) in 2024 to 109.38 (USD Billion) by 2035. The China E-Wallet Market CAGR (growth rate) is expected to be around 21.833% during the forecast period (2025 - 2035).

Key China E-Wallet Market Trends Highlighted

The China E-Wallet Market is witnessing rapid growth driven by increased smartphone penetration and the widespread adoption of digital payment solutions among consumers. The ease and convenience of transactions through e-wallets have encouraged more people in urban and rural areas alike to adopt cashless payment methods. Moreover, governmental support for the digital economy is a significant market driver, as initiatives promoting digital finance and financial inclusion have created a favorable environment for e-wallet providers.

Opportunities in the China E-Wallet Market are substantial, particularly for innovative services such as peer-to-peer payments, loyalty programs, and integration with online platforms.The rise of e-commerce in China, fueled by platforms like Taobao and JD.com, has increased the need for seamless payment solutions, enhancing the attractiveness of e-wallets. Additionally, the ongoing push towards a cashless society presents new avenues for expansion, especially among small and medium-sized enterprises looking to adopt digital payment systems. Recent trends indicate a shift towards enhanced security features in e-wallet applications.

Users are increasingly concerned about data privacy and fraud prevention, prompting providers to invest in advanced encryption and biometric authentication technologies. Furthermore, collaborations between e-wallet platforms and social media apps to facilitate payments in social interactions are gaining traction, aligning with consumers' preferences for integrated digital experiences.As China continues to prioritize technological innovation, the e-wallet market is expected to evolve, adapting to changing consumer demands and regulatory frameworks in the digital finance landscape.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

China E-Wallet Market Drivers

Rapid Adoption of Mobile Payment Solutions

The China E-Wallet Market Industry is rapidly expanding due to the widespread usage of mobile payment solutions. According to the People's Bank of China, mobile payment transactions in the country will exceed 400 trillion CNY in 2022, representing a 28% rise over the previous year. This spike is mostly driven by rising smartphone adoption (over 98% in metropolitan areas) and a growing desire for cashless transactions.

Prominent players like Alipay and WeChat Pay have had a big impact on this trend by providing user-friendly interfaces and smooth transaction procedures. The Chinese government's push for digital currency transformation adds impetus, as detailed in the Digital Currency Electronic Payment (DCEP) project, which aims to improve payment system efficiency. By harmonizing government rules with market demand, e-wallet use is expected to expand steadily.

Government Initiatives Promoting Cashless Transactions

Government initiatives aimed at promoting cashless transactions are significantly driving the China E-Wallet Market Industry. The Chinese government has implemented various policies to encourage businesses and consumers to adopt digital payment methods. Recent initiatives include the promotion of the 'National Interoperability of E-Payment Systems', which is designed to make it easier for different e-wallet systems to work together.

As a result, the share of cashless transactions in urban areas increased to 85% in the past year.The impact of these government policies is exemplified by the establishment of regulatory frameworks that ensure consumer safety and cybersecurity, fostering public trust in e-wallet systems like Alipay and WeChat Pay.

Growing E-Commerce Sector

The growth of the e-commerce sector in China is a major driver for the China E-Wallet Market Industry. In 2022, the value of online retail sales in China reached approximately 13 trillion CNY, growing by over 15% year-on-year, according to the National Bureau of Statistics. This growth is closely associated with the increasing preference for online shopping, especially among younger consumers, who prefer using e-wallets for convenience and speed of transactions.

The seamless integration of payment solutions within e-commerce platforms by companies like JD.com and Alibaba has encouraged e-wallet usage. As e-commerce continues to boom, the need for efficient and secure payment methods will further propel the e-wallet market.

China E-Wallet Market Segment Insights

E-Wallet Market Technology Insights

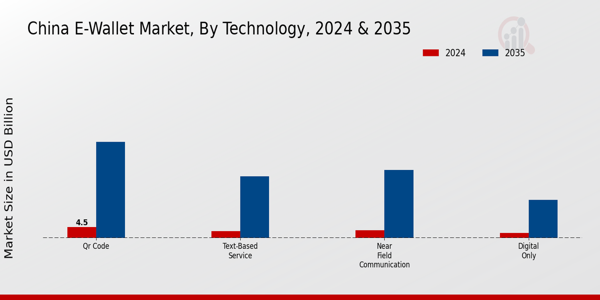

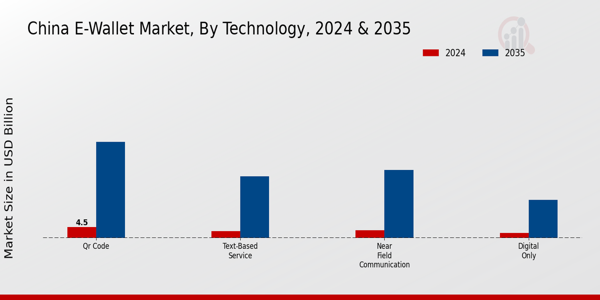

The China E-Wallet Market is profoundly influenced by various technologies that facilitate digital payment solutions, leading to a rapid increase in adoption across the country. Among these technologies, Near Field Communication (NFC) has gained traction due to its convenience and speed, allowing users to make contactless transactions with a simple tap of their device. This technology is particularly significant in urban areas where the demand for swift and efficient payment methods is escalating.

QR Code technology also holds a dominant position, being extensively used for payments in retail settings, restaurants, and even e-commerce platforms, enabling consumers to make transactions using their smartphone cameras.

The growing prevalence of QR Code adoption is attributed to its ease of use, accessibility, and integration with other digital services, making it a preferred choice for businesses and consumers alike. Furthermore, Text-based Services enhance the E-Wallet experience by providing users with notifications, transaction details, and customer support through messaging platforms.

This method not only reinforces user engagement but also improves the overall customer experience, as users can swiftly manage their e-wallets without navigating complex menus.Lastly, the Digital Only model, which refers to companies primarily operating online without a physical presence, continues to reshape the E-Wallet landscape by creating seamless experiences geared towards tech-savvy users who prefer to conduct their financial transactions digitally.

This shift emphasizes the importance of leveraging cutting-edge technology to drive innovation and cater to an increasingly digital consumer base in China. Overall, the China E-Wallet Market segmentation reflects a dynamically evolving landscape where various technologies play crucial roles in shaping user preferences and enhancing the digital payment ecosystem.The synergy among these technologies is fostering a richer, more diverse user experience in the realm of digital payments, which is sure to continue influencing market statistics and growth in the coming years.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

E-Wallet Market Application Insights

The China E-Wallet Market is experiencing significant growth driven by diverse applications that cater to various sectors. The Retail and E-Commerce segment is a major contributor, as digital payments have transformed consumer shopping habits, leading to increased online transactions and customer engagement. In the Hospitality and Transportation category, E-Wallets facilitate seamless payments for services, enhancing user convenience and operational efficiency. The Banking sector benefits from E-Wallet integration as it offers customers easier access to financial services, streamlined transactions, and security features.

Additionally, Vending Machines equipped with digital payment solutions cater to a tech-savvy consumer base, supporting on-the-go transactions. As China continues to push for greater digitalization, the penetration of E-Wallets across these applications reflects a broader trend of cashless transactions, aligning with national goals for a more efficient payment ecosystem.

The China E-Wallet Market segmentation shows a dynamic landscape where each application plays a crucial role in shaping market dynamics and consumer preferences, reinforcing the importance of digital payment solutions in everyday life.Economic policies promoting cashless payments further amplify the significance of these segments, signaling a shift toward a more connected and technologically advanced economic environment.

China E-Wallet Market Key Players and Competitive Insights

The China E-Wallet Market has experienced significant growth in recent years, becoming a crucial component of the nation’s digital economy. The intense competition among various players has led to the development of innovative payment solutions that cater to the unique preferences of Chinese consumers. With increasing smartphone penetration and a favorable regulatory environment, these e-wallets are not only facilitating seamless transactions but are also integrating various features such as social interaction, rewards programs, and financial services.

The market is characterized by strong incumbents leveraging large user bases, advanced technology, and strategic partnerships, which together create a dynamic landscape where user experience and security are paramount.

WeChat Pay has emerged as a formidable player in the China E-Wallet Market, seamlessly integrating its services within the WeChat ecosystem, which boasts hundreds of millions of active users. The strength of WeChat Pay lies in its immediate accessibility through the popular messaging app, which encourages widespread adoption among consumers and merchants alike. The platform allows users to make various transactions, from peer-to-peer payments to online shopping, while offering features like mini-programs that enhance user engagement. Additionally, WeChat Pay's close ties to local businesses facilitate promotional campaigns and loyalty programs, deepening customer relationships.

Moreover, the brand’s extensive presence in brick-and-mortar retail, coupled with strong collaborations with merchants, reinforces its dominance in the market, making it convenient for users to transact seamlessly.

Baidu Wallet, while competitively positioned in the China E-Wallet Market, focuses on integrating payment solutions with Baidu's broader range of services. This platform offers various financial products, including digital wallets, online payment services, and rich data-driven advertising platforms, allowing merchants to target consumers more effectively. Baidu Wallet's strengths lie in its collaboration with content and online services, enabling users to transact while engaging with Baidu's search engine and other digital services. The company has made strategic investments and partnerships to enhance its technology infrastructure and expand its market presence.

Additionally, Baidu Wallet is known for its focus on enhancing security and user experience, successful mergers, and acquisitions, allowing it to broaden its service offerings and strengthen its competitive edge in the China E-Wallet landscape. Overall, Baidu Wallet consistently innovates its product line, aiming to capture and retain a significant share of the growing market through continuous enhancements that resonate with the changing needs of consumers in China.

Key Companies in the China E-Wallet Market Include:

- WeChat Pay

- Baidu Wallet

- Xiaomi Pay

- Meituan

- JD Finance

- Ant Group

- WeBank

- Alipay

- Huawei Pay

- Lufax

- Tencent

- Dingdong Maicai

- UnionPay

- Bilibili

China E-Wallet Market Industry Developments

Recent developments in the China E-Wallet Market indicate significant growth and evolving competition among key players. In October 2023, WeChat Pay expanded its services to international markets, enhancing its position against competitors like Alipay, which is continuously evolving its product offerings to cater to younger users. In September 2023, Baidu Wallet reported a rise in user engagement, driven by new loyalty programs tailored for frequent users.

Xiaomi Pay has also made strides by integrating with various retail partners to streamline payment processes, while Ant Group is focusing on regulatory compliance as it seeks to regain market confidence following previous governmental scrutiny. Additionally, Meituan has initiated promotions linked with local businesses to attract more users to its platform.

A notable merger occurred in August 2023 when JD Finance acquired Lufax, strengthening their combined market capabilities. Huawei Pay is actively focusing on enhancing security features to boost user trust amidst increasing concerns over digital payment safety. The continuous innovations and strategic partnerships among these companies indicate a dynamic market landscape and a potential for further expansion in the digital payment ecosystem in China.

China E-Wallet Market Segmentation Insights

E-Wallet Market Technology Outlook

- Near Field Communication

- QR Code

- Text-based Service

- Digital Only

E-Wallet Market Application Outlook

- Retail & E-Commerce

- Hospitality & Transportation

- Banking

- Vending Machine

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2023 |

10.2(USD Billion) |

| MARKET SIZE 2024 |

12.46(USD Billion) |

| MARKET SIZE 2035 |

109.38(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

21.833% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Billion |

| KEY COMPANIES PROFILED |

WeChat Pay, Baidu Wallet, Xiaomi Pay, Meituan, JD Finance, Ant Group, WeBank, Alipay, Huawei Pay, Lufax, Tencent, Dingdong Maicai, UnionPay, Bilibili |

| SEGMENTS COVERED |

Technology, Application |

| KEY MARKET OPPORTUNITIES |

Mobile payment integration, Cross-border e-commerce transactions, Enhanced security features, Loyalty program partnerships, AI-driven financial services |

| KEY MARKET DYNAMICS |

Rapid digital payment adoption, Government regulations and support, Intense competition among platforms, Increasing smartphone penetration, User-friendly interfaces and features |

| COUNTRIES COVERED |

China |

Frequently Asked Questions (FAQ):

The China E-Wallet Market is expected to reach a valuation of 12.46 USD Billion in 2024.

By 2035, the market is anticipated to grow to a value of 109.38 USD Billion.

The market is expected to experience a CAGR of 21.833% from 2025 to 2035.

In 2024, the QR Code segment is valued at 4.5 USD Billion, making it a significant player in the market.

The Near Field Communication technology segment is projected to be valued at 28.5 USD Billion in 2035.

Major players include WeChat Pay, Alipay, and Ant Group among others.

The Text-based Service segment is expected to reach a value of 2.86 USD Billion in 2024.

Trends include the increasing adoption of digital payments and the expansion of cashless transactions.

Intense competition among key players is driving innovation and offering consumers a variety of options.

Challenges include regulatory hurdles and the need for enhanced security features to protect user data.