China Electronic Waste Recycling Market Overview:

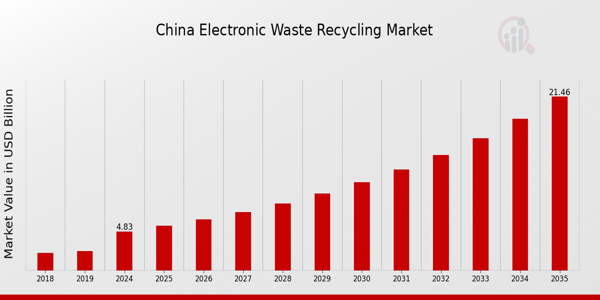

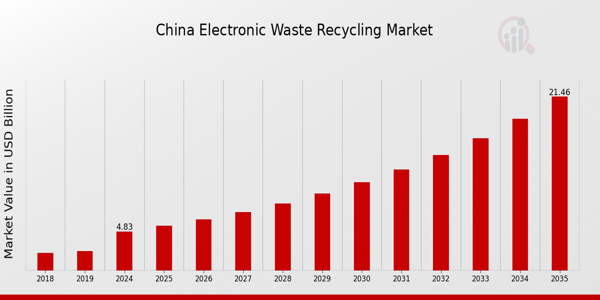

The China Electronic Waste Recycling Market Size was estimated at 4.26 (USD Billion) in 2023. The China Electronic Waste Recycling Market Industry is expected to grow from 4.83(USD Billion) in 2024 to 21.46 (USD Billion) by 2035. The China Electronic Waste Recycling Market CAGR (growth rate) is expected to be around 14.52% during the forecast period (2025 - 2035).

Key China Electronic Waste Recycling Market Trends Highlighted

China Electronic Waste Recycling Market is increasing due to rising concern about the environment and stricter waste management policies. The government has created laws to increase the recycling of electronic waste as they are becoming aware of the threat to nature caused by negligence in disposal. This has placed greater emphasis on sustainable approaches and the circular economy. The growing use of electronics further adds to the increase in e-waste, which signals the need for efficient recycling mechanisms.

The opening of new prospects in the marketing sphere is based on the search for responsible ways of disposing of old electronics among people and companies.

The government's push for technology upgrades, particularly in urban areas, leads to an influx of electronic devices in need of recycling. As demand increases for effective recycling solutions, companies that can offer innovative approaches or technologies stand to gain a competitive advantage. The increasing involvement of private players, alongside government initiatives, creates a robust ecosystem for e-waste recycling. Recent trends show rising investments in infrastructure and technology focused on the recycling process. This includes advancements in sorting and processing technologies that enhance the efficiency of e-waste recovery.

The expansion of collection networks, where local and regional businesses collaborate with municipalities, also showcases a shift towards more organized recycling efforts. There is a growing trend of consumer awareness campaigns that educate the public on proper e-waste disposal. Overall, the combination of government support, technological Innovation, and public awareness is shaping the future of the electronic waste recycling market in China, emphasizing sustainability and resource recovery.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

China Electronic Waste Recycling Market Drivers

Growing E-Waste Generation

China is witnessing an unprecedented rise in electronic waste generation due to rapid urbanization and increased disposable income among its population. The China Electronic Waste Recycling Market Industry is expected to grow significantly as the volume of discarded electronics is projected to reach 10 million tons annually by 2025, according to China's Ministry of Ecology and Environment. This substantial increase in e-waste highlights the urgent need for efficient recycling solutions. The country's large population and high consumption rates of electronic devices contribute directly to this surge.

Companies such as Tencent and Huawei are actively involved in developing technologies and initiatives for better recycling practices, thus contributing to market growth. The push for responsible disposal and recycling of e-waste has become a significant factor in the strategic policies implemented by the government and industry leaders alike, further enhancing the growth of the China Electronic Waste Recycling Market.

Government Initiatives and Regulations

The Chinese government has implemented strict regulations and policies aimed at improving electronic waste recycling. The Extended Producer Responsibility (EPR) policy mandates that manufacturers are responsible for the proper disposal and recycling of their products. As a result, companies are compelled to invest in recycling technologies and facilities, fostering the growth of the China Electronic Waste Recycling Market Industry. According to recent regulatory updates from the Ministry of Ecology and Environment, the government aims to recycle over 25% of the electronic waste generated by 2025.

This regulatory framework not only enhances compliance among manufacturers but also promotes environmentally sustainable practices, encouraging companies like Lenovo and Xiaomi to adopt more robust recycling processes.

Increasing Environmental Awareness

There is a growing awareness among the Chinese population regarding the environmental impacts of improper electronic waste disposal. Research shows that over 70% of Chinese consumers recognize the importance of e-waste recycling and are willing to participate in recycling programs. This rise in public consciousness is driving demand for recycling services in the China Electronic Waste Recycling Market Industry. Companies such as Alibaba and JD.com are spearheading initiatives that promote easy access to electronic waste collection points, reflecting this shift in consumer behavior.

Environmental NGOs and community programs also play a pivotal role in educating the public, ultimately pushing for higher recycling rates and a circular economy.

Technological Advancements in Recycling Processes

The introduction of innovative technologies in electronic waste recycling is substantially driving the growth of the China Electronic Waste Recycling Market. Advanced methods such as hydrometallurgical processes and artificial intelligence for sorting e-waste are streamlining operations and improving recovery rates of valuable materials, such as rare metals. For instance, companies like BYD and TCL are investing in state-of-the-art recycling technologies that enhance efficiency and reduce environmental impact. These advancements not only increase the profitability of recycling operations but also provide a competitive edge in the market.

As a result, the overall efficiency in handling e-waste is projected to improve, thereby accelerating the growth of the industry in China.

China Electronic Waste Recycling Market Segment Insights:

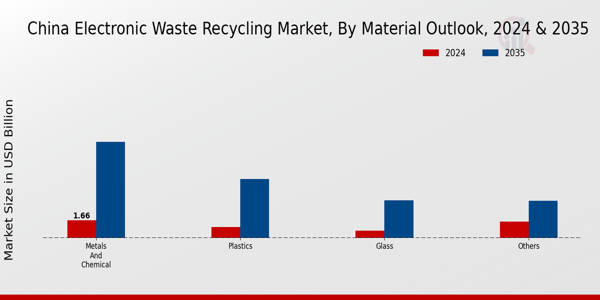

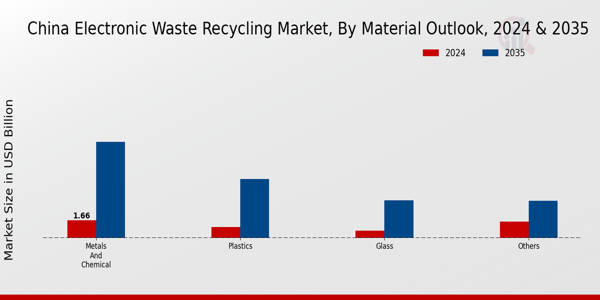

Electronic Waste Recycling Market Material Outlook Insights

The China Electronic Waste Recycling Market, particularly in the Material Outlook segment, reflects a robust and dynamic landscape that is essential for the management of electronic waste in the region. This segment consists of various materials, including Metals and Chemicals, Plastics, Glass, and Others, each contributing uniquely to the overall recycling efforts. With electronic waste recycling becoming increasingly crucial due to the growing volume of discarded electronics in China, the country is witnessing significant advancements in recovery technologies.

The Metals and Chemicals segment plays a vital role as it not only dominates the recycling efforts but also includes precious metals such as gold, silver, and platinum, which are highly sought after in the electronics industry. In addition, the recovery of base metals like copper and aluminum is essential due to their high demand and substantial economic benefits.

Plastics, another key component, has been gaining attention due to the implementation of stricter regulations against plastic waste. The challenge lies in effectively separating high-quality plastics from contaminated materials, which requires specialized technology and processes. Meanwhile, the glass segment, although smaller in scale, serves an essential function by recycling screens and other electronic components, thereby reducing landfill contributions and promoting circular economy practices among manufacturers. The 'Others' category encompasses various materials, including some composites and batteries, which also require effective recycling solutions to minimize environmental impacts.

Trends such as increasing public awareness, government regulations promoting e-waste recycling, and technological developments in recycling processes are anticipated to drive the growth of the China Electronic Waste Recycling Market further. Overall, the Materials Outlook reflects critical insights into the current challenges and opportunities within the recycling industry, emphasizing the need for Innovation and effective waste management practices across these segments to support sustainable development in China. As the country continues to lead in electronic manufacturing, efficient recycling methodologies are paramount for environmental stewardship and economic viability.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Electronic Waste Recycling Market Source Insights

The Source segment of the China Electronic Waste Recycling Market plays a crucial role in the overall industry, addressing the growing need to manage electronic waste effectively. Various sources, including Household Appliances, Entertainment Consumer Electronics, IT Telecommunication, and Medical Equipment drive this segment. Household appliances contribute significantly to electronic waste due to their prevalence in urban households; their recycling not only conserves resources but also mitigates environmental impacts. Entertainment Consumer Electronics, characterized by rapid technology upgrades, generate considerable waste that underscores the importance of recycling processes to recover valuable materials.

The IT & Telecommunication sector provides a unique challenge, as the swift pace of technological advancement leads to frequent device obsolescence, necessitating efficient recycling methods to recover rare metals and plastics. Medical Equipment, essential for healthcare, also represents a unique waste stream requiring specialized recycling due to the need for compliance with safety standards. The 'Others' category encompasses various electronic devices that further enrich the recycling landscape, reflecting a diverse array of products requiring responsible end-of-life management.

As the importance of sustainable practices grows in China, addressing these multifaceted sources of electronic waste is critical to developing a circular economy and enhancing environmental sustainability efforts.

China Electronic Waste Recycling Market Key Players and Competitive Insights:

The China Electronic Waste Recycling Market is witnessing significant growth driven by increasing environmental concerns and stringent regulations regarding electronic waste disposal. The rapid advancement of technology has led to a surge in electronic products, which in turn has escalated the volume of e-waste generated across urban areas in China. As the government promotes circular economy practices and sustainability initiatives, various players in the market are striving to offer practical and eco-friendly recycling solutions.

Companies are innovating their recycling processes and expanding their operational capacity to cater to the rising demand, creating a highly competitive landscape characterized by both local players and multinational corporations. The emphasis on recovering precious metals and materials from electronic waste presents ample opportunities for companies to thrive, fostering a dynamic environment in the electronic waste recycling sector.

China Minmetals Corporation holds a commanding presence in the China Electronic Waste Recycling Market, leveraging its extensive experience in metals and mining to enhance its recycling efforts. The company has developed a robust infrastructure that allows for efficient collection, processing, and recycling of electronic waste throughout the country. By deploying advanced technologies and sustainable practices, China Minmetals Corporation strengthens its position in the market. The firm benefits from a well-established network and partnerships with various stakeholders, which enables it to maximize the recycling rate and extract valuable resources from e-waste.

Additionally, the company’s strong commitment to environmental stewardship helps reinforce its brand image and aligns with the growing demand for responsible electronic waste management in China.

Dowa Holdings is another key player in the China Electronic Waste Recycling Market, and it is recognized for its innovative approach to electronic waste management. The company offers a range of services, including dismantling, recycling, and recovery of valuable materials from used electronic devices, positioning itself as a leader in resource recovery. Dowa Holdings' advanced recycling technology contributes to its ability to effectively recover metals and other materials from e-waste, promoting sustainability. The firm has established a significant market footprint in China through strategic partnerships and collaborations that enhance its operational capabilities.

Recent mergers and acquisitions have further bolstered its market presence and provided access to newer technologies, allowing Dowa Holdings to strengthen its competitive edge. The company’s focus on RD and investment in state-of-the-art facilities underlines its commitment to optimizing recycling processes, ensuring compliance with regulatory standards, and meeting the evolving demands of the Chinese market.

Key Companies in the China Electronic Waste Recycling Market Include:

- China Minmetals Corporation

- China National Chemical Corporation

- Chiho Environmental Group

- SinoEnvironment Technology Group

- SIIC Environment Holdings

- SUEZ Recycling and Recovery

China Electronic Waste Recycling Market Industry Developments

In recent months, the China Electronic Waste Recycling Market has experienced significant developments. Notably, in August 2023, China Minmetals Corporation announced an expansion of its recycling facilities to enhance its processing capacity for electronic waste, aiming to address the growing issue of e-waste in urban areas. Additionally, Dowa Holdings and Chiho Environmental Group have collaborated to improve resource recovery from discarded electronics, reflecting an increasing trend toward sustainable practices.

In the past two years, notable events include the tightening of regulations by the Chinese government to manage electronic waste more effectively, with policies established in June 2021 focusing on increased accountability for producers in e-waste disposal. The overall market valuation is witnessing growth, propelled by rising awareness of environmental issues and the need for responsible recycling processes. Furthermore, in July 2022, EnviroHub Holdings launched a new initiative to promote electronic waste collection drives in collaboration with local communities, enhancing public participation in recycling efforts.

This shift is indicative of a broader movement within China to prioritize sustainable waste management and increase the capacity for electronic waste recycling.

Electronic Waste Recycling Market Segmentation Insights

Electronic Waste Recycling Market Material Outlook Outlook

- Metals and Chemical

- Plastics

- Glass

- Others

Electronic Waste Recycling Market Source Outlook

- Household Appliances

- Entertainment Consumer Electronics

- IT Telecommunication

- Medical Equipment

- Others

Report Scope:

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2023 |

4.26 (USD Billion) |

| MARKET SIZE 2024 |

4.83 (USD Billion) |

| MARKET SIZE 2035 |

21.46 (USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

14.52% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Billion |

| KEY COMPANIES PROFILED |

China Minmetals Corporation, Dowa Holdings, Sungrow Power Supply, China National Chemical Corporation, Royal Dutch Shell, Chiho Environmental Group, Tianjin Qinye, EnviroHub Holdings, GEEP, SinoEnvironment Technology Group, Green Impact, Enviroserve, SIIC Environment Holdings, Print Recycler, SUEZ Recycling and Recovery |

| SEGMENTS COVERED |

Material Outlook, Source |

| KEY MARKET OPPORTUNITIES |

Expanding urban population growth, Government support and regulations, Increasing electronic consumption rates, Innovation in recycling technologies, Circular economy initiatives and awareness |

| KEY MARKET DYNAMICS |

increasing e-waste generation , stringent regulatory frameworks , rising awareness for recycling , advancements in recycling technologies , growing demand for recovered materials |

| COUNTRIES COVERED |

China |

Frequently Asked Questions (FAQ):

The China Electronic Waste Recycling Market is expected to be valued at 4.83 USD Billion in 2024.

By 2035, the market is anticipated to reach a value of 21.46 USD Billion.

The expected CAGR for the market during this period is 14.52%.

By 2035, metals and chemical materials are projected to be a dominant segment, valued at 9.0 USD Billion.

The plastics segment is expected to be valued at approximately 5.5 USD Billion by 2035.

Major players include China Minmetals Corporation, Dowa Holdings, Sungrow Power Supply, and Chiho Environmental Group.

The market size for the glass segment is expected to reach 0.663 USD Billion in 2024.

Challenges include regulatory issues, environmental concerns, and competition from informal recycling sectors.

Opportunities lie in increased consumer awareness and advancements in recycling technologies.

The demand is expected to grow significantly as more consumers and businesses focus on sustainability and responsible disposal.

By 2035, the market size is anticipated to reach 30.0 billion USD.

The expected CAGR for the market is 18.061 percent from 2025 to 2035.

The market is segmented into Metals and Chemicals, Plastics, Glass, and Others, with significant growth expected in all categories.

The market value for Metals and Chemicals is projected at 1.55 billion USD in 2024.

By 2035, the market value for Plastics is expected to grow to 7.5 billion USD.

Key players include Shanghai Jianzhong, Sega Technology, Green Chi, and Veolia among others.

The expected market value for Glass is 0.8 billion USD in 2024.

The market faces challenges related to regulatory compliance and effective waste management practices.

Opportunities include advancements in recycling technologies and increasing consumer awareness about e-waste recycling.